There are hundreds of crypto exchanges in the UK. Some have been around for almost a decade, while some have launched within the last year. Others have reportedly lost millions of user funds to security breaches, while some do not have sufficient liquidity for users who want to execute large trades.

How do you pick out the best exchanges so you don’t lose your hard-earned money or encounter avoidable difficulties while trading and moving funds?

We made the work easier for you by providing this list of the best cryptocurrency exchanges in the UK. Note that even though some of these platforms are not located in the UK, they offer top-notch services to customers in the jurisdiction.

Top Crypto Exchanges List

Here is a list of the tier-1 top cryptocurrency exchanges in the UK.

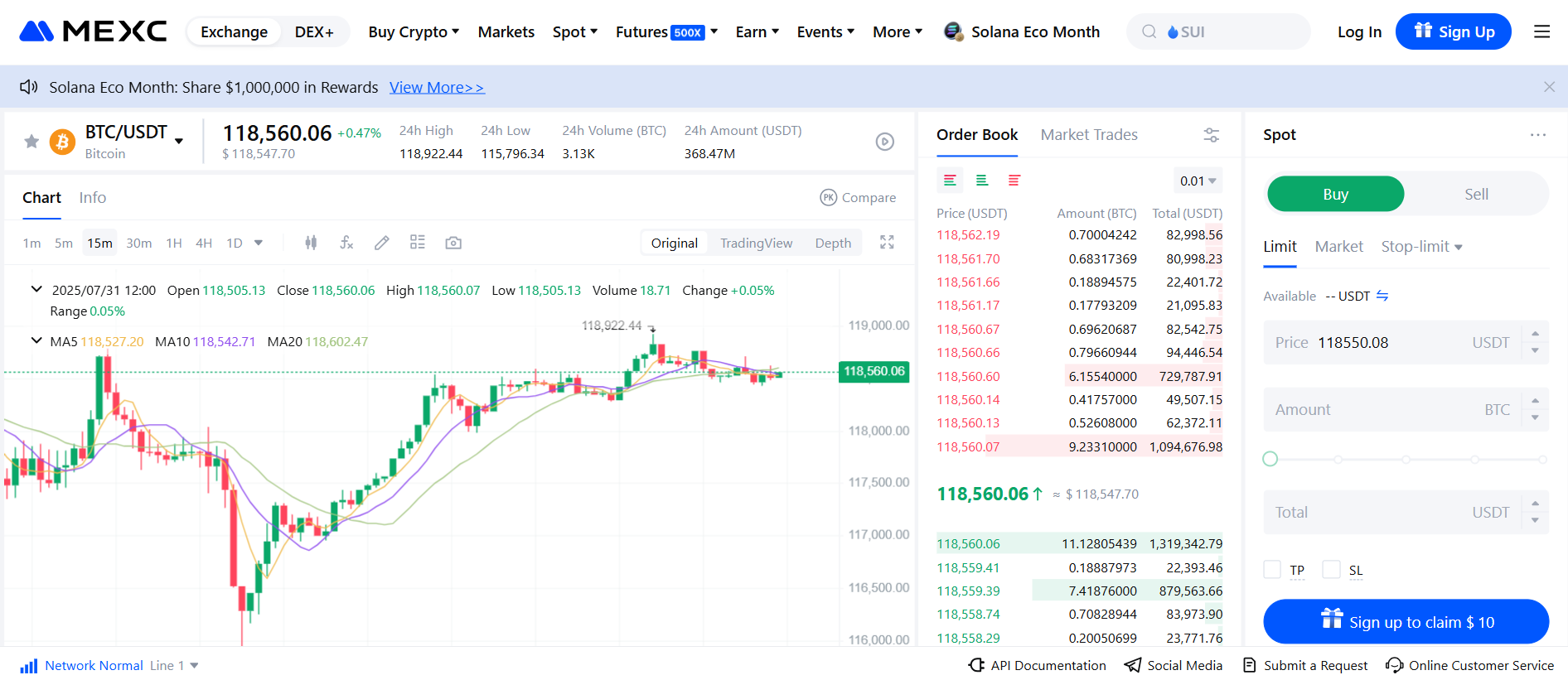

1. MEXC – Best for Decentralized Access to Crypto

MEXC is a crypto exchange that stands out from other centralized exchanges for its heavy lean towards decentralization. For one thing, it offers the flexibility of creating accounts without undergoing the Know Your Customer (KYC) process. However, users must complete KYC to exceed the limit of 10 BTC daily withdrawal.

