The internet is flooded with reviews about popular crypto exchanges like Binance and Coinbase. Thus, little attention is given to other exchanges on the list. One such platform is MEXC. This article would probably be the only MEXC review UK residents will need to digest to get an in-depth understanding of how the crypto exchange works.

MEXC ranks among the top 10 crypto exchanges by traded volume. It also sees a weekly visit of over 6.8 million. These metrics say a lot about its dominance and usage globally. You might wonder what keeps the exchange at the top of its game and whether it is usable within the UK. This review, which gives an honest look on MEXC, has all the answers you seek.

Table of Contents

What is MEXC?

MEXC is a centralized cryptocurrency exchange that facilitates the buying, selling, holding, trading, and investing of cryptocurrencies. The platform serves over 10 million users across over 170 countries globally. It is accessible via mobile app (iOS and Android) and desktop devices.

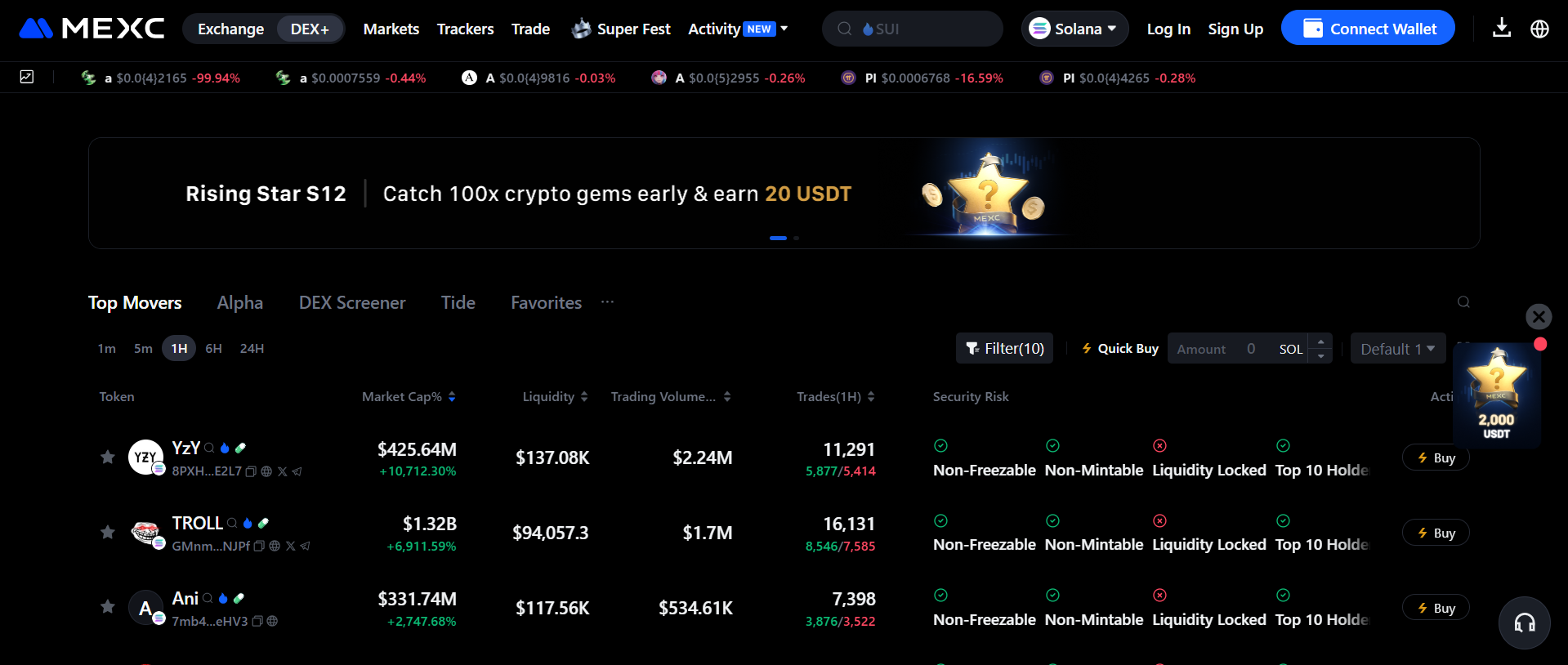

One of MEXC’s selling points is its support for numerous cryptocurrencies (coins and tokens). Prioritizing innovation, the crypto exchange adopts a flexible listing requirement. This way, the platform is often among the first to list cryptocurrencies, such as trending memecoins and AI-powered tokens. As of the time of writing, MEXC supports over 4,100 crypto assets (2,813 Spot pairs and 1,350 Futures pairs). Users seeking to gain early access to cryptocurrencies that can potentially net them massive profits can join the MEXC ecosystem.

Another selling point that has attracted users to MEXC is its flexibility regarding its know your customer (KYC) verification. The crypto exchange allows users to create an account without submitting their personal credentials. Those using a no-KYC account are limited to a 24-hour withdrawal of 10 BTC. They also do not have access to over-the-counter (OTC) transactions.

The platform noted on its website that users without KYC in some countries may face a combined deposit and withdrawal of 1000 USDT. On the other hand, KYC’ed accounts can withdraw as much as 80 BTC or 200 BTC daily.

MEXC boasts a clean sheet regarding security breaches. Since the FTX crash in 2022, MEXC, alongside other crypto exchanges, has introduced a proof of reserves (PoR). The platform, having a 1:1 asset reserve ratio, uses this to ensure transparency.

