Leverage trading in crypto can boost your market exposure without requiring a substantial upfront investment. Sure, the potential profits can look pretty appealing, but the risks are just as real, especially in the UK. That’s why choosing the best crypto leverage trading platforms matters if you want to trade wisely and stay safe.

In this guide, we’ll walk you through seven of the best platforms that currently offer crypto leverage trading to UK-based users. We’ll look at what each one offers, how they handle compliance, and whether they’re beginner-friendly or more suitable for advanced users. You’ll also learn about their fee structures, leverage options, and standout features. This will help you choose the one that fits your risk tolerance and trading goals.

Table of Contents

How Does Leverage in Crypto Trading Work in the UK?

Leverage trading in cryptocurrencies allows you to take larger positions than your account balance would normally permit by borrowing funds from the platform. But in the UK, things are a bit more complicated. Since 2020, the Financial Conduct Authority (FCA) has restricted retail access to crypto derivatives to protect consumers.

However, leveraged trading isn’t completely off the table. Some platforms still offer these features to people in the UK by focusing on professional users or operating under international regulations. Because of these rules, it’s very important to be careful about which platform you pick. Some are fully registered with the FCA and comply with all regulatory requirements. Others lack local oversight but still offer leveraged trading.

Best Crypto Platforms and Brokers for Leverage Trading: Our Top Picks

Below are the seven top platforms that support leveraged crypto trading in the UK:

Table of Contents

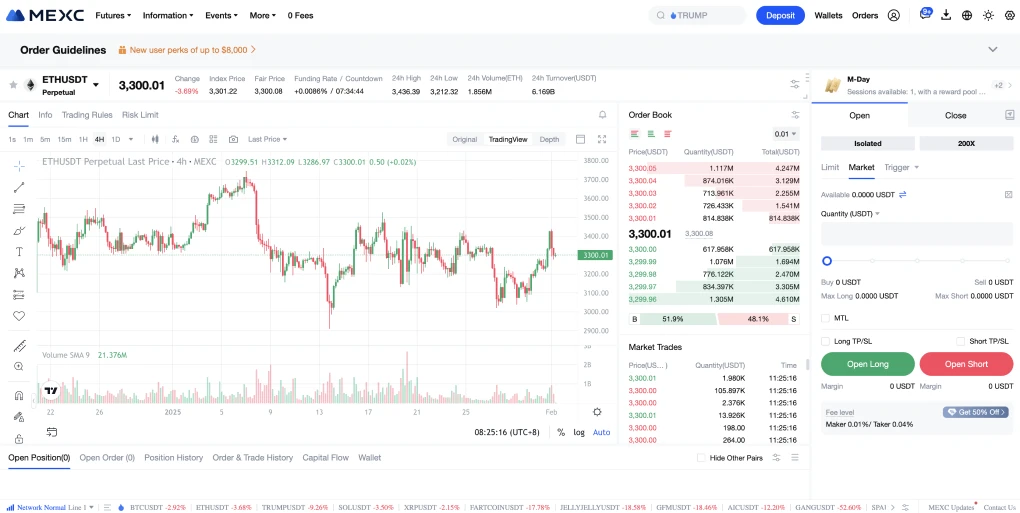

MEXC

MEXC is known for offering high leverage for traders, with up to 200x available on crypto futures. That’s a lot of firepower for risk-takers. It also lists over 2,500 cryptocurrencies, providing users with a wide range of options. Spot trading is free, and futures fees are very low.

The platform includes TradingView charts, copy trading, and demo accounts for practice. It’s packed with tools for different experience levels. Even if you're new, there's room to explore before using real money.

MEXC isn’t FCA-regulated, but UK users can still sign up. Just know that some restrictions may apply. With high leverage comes high risk, so it’s smart to take it slow. The platform utilizes cold wallets and two-factor authentication for enhanced security.

Pros

- MEXC offers leverage of up to 200x on crypto futures, providing experienced users with more room to act.

- It supports over 2,500 cryptocurrencies, so you're not limited to just the major ones.

- Spot trading comes with no fees, and futures fees are among the lowest you’ll find.

- Tools like TradingView, copy trading, and demo accounts make it easier to plan and practice trading strategies.

Cons

- UK users may face some access limitations, as the platform isn’t FCA-regulated.

- High leverage can backfire quickly, primarily if risk is not managed carefully.

