When Laszlo Hanyecz paid 10,000 bitcoins for two pizzas in 2010, it kickstarted the use of cryptocurrency in real-life transactions and led to today’s crypto cards.

Have you ever paid for something using a bitcoin debit card?

Some are merely content with buying and holding cryptocurrencies to sell them for a lot more in the future. But one might argue that if you have plenty of digital assets, you also want to be able to spend them when the need arises.

Key takeaway: The most stable and generous offer for UK and Euro-based customers is Brighty App. They even pay $25 USDC upon activation

Enter bitcoin debit cards.

What is a Bitcoin debit card?

Many merchants do not directly accept bitcoin or cryptocurrencies as a method of payment. Since most of them prefer to receive fiat for their goods and services, there had to be a way for cryptocurrency holders to still pay with their digital assets.

A Bitcoin or cryptocurrency debit card allows users to shop online or offline while using their cryptocurrency assets to pay. The market price of the assets at the time of the purchase is used to convert them to fiat and settle the transaction.

Now that you understand how a Bitcoin debit card works, you may wonder what are the best crypto debit cards in the UK.

For the rest of this article, we’ll review the best bitcoin debit cards available to UK users. Next, we’ll share information about choosing from the various options available and getting started with the card.

The best crypto debit cards in the UK

1. Wirex Bitcoin Debit Card

Type: Visa, MasterCard

Cost of Issuance: Free

Country where the company is registered: London, United Kingdom

Commissions:

- Wirex charges a 2% fee when users exhaust the free £400 monthly ATM withdrawal limit.

- Cash withdrawals in Europe cost €2.25 plus 3% of the transaction value.

- European debit card payments attract a fee worth 3% of the transaction value.

- Debit card payments in foreign currency cost €2.25 and 3% of the transaction value.

Supported currencies: EUR, GBP, SGD, etc.

Supported cryptocurrencies: Bitcoin, Litecoin, Ethereum, XRP, WAVES, DAI, NANO, XLM, and WXT.

Cashbacks: 2% back in WXT tokens for all in-store purchases (up to 8% for premium users)

Verification required: Yes.

Launched in Europe in 2018, the Wirex crypto debit card is one of the most widely used UK bitcoin debit cards. It offers instant crypto-to-fiat and fiat-to-fiat conversions, among other benefits. Wirex allows up to £400 monthly in free ATM withdrawals.

2. Uphold Crypto Card

.png)

Type: Mastercard

Cost of Issuance: Free for virtual cards and £9.95 for physical cards (shipping cost)

Country where the company is registered: London, United Kingdom

Commissions:

- Cash withdrawals from national ATMs in the UK cost €2.50

- Foreign cash withdrawals attract a fee of £3.50

Supported currencies: EUR, GBP, USD plus 15 more

Supported cryptocurrencies: Bitcoin, XRP, Ethereum, Casper, XDC Network, plus 250 more

Cashbacks: 2% when users spend in national currencies

Verification required: Yes.

The Uphold Card, a Mastercard, allows users to spend any currency anywhere in the world including cryptocurrencies like Bitcoin, XRP, and Ethereum. Accessible in both physical and virtual formats, the card boasts perks like zero foreign transaction fees, favourable FX rates, and compatibility with Google and Apple Pay.

This versatile card caters to the modern financial landscape, facilitating borderless spending and financial flexibility with a user-friendly approach and attractive benefits, making it an appealing choice for those navigating the dynamic world of digital and traditional currencies.

Non-Uphold fees may apply. Uphold Card is Issued by Optimus Cards UK Limited, a principal member of Mastercard and authorised by the FCA.

Non-Uphold fees may apply. Uphold Card is Issued by Optimus Cards UK Limited, a principal member of Mastercard and authorised by the FCA. Terms Apply.

Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more

3. MCO Visa Card

Type: Visa

Cost of Issuance: The basic MCO Visa card is Free. Other cards require staking different amounts of CRO, Crypto.com’s crypto token.

The country where the company is registered: Hong Kong, HK.

Supported Currencies: EUR, GBP, SGD, HKD, AUD, JPY.

Supported Cryptocurrencies: Bitcoin (BTC), Crypto.com Coin (CRO), Ethereum (ETH), Litecoin (LTC), XRP, Basic Attention Token (BAT), Binance Coin (BNB), and many more.

Monthly ATM Withdrawal Fee: 2% of the transaction after a user exceeds the monthly no-fee withdrawal limit.

Interbank Exchange Fees: 0.5%

Cashbacks: 1% paid in CRO and up to 5% for premium cardholders.

Verification Required: Yes

The MCO Visa Card is issued by the popular cryptocurrency company Crypto.com, formerly known as Monaco. It is issued by Payrnet for UK users and is available in various colours that the company uses to differentiate the tiers of benefits attached.

4. Coinbase Crypto Debit Card

Type: Visa

Cost of Issuance: £4.95

Country Where the Company is Registered: United States

Commissions

- All domestic purchases are free.

