Key Takeaway: ING Bank does not directly support cryptocurrency trading within its services. Clients can instead transfer GBP from their ING accounts to FCA-registered exchanges such as eToro.

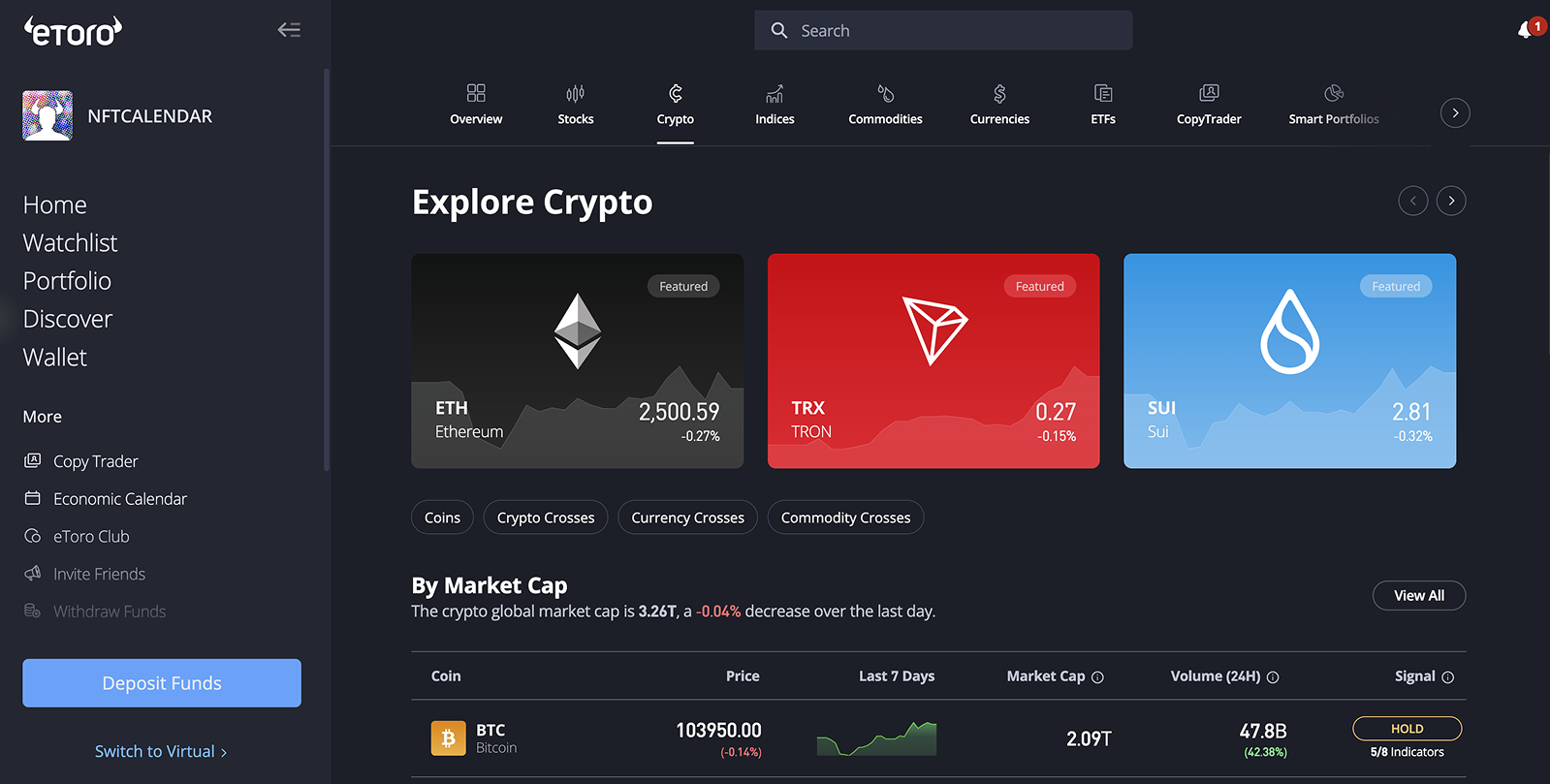

eToro, registered with the Financial Conduct Authority (FCA), allows investors to access over 70 cryptocurrencies, as well as traditional investments including stocks and ETFs.