Unlike most rival centralized exchanges, MEXC offers users seamless access to crypto assets by softening its listing criteria. It currently supports 4,230 trading pairs across its spot and futures markets. It also features copy trading, P2P trading, a referral program, and demo trading. MEXC also features a dedicated decentralized exchange interface, enabling traders to take trading to the next level.

While at it, the crypto exchange ensures users’ funds security by dedicating a $100 million Guardian Fund, backing reserves 1:1, and creating the Futures Insurance Fund to protect futures traders.

Features

- Supports 4,230 trading pairs.

- Copy trading.

- Easy to start trading.

- Spot and futures trading.

- Enables no-KYC verification.

- Mobile app.

- DEX Interface.

- MEXC MasterCard.

- Native MX token.

Fees

- In its Spot market, MEXC charges 0% in maker fees and 0.05% in taker fees.

- In its Futures market, MEXC charges 0% in maker fees and 0.02% in taker fees.

- Holding at least 500 MX tokens (its flagship crypto) cuts the fees by up to 50%.

Pros

- Quick token listing makes it easy to access new tokens.

- Relatively cheap trading fees.

Cons

- Listed tokens may not undergo adequate scrutiny before listing.

- Limited support for payment methods.

Supported Payment Methods: Credit/debit card, bank transfers, Apple Pay, Google Pay, Mercuryo, Moonpay, and Banxa.

Terms of Use apply. Please consult the list of supported countries. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

2. BitPanda – Best Regulated Crypto Exchange

Country: Austria

Bitpanda is a crypto broker that allows users to buy, sell, hold, and invest over 600 cryptocurrencies. The platform serves over 7 million users globally, including the UK.

Most of Bitpanda’s competitors have their platforms tailored for advanced users with an understanding of comprehensive tools and trading features. Taking a different turn, Bitpanda focuses on bringing in new investors into the crypto industry. Upon joining the crypto exchange, users can start investing in their preferred digital asset with as little as £1. It also introduces a zero-fee policy on deposits and withdrawals.

Bitpanda also offers access to decentralized finance (DeFi) protocols, crypto indices, limit orders, and crypto staking. These features enable BitPanda users in the UK to maximize their earning potential.

Features

- Multi-language support.

- Cold storage.

- Mobile app.

- Staking function.

- Affiliate program.

- DeFi compatibility.

- Limit Orders.

- Crypto Indices.

Fees

- The crypto broker does not charge a fee for deposit and withdrawals.

Pros

- Free deposits and withdrawals.

- The largest selection of cryptocurrencies (600+)

- Easy to use.

- Zero occurrences of security breach.

Cons

- Limited features compared to crypto exchanges.

Supported Payment Options: Credit/debit cards, Paypal, regular and instant bank transfers, and Apple Pay.

Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take two minutes to learn more

3. eToro – Best Broker-like Crypto Exchange

Country: UK

eToro is a trading and multi-asset management company launched in January 2007. The platform offers over 6,000 digital assets, including cryptocurrencies, to over 35 million users globally in more than 100 countries. The firm has an FCA license, enabling its operation in the UK.

Features

- Mobile app.

- NFT trading.

- Copy trading.

- Demo trading.

- Affiliate program.

- Staking service (crypto staking is unavailable in the UK).

Fees

- 1% for buying and selling crypto.

- Conversion fee between 1.5% and 3%.

Pros

- The platform has an intuitive user interface.

- The trading platform supports 100 cryptocurrencies.

- eToro has an established presence in the global financial market since 2007.

- eToro Academy allows users to learn about crypto and practice crypto trading in a virtual portfolio.

