We’re thrilled to introduce Stephane Bounmy, founder of BitcoinCompanies.

A solopreneur built 3 projects on Bitcoin. 15 years of developer experience with Ruby on Rails.

Chris: Let’s start at the beginning. You describe this project very simply: a Bitcoin leaderboard with verified treasuries. What problem personally annoyed you enough to start building this?

Stephane: We say "don't trust, verify" in Bitcoin. But for companies? It's basically impossible. Strategy says they hold 714k BTC. The only proof is an SEC filing or a Saylor tweet. Cool, but how do I actually verify that on-chain easily? Nobody had a good answer. So I built one.

Chris: Before we go deeper - did you expect this to turn into a public-facing product at all, or was it initially just something you built for yourself?

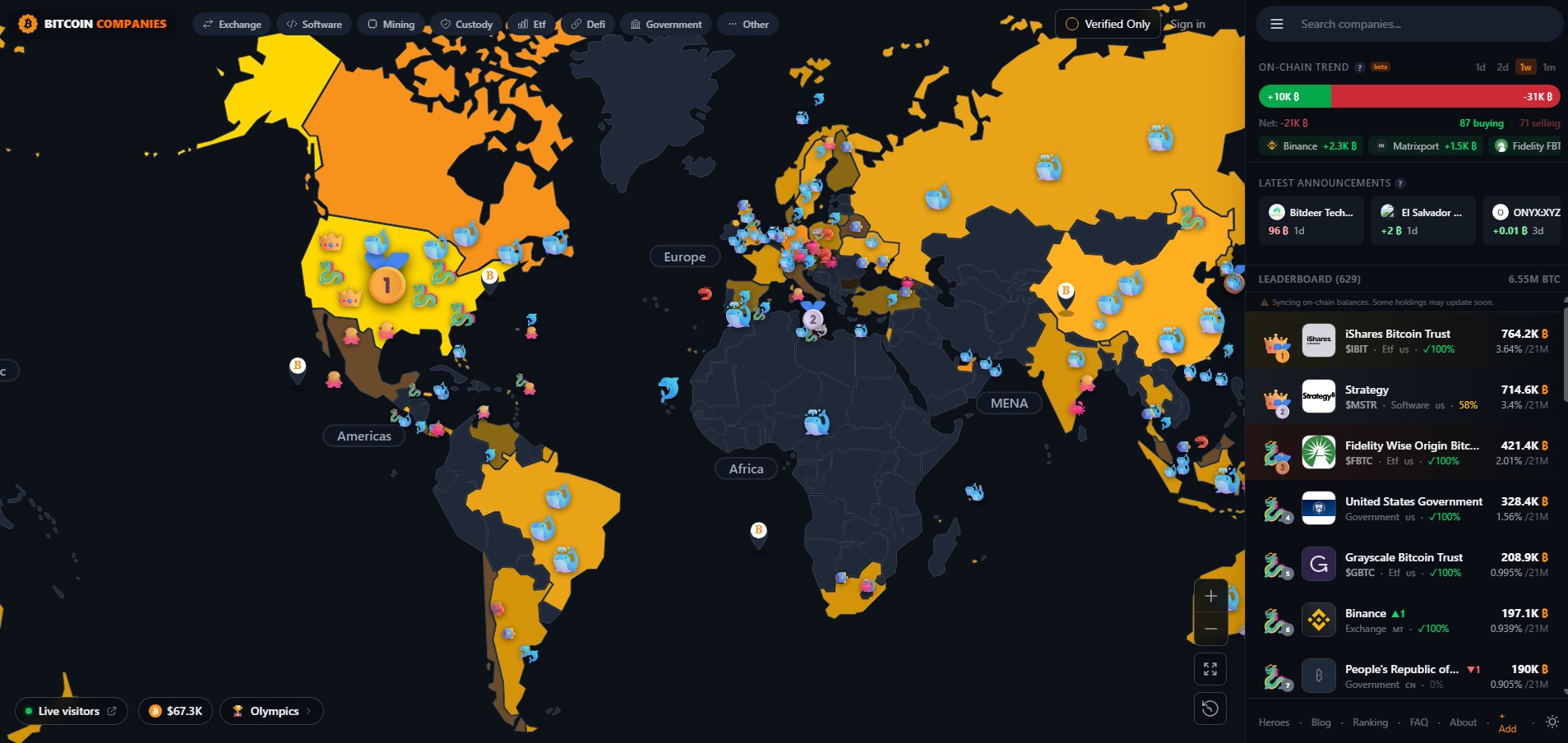

Stephane: Always meant it to be public. I was checking bitcointreasuries.net almost daily to see if companies were buying or selling. It's a great signal for Bitcoin adoption. But the data was just... tables. No map, no visual way to explore it. Felt like something was missing.

