Cryptocurrencies have become an increasingly important part of global finance, and the United Kingdom is no exception. With the rising adoption comes a growing concern about security, control, and accessibility, especially as news of exchange hacks and frozen funds make headlines. As the awareness of crypto risks deepens, many users are actively seeking wallets that give them more control over their digital assets. This rising demand has contributed to the search for beginner-friendly and reliable wallets that don’t compromise user control.

This Trust Wallet review examines how the wallet meets the evolving needs of UK-based cryptocurrency users. We’ll take a detailed look at Trust Wallet’s features, supported assets, restrictions, fees, regulatory standing in the UK, and how it compares with other popular wallets. The goal is to give a clear, well-rounded understanding of what to expect, so users can make an informed choice about their crypto journey.

Table of Contents

- What is a Trust Wallet?

- How does a Trust Wallet work in the UK?

- Key features of Trust Wallet for UK users

- Key Trust Wallet restrictions for UK users to know

- The list of cryptocurrencies supported by Trust Wallet

- Trust Wallet fees and charges explained for UK traders

- Trust Wallet vs Exodus Wallet

- FAQs

- Conclusion

What is a Trust Wallet?

Trust Wallet is a mobile-based cryptocurrency wallet that allows users to store, manage, and interact with a wide range of digital assets in one secure application. It is a non-custodial wallet, meaning users have full control over their private keys and funds, rather than relying on a centralised exchange or third party. The wallet is designed to support multiple blockchains, enabling users to hold and manage various cryptocurrencies, including Bitcoin, Ethereum, and many others, all within a single app. In addition to basic storage and transfer features, Trust Wallet also provides access to decentralised applications (dApps), staking services, and NFT storage, making it a comprehensive tool for both everyday users and those exploring more advanced crypto use cases.

How does a Trust Wallet work in the UK?

