The UAE is emerging as a global crypto hub, thanks to progressive regulations from the Dubai Virtual Assets Regulatory Authority (VARA) and Abu Dhabi Global Market (ADGM). With clear licensing frameworks and tax-friendly policies, the region has attracted top international exchanges alongside strong local players.

To help you find the best platform, we’ve reviewed the top UAE crypto exchanges based on security, AED deposit methods, fees, and regulatory compliance.

Table of Contents

Top Crypto Exchanges in the UAE List

These are the six best cryptocurrency trading platforms in the UAE, ranked for compliance, ease of use, and trading features.

1. Rain – Best Overall Crypto Exchange in the UAE

Regulation: Fully licensed by ADGM & FSRA, Shari’a Compliant

Rain is the most trusted locally licensed exchange, fully regulated under the Financial Services Regulatory Authority (FSRA) in the Abu Dhabi Global Market (ADGM). It is the only Shari’a-compliant crypto platform in the UAE, making it ideal for halal-conscious investors.

Rain offers zero trading fees, with a 0.2% spread, making it one of the cheapest ways to buy and sell crypto in the UAE. The platform supports 80+ cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and USDT, with AED deposits and withdrawals via local bank transfers, debit/credit cards, Apple Pay, and Google Pay.

Security is a priority, with cold storage, multi-signature wallets, and FSRA audits. Unlike offshore exchanges, Rain provides 24/7 customer support in Arabic and English, ensuring local traders get reliable assistance.

Key Features

✅ Security: Cold storage, multi-signature wallets, FSRA audits

✅ AED Deposit Methods: Bank transfers, debit/credit cards, Apple Pay, Google Pay

✅ Fees: Zero trading fees, 0.2% spread

✅ Shari’a Compliance: Certified halal investment platform

✅ Customer Support: 24/7 in Arabic and English

Pros

✔️ Fully licensed, trusted local exchange

✔️ No trading fees (0.2% spread only)

✔️ Easy AED deposits and withdrawals via local banking channels

✔️ Dedicated Arabic & English customer support

Cons

❌ Limited altcoin selection compared to global platforms

❌ No derivatives or margin trading

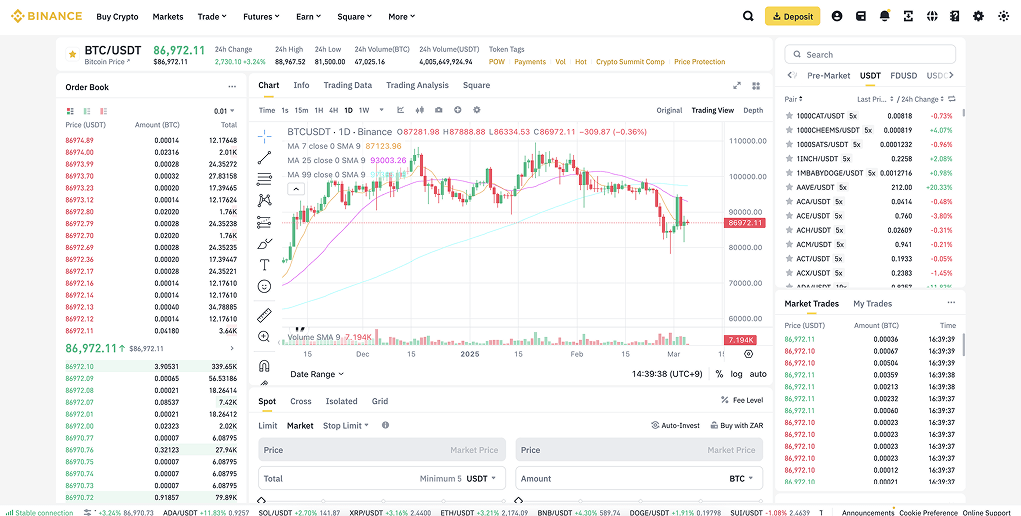

2. Binance – Best for Advanced Traders & Liquidity

Regulation: Licensed under Dubai VARA (VASP License)

Binance is the largest global exchange, licensed under Dubai’s VARA as a Virtual Asset Service Provider (VASP). It offers spot trading, futures, staking, and lending, with access to 350+ cryptocurrencies and the deepest liquidity worldwide. AED deposits are supported via bank transfers, debit/credit cards, and Binance Pay.

