Picking the right crypto futures exchange can be tricky, especially with the variety of platforms available. Some have been around for years, others are new, but not all are reliable. Just look at FTX, where users lost billions because of poor security and operational oversight.

So, how do you avoid risky platforms and make sure your money is safe? To give you clarity, we've broken down the top five futures exchanges for 2024 that are considered tier-1.

Table of Contents

Our analysis focuses on key factors like regulatory compliance, liquidity, fees, and contract types, helping you make an informed decision on where to trade securely.

Top Crypto Futures Platforms List

Here is our handpicked list of the seven best cryptocurrency futures trading platforms.

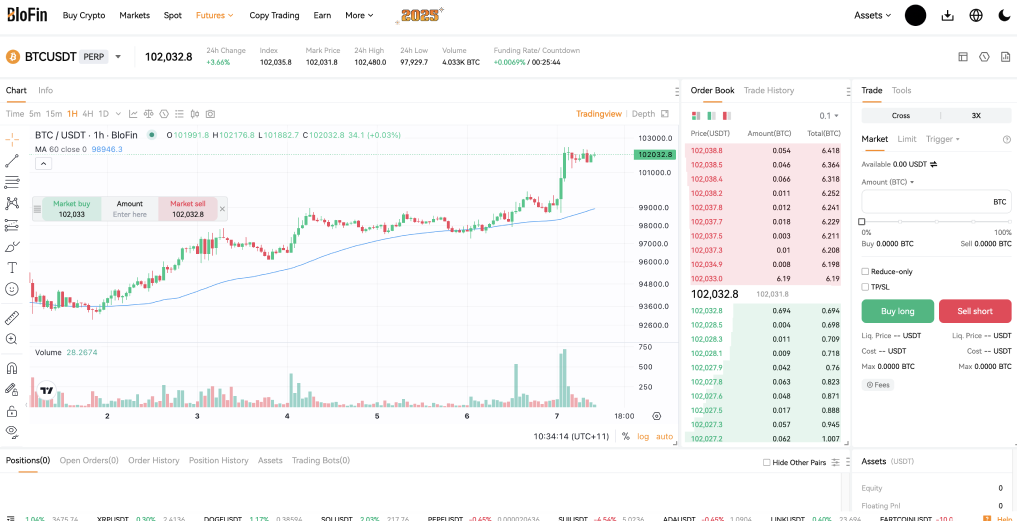

1. Blofin – Best Crypto Futures Platform for the UK

Country: Cayman Islands

Blofin is a leading global cryptocurrency exchange offering secure and anonymous no-KYC trading, making it highly appealing to UK users seeking privacy. Founded in 2019 by Matt Hu, Blofin provides easy access to spot and futures markets without mandatory identity verification.

The platform maintains a transparent 1:1 proof-of-reserves, currently holding assets exceeding $117 million. Security protocols include two-factor authentication (2FA), asset segregation, and strategic collaborations with leading security providers such as Fireblocks and Chainalysis.

Blofin supports over 450 cryptocurrencies, providing robust spot trading options and futures contracts with leverage up to 150x. Key trading features include automated bots, copy trading capabilities, staking opportunities, and a comprehensive demo trading environment.

Key Features:

- Spot and futures trading (leverage up to 150x)

- Deposit options: 85 global fiat currencies via credit/debit cards, Apple Pay, Google Pay

- Trading fees: 0.1% (spot), 0.02% maker and 0.06% taker (futures)

- High daily withdrawal limit: $20,000 without KYC

- Advanced security measures: 2FA, asset segregation, partnerships with Fireblocks and Chainalysis

- Multilingual support: English, Spanish, French, Russian, Ukrainian, Vietnamese, Portuguese

Pros:

- High no-KYC daily withdrawal limit

- Wide fiat currency support and diverse payment options

- Competitive fee structure beneficial for active traders

- Extensive trading tools, including copy trading and automated bots

Cons:

- Not available in 46 jurisdictions

- Limited official regulatory licensing, potentially raising compliance issues

- Language support limited to seven languages, impacting broader accessibility

Supported Payment Methods: Bank transfers, Credit/Debit cards, Crypto transfers, Wise, PayPal, Google Pay & Apple Pay