The crypto trading platform also offers an advanced matching engine that facilitates 1.4 million transactions per second. This way, traders can be assured of seamless transactions while trading. The platform also has a 3 billion USDT stash, where 300 million units are earmarked for futures risk management and coverage of sudden events. Above all, the exchange complies with regulatory standards across various countries where it is regulated.

How does MEXC work in the UK?

Due to MEXC’s flexible onboarding process, UK residents can create an account on the crypto exchange without undergoing the KYC verification. Its services are tailored to meet the needs of both experienced crypto users and beginners, giving them a wide range of assets to choose from.

The crypto exchange enables UK users to access several spot and futures trading pairs with low transaction fees. It has a fixed cost for all users, depending on the type of trade.

Notably, the MEXC exchange has a native cryptocurrency built on the Ethereum network. Dubbed MX, the token unlocks exclusive access to various activities and incentives on the platform, including discounts. As a result, holders of the ERC-20 token pay 50% less to cover trading fees.

Is MEXC legal in the UK?

MEXC is not licensed to provide financial services in the UK. Most countries have a body that oversees the operations of financial service providers. In the UK, the Financial Conduct Authority (FCA) regulates cryptocurrency exchanges and issues licenses to them. For now, UK users can freely use the MEXC exchange even though they are not regulated.

This means that UK residents using MEXC are not protected by the FCA’s regulatory guardrails. So, if the exchange becomes insolvent or suddenly exits the country, users are not guaranteed to reclaim their money.

Are there any restrictions for UK users on MEXC?

There are no outlined restrictions for UK users on MEXC. The platform is accessible to everyone, regardless of location, provided they have internet access. They should, however, bear in mind the dangers associated with using unlicensed platforms.

MEXC features and offerings for UK traders

In this MEXC exchange review, we present seven top features that have earned the crypto exchange its current user base. They are:

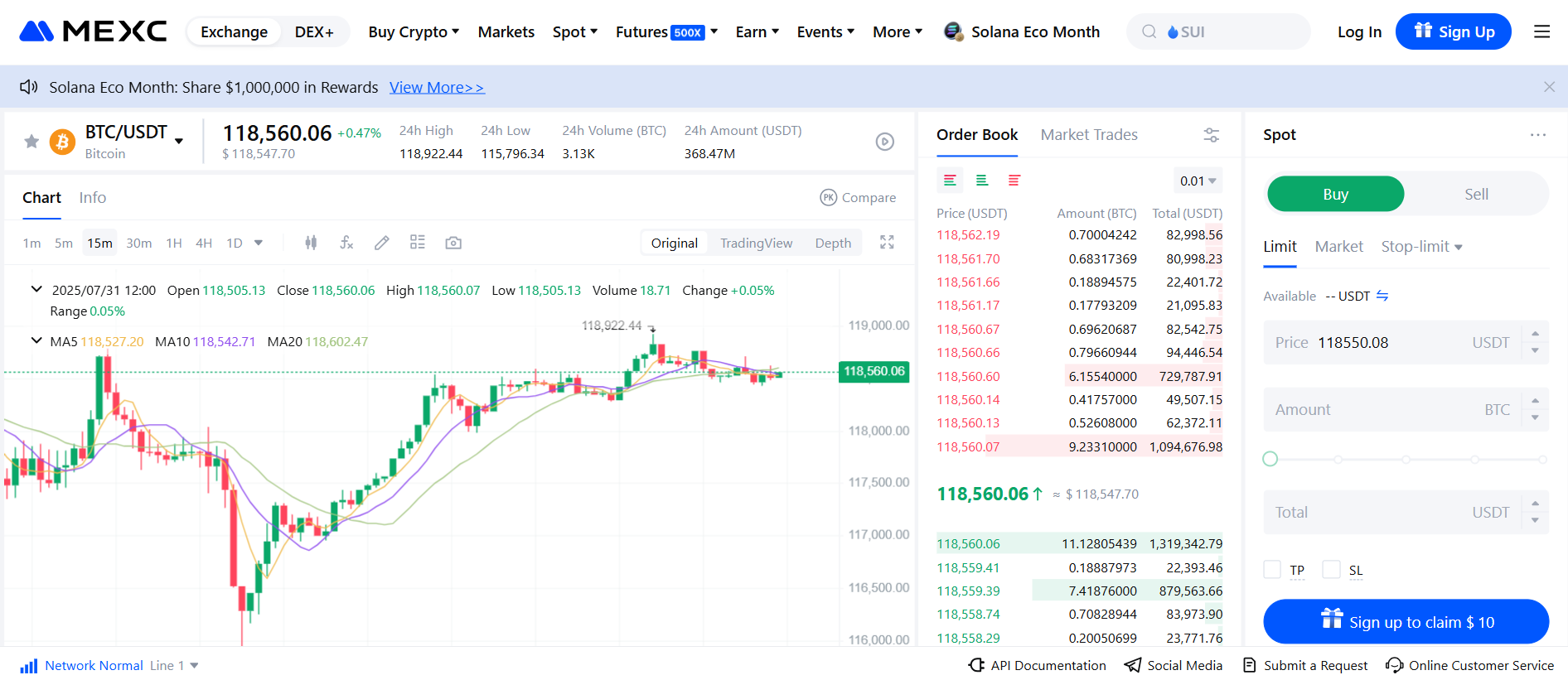

- Spot trading: MEXC offers spot trading to UK users with over 2,800 trading pairs available to choose from. All you need to do is select your preferred trading pair and the amount you want to trade. Users can also employ features like market (instant), limit, or stop-limit orders.

- Futures trading: The platform offers up to 200x leverage for both COIN-margined (COIN-M) and USDT-margined (USDT-M) futures. It features over 1,300 trading pairs across its centralized and DEX+ interfaces.

- Demo trading: This feature is primarily for beginners or new users, allowing them to practice futures trading on the platform. Users can use their demo accounts to place orders and execute trades with access to live cryptocurrency prices. However, demo trading is not available for spot trading.

- Peer-to-peer (P2P) Marketplace: The cryptocurrency exchange allows traders to buy and sell crypto directly with other users on the platform. It enables users to negotiate prices, payment methods, and trading terms directly with escrow services, eliminating the need for intermediaries. This provides them with greater control of their crypto transactions and a cost-effective way to trade.