Cons

- eToro supports accounts denominated in USD. Users using non-USD fiat currencies must use a currency converter (with a fee).

- The platform does not offer as many cryptocurrencies as rival trading apps.

Supported Payment Methods: Neteller, Skrill, iDEAL, Klarna/Sofort Banking, Trustly, and Bank Transfer.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

4. Gemini – Best for User-Friendly Interface and Safety

Gemini is a New York-based crypto exchange launched in 2014. The crypto custodial platform supports about 100 cryptocurrencies and includes features like staking, Web3 functionalities, and derivatives trading. It has operated in the UK since 2020.

Features

- Mobile app.

- Supports about 100 cryptocurrencies.

- Derivatives trading.

- Staking.

- Spot trading.

- Web3 Creative Studio.

Fees

- Fees are varied based on the trader’s transaction size and type. The platform charges 1.49% on transactions on instant and limit orders.

- Maker’s fee is 0.02%, and taker’s fee is 0.04%.

- View fee schedule.

Pros

- Intuitive user interface.

- Supports advanced trading tools.

- Supports many cryptocurrencies.

- Competitive fees.

- Accessible in various countries.

Cons

- Limited staking coins.

- Limited payment methods.

- Supports fewer cryptocurrencies compared to other exchanges.

- Limited customer support.

Supported Payment Methods: Credit/debit cards, bank transfers, and Google/Apple Pay.

5. Uphold - Best for an array of asset and security

Uphold stands as a premier trading platform for UK crypto investors, providing access to over 250 tokens and early support for emerging assets. Its intuitive interface and unique "anything to anything" feature empower users to seamlessly trade between cryptocurrencies. Uphold's exceptional liquidity ensures competitive transaction prices, particularly during high-volume market periods. Notably, Uphold distinguishes itself through its unwavering commitment to transparency and security. Real-time assets and liabilities are openly displayed on a public website, updated every 30 seconds, showcasing Uphold's 100% reserved approach that safeguards user funds without engaging in lending practices. Uphold's comprehensive token options, user-friendly interface, liquidity advantage, and dedication to transparency and security set it apart in the trading landscape.

Features

- Broad range of tokens and earliest token support

- Connected to 26 underlying exchanges to find you the best token prices

- Spend assets anywhere in the world with the Uphold Card

- Advanced trading features like take profit and trailing stop loss.

- Instant conversion between supported assets.

- Automated trades with transaction scheduling feature

- Cryptocurrency staking

- Support for both mobile and web devices.

- Proof of reserves audit

Fees

- Maker and Taker fees range between 0.2% to 1.25% but generally differ based on the traded asset

- $0.99 flat fee for orders below $500

Pros

- Users can deposit as little as £1

- Supports a wide range of cryptocurrencies

- Various on-ramp and off-ramp methods

- Uphold is heavily regulated in the UK.

- Uphold is transparent about its trading fees.

Cons

- The Uphold web platform could use improvement to become more user-friendly.

Supported Payment Options: Visa, Mastercard, Apple Pay, Google Pay & bank transfer