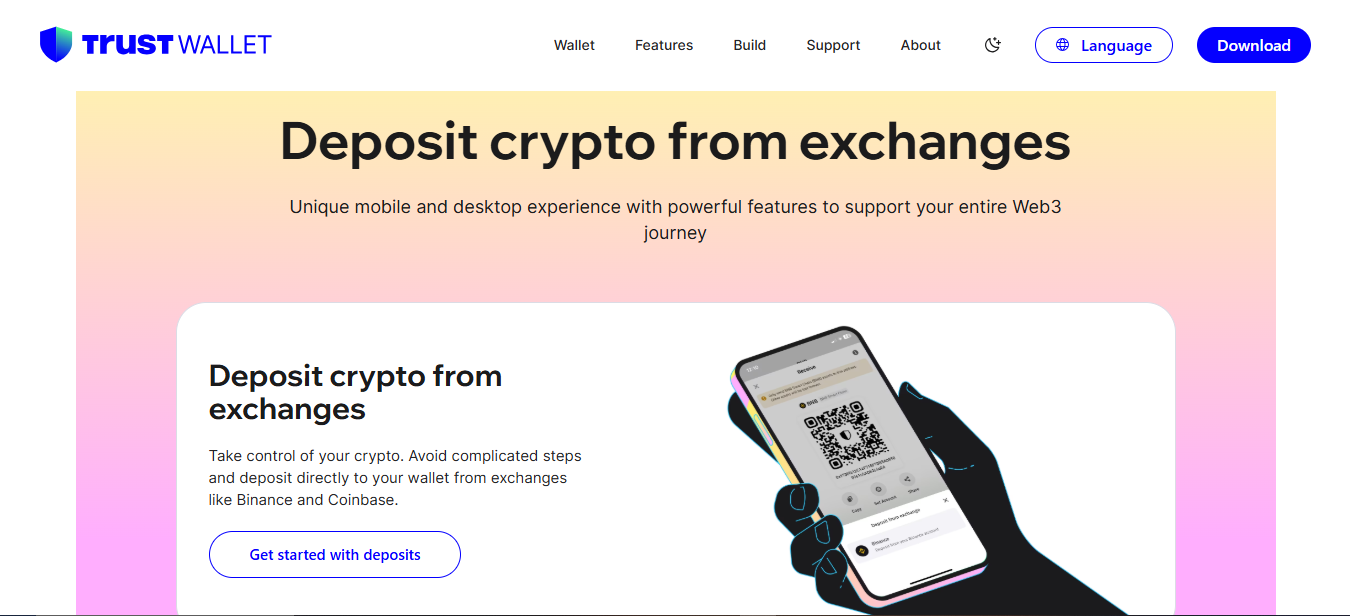

Trust Wallet is fully functional and accessible to users in the United Kingdom. As a decentralised, non-custodial cryptocurrency wallet, it operates independently of region-specific infrastructure, allowing it to be used globally without geographic limitations. The application is readily available for download via the Apple App Store and Google Play Store in the UK, offering the same features and capabilities as in other markets. Upon installation, users can create a wallet, securely store digital assets, interact with dApps, and manage various blockchain-based activities directly from their mobile devices. Importantly, because Trust Wallet does not operate as a centralised financial institution, it is not subject to the same regulatory restrictions as cryptocurrency exchanges, thereby enabling UK users to retain full control over their assets while maintaining access to a wide range of Web3 functionalities.

Is Trust Wallet legal in the United Kingdom?

As a non-custodial cryptocurrency wallet, Trust Wallet is legal to use within the United Kingdom because it allows individuals to securely store and manage their digital assets without relying on a third-party custodian. This structure places Trust Wallet outside the scope of direct regulation by the Financial Conduct Authority (FCA), as it does not offer custodial services or conduct activities such as fiat-to-crypto exchange, which would otherwise require FCA registration. As a result, it is excluded from the category of crypto asset businesses that must be registered with the FCA under the UK’s 2017 Money Laundering Regulations.

Nevertheless, it is important for users to note that while the use of Trust Wallet is lawful, certain activities conducted through the wallet, such as trading, staking, or engaging with DeFi platforms, may involve third-party services that are subject to UK financial regulations. Users are responsible for ensuring that their actions comply with applicable laws, particularly those relating to taxation and anti-money laundering obligations.

