Thinking about using CoinEx from the UK? This CoinEx review UK gives you a clear and honest look at what to expect. Whether you're new to crypto or just exploring your options, it’s important to know how a platform works for your region.

CoinEx is a global exchange with a wide selection of digital assets and some solid features. But how does that experience translate for users in the United Kingdom? Are there any limitations or legal concerns? That’s what we’re here to unpack.

In this review, you’ll get a breakdown of how the platform works and what tools are available. You’ll also find out whether it’s a good fit for your needs. We’ll also point out any red flags or standout features worth knowing. No hype — just the facts, from a UK user’s perspective.

How does CoinEx work in the UK?

Using CoinEx in the UK feels much like using any other global crypto exchange. You sign up with an email, complete identity verification, and you're ready to start. The platform offers access to hundreds of tokens, including major assets like BTC, ETH, and USDT.

UK users can trade spot and futures markets, stake tokens, and access features like AMM swaps. The layout is clean, and the mobile app runs smoothly for day-to-day use. Users can also set up custom trading pairs and access charts powered by TradingView.

Deposits are crypto-only, as fiat on-ramps like GBP deposits aren’t available. To fund your account, you’ll need to transfer crypto from another wallet or exchange. Once you’re set up, you can trade, stake, or manage assets easily through the dashboard.

The platform doesn’t localize services for the UK specifically. There’s no direct GBP support, UK-based promotions, or FCA recognition. Still, most tools and features work the same way. As long as you’re comfortable using crypto-native platforms, it remains accessible and usable from within the UK.

Is CoinEx legal and regulated in the UK?

CoinEx is not registered with the Financial Conduct Authority (FCA), which regulates crypto businesses in the UK. This means the platform doesn’t fall under UK regulatory oversight.

Notably, the company is based offshore and operates globally, allowing UK residents to sign up and use the platform at their own risk. While using it isn’t illegal, it’s important to know that there’s no FCA protection in case of disputes or security issues.

For comparison, platforms like Binance or Coinbase have faced restrictions or licensing battles in the UK. CoinEx has mostly stayed under the radar, offering access without formal approval.

Are there any restrictions for UK users on CoinEx?

There are a few key limitations for UK users. First, you can’t deposit or withdraw GBP. Everything runs through crypto transfers.

Second, CoinEx doesn't offer a localized version of the platform for UK customers. You won’t find UK-based payment methods or support channels. Also, because it isn’t FCA-regulated, some features could be limited in the future.

That said, UK residents can still access the full range of tools. But they’ll need to manage compliance and tax reporting on their own.

CoinEx features and tools available for UK traders

CoinEx offers a wide range of features, most of which are accessible to UK users. The platform is designed to support both casual users and more experienced market participants. It offers speed, flexibility, and access to many crypto services.

Here’s what you get on CoinEx:

- Spot and margin trading: Swap hundreds of crypto pairs with limit or market orders. Margin options are available for some pairs.

- Futures market: Access USDT- and coin-margined contracts with up to 100x leverage, suitable for experienced users.

- Automated Market Maker (AMM): Swap tokens instantly via liquidity pools instead of traditional order books.

- Staking and Financial services: Lock assets to earn passive income through flexible or fixed-term staking options.

- CoinEx Smart Chain (CSC): Use the platform’s native chain for DeFi, NFTs, and low-fee transactions.

- API and bot integration: For advanced users, CoinEx supports custom bots and trading scripts.

- Multilingual support: The site and app are available in multiple languages, including English.

- Security tools: 2FA, anti-phishing codes, and withdrawal whitelists are available to protect user accounts.

While not tailored to the UK, these tools are fully usable from within the region.