Terms Apply. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more

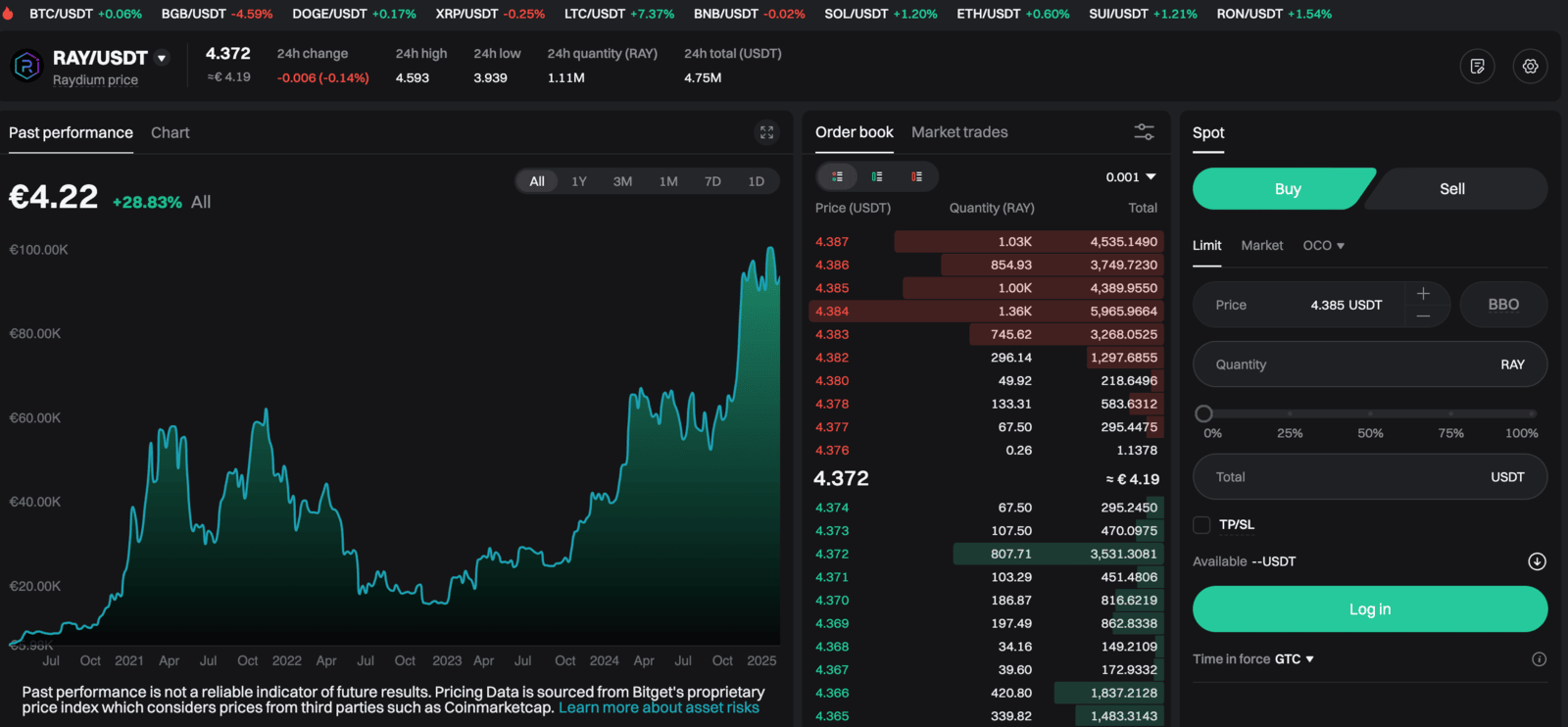

6. BitGet – Best for Day Trading

Country: Seychelles

Bitget is an online crypto trading platform where users can buy, sell, and trade digital assets, including Bitcoin and Ethereum. The crypto exchange also offers advanced trading features, such as futures trading with leverage, spot trading, and copy trading.

Founded in 2018, Bitget is one of the newer players in the space but has since grown to become one of the most popular cryptocurrency exchanges in the world. At its launch, the platform was focused on serving the Asian market, but it has since expanded globally, offering its services to users in over 150 countries. Gracy Chen is currently the platform's chief executive officer.

Features

- Supports over 800 trading pairs

- Copy trading

- Bitget Earn

- Spot trading

- Futures trading

- Bitget Quanto Swap Contracts

- Mobile app

Fees

- Fees vary depending on the type of transaction, but Bitget offers a tiered fee structure, promotions, and discounts.

See the full fee schedule.

Pros

- Available in over 150 countries and regions

- High liquidity

- Mobile app

- Supports over 800 cryptocurrencies

- Low fees with a BGB discount

- Advanced trading features

- Strong security measures

- High-performance trading engine

Cons

- Restricted in some countries, including the United States.

