We’re pleased to welcome – Sharif, Co-Founder of Defactor!

Chris: Let’s start with the big news — the launch of RWA.io. What was the initial spark that led Defactor to create an entirely new ecosystem instead of just expanding your existing toolkit?

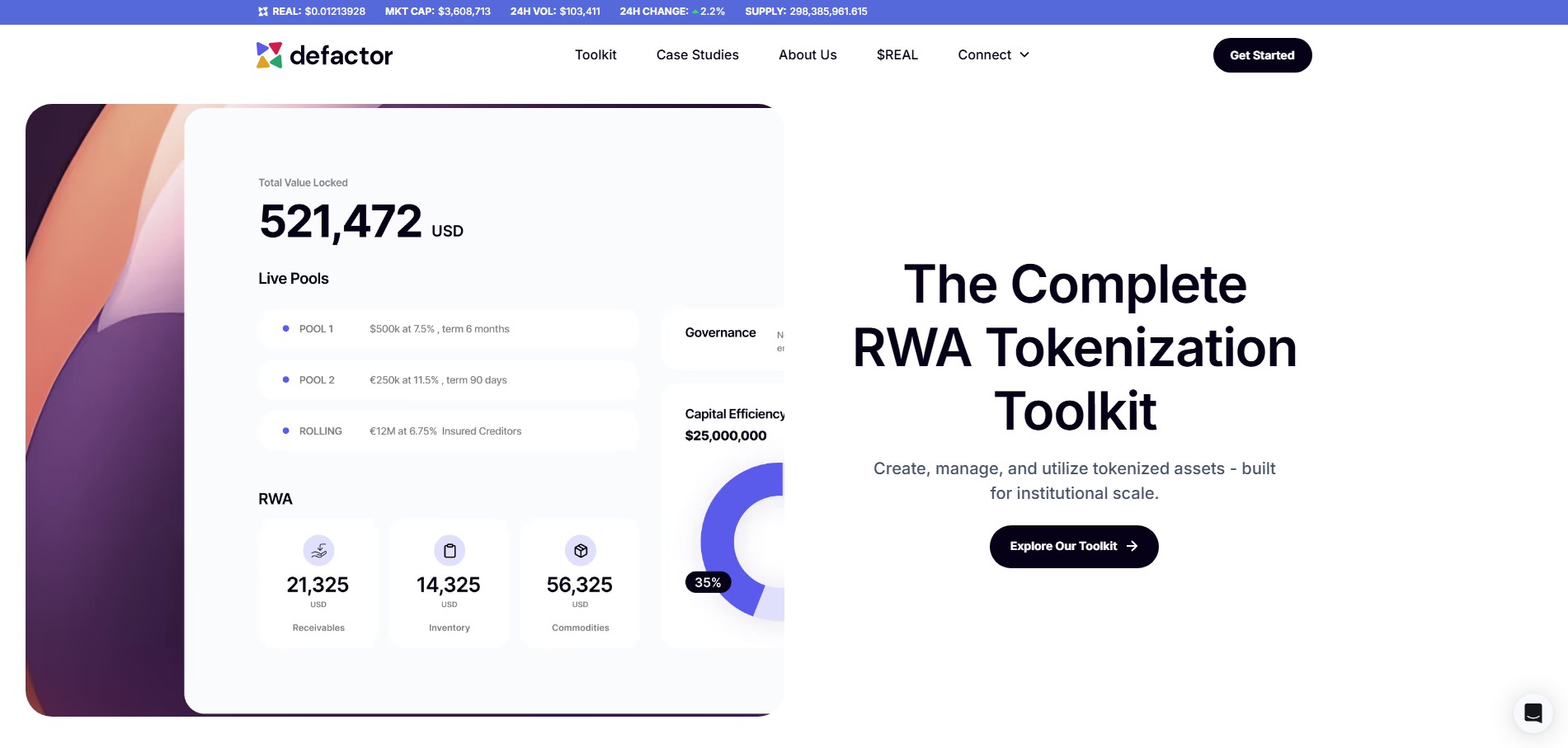

Sharif: The initial spark for RWA.io was the critical market gap for a dedicated data platform.

While we built tools, the ecosystem lacked a central hub for transparent, verifiable data on tokenized assets. RWA.io fulfills this need by providing the missing layer for asset evaluation and traction, which in turn helps uplift every project in our ecosystem through better data management and trust.