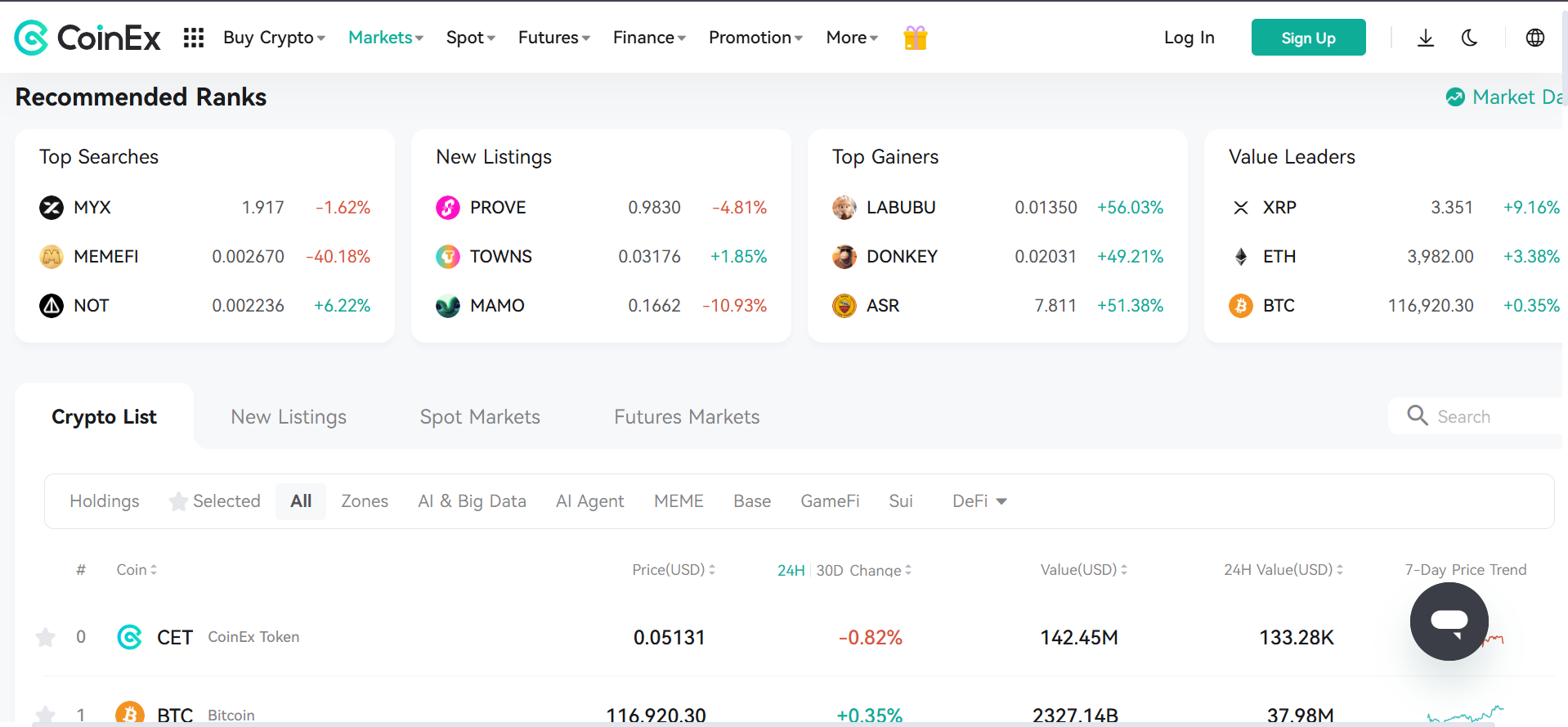

What cryptos does CoinEx support?

CoinEx supports over 700 cryptocurrencies, including popular names like Bitcoin, Ethereum, Solana, and XRP. UK users also have access to a wide range of altcoins, stablecoins, and emerging tokens.

The platform regularly lists new assets and offers deep liquidity on major trading pairs. You can trade BTC/USDT, ETH/USDT, and hundreds of other pairs across spot and futures markets.

There’s also support for regional or niche tokens not found on larger exchanges. However, GBP pairs are not supported.

All deposits and withdrawals must be done in crypto, with each asset having its own wallet address and fee structure. The broad selection gives UK users exposure to trending tokens and long-term crypto assets alike.

How good is the CoinEx app?

To begin with, the CoinEx mobile app is available for both Android and iOS and runs smoothly on most devices. It mirrors the desktop layout but simplifies navigation for mobile use.

Moreover, users can access all key features, including spot and futures markets, staking, wallet balances, and order history. The app also allows real-time price alerts and supports biometric login for added security.

In addition, charts are powered by TradingView, giving users access to professional-grade analysis tools on the go. You can open and close trades, manage positions, and transfer funds easily.

Lastly, push notifications help users stay updated with order execution, price changes, or platform announcements. Though not tailored to UK-specific needs, the app offers a reliable experience for anyone managing crypto from their phone.

CoinEx fees and limits explained for UK-based users

Understanding the fee structure is key when using any crypto platform. Here's a breakdown of what UK users can expect on CoinEx:

Trading fees:

CoinEx uses a tiered fee system based on 30-day trading volume or CET holdings. The base rate is 0.2% for both makers and takers. Holding CET (CoinEx Token) can unlock discounts.

Withdrawal fees:

Fees vary by token. For example, withdrawing BTC costs 0.0001 BTC, while USDT (ERC-20) may cost 10–20 USDT. The platform provides a full fee table on its site.

Deposit fees:

Crypto deposits are free. CoinEx does not accept fiat, so GBP deposits aren’t possible.

Limits:

Daily and monthly withdrawal limits depend on verification level. Fully verified users can withdraw up to 1 million USD daily.

Inactivity fees:

There are no inactivity or maintenance charges. You can leave your account unused without penalties.

While the platform isn’t UK-optimized, the fee model is transparent. Users should always check the live fee rates before transactions, especially for smaller-cap tokens where costs may be higher.