Key features of Trust Wallet for UK users

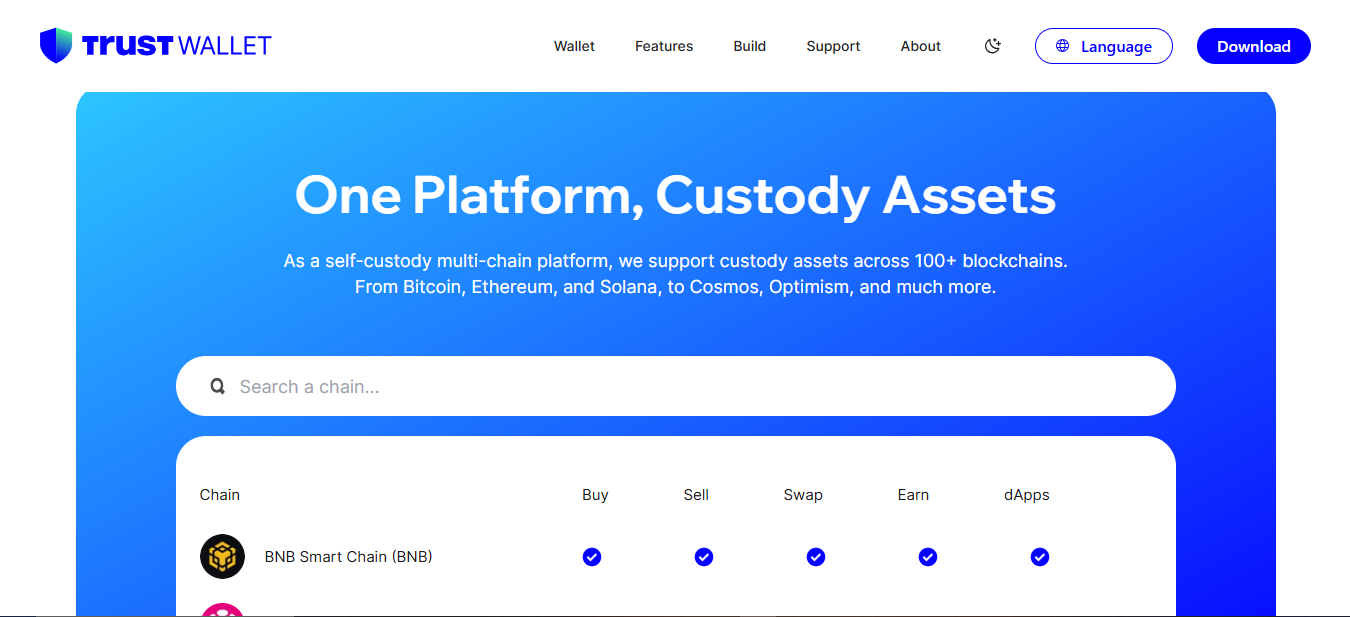

Trust Wallet offers a wide range of features that make it a standout option for UK users seeking a secure and user-friendly self-custody wallet. One of its core advantages is its multi-chain support. This allows users to store, send, and receive a wide variety of cryptocurrencies and over 10 million digital assets across more than 100 blockchains, all within a single mobile application. This eliminates the need for managing multiple wallets or apps for different tokens.

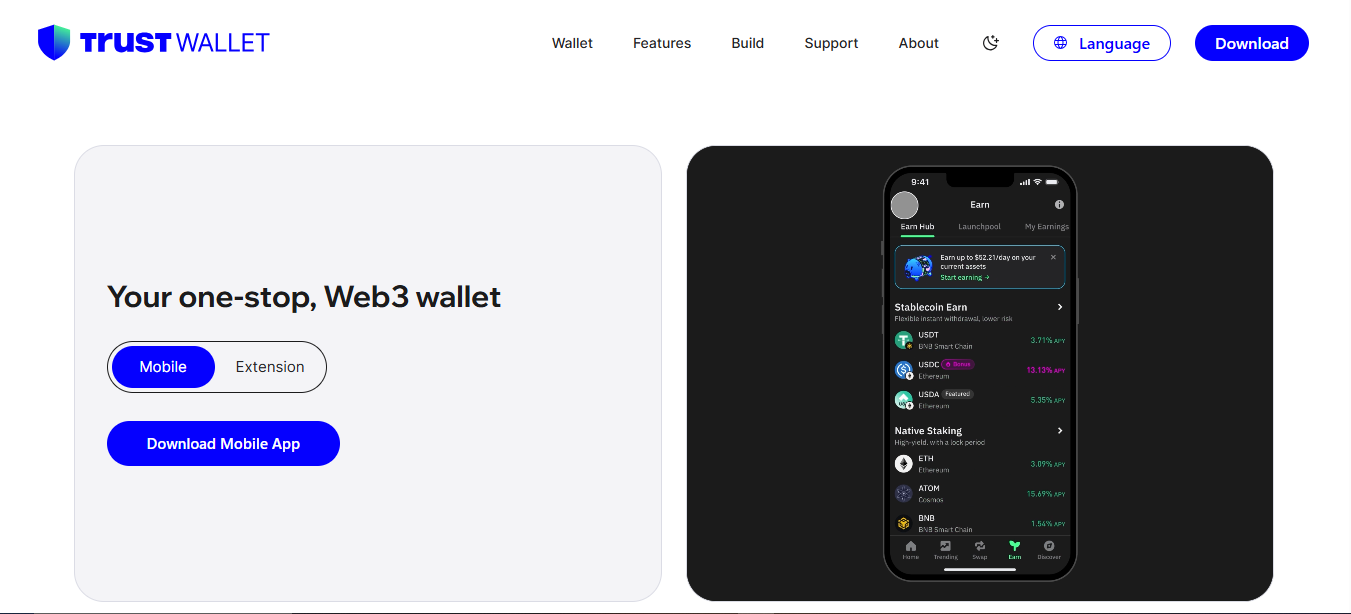

Another key feature is its built-in decentralised exchange (DEX), which enables users to swap tokens directly within the app without relying on a centralised platform. This is particularly valuable for users who prioritise privacy and decentralisation. Trust Wallet also includes staking capabilities, allowing users to earn passive income on supported assets by participating in network validation. This feature is integrated in a beginner-friendly way, unlike other wallets that require a more technical setup.

The wallet’s Web3 browser makes it easy to access and interact with decentralised applications (dApps), decentralised finance (DeFi) platforms, NFT marketplaces, and more. Unlike many competing wallets that require external connections or browser extensions, Trust Wallet’s mobile dApp browser offers a more integrated and seamless experience.