- Domestic Withdrawals attract a fee of 1% of the transaction amount for transactions above £200.

- International withdrawals attract a fee of 2% of the transaction amount for transactions above £200.

- Users pay a liquidation fee worth 2.49% of the transaction amount to liquidate their crypto holdings.

Limits

- The daily spending limit is £10,000

- The daily ATM withdrawal limit is £500

Supported Currencies: EUR, GBP, USD.

Supported Cryptocurrencies: BTC, ETH, LTC, BCH, XRP, BAT, REP, ZRX, and XLM.

Verification Required: Yes

The Coinbase crypto debit card is issued by Paysafe and arguably offers the same security and convenience as the Coinbase cryptocurrency exchange. However, fees are relatively cheaper when you use other bitcoin debit cards.

5. CryptoPay

Type: Visa

Cost of Issuance: £5

Country Where the Company is Registered: Estonia.

Commissions

- Monthly management fee: £1

- Cash withdrawal in card currency: £2.50

- Cash withdrawal in foreign currency: £3.50 plus 3% of the transaction amount.

Limits

- The maximum card balance is £45,000 or €50,000

- The limit for a single transaction is €30,000

- The daily withdrawal limit is £400 or €450

Supported Currencies: GBP, EUR, USD.

Supported Cryptocurrencies: BTC, LTC, XRP, ETH

Cashbacks: No

Verification Required: Yes

The CryptoPay card (C.Pay card) is ideal for online transactions and big purchases. The card is available in virtual or physical form and is issued by Wirecard.

6. Revolut Bitcoin Debit Card

Type: Mastercard

Cost of Issuance: Free. £12.99 a month for the Revolut Metal card.

Country Where the Company is Registered: London, United Kingdom.

Commissions

- 2% of the transaction size for international cash withdrawal

- No Fee ATM Withdrawals up to £800 for the Revolut Metal (2% thereafter)

Limits

- Fiat currency conversion up to £1,000 per month for free cardholders

- There is no monthly fiat currency conversion for Premium and Metal Card holders.

Supported Currencies: EUR, GBP, USD, and more.

Supported Cryptocurrencies: Bitcoin, Litecoin, and Ethereum.

Cashbacks: 1% outside Europe and 0.1% in Europe

Verification Required: Yes.

The Revolut Bitcoin debit card comes with a free UK account and is ideal for travellers because of its numerous benefits across trips. These include unlimited foreign exchange transactions, overseas medical insurance, winter sports coverage, and many more.

7. WhiteBIT Nova Card

Type: Visa

Cost of Issuance: Free for digital cards, up to €40 for physical cards

Fees:

- Free opening, free closing, no upfront deposits

Supported Currencies: USDC, BTC, ETH, XRP, SOL, NEAR, ADA, AVAX, WBT, DOGE

Cashback:

- Up to 10% true cashback in BTC or WBT

- Cashback categories include 10% on subscriptions, 3% on dining, 1% on groceries, and more

- Monthly cashback cap of €25 equivalent

- Countries: The card is available in the following countries: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Norway, Iceland, Liechtenstein, and Ukraine. It is not available in the UK.

Verification Required: Yes

The crypto debit card WhiteBIT Nova, powered by Visa, offers a seamless way to use cryptocurrencies for everyday purchases. With support for multiple digital assets, users can prioritize which crypto to use for transactions, ensuring flexibility and ease of use. The card is available in both physical and digital formats, with the physical version enabling ATM withdrawals.

A standout feature of the crypto card WhiteBIT Nova is its generous cashback program, rewarding users with up to 10% in Bitcoin (BTC) or WhiteBIT Coin (WBT) on select purchases. Additionally, the card supports Apple Pay and Google Pay, making contactless payments quick and effortless.

With free opening and closing, a lucrative invite program, and 24/7 customer support, the WhiteBIT Nova Card is an excellent choice for those looking to integrate crypto into their daily transactions while earning valuable rewards.

8. AdvCash

Card Type: Visa

Cost of Issuance: $95

Country where the company is registered: Belize City, Belize (Formerly British Honduras)

Commissions

- No monthly or annual maintenance fees

- Stablecoin transaction fees are fixed at $1, while crypto transaction fees are charged based on Advcash’s internal exchange rate.

- Purchases in card currency are free.

Limits

- Daily withdrawal limit €3000

- Daily deposit limit $30,000.

Supported Currencies: GBP, EUR, USD, and more.

Supported Cryptocurrencies: BTC, ETH, LTC, BCH, XRP, ZEC

Cashbacks: No.

Verification Required: Yes.

The Advcash bitcoin debit card is a prepaid card ideal for regular transactions, given the absence of a monthly maintenance fee associated with some of the other cards we’ve listed so far. Advcash also boasts a partnership with leading cryptocurrency exchange Binance, allowing users to access certain Binance features, such as buying and selling crypto directly from their Advcash account.

