Chris: Welcome, Anna! Great to have you here, and my first question is introductory: tell us a little bit about yourself and how you got into fintech.

Anna: Thank you so much for inviting me! Absolutely. I am lucky enough to have always worked in tech-heavy industries like web design, online games, or fintech. I have been active in the global fintech community for a decade, moving through online payments provider, e-wallet, and neobanking businesses. It seems to be good coverage of industries to witness the fintech evolution and revolution that happened all around the world at a different pace and with different nuances. I am still mesmerised by this industry and how the world looks from its lenses.

Chris: How did you come up with the idea for What the Money? The mission behind the project.

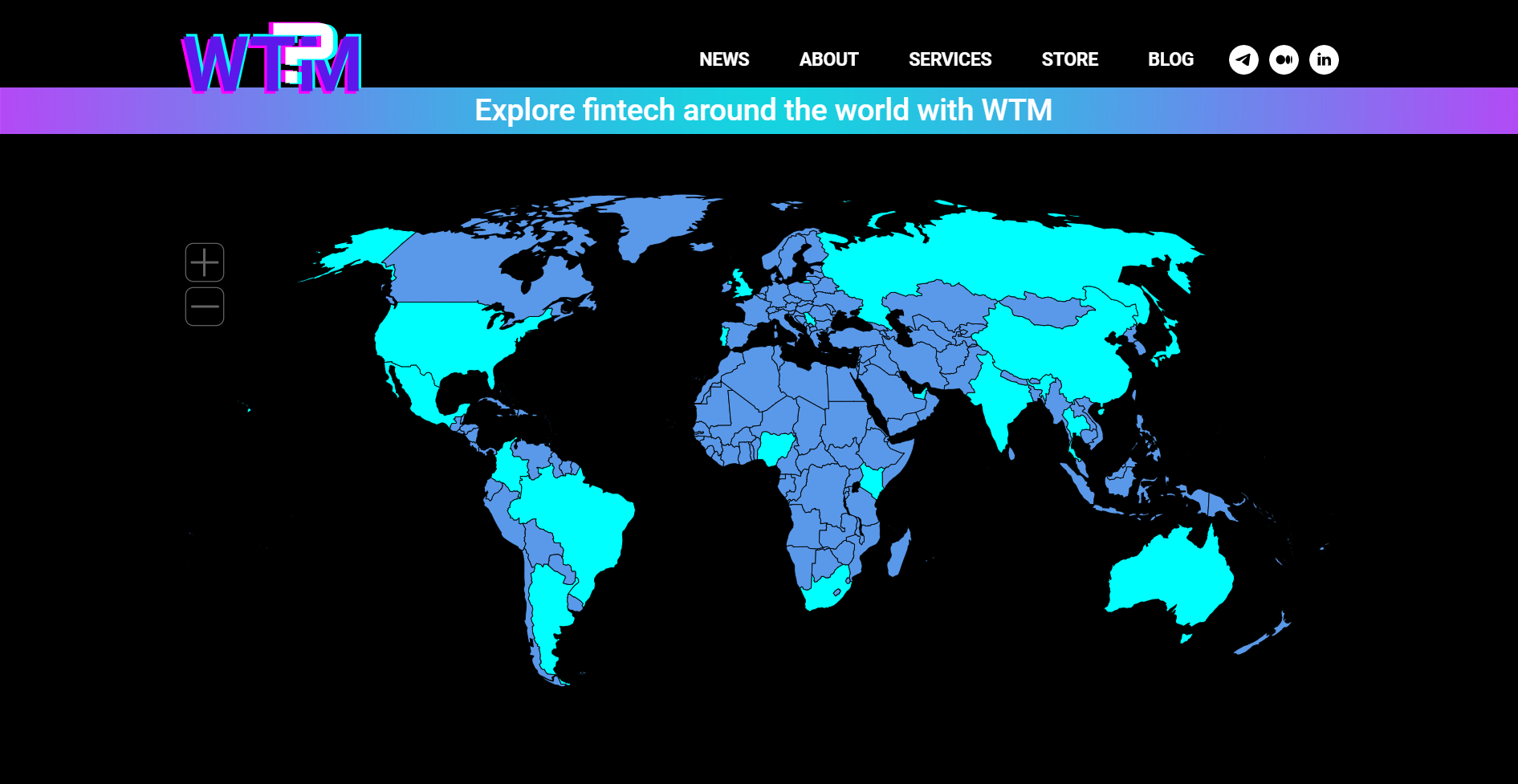

Anna: A few years ago, I started a blog about fintech as seen by my eyes while I travelled from country to country, networking with local experts. I wanted to paint the local fintech landscapes as objectively as possible - interviewing locals, doing my own research, and not relying on corporate data, which is always subjective and prone to advertising. Ultimately, this blog became an agency, and the articles became full-on country reports, so-called ‘fintech world map & wikipedia.’ Following the knowledge came consultancy services.

Now our services range from project management, business development as a service, marketing & PR for fintech and Web3 start-ups, interim management service, and much more.

Chris: Awesome! Talk about your team, please. To produce so much content and offer such a wide range of services, you must have committed people with you.

Anna: Sure I do, my team is actually the one behind everything that you see online. I was lucky enough to gather a small and dedicated number of fintech professionals coming from different backgrounds - crypto, banking, and payments. Also, geographically speaking, we are all spread out across 5 countries. Additionally, we are practicing internships for short-term projects.

Chris: How can the fintech posse benefit from What the Money?

Anna: Knowledge, at the very least. We are building a knowledge database of the global fintech evolution across all continents and all countries. Our goal is to have an actual and objective description of everything that is going on at every place on earth right now in fintech. We are constantly looking for local professionals and their input. We dive through hundreds of reports each month, searching for data, and then we combine them to see the full picture. So I believe any fintech needs that point of view, to evaluate their strategy and vision and monitor the trends.

