The digital pound is making headlines these days. The UK government has publicly announced plans to roll out its digital currency, following the footsteps of many countries that have already done so.

However, there is much confusion about how the digital pound would function and whether or not the government would mandate people to use it. This article on the digital pound has been carefully prepared to enlighten you on what you should know as the UK awaits the launch and circulation of the digital currency. Let’s dive in!

Table of Contents

What Is a Digital Pound?

The digital pound is a central bank digital currency to be issued by the Bank of England (BoE). This means that the central bank of the country backs the asset. It is designed to serve as a means of exchange within the UK. It can be stored in an electronic wallet. It will work alongside banknotes and coins used in the country and will not replace them.

The digital asset will have its price equal to the current payment currencies used in the UK economy. This means £100 in digital pounds must equal £100 in bank notes.

The digital pound has yet to be released as of the publication date. However, the Bank of England (BoE) has commenced activities that will bring the new currency to fruition. In March 2020, the central bank published a discussion paper showing its interest in the rollout of a central bank digital currency (CBDC).

In collaboration with HM Treasury, the BoE pushed forward its plan to launch the digital asset by setting up a task force group to oversee the work. The task force group is called the Central Bank Digital Currency Taskforce.

Another group working towards the establishment of the digital pound is the independent group called the Digital Pound Foundation. The group is focused on combining the efforts of the public and private sectors in the country to fully support the integration of the digital pound into the UK economy. Some of its top executives include individuals who work with crypto-based projects.

Recent reports show that HM Treasury has stepped up its game in bolstering the development of a digital currency. On January 10, 2023, a news report showed that the financial agency had tabled the idea of a national digital currency to Members of Parliament (MPs). MPs can vote on laws and policies that bring new forms of money into the financial system.

Andrew Griffith, the secretary to the Treasury, termed the new digital asset a “potentially disruptive game-changing technology.”

On January 24, the Treasury shared a job posting on LinkedIn for the head of a team focused on building the UK-focused digital currency. The team will represent the Treasury office in the potential creation of a CBDC.

Before going further, let us understand the meaning of a term we will use frequently in this article – CBDC.

What exactly is CBDC? The acronym CBDC means Central Bank Digital Currency. CBDC is a digital currency issued and regulated by a country's central bank. CBDC is stored in a digital wallet. It is used as a means of exchange, just like physical fiat currencies.

How Does It Work?