- Staking: Crypto staking generally involves locking one’s asset for a specified period to earn rewards in return. MEXC offers two types of staking, namely, locked staking and flexible staking. Locked staking is suitable for users who wish to lock their assets in their MEXC wallets for the long term. Flexible staking, on the other hand, allows users to enjoy short-term liquidity of their crypto assets.

- Copy Trading: As the name implies, this feature allows users to ‘copy’ or replicate trading techniques from other futures traders. This is a fully automated process, unlike in traditional finance platforms. To do this, select the trader(s) you want to copy from on the Copy Trade page and click on Follow. Next, allocate some percentage of your account funds to them.

- Launchpad: MEXC launchpad events allow users to earn extra tokens when they subscribe to pools using MX tokens or USDT. Participants may also be required to complete specific tasks.

- Kickstarter: The Kickstarter event allows UK MEXC users to vote to support crypto projects during their prelaunch stage. It is usually accompanied by airdrop distributions to successful voters.

What bonuses and special offers can UK users get on MEXC in 2026?

MEXC exchange holds staking campaigns regularly, which is likely a contributing factor to the exchange’s large user base. The campaign events allow users to earn extra tokens by performing tasks such as staking or trading.

Special offers on the platform are usually accompanied by a timeline, sometimes up to one month. This gives users, including those based in the UK, enough time to participate and complete the required tasks.

What cryptos are supported on MEXC?

As one of the most popular cryptocurrency exchanges, MEXC offers support to a vast range of crypto assets. They number up to 2,813 at the time of writing. This wide offering provides traders and users opportunities to diversify their investment portfolios in the financial space.

Here are some of the crypto assets available on MEXC:

- MX Token (MX)

- Bitcoin (BTC)

- Ethereum (ETH)

- Pepe (PEPE)

- Solana (SOL)

- Avalanche (AVAX)

- Tron (TRX)

- Cardano (ADA)

- XRP (XRP)

- Litecoin (LTC)

- Toncoin (TON)

- Monero (XMR)

- Binance Coin (BNB)

- Wrapped Bitcoin (WBTC)

- DOGE (DOGE)

- Shiba Inu (SHIB)

- Chainlink (LINK)

- Polkadot (DOT)

- Taraxa Coin (TARA)

- Bitcoin Cash Node (BCH)

- Floki (FLOKI)

- Turbo (TURBO)

- Melon (MLN)

- Stellar Lumens (XLM)

- Baby Doge Coin (BABY DOGE)

- COSMOS (ATOM)

- IQ (IQ)

- Cronos (CRO)

- AERGO (AERGO)

- CONFLUX (CFX)

- Rarible (RARI)

- Maker (MKR)

- AVA (AVA)

- USD Coin (USDC)

- Aave Token (AAVE)

- Alchemy (ACH)

- PancakeSwap (CAKE)

- UNISWAP (UNI)

- Curve (CRV)

- Klever (KLV)

- Jasmy (JASMY)

- Raydium (RAY)

- Sandbox (SAND)

- Gods Unchained (GODS)

- Immutable X (IMX)

- WEMIX (WEMIX)

- IX Swap (IXS)

MEXC fees and charges explained for UK-based users

As mentioned earlier, holding a minimum of 500 MX tokens enables users to ditch 50% of most fees. Aside from holding MX tokens, users can reduce their fees by joining VIP plans or investing in special trading pair discounts.

There are specific fees that users will be charged for. Here are the applicable fees within the MEXC ecosystem:

- Trading fees: 0% maker fee and 0.05% taker fee for spot. 0% maker fee and 0.02% taker fee for futures.

- Deposit fee: MEXC charges no fee for deposits. Still, those depositing funds through channels like credit cards will pay the applicable fees charged by the payment provider.

- Withdrawal fees: Like other crypto exchanges, MEXC facilitates withdrawals through on-chain transfer. However, the applicable blockchain network fees vary between blockchains. Typically, popular blockchain networks implement higher fees due to heavy usage. On the other hand, smaller blockchains have lower costs.