- High leverage risks

- No margin trading for USDT

- Regulatory uncertainty

- No demo account

- KYC requirements

Supported Payment Methods: Cryptocurrencies, Credit/Debit Card, Apple Pay, Google Pay, and bank transfers.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

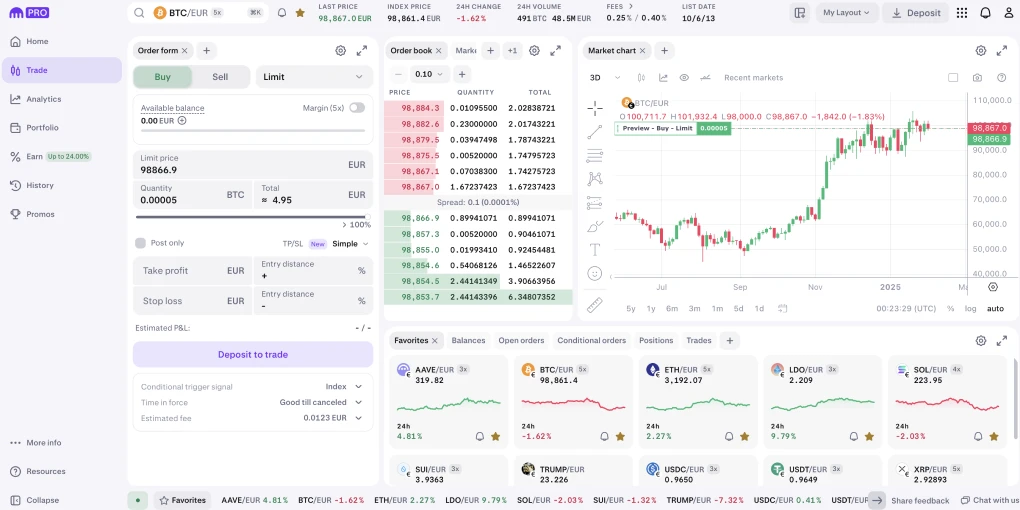

7. OKX – UK-Friendly

Country: Singapore

OKX is a popular crypto exchange and an excellent option for UK users, given their compliance with new regulations for UK-based trading platforms. OKX is also exceptional for having a wide selection of coins and advanced trading tools.

Features

- Mobile app

- P2P trading

- NFT trading

- Demo trading

- Affiliate program

- Launchpad sales

- Instant Buy and Sell widget

- Spot, margin, futures, and options trading.

- Crypto staking and savings products

- Institutional and OTC desk for high-profile investors

Fees:

- Maker 0.08% - Taker 0.1% (lowered for OKB holders)

- View fee schedule

Pros

- Deep liquidity

- Transparent fee schedule

- Advanced trading tools and options

- Access to a wide range of cryptocurrencies.

- Automated trading via copy trading and trading bots.

- OKX publishes regular proof-of-reserves (PoR) updates to confirm user assets are fully backed.

Cons

- Relatively sophisticated for new users

- OKX does not offer native GBP accounts for holding fiat.

Supported Payment Methods: Bank Transfer, Debit Cards (Mastercard and Visa), and P2P Trading (Revolut, Wise, FasterPay).