Chris: Let’s talk about verification. You’re pushing for on-chain proof of reserves, but convincing companies to verify their addresses is notoriously difficult. Why do you think companies are still so hesitant?

Stephane: I realized this the hard way after building v0.

Two reasons.

One, I'm a nobody. Small audience, no conference talks, no brand. Why would a public company trust some random French dev?

Two, even Saylor himself said proof of reserves is "like publishing your kids' bank accounts." Which is funny because... look at Satoshi. All his addresses are basically known (Patoshi Pattern). And it's fine. Nobody robbed Satoshi.

Chris: You make a clear distinction between “claimed” and “verified” BTC. Why was that separation important to you?

Stephane: At first, I only showed verified companies. Guess how many showed up. 3, my side projects.

Classic chicken and egg. Need data to get visitors. Need visitors to convince companies to get listed. So I said fine, let's show what they claim publicly, then track the % that's actually verified on-chain. Transparency about the transparency.

Chris: Let’s switch to the fun part. The animal tiers - shrimp to dragon - started as memes, but they clearly work. Why do you think this visual language resonates so strongly?

Stephane: Whales are already part of Bitcoin culture. Everyone knows what a whale is. I just extended it both ways. Shrimp, crab, octopus, fish, dolphin, shark, whale, humpback, leviathan, sovereign. And recently added "Immortal" > 1 000 000 BTC for you know who

My son loves it. He opens the map and goes "Dad, where's the dragon?" That's when I knew it worked. If a kid gets it instantly, the design is right.

Also it gives every company a visual identity you actually remember. "Oh they're a dolphin" sticks way more than "they hold 200 BTC."

Chris: You chose BTC-based thresholds instead of USD. Was that a philosophical Bitcoin decision, or a practical one?

Stephane: Wasn't even intentional at first. I was focused on mobile, didn't have much space, so I just showed btc amounts.

but now that you ask, it makes way more sense. 714k btc, you can picture that against 21m total supply. but $50 billion? how big is that really? there's no cap to compare it to. btc gives you a fixed denominator. usd doesn't.

Chris: You mentioned your kid using the map. Did that moment change how you think about education and UX in Bitcoin?

Stephane: I always build for myself and my family first. My son was already my first customer on my other project hongbao bitcoin. If a 5 year old can use the map, point at countries, and understand that bigger animals = more bitcoin, then anyone can.

Most bitcoin tools are built for traders and devs. I wanted something my kid could learn from. turns out that's also what normal people want.

It will be fun if in the future Bitcoin is taught at school through BitcoinCompanies'map.

Chris: Let’s talk about the Reddit moment. When the post hit #3 on r/Bitcoin, did you realize you had something special - or was it just validation?

Stephane: I posted on Reddit many times before that. Got banned, removed, "self-promotion", "not useful." The usual.

Then the map post hit 125k views and #3 on r/Bitcoin. That validated two things: the map is the feature that makes this memorable, and people understand a visual map way better than a blockchain explorer like Arkham Intel. And nobody had done it before. That felt good.

Chris: Do you worry that monetization could compromise trust - especially in a Bitcoin-native audience?

Stephane: Let's be honest. If it's free, you're the product. Lots of Ads, data selling, whatever.

I'd rather charge businesses directly. B2B. BTC companies, traders, hedge funds who need this data. Keep it free for regular people as long as possible.

But I'm not there yet. Right now it's all about traffic, most accurate data possible, and building the best product. Monetization comes after people can't stop checking it.

Chris: Do you think Bitcoin needs more “boring infrastructure” projects like this - or more radical experimentation?

Stephane: If we want adoption we need to make Bitcoin easier for normal people. We forget that Bitcoin is people's money. The protocol works. Lightning works. Ark is coming. The infra is there.

There are tons of smart, complicated projects out there. That's just not me. I've never been the smartest person in the room. But I'm a bit creative.

The map is geography. The data is history. "Study the past to define the future," right? So I built a time machine. You can go back to the Satoshi era, watch adoption grow year by year. That's not radical tech. It's just a good way to tell the story.

Chris: And looking further ahead - if someone checks this site every day in five years, what do you hope it has become?

Stephane: The Google Maps for Bitcoin. You open the app, see companies in your country, check if their holdings are real or just PR. Read reviews from actual Bitcoiners. Maybe you're a company looking at your competitors. Maybe you're a Bitcoiner deciding who to trust with your money. Maybe you're a kid zooming into Japan going "Dad, why are there so many dolphin in Japan?"

Right now, if you want to know which companies hold Bitcoin, you AI/Google it, get a Forbes article from 2023, and hope it's still accurate. That's broken. I want this to be the place where you go, every morning, to see what changed overnight. Who bought. Who sold. Who just joined the leaderboard. A living, breathing map of Bitcoin adoption happening in real-time.

usdt

usdt xrp

xrp