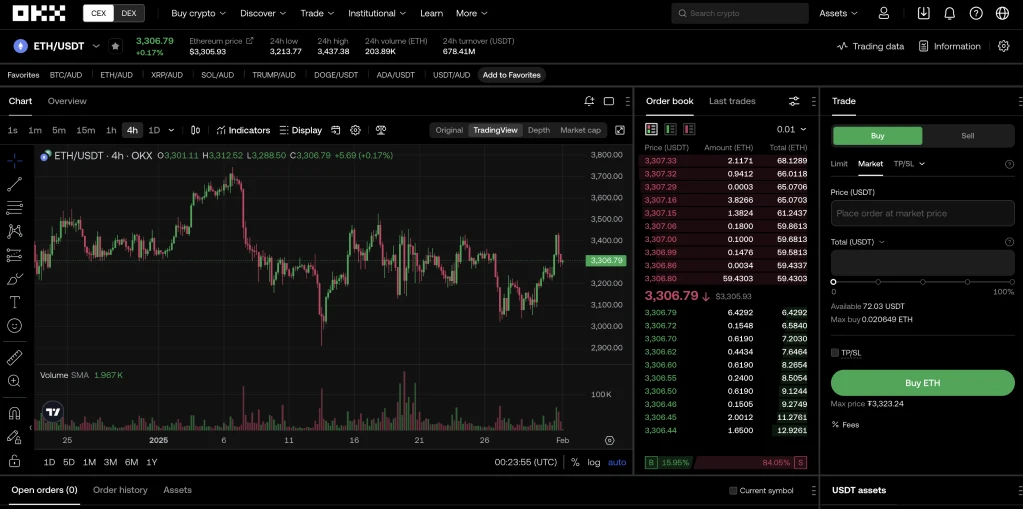

OKX

OKX is another well-known crypto leverage trading platform that supports various trading features. However, your options are somewhat limited if you’re in the UK. Since late 2023, OKX has ceased offering derivatives and margin trading to UK users to stay in line with FCA regulations. Even so, you can still use the platform for spot trading, and it supports over 350 cryptocurrencies.

One thing users often like about OKX is its sleek interface. It’s easy to navigate, even for those new to crypto. The platform also comes with advanced charting tools, deep liquidity, and competitive fees, starting at just 0.08% for makers. Takers pay 0.1%, which is still a reasonable rate compared to many other platforms. On top of that, you’ve got access to staking and flexible investment products if you want more than basic trading.

Pros

- You get access to over 350 cryptocurrencies for spot trading, so there’s plenty to choose from.

- It’s easy to navigate.

- Trading fees are low, starting at 0.08% for makers and 0.1% for takers.

- You can also earn on your crypto through staking and flexible earning options.

Cons

- UK users don’t have access to margin or derivatives due to local regulations.

- Since it’s not FCA-regulated, some people might feel uneasy using it.

