Cryptocurrency trading has become increasingly popular in the UK, but with so many platforms to choose from, it’s crucial to pick one that’s safe and reliable. This is where FCA-regulated crypto exchanges come in. These platforms are approved by the Financial Conduct Authority (FCA), which ensures they meet strict regulatory standards.

Whether you are a beginner or an experienced trader, this article will guide you through the top FCA-registered exchanges in the UK, highlighting their features, fees, pros, and cons.

What exchanges are FCA-approved in the UK

eToro

Launched in 2007, eToro is a leading social trading and multi-asset platform with over 38 million users. It offers over 7,000 financial assets, including cryptocurrencies, stocks, and commodities. Its standout feature is copy trading, which allows beginners to mimic the strategies of successful traders.

Moreover, it offers features such as a smart portfolio that allows users to diversify their trading portfolios easily.

Pros

- Social trading features

- Supports multiple digital assets

- Easy to use platform, making it beginner-friendly

- Copy trading feature to help beginners get started

Cons

- High trading fees

- Lacks advanced trading and analytic tools

Fees

1 . Trading Fees: 1-2%

2 . Deposit fees: None

3 . Withdrawal fees: $5 (£3.85 GBP)

Best For: Traders interested in social trading and copy trading

Supported payment methods: Debit card, bank transfer, PayPal

Gemini

Gemini is a popular cryptocurrency exchange founded in 2014 by the Winklevoss twins. It boasts a user-friendly interface suitable for both beginners and experienced traders. It also features a specialized platform, ActiveTrader, dedicated to providing advanced trading options to expert traders.

Known for its strong focus on security, Gemini prioritizes protecting user assets. These include two-factor authentication (2FA) and insurance coverage.

Pros

- High-security standards

- User-friendly interface

- Supports over 150 cryptocurrencies

- Supports GBP

Cons

- Higher trading fees compared to competitors

- Fewer staking options when compared to competitors

Fees

1 . Trading Fees

Stablecoins: 0.00% (Maker fee) and 0.01% (Taker fee)

Other cryptocurrencies: 0.00% - 0.20% (Maker fee) and 0.03% - 0.40% (Taker fee)

2 . Deposit fees: 2.50% (PayPal), 3.49% (Debit cards), other deposit methods (Free)

3 . Withdrawal: Fiat currency withdrawals are free, ERC-20 tokens will require a gas fee, and other fees will depend on network activities at withdrawal time

Best For: Traders seeking a secure trading platform

Supported payment methods: Bank transfers (Faster Payments, CHAPS, or SWIFT wire) and Debit cards

Check out full Gemini Review for UK traders article.

Uphold

Uphold is an advanced, easy-to-use platform that allows users to invest in an array of assets, including cryptocurrencies and precious metals. Founded in 2015, Uphold has established itself as a user-friendly investment platform catering to seasoned and novice traders.

Its unique "Anything-to-Anything" trading feature lets users seamlessly swap any asset for another.

Pros

- Wide range of assets

- User-friendly interface

- Unique Anything-to-Anything trading feature

Cons

- Lack of advanced trading features

Fees

1 . Trading Fees: 0.2% to 2.95%, depending on the assets you trade

2 . Deposit Fees: None

3 . Withdrawal Fees: 1.75% ( Debit cards/Google Pay/Apple Pay), SEPA/FPS (none)