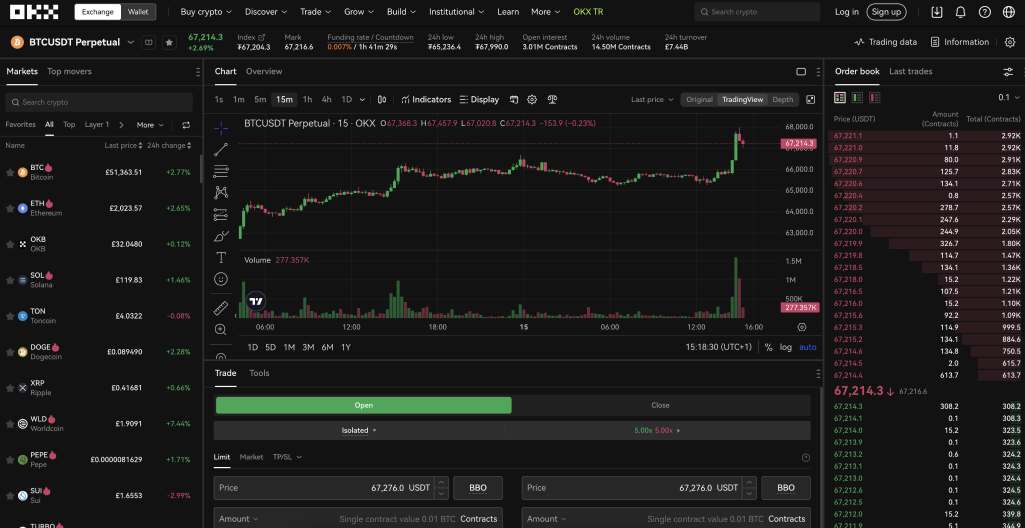

2. OKX – Best for Advanced Traders

Country: UAE

OKX stands out as a top choice for futures traders who need a platform with a comprehensive set of tools. Offering up to 125x leverage and access to over 300 cryptocurrencies, OKX provides a variety of futures contracts, including perpetual swaps and quarterly options.

The platform is known for its deep liquidity and competitive fees, making it ideal for traders looking to execute more complex strategies. Whether you're an advanced trader or just starting to explore futures, OKX has the tools to support your approach.

Key Features:

- Perpetual, quarterly, and bi-quarterly futures contracts

- Leverage up to 125x

- Maker fee: 0.02%, Taker fee: 0.05% (reduced for higher volumes)

- Advanced order types: stop-limit, trailing stop, and trigger orders

- Automated trading options via bots and copy trading

- Strong security: 2FA, cold storage, multi-signature wallets

Pros:

- Excellent for complex trading strategies

- High liquidity ensures smooth execution

- Transparent fees

- Regular proof-of-reserves for added confidence

- Mobile and desktop apps for seamless trading

Cons:

- Steeper learning curve for beginners

- Limited direct support for GBP deposits

Supported Payment Methods: Bank transfer, Credit/Debit cards (Mastercard and Visa), P2P trading (Revolut, Wise, FasterPay)

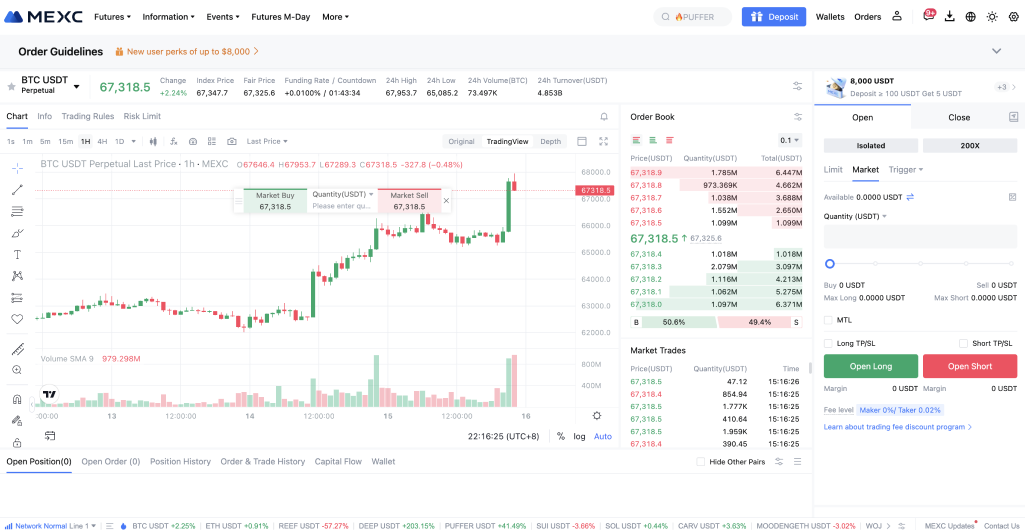

3. MEXC – Best for High Leverage Futures

Country: Singapore

MEXC stands out in the crypto futures trading space by offering some of the highest leverage available, up to 200x on major assets like BTC and ETH. This platform is perfect for traders looking to maximize their exposure with minimal capital, though it comes with the increased risk associated with high leverage.

MEXC supports over 500 trading pairs, including both popular and altcoin futures, making it a go-to for traders who want variety and high-risk, high-reward opportunities.