CoinEx staking and earning rewards

CoinEx offers staking options through its Financial Account and flexible earn products. UK users can lock supported assets to earn passive income over time.

The most common options include flexible staking, where users can withdraw anytime, and fixed-term products with higher rates. These include popular coins like USDT, ETH, and CET. Returns vary based on market demand and asset type.

There’s also “Strategic Earn,” which includes structured products with higher yields and more conditions. All staking activities are accessible from both desktop and app.

While CoinEx is not FCA-regulated, UK users can still access these earning tools. However, it's essential to understand that rewards are not guaranteed and come with risks. Always check terms before locking assets, and track returns through the Financial section of your account.

CoinEx payment methods

CoinEx doesn’t support fiat payments, so UK users can’t buy crypto directly with GBP on the platform. There are no bank transfers, debit cards, or PayPal options available.

To fund your account, you’ll need to transfer crypto from another exchange or wallet. Once deposited, funds are available immediately for use.

The platform does offer third-party gateways like Banxa or MoonPay via its fiat portal. However, these services work outside CoinEx and may carry high fees.

This setup may be inconvenient for beginners in the UK. Still, experienced users familiar with crypto wallets will find the process manageable.

What CoinEx bonuses and special offers are available for UK traders?

CoinEx runs frequent promotions, but most aren’t UK-specific. New users may receive sign-up bonuses in CET or discount vouchers after completing KYC.

There are also referral rewards, trading competitions, and seasonal campaigns offering prize pools in crypto. Occasionally, CoinEx partners with token projects to airdrop rewards for holding or trading specific assets.

Bonus eligibility often depends on activity level, not location. UK users can participate fully, provided they meet the terms.

Offers are promoted on the site’s event page, so it’s worth checking regularly for new deals.

CoinEx vs MEXC: which crypto exchange is right for you?

CoinEx and MEXC are both global crypto exchanges with wide token support, but they differ in features and user experience. For UK users, neither platform is FCA-registered, meaning both operate without formal UK oversight. Still, each offers unique advantages depending on your priorities.

CoinEx has a cleaner interface and is easier for beginners to navigate. It also feels more stable and consistent during use. The exchange supports fewer coins than MEXC but focuses on liquidity and smooth performance.

MEXC, on the other hand, offers access to over 1,500 tokens and highly active futures markets. Advanced users may appreciate MEXC's deeper trading tools and faster listings. However, the interface can feel overwhelming, especially on mobile.

For UK users, CoinEx’s simplicity, staking options, and stable mobile app make it appealing. MEXC offers more tokens and higher leverage, but it can be complex for new users.

Both platforms lack GBP support, so funding must be done via crypto transfers. Your choice depends on whether you want ease of use (CoinEx) or access to more tokens and features (MEXC).

FAQs

Is CoinEx safe for UK users?

CoinEx has not reported any major hacks since its launch in 2017. It uses standard security measures such as two-factor authentication (2FA), anti-phishing codes, and withdrawal whitelists. Assets are stored using cold wallets to reduce risk.

That said, it’s not regulated by the FCA, so UK users don’t have government-backed protection. While generally safe, users should still apply best practices and use strong personal security measures.

How good is CoinEx customer support in the UK?

CoinEx offers customer support through live chat and email, but there’s no dedicated UK support line or regional office. Live chat is available 24/7 and usually responds within minutes.

There’s also a Help Center with guides and troubleshooting tips. However, support is global, so response quality may vary. UK users may not get location-specific advice but can still access timely and helpful answers.

Does CoinEx require KYC?

Yes, CoinEx requires Know Your Customer (KYC) verification for full access. Without it, users can only make limited trades and small withdrawals.

To complete KYC, UK users must submit a government-issued ID and a selfie for identity verification. Once verified, higher withdrawal limits and full account features become available.

The process usually takes less than 24 hours. KYC also enhances account security and aligns with global compliance standards.

Conclusion

This CoinEx review has highlighted the key features, tools, and limitations of the platform from a UK user’s perspective. The exchange offers a clean interface, access to hundreds of tokens, staking options, and futures markets. Its mobile app is stable, and the overall experience is smooth, especially for users already familiar with crypto.

However, the lack of FCA regulation, absence of GBP support, and crypto-only payment methods may limit its appeal for complete beginners in the UK. The CoinEx exchange review also shows that while the platform is secure and functional, it doesn’t offer localized features or support tailored to UK residents.

That said, if you're comfortable using global platforms and prefer simplicity over flashy extras, CoinEx could be a suitable option. It works well for everyday crypto use and offers transparency in fees and tools.

UK users should weigh the pros and cons carefully, especially around legal protection and fiat access. As always, make informed choices based on your own needs and risk tolerance.

usdt

usdt xrp

xrp