Trading fees start at 0.1% and can be reduced with BNB tokens. Advanced tools include margin trading, perpetual contracts (up to 125x leverage), copy trading, and API integrations. Institutional clients benefit from OTC desks and custodial solutions.

Security features include cold storage, two-factor authentication (2FA), and Proof-of-Reserves audits. While Binance offers top-tier liquidity and advanced trading tools, full KYC verification is required, and its interface may be complex for beginners.

Key Features

✅ Security: 2FA, cold storage, PoR audits, institutional-grade encryption

✅ AED Deposit Methods: Bank transfers, debit/credit cards, Binance Pay

✅ Fees: 0.1% spot trading fees (discounts available with BNB)

✅ Leverage: Up to 125x on futures contracts

✅ Trading Tools: Margin trading, copy trading, algo bots, API access

Pros

✔️ Largest crypto exchange globally with the highest liquidity

✔️ Advanced trading tools for professional traders and institutions

✔️ Low fees with BNB discounts

✔️ Strong security and compliance with VARA oversight

Cons

❌ Full KYC verification required for access

❌ Advanced interface may be overwhelming for beginners

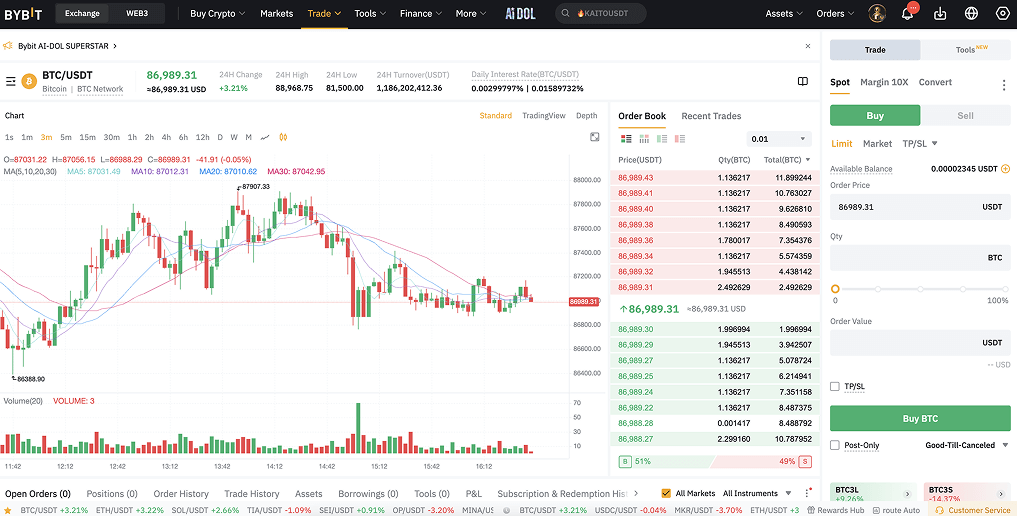

3. Bybit – Best for Futures & Derivatives Trading

Regulation: In-principle ADGM license (not yet fully operational)

Bybit is a leading futures and derivatives platform, offering up to 100x leverage on contracts and access to 1,600+ cryptocurrencies. It provides a full suite of trading tools, including spot markets, perpetual contracts, staking, and TradeGPT, an AI-powered trading assistant designed to enhance trading strategies.

Bybit prioritizes security, storing 95% of user funds in cold wallets and conducting regular proof-of-reserves audits. AED deposits are supported via bank transfers, debit/credit cards, Apple Pay, and Google Pay, ensuring a smooth onramp for UAE traders.