Chris: What do you think of the current state of fintech and crypto in the UK?

Anna: I believe that the UK has always been one of the global fintech centres, and will continue to be there, especially after Brexit. I view the UK as a trendsetter in the infrastructural changes, in the consumer-oriented approach. Whatever bad days that might be for the fintech and crypto industries there now, they will pass. It comes in cleansing waves for the bad actors, and after each one, the UK goes the next mile to set a new standard in compliance, regulation, and technology.

Chris: What are your thoughts on CBDCs and their impact on the industry?

Anna: I believe that CBDCs are a natural evolution of paper money and digital money of all sorts but they will co-exist in parallel for a long long time. This is their infant stage, heavily reliant on local politics, geopolitical and economic circumstances. CBDCs as a concept are extremely powerful and extremely vulnerable at the same time in their essence. They have the potential to reshape the way governments, policies, and civil rights work. And at the same time, they will demand tons of new skilled workers 24/7, computing power, electricity, connectivity, risk management, and most importantly, liquidity management. Our governments have to become high-tech fintech companies to orchestrate this. Some will fail.

CBDCs are being rolled out and tested in most countries around the world now. First as a pilot and a proof of concept, then wholesale, then retail. I think that CBDCs are inevitable, but their roads are going to be rocky. Fintech industries will adapt, as they always do. Fintechs in some countries will reserve the right to be the front-end - a face, a brand for the consumer, while Central Banks and designated banks learn to play the back-end role. In others, fintech will find its way into the niches.

Chris: Last but not least, where can our readers follow you? Thanks a lot! It was a pleasure!

Anna: First, we share the latest news and announcements of new reports on our Telegram channel and publish personal and industry insights and op-eds in the WTM blog. For access to our knowledge database, please visit the ‘What the Money?’ website, where we constantly update the set of our free country reports and fintech landscape outlook in a nutshell as well as extended versions for deep dive into every country’s profile. And let’s connect on LinkedIn, for sure.

Thanks for having me! I enjoyed the conversation very much, Chris.

usdt

usdt xrp

xrp