Enhanced asset protection is a key benefit of using the app. With its self-custody model, users manage their private keys, which are stored locally, reducing the risk of exchange hacks or third-party breaches. It also supports biometric authentication and encrypted backup options to enhance account security. The wallet is also completely free to use, with no subscription fees or hidden charges, and it is open-source, meaning the code is publicly accessible and continuously reviewed by the community.

Lastly, it offers multi-language support, including English, and a clean, well-designed user interface suitable even for individuals who are new to crypto.

Key Trust Wallet restrictions for UK users to know

While Trust Wallet offers extensive features globally, UK users should be aware of certain restrictions. Some DeFi services and token staking options may be limited or unavailable depending on local compliance rules. Users should also note that Trust Wallet itself is a non-custodial wallet, meaning it does not offer customer support for recovering lost private keys or funds. UK users need to exercise caution, ensure a secure backup of their wallet credentials, and understand these limitations before use.

The list of cryptocurrencies supported by Trust Wallet

Trust Wallet supports a wide range of cryptocurrencies, making it one of the most versatile mobile wallets available to users today. In total, the wallet allows users to store, manage, and transact with over 10 million digital assets across multiple blockchains. This includes popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), Solana (SOL), and Polygon (MATIC), among many others. Trust Wallet also supports a wide variety of tokens based on leading blockchain standards like ERC-20, BEP-20, and SPL, giving users access to a large ecosystem of DeFi tokens, stablecoins, and utility tokens. This extensive support ensures that both beginners and experienced users can manage their portfolios in one convenient, user-friendly platform without needing multiple wallets.

Trust Wallet fees and charges explained for UK traders

Trust Wallet itself does not charge any fees for downloading or using the app, making it a cost-effective choice for UK users. However, when sending or receiving cryptocurrencies, users must pay network fees, also known as gas fees, which are required by the blockchain to process transactions. These fees vary depending on the blockchain’s traffic and can fluctuate frequently. In addition, Trust Wallet does not impose any extra commissions or hidden charges on trades or swaps executed within the app.

Trust Wallet vs Exodus Wallet

Trust Wallet and Exodus Wallet each offer distinct advantages for UK users seeking reliable cryptocurrency management. Trust Wallet excels as a mobile-first, open-source solution supporting a broad range of assets and seamless interaction with decentralised applications, making it ideal for users prioritising control, privacy, and access to emerging crypto sectors. On the other hand, Exodus Wallets provides a polished desktop and mobile interface with integrated exchange features and dedicated customer support, appealing to those valuing convenience and assistance. However, Exodus supports fewer cryptocurrencies and lacks full open-source transparency. For UK users emphasising asset diversity, privacy, and mobile accessibility, Trust Wallet presents a compelling and secure option.

FAQs

Is it legal to use a Trust Wallet in the UK?

Using Trust Wallet in the United Kingdom is fully lawful, as it functions as a non-custodial application that grants users complete control over their digital assets without involving regulated financial intermediaries. Consequently, it operates outside the scope of direct FCA oversight, allowing legal and unrestricted access to cryptocurrency management on a personal level.

Is Trust Wallet good for beginners?

Trust Wallet is an excellent choice for beginners due to its easy-to-use interface, extensive multi-asset support, and integrated features such as staking and dApps access. Its mobile-first design, combined with strong security measures, allows new users to confidently manage their digital assets without technical complexity.

Can I buy crypto directly in Trust Wallet from the UK?

UK users cannot directly purchase cryptocurrencies within Trust Wallet due to regional regulatory constraints and the wallet’s design as a non-custodial platform. While Trust Wallet facilitates token swaps and transfers, acquiring crypto assets requires using external exchanges or payment services (third-party platforms) compatible with UK regulations before transferring funds into the wallet.

Conclusion

UK users must exercise careful judgment when selecting a cryptocurrency wallet, as the right choice can significantly impact security, control, and ease of use. A reliable wallet enables users to maintain ownership of their assets while engaging confidently with the digital economy. Trust Wallet offers a comprehensive combination of broad asset support, strong privacy protections, and flexible features that meet the practical needs of UK investors and traders, making it a prudent and valuable option for managing crypto holdings securely and effectively.

usdt

usdt xrp

xrp