The crypto world is changing fast, and decentralized exchanges, or DEXs, are leading this shift. Have you heard of Aster? It’s one of the newest platforms gaining attention for its speed, flexibility, and easy-to-use design. In this Aster exchange review, we explore whether it truly delivers on its promises.

Key takeaway: you can still receive an airdrop-style welcome bonus on Aster exchange if you sign up and perform first trade right now.

Aster competes directly with platforms like Hyperliquid, dYdX, and GMX. It not only supports spot trading but also offers perpetual, or perp, trading. Additionally, users can access advanced order types, high liquidity, and leverage options tailored to their strategies.

The platform caters to different users. For example, Hyperliquid users can compare features and efficiency. Perp traders gain risk management tools and competitive fees. Meanwhile, beginners enjoy an intuitive interface that helps them learn trading basics.

This review takes a closer look at Aster’s core products, including the $ASTER token, Pro Trading Mode, 1001x options, rewards program, referral system, and mobile app. Each feature is evaluated for usability, reliability, and competitive edge. By the end, you’ll know if Aster can outperform other DEXs. So, can it really stand out in the fast-moving crypto world? This guide helps answer that question.

What is Aster?

Aster is a decentralized exchange (DEX) where you can trade both spot assets and perpetual contracts (perps). It’s built for speed, so trades happen quickly and with minimal hassle. You also get access to advanced order types and leverage options, all in one place.

The platform is designed for different types of users. If you’re just starting, you can make simple trades easily. If you trade perps, you’ll find high liquidity and helpful tools to manage risk. And if you’re curious, Aster lets you compare trading efficiency, so you can see how smooth your experience is.

Aster is non-custodial, meaning you stay in control of your funds while trading. Smart contracts handle trades automatically, making everything transparent, secure, and fast without needing a central authority.

Fees on Aster are simple and clear. Spot trades, perpetual contracts, and token swaps all have structured pricing, so you know exactly what you’re paying. This setup works well whether you trade often or just occasionally.

Security is a big priority. Aster uses audited smart contracts to keep funds safe. It’s supported by YZi Labs, a trusted name in crypto development, which adds extra confidence in the platform.

The platform also focuses on a smooth user experience. Its interface is intuitive, and the mobile app works just like the desktop version. You can switch between trading modes, monitor your positions, and manage risk easily. Overall, Aster combines advanced trading tools, strong security, and ease of use, making it suitable for both beginners and experienced traders.

Aster DEX is backed by YZi Labs. Why does it matter?

Aster is developed and supported by YZi Labs, a well-known blockchain technology firm. Why should you care? Their backing gives users confidence that the platform is reliable. YZi Labs has a strong track record of building secure, high-performance decentralized platforms. Their experience ensures Aster’s smart contracts work correctly and safely. Regular audits and code reviews help reduce risks for traders.

Backing from YZi Labs also brings financial stability. This allows Aster to maintain deep liquidity and offer competitive trading options consistently. Users can trust the platform to run smoothly, even during high demand. The team has expertise in scalability and network optimization. This means trades happen fast, even in volatile market conditions. Traders benefit from low slippage, quick order execution, and uninterrupted service.

YZi Labs values transparency and clear communication. They share updates about development, security measures, and platform improvements. Users can follow these updates and feel secure about their funds. Their reputation also attracts strategic partners and liquidity providers. This strengthens Aster’s trading ecosystem and makes it a dependable alternative to older platforms.

With YZi Labs behind it, Aster stands out among new exchanges. Can you find another platform with the same credibility and performance? Traders can explore spot and perpetual markets confidently knowing a trusted developer supports the platform.

Core Aster products and features

Aster offers products for both beginners and professional perp traders. Its main strengths are speed, liquidity, and easy-to-use design.

- Spot Trading: Aster makes buying and selling crypto simple through an intuitive interface. You can trade major tokens with low fees. Spot trading is perfect if you’re still learning how markets work.