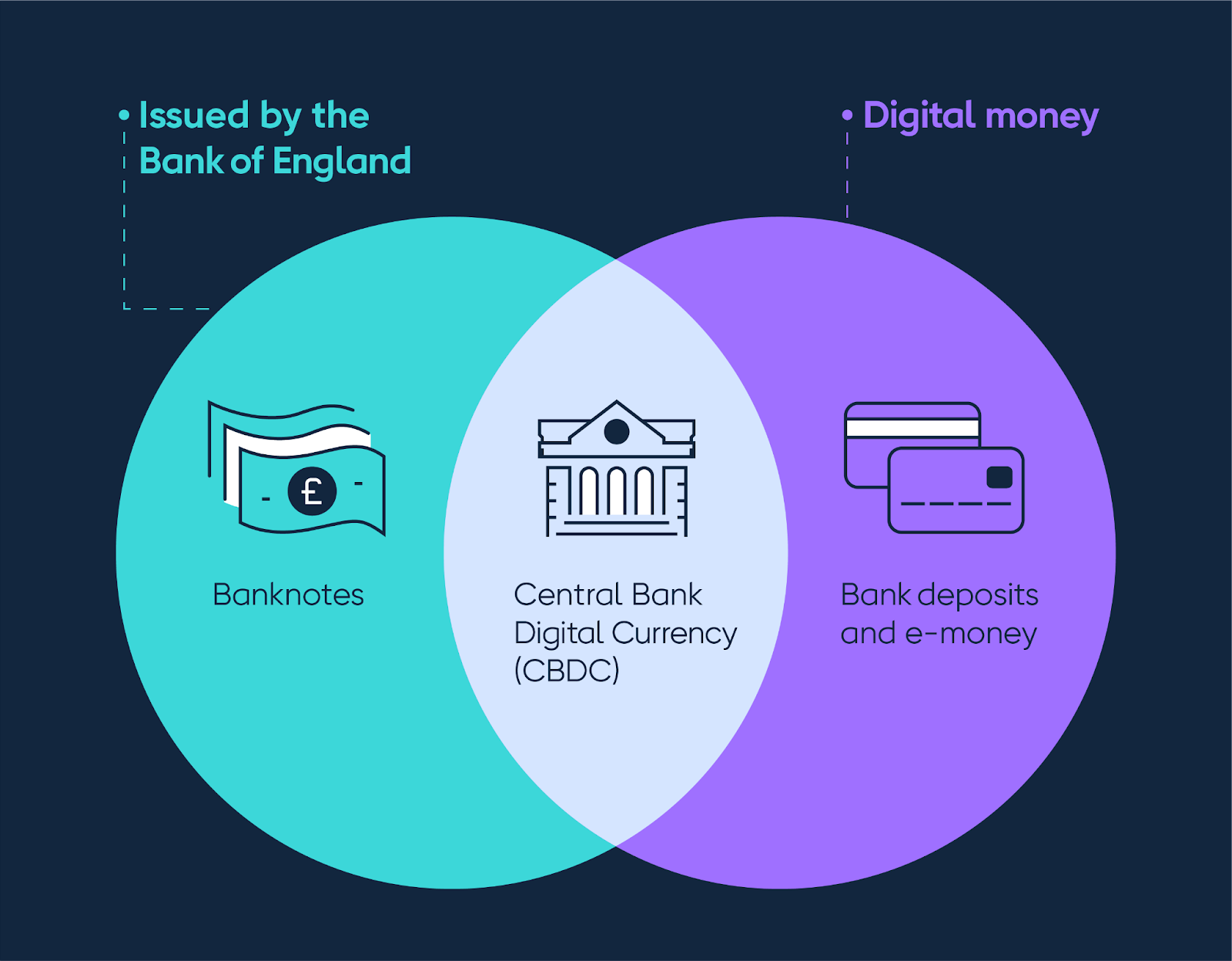

Source: Bank of England

The UK financial system uses the following types of money – banknotes, coins, and bank deposits.

The banknote is the physical cash used as a means of exchange and issued by the UK’s central bank, the Bank of England. The British coin is another physical type of money used to settle payments. It is being issued by the Royal Mint, a limited organisation owned by His Majesty’s Treasury.

On the other hand, a bank deposit is a digital type of money stored in a commercial banking institute. Deposit account owners can access and use their bank deposits through electronic wallets.

The digital pound is new to the picture, disrupting the existing money types used in the UK. It is designed to work on par with British pound banknotes. One digital pound must be exchangeable for the same value in cash. In other words, £1 in digital pounds must be redeemable for £1 in bank notes.

The digital asset would perform the same functions as bank notes. These functions include payment for goods and services within the country. It can be used as a store of value.

The new digital currency will not replace bank notes, coins, or cash deposits. Rather, people will use it alongside the existing fiat currency. The Bank of England has stated that it will “continue to provide cash for as long as the public still want it.”

How Is It Different to Cryptocurrency?

Someone just getting started with cryptocurrencies can easily mistake the new UK digital currency as one of the crypto assets. But they have their differences. Before we talk about their differences, let us understand the meaning of the terms.

What is CBDC? It is a digital currency issued and managed by a country’s central bank. Such digital currencies are always exchangeable for the country’s fiat currency. Transactions of a CBDC are stored on a private ledger held at the central bank.

An example of such currency is the digital pound. Other examples of CBDCs are China’s digital yuan, India’s digital rupee, Nigeria’s eNaira, the Bahamas’ Sand dollar, and others.

What is cryptocurrency? This digital asset is stored and verified on a blockchain public ledger. Such assets serve as a means of exchange or owning a piece of a crypto-based enterprise. Cryptocurrency is decentralised, meaning that a central authority does not manage it. Transactions are stored on several public computers called nodes.

A prominent example of a cryptocurrency is Bitcoin, the first cryptocurrency ever created. It also has the largest market capitalisation. Other examples include Ethereum, Solana, and Polygon.

Now, here are the main differences between a digital currency and a cryptocurrency:

- Digital currencies are issued and regulated by the country's central bank. Cryptocurrencies, on their part, are not issued by a central authority.

- Digital currencies use a private ledger stored by the central bank. Cryptocurrencies use a public ledger that is publicly accessible to anyone.

- Digital currencies have a fixed value often derived from primitives such as a country's fiat currency. On the other hand, cryptocurrencies are volatile and therefore have no fixed price. Only certain cryptocurrencies, called stablecoins, maintain a price pegged to a specific asset. Examples of stablecoins are Tether, USD Coin, etc.

- Digital currency may be limited to a specific jurisdiction. On the other hand, cryptocurrency is accessible to anyone in the world.

- Digital currency issuers mandate users to submit personal information. Investors using cryptocurrencies do not have to submit such data but can perform transactions pseudonymously.

- Regulations governing digital currencies are clearly defined. On the other hand, regulators are still dispensing laws to guide the use of cryptocurrencies. It is noteworthy that no singular regulator gives these laws globally.

Read More: Digital Currency vs Cryptocurrency: What’s the Difference?

Key Features

This section reviews the basic features of the digital pound:

-

Digitalisation

The UK digital currency will exist only in digital form. This means it will not have a physical counterpart and will only be transferrable using electronic devices.