Key Features:

- Leverage up to 200x on select assets

- Over 500 trading pairs with support for altcoins and major cryptocurrencies

- Competitive fees: Maker 0%, Taker 0.01%

- Perpetual and quarterly futures contracts

- Advanced order types for risk management: stop-limit, trailing stop, and take-profit orders

- High liquidity to ensure smooth execution

Pros:

- Highest leverage in the market (up to 200x)

- Low trading fees, especially for high-frequency traders

- Wide variety of altcoins and major asset futures

- User-friendly interface suitable for both beginners and experienced traders

Cons:

- High leverage increases risk, especially for inexperienced traders

- Limited transparency on some aspects of platform governance

Supported Payment Methods: Crypto transfers, Bank transfers, P2P trading

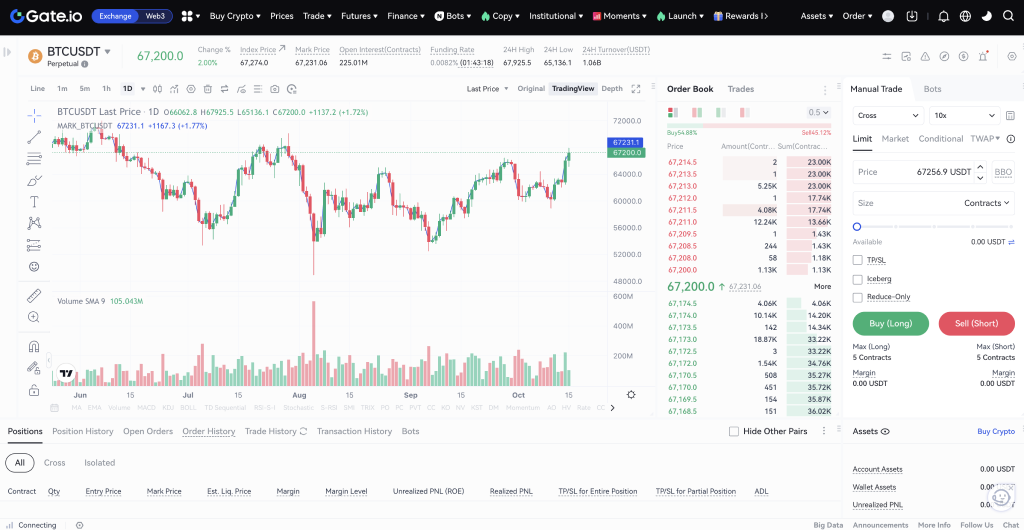

4. Gate.io – Best for Futures on Altcoins (2,100+)

Country: Hong Kong

Gate.io is the go-to platform for traders looking to explore the widest range of altcoins in the futures market, supporting over 2,100 cryptocurrencies. Whether you’re into major assets or obscure tokens, Gate.io has the depth and variety to match.

Along with its impressive altcoin selection, the platform offers competitive fees, up to 100x leverage, and a robust set of tools to help both beginner and experienced traders execute their strategies effectively.

Key Features:

- Over 2,100 altcoins supported, including niche tokens and emerging projects

- Leverage up to 100x for futures trading

- Perpetual and quarterly futures contracts

- Competitive fees: Maker 0.015%, Taker 0.05%

- Advanced trading tools: stop-loss, take-profit, and trailing stop orders

- High liquidity across altcoin pairs for smooth trading

Pros:

- Extensive selection of altcoins for futures trading

- Solid liquidity even for smaller assets

- Competitive fees, especially for high-volume traders

- Advanced tools for risk management and strategy execution

Cons:

- Interface can be complex for beginners

- Limited fiat support for deposits and withdrawals

Supported Payment Methods: Crypto transfers, P2P trading, Bank transfers

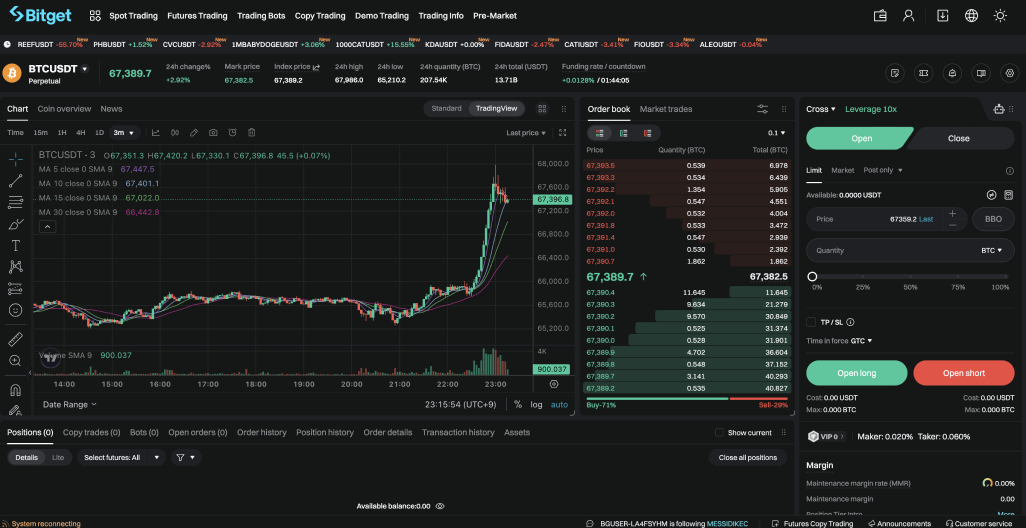

5. Bitget – Solid Overall Alternative Platform

Country: Singapore

Bitget offers a strong all-around option for futures traders, balancing advanced features with accessibility. The platform supports over 200 cryptocurrencies and provides up to 125x leverage on futures contracts, making it a great fit for newbies and high-net worth traders.

Bitget stands out with its copy trading feature, allowing users to replicate the strategies of top traders, which is particularly useful for those looking to learn or follow the market trends without active management.

Key Features

- Up to 125x leverage on futures contracts

- Over 200 cryptocurrencies supported

- Copy trading for automated strategy following

- Competitive fees: Maker 0.02%, Taker 0.06%

- Secure platform with cold storage and 24/7 customer support

Pros

- Easy-to-use interface with robust features

- Copy trading makes it accessible for beginners

- High leverage for those looking to maximize positions

- Strong security protocols, including cold storage and an insurance fund

Cons

- Higher withdrawal thresholds compared to some competitors

- Regulatory restrictions in some regions

Supported Payment Methods: Credit/Debit cards, Crypto transfers, Bank transfer

Is Crypto Futures Trading Legal?

Globally, crypto futures trading is legal in many countries, including the U.S. and across the European Union, where regulatory bodies oversee the market.

In the USA, for instance, the Commodity Futures Trading Commission (CFTC) regulates crypto futures to ensure transparency and protect investors. Other regions have also established frameworks to keep crypto derivatives trading compliant and secure.

However, in the UK, crypto futures trading has been banned for retail investors since January 2021. The Financial Conduct Authority (FCA) implemented the ban on crypto derivatives, including futures, options, and contracts for difference (CFDs), due to concerns about price volatility and the risks posed to consumers.

That being said, users in the UK can still use decentralized platforms that operate purely onchain like dYdX or GMX to overcome any KYC issues.

What are Futures Contracts in Crypto?

Crypto futures are contracts where the buyer agrees to purchase, and the seller agrees to sell, a specific amount of cryptocurrency at a set price on a future date.

These contracts are traded on derivatives exchanges and are valued based on the underlying crypto asset. Traders typically use crypto futures for two reasons:

- Hedging: Traders hedge to protect against price swings in the spot market, locking in future prices to manage risk.

- Speculation: Others trade futures to profit from price moves. They go long if they expect prices to rise or short if they expect a drop.

Perpetual futures are a popular form of these contracts, offering the option to use leverage. This allows traders to control larger positions with less upfront capital, boosting potential gains, but it also amplifies risks if the market moves against them.

What are Crypto Futures Funding Rates?

Crypto futures funding rates are periodic payments between traders holding long and short positions in perpetual futures contracts. These rates help keep the contract price aligned with the spot market price of the underlying cryptocurrency.

If the funding rate is positive, traders holding long positions pay those with short positions; if negative, short positions pay the longs. The funding rate is typically determined by the difference between the futures price and the spot price.

These payments occur at regular intervals, usually every 8 hours, and are a key mechanism in maintaining price stability in perpetual futures markets. Traders should monitor funding closely, as it can affect the cost of maintaining a position over time, especially when using leverage.

FAQs

What is the difference between perpetual futures and standard futures?

Perpetual futures have no expiration date, allowing traders to hold positions indefinitely, while standard futures expire on a set date. Perpetual futures also involve funding rate payments between long and short positions to keep prices aligned with the spot market.

How does leverage work in crypto futures trading?

Leverage allows traders to control a larger position with a smaller amount of capital. For example, with 10x leverage, a $1,000 investment can control a $10,000 position. While this can increase potential profits, it also amplifies losses.

What are maker and taker fees?

Maker fees are charged when you add liquidity to the order book by placing limit orders, while taker fees are applied when you remove liquidity by executing market orders. Maker fees are generally lower than taker fees, incentivizing liquidity provision.

Check out our Best Crypto Exchange in the UK guide.

Conclusion

Picking the right crypto futures platform depends on what fits your trading style. Bybit offers strong liquidity, OKX brings advanced tools and API trading for institutional investors, and MEXC gives you the highest leverage options.

Each has its strengths, so the key is matching the platform’s features with your strategy. In a volatile market, you want the right tools to manage risk and seize opportunities.

usdt

usdt bnb

bnb