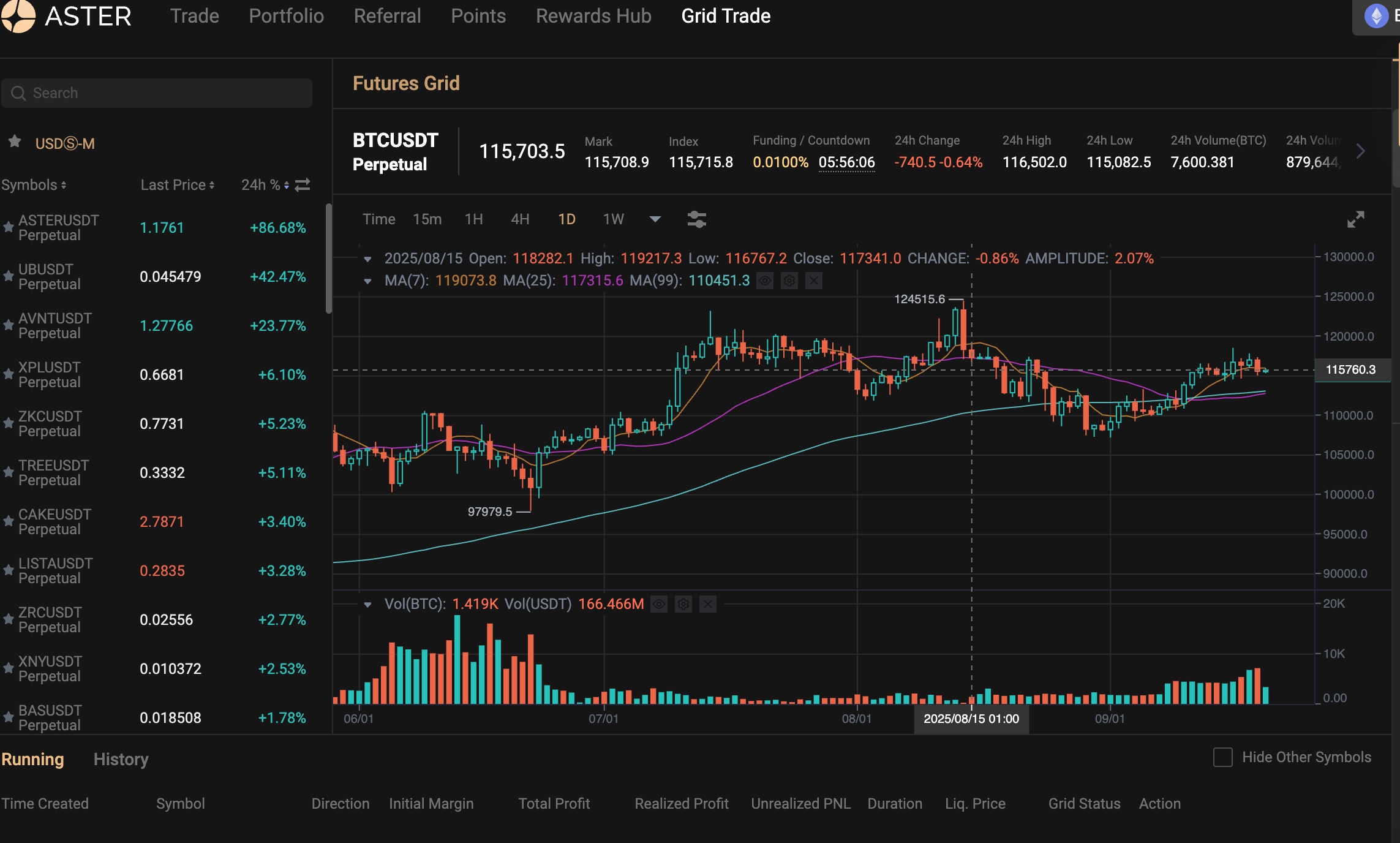

- Perpetual Trading (Perp DEX): Here, you can open leveraged positions on different assets. High liquidity keeps slippage low, even in volatile conditions.

- Advanced Order Types: Aster supports limit, stop-limit, and conditional orders. These tools help you manage risk and plan both short and long-term strategies.

- Leverage Options: Different markets support different leverage levels. This flexibility allows you to maximize opportunities or control risk depending on your approach.

- Pro Trading Mode: This mode unlocks advanced charts, detailed indicators, and faster execution. Professionals can analyze trends closely and respond quickly.

- 1001x Mode: Designed for extreme leverage, this feature carries high risk but also high reward. Users should understand potential losses first.

- Liquidity Pools: You can provide liquidity to the platform and earn a share of trading fees. This improves market depth for everyone.

- Staking and $ASTER Utilities: Holding and staking $ASTER tokens gives access to governance and other benefits. It also encourages active platform participation.

- Rewards Hub: Active traders can claim points, incentives, and bonuses. This system encourages loyalty and consistent activity on the platform.

- Mobile App: The app mirrors the desktop experience. You can monitor markets, manage trades, and adjust positions wherever you are.

- Referral Program: Aster rewards users who invite friends. This helps the community grow while giving benefits to active participants.

Aster combines simplicity with advanced tools. Beginners find it approachable, while experienced traders get the features they need. With clear fees, multiple leverage choices, and community incentives, Aster competes directly with platforms like Hyperliquid, dYdX, and GMX.

What is the $ASTER token?

The $ASTER token is the native token of the Aster platform. It plays a central role in governance, rewards, and staking. By staking $ASTER, users can take part in platform decisions. Token holders get to vote on proposals such as fee changes or product updates, making the system more decentralized.

The token also works as an incentive. Users can earn $ASTER by trading, adding liquidity, or joining reward programs. These incentives encourage consistent activity and keep the community engaged.

Within the ecosystem, $ASTER unlocks extra features. Holders can access advanced trading tools, claim platform rewards, and enjoy exclusive promotions. This adds more value and creates reasons to hold the token. The design encourages long-term loyalty, not just short-term use. Traders who keep $ASTER benefit beyond their normal trading activity.

And how about the tokenomics? The system aims to keep supply and demand balanced. Liquidity is structured to support availability while avoiding harmful price swings. This balance helps the platform grow steadily.