Best For: Best for those who seek a multi-asset trading platform

Supported payment methods: SEPA, Apple Pay, Google Pay, and Debit/Credit cards

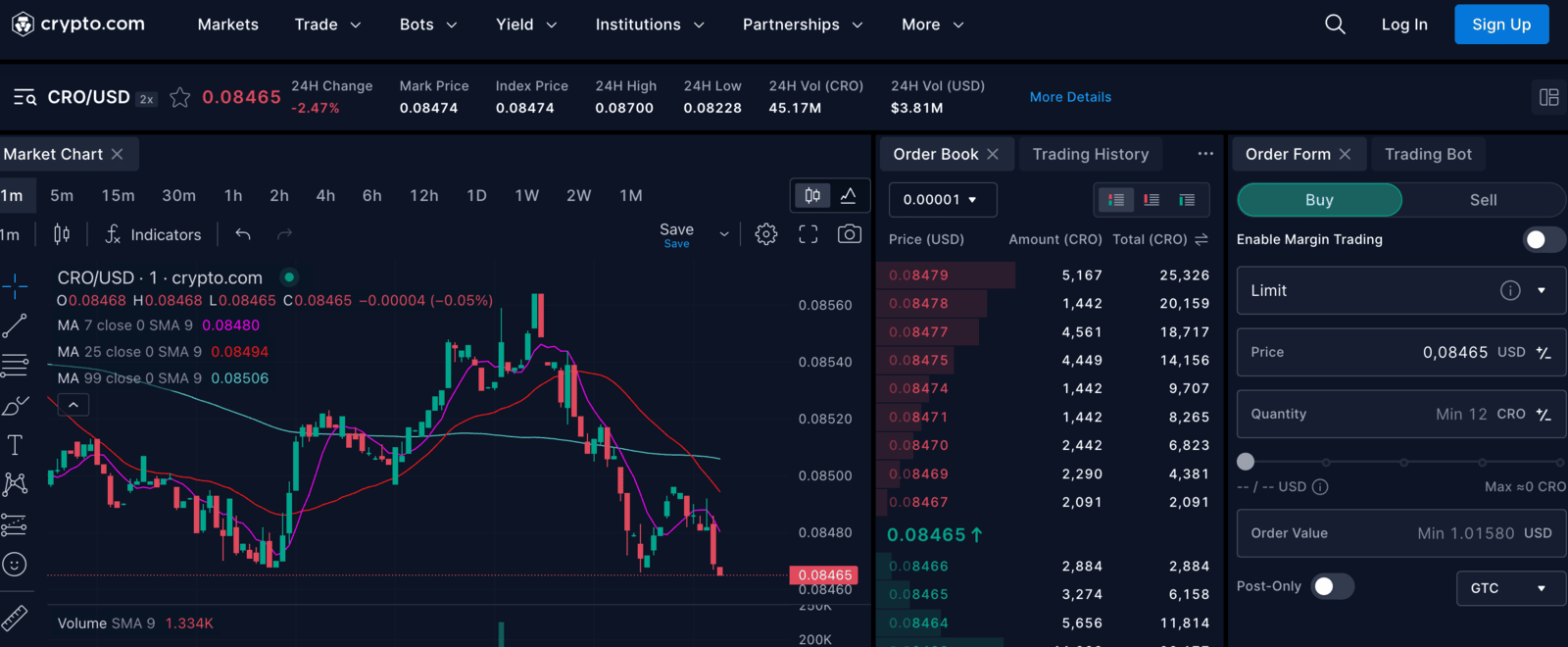

Crypto.com

Founded in 2016, Crypto.com is a renowned cryptocurrency exchange platform that offers a wide range of crypto services, including trading, staking, investing, and even an NFT marketplace.

It has over 100 million users worldwide and boasts over 350 cryptocurrencies, offering a diverse range of tradable digital assets. The exchange is known for its strong security measures, which provide users with high protection against hacking and theft.

Pros

- Extensive range of crypto-related services

- Competitive fees

- A wide range of cryptocurrencies

Cons

- Complex withdrawal fee structure

Fees

1 . Trading Fees: 0.1584% - 0.5000% (Taker fees) 0% ( maker fees) fees depend on user level and the use of CRO Lockup feature

2 . Deposit Fees: None

3 . Withdrawal Fees: Varies for different cryptocurrencies

Best For: Traders seeking platforms with a plethora of crypto trading services

Supported payment methods: Bank transfers, Debit/credit cards, Apple Pay, and Google Pay

Coinbase

Coinbase is one of the most widely used cryptocurrency exchanges globally. It is known for its user-friendly interface and strong security measures. It supports a wide selection of cryptocurrencies and offers high liquidity. The exchange is trusted by over 100 million people and boasts an intuitive interface.