Despite its in-principle approval from the UAE Securities & Commodities Authority (SCA), Bybit remains available to users while working toward a full operational license, reinforcing its commitment to regulatory compliance.

Key Features

✅ Security: Cold storage, proof-of-reserves, AI-powered risk monitoring

✅ AED Deposit Methods: Bank transfers, debit/credit cards, Apple Pay, Google Pay

✅ Fees: 0.1% spot trading, 0.02% maker & 0.06% taker for futures

✅ Leverage: Up to 100x

✅ Trading Tools: Margin trading, options trading, copy trading, AI-powered bots, API access

Pros

✔️ Best for high-leverage traders

✔️ Strong security and compliance measures

✔️ Advanced trading tools, AI-powered features

Cons

❌ Not yet fully licensed under UAE regulations

❌ Higher risk due to leverage trading

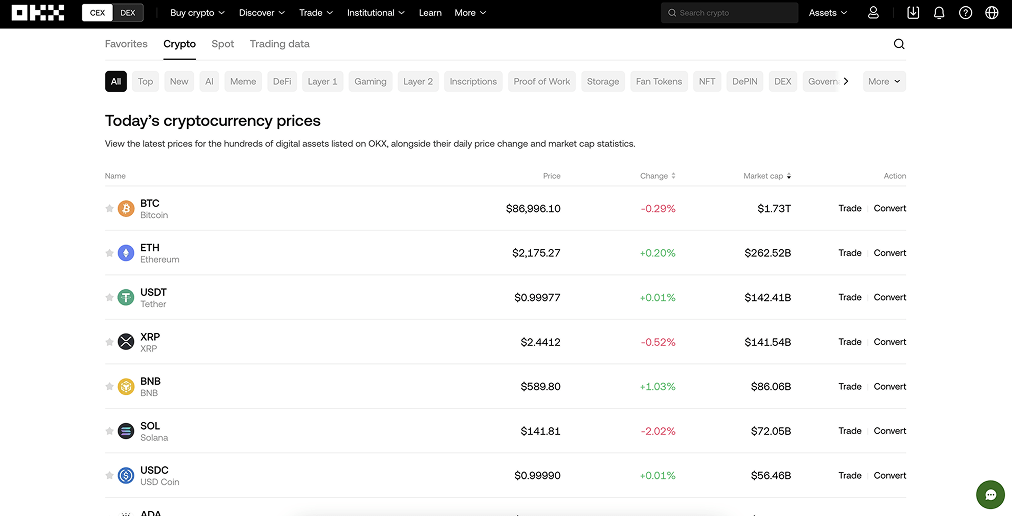

4. OKX – Best for DeFi & Web3 Integration

Regulation: Compliant with VARA & ADGM

OKX is one of the most innovative crypto exchanges in the UAE, offering a fully integrated Web3 ecosystem alongside its centralized exchange. Unlike traditional platforms, OKX bridges DeFi, NFTs, and CeFi into a single platform, allowing users to trade, stake, and earn passive income directly from its interface.

With support for 350+ cryptocurrencies, OKX provides spot trading, futures, options, and margin trading with some of the lowest fees in the industry. It is a top choice for DeFi enthusiasts, thanks to its built-in Web3 wallet, which enables seamless access to Ethereum, Solana, Arbitrum, Base, and other DeFi protocols.

The Proof-of-Reserves (PoR) system ensures all assets on OKX are fully backed, enhancing security and trust. Additionally, OKX supports AED deposits via bank transfers, Apple Pay, Google Pay, and debit/credit cards, making it convenient for UAE traders.