9. Monolith Ethereum Debit Card

Type: Visa

Country where the company is registered: Lithuania and United Kingdom

Cost of Issuance: Free

Commissions

- 1% community contribution fee

- ATM withdrawal fee £1.20

- Non-Europe ATM withdrawal fee £1.75

- The card top-up fee is 1% when done with any Ethereum-based token that is not TKN.

Limits

- £7500 daily spend limit

- Daily cash withdrawal limit £350

- Card balance limit £7500

Supported Currencies: GBP and EUR

Supported Cryptocurrencies: Ethereum and select ERC-20 tokens (DAI, SAI, MKR, etc.)

Cashbacks: 1% payback to TKN holders

Verification Required: Yes

Monolith’s Ethereum debit card is a first-of-its-kind debit card that finds primary use among cryptocurrency investors plying their trade in the decentralised finance (DeFi) space. Contis Financial Services issues the card.

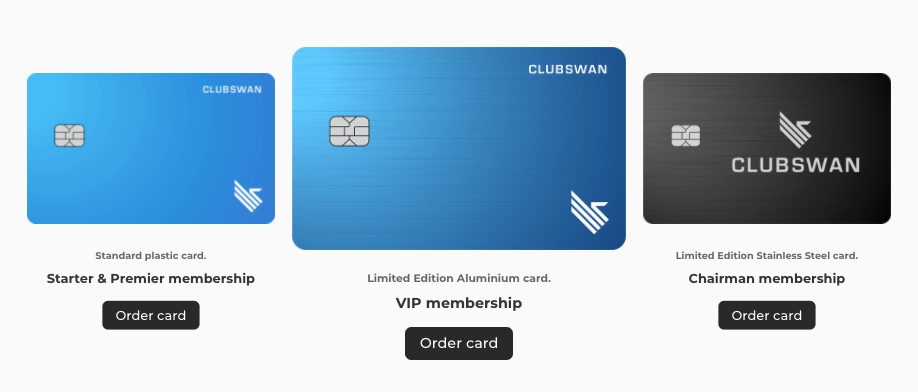

10. ClubSwan

Type: MasterCard

Cost of Issuance: $129

Country where the company is registered: London, United Kingdom

Commissions:

- The monthly maintenance fee is $35, with the virtual assistant included.

- Money withdrawal from an ATM starts with a minimum fee of $1.95 in USD and depends on the currency.

- Buy and sell fees for crypto range from 0.5% to 3%, depending on the card type.

- No commission on spending and loading.

Supported currencies: 150+ currencies

Supported cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Tether (USDT), BAT, Paxos (PAX), USD Coin (USDC) and EOS

Cashbacks: from 2% to 20%

Verification required: Yes.

ClubSwan is an alternative banking platform that offers 4 types of cards. It supports both fiat and cryptocurrencies as well as offers concierge services. You can spend up to 40% on travel expenditures and get real money rewards with cashback and referral programs using it. There are really high limits and 24/7 multilingual live customer support with no bots.

How to Choose the Best Bitcoin Debit Card

As you may have discerned, choosing the right bitcoin debit card option from the above list would depend on several factors.

For instance, individuals who only need a crypto debit card handy for emergencies will opt for those that do not incur monthly or even annual fees, such as Advcash. On the other hand, DeFi enthusiasts would prefer Monolith’s Ethereum debit card, while average spenders can make do with the Coinbase bitcoin debit card.

Thus, we recommend you carefully evaluate your reasons for wanting to have your crypto spendable and then decide accordingly.

Ordering the Card

Ordering your card usually includes creating an account with your preferred bitcoin debit card provider and verifying your identity. Once complete, you can place the order and complete the payment via any of the supported fiat or cryptocurrencies.

Depending on your location, crypto debit cards are typically delivered to your designated address within five to seven business days after order placement.

Using the Card

You can typically use cryptocurrency debit cards for any of the following activities:

- Buying and selling cryptocurrency

- Foreign currency conversions

- Online and in-store shopping

Upon receiving your ordered card, you’ll be typically provided with a pin in the enclosed letter to activate it. You can activate the card for usage via the provider’s mobile app or website portal, after which you can use the bitcoin debit card.

As long as you abide by security standards for using bank cards, you should have little or no challenge with using crypto debit cards. They work almost the same way as traditional cards, the only difference being that you’re spending crypto instead of fiat.

Conclusion

In this article, we explained how a crypto Visa or Mastercard card works and also provided a list of the best bitcoin debit cards in the UK.

As demand for ways to conveniently spend cryptocurrencies continues to rise, one might correctly predict that crypto debit cards will eventually become a famous sight. After all, even those holding cryptocurrencies to sell at a higher price will ultimately have to spend or sell them at some point.

Perhaps the bottom line would be to avoid repeating the Laszlo Hanyecz story while at the same time playing a part in promoting the mainstream adoption of cryptocurrencies.

usdt

usdt xrp

xrp