-

Centralisation

Unlike digital assets such as Bitcoin and Ethereum, which live on decentralised networks, The Bank of England will likely build the new digital currency on a centralised network controlled by approved consortium members. This may include prominent commercial banks or prominent government agencies

-

Instant Payment Settlement

Similar to other digital currencies, the digital pound will enable instant settlement. Such a feature would rival even popular cryptocurrencies, which typically take several minutes or hours to verify transactions.

-

Established Legal Framework

The legal framework shows how the new digital currency complies with outlined UK financial regulations. The Bank of England and the Treasury have established several units to oversee the creation of the digital pound. One of these units is the CBDC Engagement Forum, which studies all aspects of the UK digital currency aside from its technology.

Advantages

Here are the benefits that citizens can derive from the creation of a UK digital currency:

- It enables fast and efficient digital transactions of money.

- It promotes innovation in a world transitioning to a digital ecosystem.

- It can reduce the occurrence of financial crimes.

- Diversification of types of money that can be used for payments.

- It fosters reliability and resilience for the UK financial economy. Users can opt for CBDC in cases where their regular payment system fails to come through.

Risks

The risks that could spring from the issuance of a UK digital currency are:

- It could potentially put commercial banks out of business or disrupt some of their services. One such service includes the lending system. CBDC is capable of causing an increase in lending rates.

- It could cause a rise in inflation as more money goes into supply.

- A security breach can cause a leak of sensitive customer data to unauthorised people.

- A central bank digital currency gives the bank unprecedented control and surveillance over people’s money. It would become increasingly easy for the government to confiscate people’s money or enforce spending limits.

How Will a UK CBDC Function?

The UK digital currency will perform the same function as a physical British banknote (i.e. as a means of exchange). This means that it will be denominated in pounds sterling (GBP). This will make the denomination of the UK CBDC to be redeemable for the same denomination in the banknote.

The UK central bank produces digital currencies only for financial institutions. These digital assets form part of banking reserves and are used mainly for accounting purposes. However, the launch of a UK CBDC allows citizens to benefit from these provisions.

BoE will likely liaise with commercial banks to coordinate the distribution of the digital pound to customers. Citizens can send and receive the digital pound using everyday banking applications if that happens. They could also have the option to pay with CBDC on point-of-sale (PoS) machines and retail outlets throughout the UK.

Why Is the Bank of England Considering a Digital Pound?

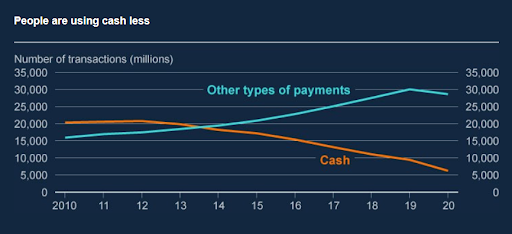

The Bank of England’s desire to create a UK digital currency comes from the fact that people are gradually reducing the use of banknotes and coins for payment settlement.

Since the introduction of bank deposits and other online payment methods, people have gradually begun to embrace electronic payment systems, thus reducing the usage of cash. Several financial technology companies now offer users platforms to explore new forms of money.

Presently, people prefer using online payment methods to using banknotes and coins. The move was sped up by the COVID-19 sickness that forced everyone into their homes. At that time, people were restricted to mostly online payment methods.

The chart below shows how people are adopting digital forms of money.

Source: Bank of England

The Bank of England believes launching a UK CBDC will support its innovative efforts. The new form of money will improve the payment service offered by the BoE. There is also the idea that launching a digital pound would lower the appeal of cryptocurrencies for UK consumers.

Why is Digital Pound Valuable?

The digital pound is valuable because it is issued by the Central Bank and is officially accepted as legal tender within the UK. Currently, the digital pound has not been released for use by the public. Notwithstanding, the asset will have its price pegged to the physical British pound.

How to Get a Digital Pound

As mentioned earlier, the digital pound is yet to be released. However, we know it is under creation by the Bank of England, which closely collaborates with HM Treasury. Like other CBDCs, the Bank of England will issue a digital pound.

As its launch date gets closer, the central bank will outline the procedure for obtaining a digital pound. Users should be wary of fraudsters trying to capitalise on the potential digital pound issuance and avoid buying into any schemes promoting investment into the digital pound.

Conclusion

This article has extensively discussed several known facts about the yet-to-be-launched digital pound. One of them is that the UK digital currency is not a cryptocurrency. Another is that it is not ruling out existing forms of money such as banknotes, coins, and bank deposits.

It will be interesting to see what other use cases the UK central bank has for the proposed digital currency. Consumers must guard against potential digital pound scams and patiently wait for the currency’s official release.

usdt

usdt bnb

bnb