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

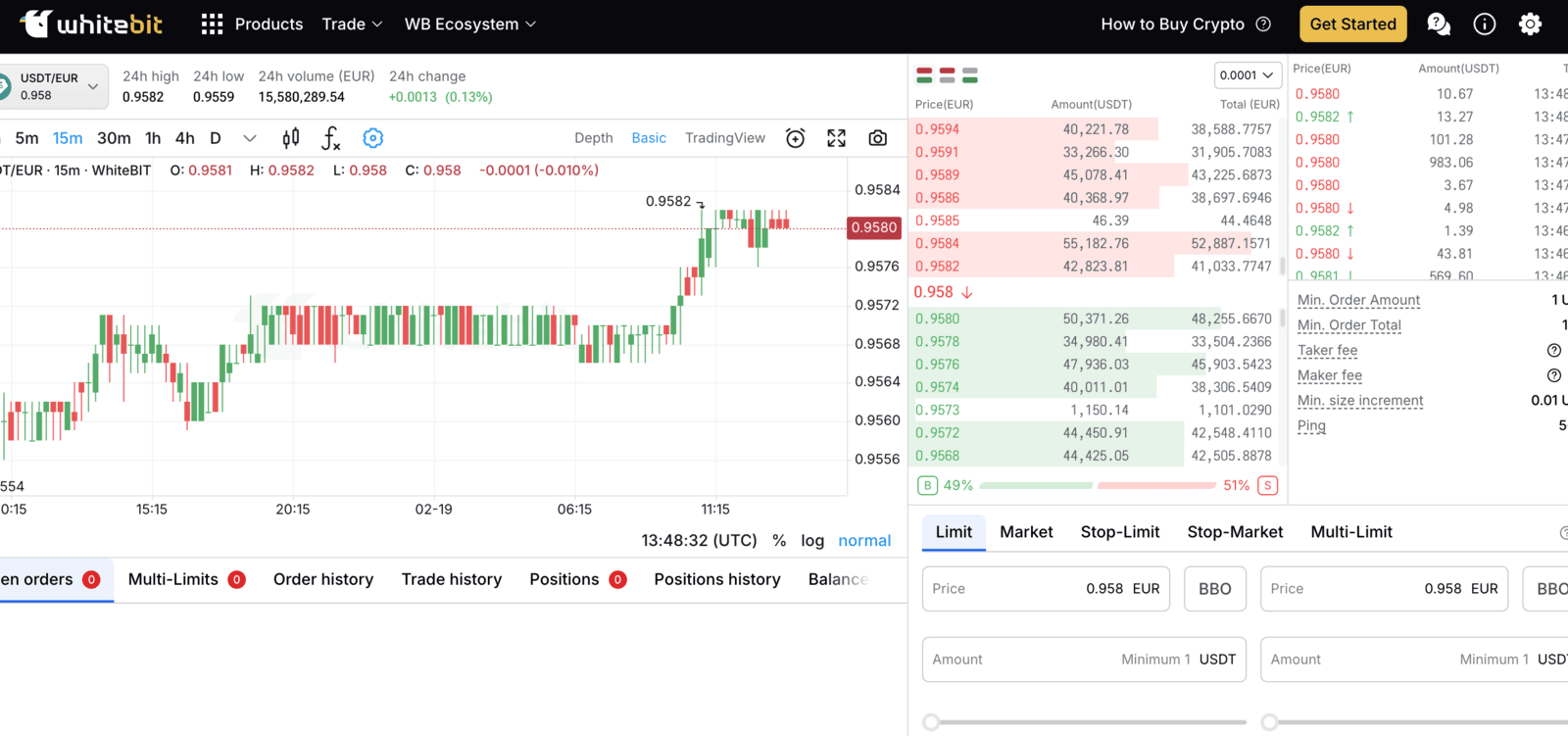

8. Whitebit – The Most Innovative Ecosystem

Country: Lithuania, Czech Republic, and others (WhiteBit Group)

WhiteBIT is a centralized cryptocurrency exchange originally founded in Ukraine in 2018. Tapping into its European origin, WhiteBIT has expanded its operations to various countries within the continent, including the UK.

The crypto platform’s current CEO is Volodymyr Nosov, who supposedly significantly expanded WhiteBit and attracted a user base of over 5 million.

The platform was audited by Hacken.io, leading specialists in the field of cybersecurity with specialization in blockchain technologies. According to the audit of the certification platform CER.live, WhiteBIT is among the five most secure crypto exchanges.

WhiteBit lists more than 300 assets in 500 pairs with average daily volume exceeding $2,5 billion which makes it one of the largest and most successful retail exchanges in Europe.