Key Features

✅ Security: Proof-of-Reserves verification, cold storage, 2FA

✅ AED Deposit Methods: Bank transfers, debit/credit cards, Google Pay, Apple Pay

✅ Fees: Maker 0.08%, Taker 0.1%

✅ DeFi Access: Staking, yield farming, liquidity pools, Web3 wallet

✅ Trading Tools: Margin trading, automated strategies, perpetual contracts

Pros

✔️ Best exchange for DeFi and Web3 integration

✔️ Low trading fees with deep liquidity

✔️ Advanced trading bots and automation tools

Cons

❌ User interface can be complex for beginners

❌ Not as liquid as Binance or Bybit for large trades

5. Gate.io – Best for Altcoin Trading & Automated Strategies

Regulation: Not licensed in the UAE but accessible

Gate.io is the best exchange for altcoin traders, offering an unmatched selection of 3,700+ cryptocurrencies—the largest of any platform available in the UAE. It provides a full suite of trading options, including spot, futures, margin trading, copy trading, and algorithmic trading strategies.

Although not yet licensed under VARA or ADGM, Gate.io remains accessible in the UAE and has gained popularity among advanced traders for its low fees (0.1%) and comprehensive trading tools.

Security is a top priority, with cold storage, multi-signature wallets, and Proof-of-Reserves audits

ensuring user funds are fully backed. The platform also integrates grid trading bots, smart order execution, and AI-powered risk management, making it ideal for those looking to automate their trading strategies.

Key Features

✅ Security: Proof-of-Reserves verification, cold storage, multi-signature wallets, 2FA

✅ AED Deposit Methods: Debit/credit cards, bank transfers

✅ Fees: 0.1% spot trading, tiered discounts for high-volume traders

✅ Altcoin Selection: 3,700+ cryptocurrencies, including new listings & low-cap gems

✅ Trading Tools: Copy trading, grid trading, algo bots, perpetual contracts

Pros

✔️ Largest selection of altcoins in the UAE

✔️ Strong automation, copy trading, and AI-powered strategies

✔️ Competitive trading fees with VIP discount tiers

Cons

❌ Not fully regulated in the UAE

❌ User interface can be overwhelming for beginners

6. BitOasis – Most Established Local Crypto Exchange

Regulation: Licensed by Dubai VARA & Bahrain’s Central Bank

BitOasis is a UAE-based exchange licensed by VARA in Dubai and the Central Bank of Bahrain, making it one of the few locally regulated platforms. It offers spot trading for 80+ cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Cardano (ADA), with full local banking support.

The platform supports AED deposits via bank transfers, debit/credit cards, and Apple Pay, with Easy Funding allowing instant, fee-free bank transfers. Security features include cold storage, multi-signature wallets, and FSRA oversight. While trading fees are competitive, card deposits incur a 3.99% fee, making bank transfers the better choice.

BitOasis offers a user-friendly interface on mobile and desktop, educational resources, customer support, and an OTC desk for high-volume traders. Its strong regulatory standing and seamless AED deposits make it a top choice for UAE investors.

Key Features

✅ Security: Cold storage, multi-signature wallets, FSRA oversight

✅ AED Deposit Methods: Bank transfers, debit/credit cards, Apple Pay

✅ Fees: 3.99% for card deposits, free bank transfers, 1% trade fee

✅ Altcoin Selection: 80+ cryptocurrencies

✅ Trading Tools: Spot trading, OTC desk for high-volume traders

Pros

✔️ Fully licensed and locally regulated

✔️ Direct AED deposits with instant bank transfers

✔️ Beginner-friendly platform with strong security

Cons

❌ Higher fees for card deposits

❌ Limited altcoin selection, no derivatives trading

Crypto Exchange Regulations in the UAE

The UAE has a structured regulatory framework designed to balance innovation, investor protection, and financial stability. Two key authorities oversee crypto exchanges:

- Dubai Virtual Assets Regulatory Authority (VARA) – Governs crypto exchanges, brokers, custodians, and asset managers in Dubai under the Virtual Asset Regulatory Framework (VARF). VARA requires Virtual Asset Service Provider (VASP) registration, enforcing capital requirements, security measures, and risk controls.