How to Buy Bitcoin with ING Bank

ING allows its users to fund their crypto investments by transferring British Pounds (GBP) to digital asset exchanges that adhere to the Financial Conduct Authority (FCA) regulations.

A recommended FCA-registered platform for UK investors is eToro, which enables trading in over 70 cryptocurrencies and accepts GBP deposits through methods like bank transfers, debit cards, and the Faster Payments Service (FPS).

Follow this straightforward process to purchase Bitcoin using ING Bank and eToro:

- Create an Account: Go to the eToro website, sign up, and complete their mandatory identity verification procedures (KYC).

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY - Deposit Funds: After logging in, select "Deposit Funds," choose your preferred deposit method, and initiate a transfer from your ING Bank account.

- Find Bitcoin: Use the search bar to locate "Bitcoin" or "BTC," then select the asset and click on the "Trade" button.

- Complete Your Purchase: Enter the amount in GBP you want to invest, double-check transaction details, and confirm the purchase by finalising the trade.

ING Bank’s Policy on Crypto Transactions

ING maintains clear guidelines on crypto activities to protect customers from financial risks and fraud. The bank allows customers to transfer funds to digital asset exchanges registered by the UK's Financial Conduct Authority (FCA).

Customers may send funds to FCA-registered cryptocurrency exchanges using ING Bank's debit cards, online banking services, mobile banking app, or through branch transactions. However, the bank strictly disallows the use of ING-issued credit cards for purchasing cryptocurrencies, aligning with responsible financial practices.

Crypto Trading Fees

If you're an ING Bank customer planning to invest in cryptocurrencies through exchanges, understanding the fees involved is crucial. Below is an overview of eToro’s fee structure:

- Trading Fees: eToro charges a 1% fee per crypto trade. This fee is included directly in the transaction price at the moment you buy or sell, preventing surprise costs.

- Market Spreads: While eToro doesn't add extra fees explicitly labeled as spreads, it's important to note that market conditions create a natural gap between buying and selling prices.

- Withdrawal Costs: When ING customers transfer their money from eToro back into their bank accounts in GBP or EUR, eToro charges no withdrawal fees.

Overall, eToro’s transparent fee approach provides ING Bank customers a clear understanding of expenses, streamlining crypto investments without surprises.

Best GBP Deposit Methods for ING Bank

ING Bank customers interested in funding their cryptocurrency investments on eToro can select from several convenient GBP deposit methods:

- Faster Payments (FPS): ING Bank clients can transfer GBP to eToro using the Faster Payments network. This method ensures quick, free transactions, typically processed within minutes to hours.

- Debit Cards (Visa/MasterCard): Using debit cards issued by ING Bank, investors can deposit GBP instantly into their eToro accounts. This method accommodates transactions of up to £30,000 per deposit, ensuring immediate trading capability.

- eToro Money: Investors can deposit amounts as high as £400,000 per transaction when using eToro Money, which is suitable for higher-volume portfolios.

When it’s time to withdraw earnings or residual balances, ING customers can seamlessly transfer funds from eToro back into their bank accounts using the Faster Payments network for free.

What is ING Bank?

ING Bank, part of the Dutch multinational ING Group, is recognised for its pioneering direct banking model, offering services online and via mobile to more than 60,000 employees across 40+ countries. As a global systemically important bank, it serves millions of clients and channels significant resources into sustainable finance.

Headquartered in Amsterdam, ING provides a full suite of financial services, from personal and SME banking to wholesale finance, mortgages, asset management, insurance, and digital payment platforms, with a strong emphasis on digital innovation and sustainability.

Conclusion

Although ING Bank doesn't directly offer cryptocurrency trading, it provides a secure gateway for UK customers to invest through trusted FCA-approved exchanges like eToro.

Investors can confidently navigate crypto markets by clearly understanding fees, choosing efficient GBP deposit methods, and adhering to responsible banking practices.

usdt

usdt bnb

bnb