Features

- Cold storage

- Mobile app

- Multi-language support

- Multi-signature wallets

- DDoS protection

- Spot trading

- Margin trading

- Stop-loss and take-profit orders

- Staking program

- Affiliate Program

Fees

- For spot trading, the maker and taker fees are both 0.1%

- Discounts for VIP users and users holding its native token

See the full fee schedule

Pros

- User-friendly interface

- Cold storage, ensuring robust security

- Advanced trading options

Cons

- Not available in all countries

- Limited educational resources

- Withdrawal Limits

- Limited payment options

- No margin trading for US users

- No futures trading

Supported Payment Methods: Cryptocurrencies, fiat currencies, credit/debit cards, and bank transfers.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

9. Kraken — Reliable Exchange

Country: United States

If you’re looking for a highly reputable cryptocurrency exchange, Kraken is a good option. The exchange launched in 2011 and is available to users in most jurisdictions, including the UK. After more than a decade of secure operations, Kraken can be considered among the safest exchange platforms.

Features

- Mobile app

- Instant “Buy and Sell”

- Kraken Pro for sophisticated traders

- Earnings product for passive income

Fees:

- Maker 0.16% - Taker 0.26%

Pros

- Deep liquidity

- Responsive customer support

- User-friendly platform ideal for beginners

- Advanced tools for sophisticated traders.

- GBP and EUR crypto pairs for major cryptocurrencies

- Regular proof-of-reserves audit to confirm user assets backing

Cons

- Higher fees than competitors

- List fewer coins than competitors

Supported Payment Methods: Debit Cards (Visa and Mastercard), ACH, CFPS (Clear Junction), BLINC, CHAPS (Clear Junction), and SWIFT

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

10. Coinbase

Country: United States

San Francisco-based Coinbase is one of the most popular cryptocurrency exchanges in the world (over 100 million users) and offers its services to the UK audience. Coinbase is especially notable for its user-friendly interface.

Features

- Native support for GBP and EUR deposits.

- Debit and Credit card purchases.

- Insurance coverage for deposited crypto assets.

- Exchange trading facility for institutional investors (Coinbase Prime).

- Staking options for popular proof-of-stake coins.

- High-security standards for both platform and client asset storage.

Fees

- 3.99% for card purchases

- 0.25 Taker, 0.15 Maker

- 25% commission on earned yield from staking product

See the full fee schedule.

Pros

- The Coinbase interface is sleek and easy to navigate for even first-time users.

- Coinbase boasts high liquidity across all listed trading pairs and assets.

- The platform lists a wide range of assets and continually expands its options.

- Multiple security options for securing user assets.

- Coinbase supports the purchase of crypto using 3D-secured credit cards.

- Coinbase provides options for users to earn free crypto by learning about new projects.

Cons

- Relatively high fees compared to competitors

- Coinbase shares user data with tax authorities.

- Coinbase has a reputation for experiencing downtime during periods of peak market demand.

Supported Payment Methods: Debit and Credit cards, Bank Transfer, Faster Payments, SWIFT, SEPA, and Cryptocurrencies.

Types of exchanges

There are primarily five types of cryptocurrency exchanges.

1. Instant Exchanges

These are crypto exchanges that primarily allow people to buy and sell cryptocurrencies instantly and via a single interface. The process is typically seamless and primarily supports card transactions.

Examples: Swapzone

2. Centralised Exchanges

Centralised exchanges maintain centralised order books and serve as a marketplace for buyers and sellers to transact with each other without knowing themselves.

They also keep custody of the assets that are being traded and often serve as a central point for hackers to steal these funds. Users are advised to only leave on a crypto exchange an amount they are actively trading and can afford to lose. Not your keys, not your crypto!

Examples: Most of the exchanges that we covered in this article are centralised exchanges.

3. Decentralised Exchanges

As the name suggests, decentralised exchanges (DEXes) are platforms that maintain no centralised order books. Users can trade directly from their cryptocurrency wallets without delegating their keys to anyone.

Examples: Ethereum-focused Uniswap and Solana-based Jupiter exchange.

4. Peer-to-peer (P2P) Exchanges

P2P exchanges are platforms that provide an escrow service for crypto buyers and sellers. Transactions are typically initiated by interested parties while the exchange holds the funds until the payment is confirmed.

Examples: OKX.