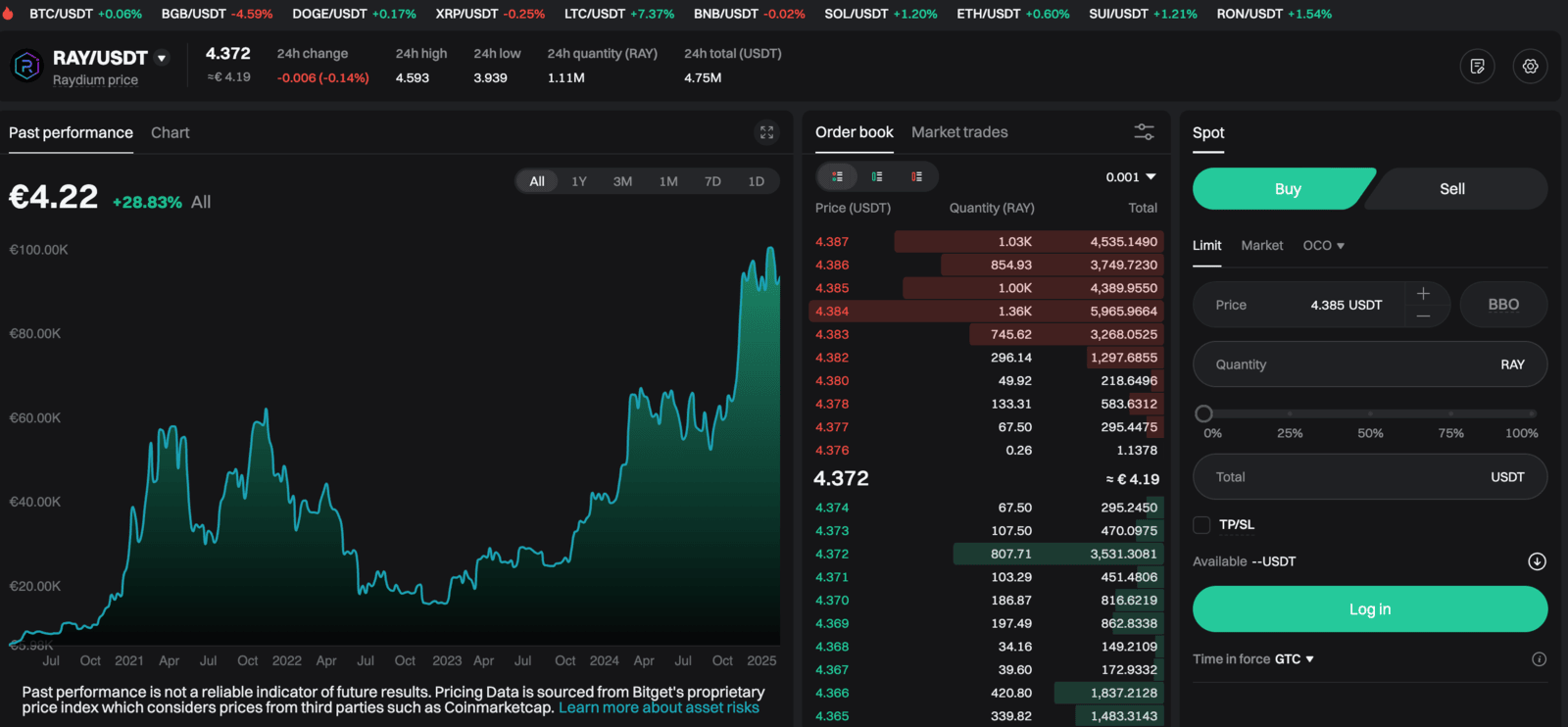

Bitget

Bitget allows users in the UK to trade with leverage of up to 125x on popular cryptocurrencies, including Bitcoin and Ethereum. The interface is straightforward, making it suitable for both beginners and experienced users. It supports trading pairs in GBP and EUR, which adds flexibility for local users. Futures trading fees are competitive, with a 0.02% charge for makers and 0.06% for takers.

Although Bitget isn’t FCA-regulated, it has made efforts to improve its compliance. It partnered with Archax, a UK-regulated custodian. This move enables Bitget to comply with FCA regulations and provide a safer trading experience for UK users.

For those who prefer technical analysis, Bitget integrates TradingView tools directly into the platform. Another helpful option is copy trading, where users can automatically follow the strategies of experienced traders. To boost trust, Bitget keeps a protection fund worth over $500 million and shares Proof of Reserves regularly.

Pros

- Bitget offers up to 125x leverage on major crypto assets, such as Bitcoin and Ethereum, substantially increasing market exposure.

- You can trade in GBP and EUR, and the layout is straightforward, even for non-technical users.

- The copy trading option makes it easier to follow seasoned traders without needing advanced strategies of your own.

- Bitget keeps a $500 million protection fund and regularly shares Proof of Reserves to promote transparency.

Cons

- Some of the platform’s more advanced tools may feel overwhelming if you’re just starting out.

- The high leverage sounds appealing, but it can lead to severe losses if you don’t manage your risk properly.

Bitfinex

Bitfinex has been around for quite some time, making it one of the more established platforms in the crypto space. It offers margin trading with up to 3.3x leverage and supports a wide selection of cryptocurrencies. If you’re into trading with fiat, you’ll be glad to know that it also handles multiple currencies, including GBP, EUR, and JPY.

One of the things that sets Bitfinex apart is its deep liquidity and advanced trading tools. It’s built for users who are familiar with trading interfaces, so it tends to appeal more to semi-pro and professional users. Aside from regular spot and margin trading, the platform offers peer-to-peer margin funding and an OTC desk for large-volume trades.

Meanwhile, it's worth noting that Bitfinex isn’t regulated by the UK’s financial authority, which might be a dealbreaker for some. The broker also has a history of security incidents, which understandably raised concerns in the past. However, they’ve since beefed up their security protocols and taken steps to regain users’ trust.