Chris: You mentioned that Defactor is the first verified project within the RWA.io ecosystem. What does “verification” mean in this context — and how does it ensure transparency and credibility across RWA projects?

Sharif: Verification is a free, 20-minute process where a project connects and syncs its live data sources to RWA.io.

This self-service process ensures the data showcased is authentic and coming directly from the source. By properly featuring this verified data, we bring crucial transparency and credibility, helping investors and users understand projects and allowing the space to grow organically.

Chris: Defactor has come a long way since its early tokenization efforts in 2021. How has your vision evolved since then — from building individual products to now designing an entire RWA ecosystem?

Sharif: Our vision evolved as the RWA space itself expanded far beyond just trade finance.

We realized that to truly serve this growing industry, which is set to capture most traditional markets, companies needed more than a tech partner. They needed an ecosystem guide for the entire journey of bringing assets on chain, from precious metals to more exotic assets like commodities and agriculture.

Chris: Many projects talk about tokenizing real-world assets, but few have shown live projects like Defactor’s partnerships with RealtyX, LandX, and Landshare. What are some key learnings from working with these real-world integrations?

Sharif: A key learning is that you cannot win battles alone; growth is driven by partnerships and community.

Success hinges on having your token holders, clients, and users believe in the industry's mission. That's why we focus on uplifting our partners by connecting them with relevant players in the ecosystem, helping them grow faster and flourish together.

Chris: What challenges do you still see for tokenization adoption — particularly when it comes to legal frameworks, liquidity, and institutional trust?

Sharif: The primary challenge is a lack of liquidity, largely driven by a regulatory landscape that is lagging behind.

This regulatory uncertainty slows down institutional adoption, as major players are hesitant to enter a space without clear legal frameworks and compliance standards, creating a bottleneck for the entire market.

Chris: The transition from $FACTR to $REAL marks a major milestone. Why was this migration important for Defactor’s evolution, and how did the 98.95% community vote influence your confidence in the change?

Sharif: The migration was vital to develop more trust by having the token's total supply unlocked and released to the market.

The near-unanimous 98.95% community vote was a tremendous confidence boost, validating our strategic pivot to focus on the Base ecosystem and the issuance of assets on that chain.

Chris: $REAL’s circular tokenomics model — where platform revenue is used for buybacks and burns — creates a self-sustaining economy. How do you balance this deflationary design with the need for ecosystem growth and liquidity?

Sharif: We balance the deflationary design by ensuring that ecosystem growth directly fuels the tokenomics model.

As platform usage and revenue increase from more assets and users, the funds for buybacks and burns grow organically. This creates a virtuous cycle where growth strengthens the token's value, which in turn attracts more participants to the ecosystem.

Chris: Defactor also plans to test SAP/ERP integrations — a big step toward connecting traditional enterprise systems with Web3 infrastructure. What’s the vision behind that proof of concept?

Sharif: The vision is to seamlessly connect traditional business operations with the benefits of Web3.

By integrating with systems like SAP, we can improve traceability and transparency for assets like invoices. This also expands financing capabilities by allowing businesses to use their tokenized assets as collateral for loans, unlocking new capital.

Chris: How do you approach multi-chain deployment? You’ve been active on Polygon, Ethereum, Algorand, and now Base — what drives your multi-chain strategy?

Sharif: Our multi-chain strategy is driven by listening to the market and observing where innovation is happening.

Each chain has a vibrant community building and testing new solutions. We monitor these ecosystems closely to understand market demand and user feedback, ensuring we deploy where it makes the most sense for our partners.

Chris: You’ve described Defactor as “no hype, just real tech that works.” In a space full of speculation, how do you maintain that credibility and long-term focus?

Sharif: We maintain credibility by consistently building and delivering working technology to real projects with real users.

We have never engaged in hype or token pump-and-dump schemes. Our focus has always been on creating robust, functional platforms that deliver tangible value and move the entire industry forward.

Chris: Finally — if we fast forward to 2027, what’s your vision for the Defactor + RWA.io ecosystem? How will you know you’ve succeeded?

Sharif: By 2027, we will have succeeded when "Real World Assets" are simply considered "Assets," with the majority onchain.

Our vision is for the tokenized asset ecosystem to rival the scale of traditional capital markets. We will know we've succeeded when our solutions are the go-to tools for businesses and individuals navigating this new, on-chain financial landscape.

usdt

usdt xrp

xrp