Pros

- Large selection of cryptocurrencies

- User-friendly interface

- High liquidity

- Strong security measures

Cons

- High fees

- Lack of advanced trading features

Fees

1 . Trading: 0.00% - 0.5% (Maker fee) 0.04% -0.5% (Taker fee) depending on user pricing tier

2 . Deposit: SEPA(EUR) €0.15, SWIFT free

3 . Withdrawal: SEPA (free) SWIFT (£1 GBP)

Best For: Beginners and casual traders

Supported payment methods: Bank transfers, Debit/credit card

Kraken

Launched in 2011, Kraken is a popular cryptocurrency exchange known for its high and reliable security standards, providing users with a secure and trustworthy trading environment.

The platform has over 9 million registered users and offers a wide range of crypto-related services. These include spot, futures, margin, over-the-counter (OTC), staking, and even an NFT marketplace. It also offers an API allowing users to integrate Kraken into their trading applications.

Pros

- There is a wide range of assets to select from

- Supports GBP

- High-security standards

- Advanced trading tools

- Provision of educational materials for users

Cons

- Complex interface not suitable for beginners

- Higher fees when not on Kraken Pro

Fees

1 . Trading Fees: 0.00%-0.25% (Maker fee) and 0.10%-0.40%(takers fee)

2 . Deposit Fees: Free

3 . Withdrawal Fee: Free to £35 for withdrawal between £1 to £150

Note that some payment methods, such as SWIFT and CHAPS, incur some deposit fees.

Best For: Traders looking for advanced trading tools

Supported payment methods: Debit/credit card, Apple Pay, Google Pay

MoonPay

MoonPay is a globally recognized fiat-to-crypto on-ramp that enables users to buy cryptocurrencies using traditional payment methods like credit/debit cards, bank transfers, and Apple Pay.

Unlike traditional exchanges, MoonPay primarily serves as a payment gateway, integrating with various wallets and crypto platforms to facilitate seamless purchases.

Pros

- Supports a wide range of cryptocurrencies

- Easy-to-use platform with instant transactions

- Integrated with major crypto wallets and exchanges

- Multiple payment methods, including Apple Pay and Google Pay

Cons

- Higher fees compared to centralized exchanges

- No direct crypto-to-crypto trading options

- Limited withdrawal functionality

Fees

1 . Trading Fees: 1% - 4.5%

2 . Deposit Fee: 1% - 4.5%

3 . Withdrawal Fee: 1% - 4.5%

Best For: Users who want a fast and convenient way to purchase crypto with fiat.

Supported Payment Methods: Credit/debit cards, bank transfers, Apple Pay, Google Pay, PayPal

Bitstamp

Bitstamp is one of the oldest crypto exchanges in the world. It has established a legacy of trust, reliability, and innovation. Its intuitive interface makes it a good choice for both beginners and experienced traders.

Bitstamp offers over 200 tradable crypto pairs, allowing traders to diversify their portfolios effortlessly. It also strongly focuses on security and provides insurance services to protect user funds.

Pros

- Competitive trading fees

- Wide range of crypto trading pairs

- Strong security features

- 24/7 customer support

Cons

- Staking and lending are not available to UK users

- Slow verification process

Fees

1 Trading Fees: 0.00% - 0.30%(Maker fee) and 0.03% - 0.40% (Taker fees) Depending on the user 30-day trading volume

2 . Deposit Fees: None

3 . Withdrawal: £2 GBP and 4% for instant purchase

Best For: Traders looking for a secure and reliable platform

Supported payment methods: Bank transfers, Debit/credit cards

Bitpanda

Founded in 2014, Bitpanda is an Austrian-based cryptocurrency exchange offering a variety of digital assets, including cryptocurrencies, stocks, ETFs, and precious metals. Known for its intuitive interface and strong security measures, Bitpanda caters to both retail and institutional investors.

Fees

1 . Trading Fees: 0.00% to 2.49%

2 . Deposit Fee: None

3 . Withdrawal: None

Archax

Archax is a UK-based digital asset exchange primarily designed for institutional investors. It became the first FCA-regulated digital security exchange, offering a secure and compliant environment for trading cryptocurrencies, tokenized assets, and other financial instruments.