Pros

- The broker lets you use up to 3.3x leverage for margin trading, which can boost your potential gains.

- It supports a wide variety of cryptocurrencies, as well as fiat currencies like GBP, EUR, and JPY, so you have plenty of choices.

- The platform has strong liquidity, making it easier to execute trades quickly.

- There are advanced trading tools available that seasoned users will find helpful.

Cons

- Bitfinex isn’t regulated by a major financial watchdog, which might be a concern for some.

- The exchange has had security issues, so it’s something to be aware of.

Margex

If you're new to crypto derivatives or just prefer a simple setup, Margex might be a good place to start. The platform focuses solely on crypto trading, offering leverage of up to 100x. At the same time, it is beginner-friendly with a simple interface and a handy demo mode for practice.

One of Margex’s standout features is its MP Shield, a system built to prevent price manipulation on its order books. While the number of supported assets is fairly small, you can trade popular ones like Bitcoin, Ethereum, and Litecoin.

Security is taken seriously here as well. Margex employs multi-layer protection and cold wallet storage to safeguard user funds. Keep in mind that the FCA does not regulate it, and it doesn’t offer many fiat deposit options.

Pros

- The platform is easy to use, even for beginners.

- The MP Shield feature adds a nice layer of protection against shady price swings.

- It comes with built-in TradingView charts and a demo account to help you practice before using real funds.

Cons

- Margex is not regulated by the FCA.

- Fiat deposit options are minimal.

- Margex doesn’t offer a huge range of crypto assets, so your options are limited.

Bitpanda

The Europe-based exchange Bitpanda is a solid option for cryptocurrency leverage trading. It’s known for its beginner-friendly and straightforward design. The platform offers up to 2x leverage, giving users some flexibility without excessive risk.

Interestingly, the platform is fully regulated in the EU and approved by the UK’s FCA. That kind of official backing means it’s a safer spot compared to many offshore exchanges.

In addition to crypto, Bitpanda also offers stocks, ETFs, and precious metals. So, if you want to keep all your investments together, it’s pretty convenient. The platform is clean and easy to navigate, which is particularly helpful if you’re new to this world. Additionally, they offer an educational section called Bitpanda Academy, allowing you to learn the basics as you go.

Another useful feature is their Visa debit card, which lets you spend your crypto directly in everyday life. The trade-off is that Bitpanda’s leverage limit and trading tools aren’t designed for heavy speculators. Also, the fees can be a bit higher than some less regulated platforms.

Pros

- Bitpanda is fully regulated in both the EU and the UK.

- It supports more than just crypto, including stocks, ETFs, and metals.

- The platform is beginner-friendly with a clear design and helpful educational tools.

- Users can easily spend their crypto using the Bitpanda Visa card.

Cons

- Leverage is limited to just 2x, which may not suit active speculators.

- The platform has fewer advanced trading features.

- Fees can be higher compared to other platforms.

How to Choose the Right Leverage Trading Crypto Platform: 5 Things to Consider

- Regulatory Compliance: Ensure the platform adheres to the outlined regulatory standards, such as FCA approval or similar regulations in other countries.

- Leverage Options: Check if the platform offers the right amount of leverage for your trading goals and risk level.

- Trading Fees: Look at the fees, including maker and taker fees, as well as any overnight charges.

- Security Measures: Choose a platform that uses solid security tools, including two-factor authentication, cold wallet storage, and insurance.

- User Experience: Go for a platform that has a simple interface, offers demo accounts, and has helpful customer support.

FAQs

Do I need KYC to trade crypto with leverage in the UK?

Yes. Most platforms require identity verification to comply with anti-money laundering regulations, which typically include a valid ID and proof of address.

What is the maximum leverage allowed on UK-available crypto platforms?

For FCA-regulated platforms, leverage is usually capped at 2x. Offshore or unregulated platforms may offer up to 200x, but these come with greater risks.

Which crypto platforms offer 100x leverage in the UK?

Platforms like Margex and MEXC offer leverage up to 100x or more. Keep in mind that these are not FCA-regulated and involve a higher level of risk.

Conclusion

Platforms such as Bitget, MEXC, and Margex offer higher leverage and advanced tools, but they also come with increased risk. Before making a choice, consider factors such as regulation, fees, leverage levels, and user experience. Most importantly, never risk more than you can afford to lose when trading with leverage.

usdt

usdt xrp

xrp