Pros and Cons of Using MEXC in the United Kingdom

Pros

- Supports over 2,800 crypto spot pairs.

- Low trading fees.

- Processes over 1.4 million transactions per second.

- Supports diverse trading features.

- Users can join without KYC verification.

Cons

- The UK’s FCA does not regulate MEXC.

- Limited bank deposit options

- Poor customer support

MEXC vs OKX: Which crypto exchange is better?

MEXC vs OKX: Which crypto exchange is better?

When comparing MEXC and OKX, both crypto exchanges offer solid features, but each stands out in different areas depending on what you’re looking for as a trader.

OKX currently has a larger user base, with over 50 million users globally and a more extended history in the crypto space. MEXC, on the other hand, isn’t far behind with around 40 million users. In terms of user trust and reputation, OKX has the edge due to its longer track record and more established presence.

If you’re into trading a wide variety of coins, MEXC might catch your attention. It offers over 2,800 cryptocurrencies in its spot market, featuring new and smaller projects. OKX supports far fewer, around 300 to 400 crypto assets, but tends to focus on more stable and popular tokens. This makes MEXC a better fit for altcoin hunters or those looking for early access to new cryptocurrencies.

As for features, MEXC is excellent for users who want more than just trading. It includes launchpads, copy trading, staking, and access to new coin listings before they hit major platforms. It also offers trading-centric DeFi integration through its DEX+ interface. OKX, on the other hand, has diverse DeFi options, such as staking. At the same time, it focuses more on a secure and streamlined trading experience.

When it comes to trading fees, MEXC has lower costs than OKX. This means you might save a bit more on fees if you’re trading frequently with MEXC.

Both platforms support futures trading with high leverage. MEXC offers up to 200x leverage and low futures fees, while OKX also provides a maximum leverage of up to 125x.

For UK users or anyone wanting to use bank transfers or fiat currencies, OKX has the advantage. It supports a broader range of fiat currencies and payment methods, including GBP bank deposits. MEXC’s fiat support is more limited, especially for UK users.

It is worth noting that neither of these crypto exchanges is licensed by the UK’s Financial Conduct Authority (FCA). So, they offer limited services to UK clients.

FAQs

Is MEXC safe for UK users?

MEXC can be used in the UK, but it is not regulated by the UK’s Financial Conduct Authority (FCA). This means users don’t get the same legal protection as they would on FCA-approved platforms. While the platform uses standard security features like two-factor authentication (2FA), users should still be cautious.

Does MEXC require KYC Verification?

MEXC allows users to trade without Know Your Customer (KYC) verification. However, such users have a withdrawal limit of 10 BTC. On the other hand, users who undergo KYC gain access to higher withdrawal limits and advanced features. This process usually involves uploading an ID and a selfie. It helps improve security, but also means sharing personal information.

How good is MEXC customer support in the UK?

Customer support on MEXC has received mixed reviews, especially from UK users. Many report delayed responses and difficulty solving account issues. Compared to other exchanges like OKX, MEXC’s support team tends to be slower. It’s a weak point for the platform that users should keep in mind.

Has MEXC ever faced any major issues?

MEXC has faced issues in the past, including technical glitches and user complaints about frozen funds. However, it hasn’t experienced any major publicized hacks so far. While the platform operates globally, it lacks strong regulatory oversight in regions such as the UK. This makes some investors hesitant about long-term use.

Conclusion

MEXC is by far one of the best platforms to explore crypto trading. With its sophisticated tools and a basket of supported cryptocurrencies, the crypto exchange has captured the attention of millions globally. Although not licensed in the UK, MEXC provides various features that will benefit local users.

Information in this article will be helpful whether you’re a crypto trader exploring alternative exchanges to your current one, a pro crypto user, or a beginner seeking a detailed understanding of the exchange and its operations. With MEXC reviewed, users can make well-informed financial decisions.

usdt

usdt xrp

xrp