5. Derivatives Exchanges

Derivative exchanges offer products that track the price of cryptocurrencies, allowing investors to profit from price movements without holding the underlying asset. Popular crypto derivatives products include futures, options, and perpetual contracts.

Notably, crypto derivatives trading is currently banned in the UK. Hence, exchanges do not offer this option to UK-based customers.

How to choose a Bitcoin exchange

As you may already guess, your preferred Bitcoin app is one that offers the exact services you’re seeking. Here are some other factors to look out for when choosing a Bitcoin exchange:

Ease-of-use

The best cryptocurrency exchanges prioritize the provision of a user-friendly platform. Therefore, your preferred platform should have an easy-to-navigate interface for user balances, deposit and withdrawal options, as well as other trading tools.

Security

Cryptocurrency exchanges are primary targets for hackers. Therefore, world-class exchanges implement the latest security standards to secure user assets and also provide users with security features. This may include two-factor authentication (2FA) and the mandatory use of unique and strong passwords.

Fees

Experienced traders understand how much they can save by using exchanges that offer low trading fees and related bonuses. Therefore, before you choose a Bitcoin exchange, ensure that they provide the best fees.

Supported Cryptocurrencies

If you’re not only into Bitcoin, then you probably need a Bitcoin trading platform that allows you to buy and trade as many altcoins as possible. Remember to beware of exchanges that list valueless tokens and always do due diligence before investing.

How to use a cryptocurrency exchange

The user interface on cryptocurrency apps may differ, but some features available on these platforms are permanent and, thus, can be easily located by even first-time visitors. Therefore, you can take the following steps to use a cryptocurrency exchange.

- Sign up with your email and complete the email verification.

- Go through the KYC process to verify your identity and increase transaction limits.

- Enable 2FA and other security measures provided by the platform.

- Access the Deposit button and use your preferred option (fiat or crypto)

- For fiat deposits, you’re typically provided with a bank account to transfer funds. Once the deposit is confirmed, you will see it on your exchange account.

- For crypto deposits, get the address for the assets you want to transfer and send funds from your external address. Wait for network confirmation to access the funds on your exchange account.

- Locate the “Buy” button if you wish to sell fiat for Bitcoin or other supported cryptocurrencies.

- For crypto-to-crypto trades, find the “Markets” or “Exchange” tab and select a suitable trading pair, e.g. BTC/ETH, to sell Bitcoin for Ether.

- Choose the order type and complete the trade.

F.A.Q

Are Deposits on Cryptocurrency Exchanges Insured?

No. Cryptocurrency deposits on exchanges are typically not insured like with traditional institutions. However, some operators like Coinbase insure client’s fiat currency deposits. Others like Bitget also implement a self-insurance policy that allows it to pay back users if there’s a security breach.

Which Exchanges are suitable funds withdrawal to traditional banks?

We have created a separate article about Crypto Off-Ramp Platforms.

Are All Crypto Trading Platforms Regulated in the UK?

No. Not all cryptocurrency platforms are regulated. However, the basic way to determine if a platform is playing by regulatory standards is if it requires you to submit KYC documents before you can access certain features. You can also check their website for more information since most regulated bitcoin exchanges like to flaunt their regulatory credentials.

Lastly, you can find a list of licensed UK exchanges and crypto platforms on the FCA crypto-related entities register.

Does Every Major Bitcoin Trading Platform have a Mobile App?

Yes. Every large player in this field launched a crypto app, and most of these apps are available for UK-based users.

Do only large-volume Cryptocurrencies become listed on the Exchanges?

No. Most of the big platforms list various altcoins. In addition to regulatory requirements, crypto exchanges have various standards for determining cryptocurrencies they list and only add coins they believe would boost their trading volume or userbase.

Conclusion

As promised, we covered in this article the ten best cryptocurrency exchanges in the UK. We discussed the features, fees, pros, cons, and supported payment methods on these platforms, and hope that the provided information will help you make a great choice.

Finally, remember to keep custody of your crypto assets when possible and implement best security practices while using exchanges. If you do this, then you can focus on growing your crypto investments and not scratching your head because of security failures.

usdt

usdt bnb

bnb