- Abu Dhabi Global Market (ADGM) – Regulates exchanges in Abu Dhabi through the Financial Services Regulatory Authority (FSRA). ADGM was among the first global regulators to introduce a comprehensive virtual asset framework, enforcing AML (Anti-Money Laundering), CFT (Counter-Terrorism Financing), and consumer protection rules.

Both authorities mandate KYC verification, AML compliance, and Proof-of-Reserves (PoR) audits to ensure transparency. Non-compliant firms risk license suspension or revocation.

As regulation evolves, the UAE continues to position itself as a secure, crypto-friendly jurisdiction for businesses and institutional investors.

How to Buy Bitcoin and Crypto in the UAE & Dubai

Buying Bitcoin or other cryptocurrencies in the UAE and Dubai is a straightforward process. Follow these steps to ensure a smooth and secure transaction.

- Choose a Licensed Exchange: Use a UAE-regulated platform like Binance, Bybit, Rain, or BitOasis that supports AED deposits. Check for strong security, transparent fees, and positive reviews before signing up.

- Create an Account & Verify Your Identity: Register with your email and phone number. Most exchanges require KYC verification, meaning you’ll need to upload your passport, Emirates ID, or utility bill to confirm your identity.

- Deposit AED: Fund your account via bank transfer, debit/credit card, Apple Pay, or Google Pay. Bank transfers usually have lower fees, while card payments process faster.

- Buy Bitcoin or Other Cryptocurrencies: Select BTC/AED or another trading pair like ETH/AED. Enter the amount and confirm your purchase. Some exchanges offer limit orders, letting you set a specific buy price.

- Transfer to a Wallet (Optional): For added security, move your crypto to a hardware or mobile wallet. This gives you full control over your assets and reduces exchange-related risks.

By following these steps, UAE residents can securely invest in Bitcoin while staying compliant with local regulations.

Best Payment Methods for Buying Crypto in the UAE

UAE residents can buy crypto using bank transfers, debit/credit cards, and digital wallets like Apple Pay and Google Pay. Bank transfers are the most cost-effective option, often with zero deposit fees, while card payments offer faster transactions but may come with higher fees (e.g., 3.99% on BitOasis).

Some exchanges also support P2P trading, allowing users to buy crypto directly from others using local payment methods. Choosing the right deposit method depends on whether you prioritize lower costs or faster processing times.

Conclusion

The UAE’s regulatory approach has made it one of the safest places for crypto trading, with exchanges offering secure and compliant access to digital assets. Rain provides a fully licensed, zero-fee option, while Binance and Bybit cater to traders needing deep liquidity and advanced tools.

Choosing the right platform depends on your priorities - whether it's cost, features, or regulatory oversight. Always review an exchange’s fees, deposit methods, and security before trading.

If you are based in the UK, check our Best Crypto Exchange in the UK guide.

FAQs

What is the safest crypto exchange in the UAE?

Rain is the most secure locally licensed exchange, regulated by ADGM & FSRA, while Binance and Bybit, licensed under VARA, offer advanced security features like cold storage and Proof-of-Reserves audits.

Are crypto profits taxed in the UAE?

No, individuals pay no tax on crypto gains. However, businesses may be subject to a 9% corporate tax if profits exceed AED 375,000, depending on their licensing jurisdiction.

What are the most crypto-friendly banks in the UAE?

Emirates NBD, ADCB, Mashreq Bank, and RAKBANK allow AED deposits and withdrawals to licensed crypto exchanges, with varying compliance policies. Some require additional verification for large transactions.

Can I buy Bitcoin in the UAE without KYC?

Most regulated exchanges require KYC to comply with AML laws, but P2P platforms and decentralized exchanges (DEXs) may allow limited trading without verification.

Is Dubai a good place for crypto investors?

Yes, Dubai is one of the most crypto-friendly cities due to its pro-business regulations, zero personal tax on crypto, and strong licensing framework under VARA. The city attracts global exchanges, blockchain startups, and institutional investors, making it a major hub for digital assets.

usdt

usdt bnb

bnb