Fees

1 . Trading Fees: 0.1% - 0.25%

2 . Deposit Fees: None

3 . Withdrawal Fees: None

CoinJar

Founded in 2013, CoinJar is one of the longest-running cryptocurrency exchanges in the UK, known for its ease of use and reliable customer support. It offers various crypto services, including a crypto debit card, an over-the-counter (OTC) desk, and a user-friendly mobile app.

Fees

1 . Trading fees: 0.00% - 0.08% (Maker fee) and 0.001% - 0.10% (Taker Fee), depending on the user's 30-day trading volume

2 . Deposit: None

3 . Withdrawal: None

Solidi

Solidi is a UK-based cryptocurrency exchange designed for quick and straightforward crypto transactions. It allows users to buy and sell digital assets with minimal verification requirements, making it an attractive option for those who want a hassle-free trading experience.

Fees

1 . Trading Fees: no transaction fees required

2 . Deposit: None

3 . Withdrawal: £0.50

Coinpass

Coinpass is a UK-based cryptocurrency exchange that offers a secure and efficient trading experience. Its user-friendly interface and strong security features make it suitable for both beginners and experienced traders.

Fees

1 . Trading Fees: 0.05% - 0.35% depending on user tier level.

2 . Deposit Fees: Free

3 . Withdrawal: £5 - £25 + 0.2%

Iconomi

Iconomi is a unique cryptocurrency investment platform that allows users to invest in and manage digital asset portfolios. Unlike traditional exchanges, it offers a copy portfolio feature, allowing users to mirror experienced investors' trading strategies.

Fees

1 . Trading Fees: 0.50% per trade or a minimum of 0.50 EUR per whole buy/sell transaction.

2 . Deposit Fees: None ( 0.5% - 3% for instant deposits)

3 . Withdrawal Fee: 0.50 – 1.50 EUR (SEPA), 1.00 – 1.80 GBP ( FPS), 20 GBP (CHAPS)

How to choose the best crypto exchange in the UK: 5 things to consider

Regulation: Always select a platform that has completed FCA registration or is registered by the FCA to ensure your assets are protected and that the exchange complies fully with UK FCA regulation.

Fee structure: A good exchange will boast a transparent and competitive fee structure. This ensures traders understand the cost and minimize hidden charges and unplanned expenses.

Security: Look for platforms with strong security measures such as advanced encryption, two-factor authentication, cold storage, and regular security audits. These measures protect your digital assets from unauthorized access and other potential threats.

Ease of Use: Crypto traders, especially beginners, should opt for exchanges with user-friendly interfaces. This ensures a seamless trading experience and minimizes the risk of errors due to complex navigation.

Supported Cryptocurrencies: Ensure the exchange supports the coins you want to trade and a wide range of other assets. This will ensure you have the flexibility and option to diversify your portfolio.

FAQs

Is there a difference between FCA-approved and FCA-regulated crypto exchanges?

Yes, there is a difference between FCA-approved and FCA-regulated crypto exchanges. FCA-regulated exchanges are fully overseen by the Financial Conduct Authority (FCA) and must comply with a broad set of rules, including AML, consumer protection, and financial conduct regulations. These exchanges are held to higher operational and compliance standards, ensuring stronger investor protection.

On the other hand, FCA-approved exchanges have received approval for specific activities, such as marketing crypto assets to UK customers or providing certain crypto-related services. This does not mean they are fully regulated across all operations.

Essentially, "regulated" implies broader and stricter oversight, while "approved" is more limited in scope.

Which FCA-approved crypto exchange offers the lowest fees?

Kraken is known for having very low trading fees and a transparent fee structure.

Does FCA approval means exchange becomes truly legal?

Both regulated and approved exchanges can conduct legal business.

Which crypto exchange is the safest for UK traders?

Gemini is regarded as the safest crypto exchange in the UK because of its strict regulatory standards and top-notch security measures.

Conclusion

Choosing the right FCA-approved exchange in the UK is essential for a safe and enjoyable trading experience. Whether you’re a beginner or a seasoned trader, this list provides a comprehensive guide to the top platforms registered with the FCA.

By selecting an exchange that meets UK FCA regulations, you can trade confidently, knowing your assets are protected.

usdt

usdt bnb

bnb