In short, $ASTER is at the heart of Aster. It connects user incentives, strengthens the platform’s economy, and gives the community real influence over its future.

What’s the difference between Aster Pro Trading Mode and 1001x?

Aster provides two main trading modes, each built for different needs: Pro Trading Mode and 1001x Mode. But how do they differ?

Pro Trading Mode is designed for users who want precision and control. It includes advanced charts, technical indicators, and flexible order types. Traders can study market trends closely and execute trades quickly. Leverage is available but kept moderate, helping users manage risk without going overboard.

1001x Mode, on the other hand, is built for high-risk, high-reward strategies. It allows extreme leverage on select assets, magnifying both potential profits and losses. This mode is only suitable for those who fully understand the dangers of over-leveraging. Are you willing to take that risk?

Ultimately, the main differences between the modes lie in risk, tools, and trading style. Pro Trading Mode emphasizes stability, analytics, and control, while 1001x Mode focuses on speed, aggression, and extreme leverage. The right choice depends on your experience, risk tolerance, and trading goals.

Liquidity also works differently in each mode. Pro Trading Mode uses standard liquidity pools for smooth execution. 1001x Mode taps into special pools built to handle extreme leverage, reducing slippage during volatile conditions.

Both modes still connect with Aster’s rewards, staking, and referral features. Users can switch between modes without losing open positions, giving more flexibility. For comparison, Pro Trading Mode feels similar to platforms like dYdX or Hyperliquid, while 1001x Mode offers a more adventurous path. Together, these modes ensure Aster appeals to beginners, intermediate users, and professionals alike.

How do Aster Rewards work?

Aster Rewards make the platform engaging by giving you perks for being active. You can earn points, benefit from trades, and manage everything in one place.

Points System

You earn points when you complete trades, provide liquidity, or stake $ASTER tokens. These points can be exchanged for bonuses, exclusive perks, or other benefits. The program also includes referrals, so you gain extra when people you invite trade or stake tokens.

Trade & Earn

Every trade you make adds to your rewards. Bigger trades or frequent activity bring in more points, motivating you to stay active. Beginners enjoy small bonuses, while experienced perpetual traders can unlock higher perks from volume and staking.

Rewards Hub

The Rewards Hub is where everything comes together. You can track, claim, and manage all your rewards in one place. It shows promotional tokens, bonuses, and special offers. The system is transparent, so you always see your points, history, and earnings in real time. This clarity helps you plan strategies around rewards.

How does the Aster Referral Program work?

Aster has a referral program that lets you benefit by inviting friends to the platform. Each user gets a special referral link that they can share with others. When someone signs up through your link and starts trading or staking, you earn a share of the fees or bonus rewards.

The program runs on different levels, or tiers. As you bring in more people and your network grows, your rewards increase. It’s designed to keep you motivated in the long run. The good part is, your friends don’t miss out either. New users who join through your link can enjoy perks like bonus points or reduced fees on their first trades.

The referral program also connects directly with Aster Rewards. This means any bonuses or points you earn through referrals are added to your overall rewards. So, you’re not only helping your friends get started, but you’re also boosting your own activity on the platform. It’s a win-win that helps build a stronger Aster community.

How good is the Aster App?

The Aster mobile app works just like the desktop platform, giving you trading freedom anywhere. You can place trades, check positions, and manage risks with no restrictions. Its simple design makes it easy for both beginners and experienced users.

The app is fast and reliable. Trades confirm quickly, charts display without delay, and prices update in real time. This speed helps reduce slippage and ensures you react to market moves immediately. You can trade spot and perpetual markets with advanced order types and leverage.

Security is built into every part of the app. You always control your funds through non-custodial protocols. Features like two-factor authentication, encryption, and regular updates keep accounts safe. Backing from YZi Labs adds further trust and credibility.

The app also connects directly to Aster Rewards, the referral program, and staking tools. You can track points, claim bonuses, and manage tokens in one place. Alerts notify you about filled orders, price moves, and platform updates, so you never miss key changes.

In summary, the Aster app is reliable, quick, and easy to use. Its design makes mobile trading just as effective as desktop.

FAQs

Is KYC needed for Aster?

No, you can trade on Aster without KYC.

Who is Aster’s main competitor?

Aster mainly competes with Hyperliquid, alongside dYdX and GMX. Its edge is low fees, advanced order types, and a smooth mobile app.

Why is Aster DEX getting attention now?

Aster stands out for low fees, strong liquidity, and up to 1001x leverage. Backing from YZi Labs and reward programs also boost trust and engagement.

Conclusion

Aster makes trading simple by supporting both spot and perpetual markets, so it works well for beginners and experienced users alike. The platform is easy to use, fast, and packed with helpful tools.

Low fees, strong liquidity, and flexible leverage options give users a smooth experience. Features like Pro Trading Mode and 1001x Mode cater to different risk levels. The $ASTER token adds extra perks through staking, governance, and rewards.

The Rewards Hub and referral program add more incentives, and the mobile app lets you trade anywhere with the same features as desktop. Backed by YZi Labs and strong security measures, Aster positions itself as a reliable and user-friendly exchange.

usdt

usdt bnb

bnb