Chris: Welcome! Please tell us a bit about yourself and your background.

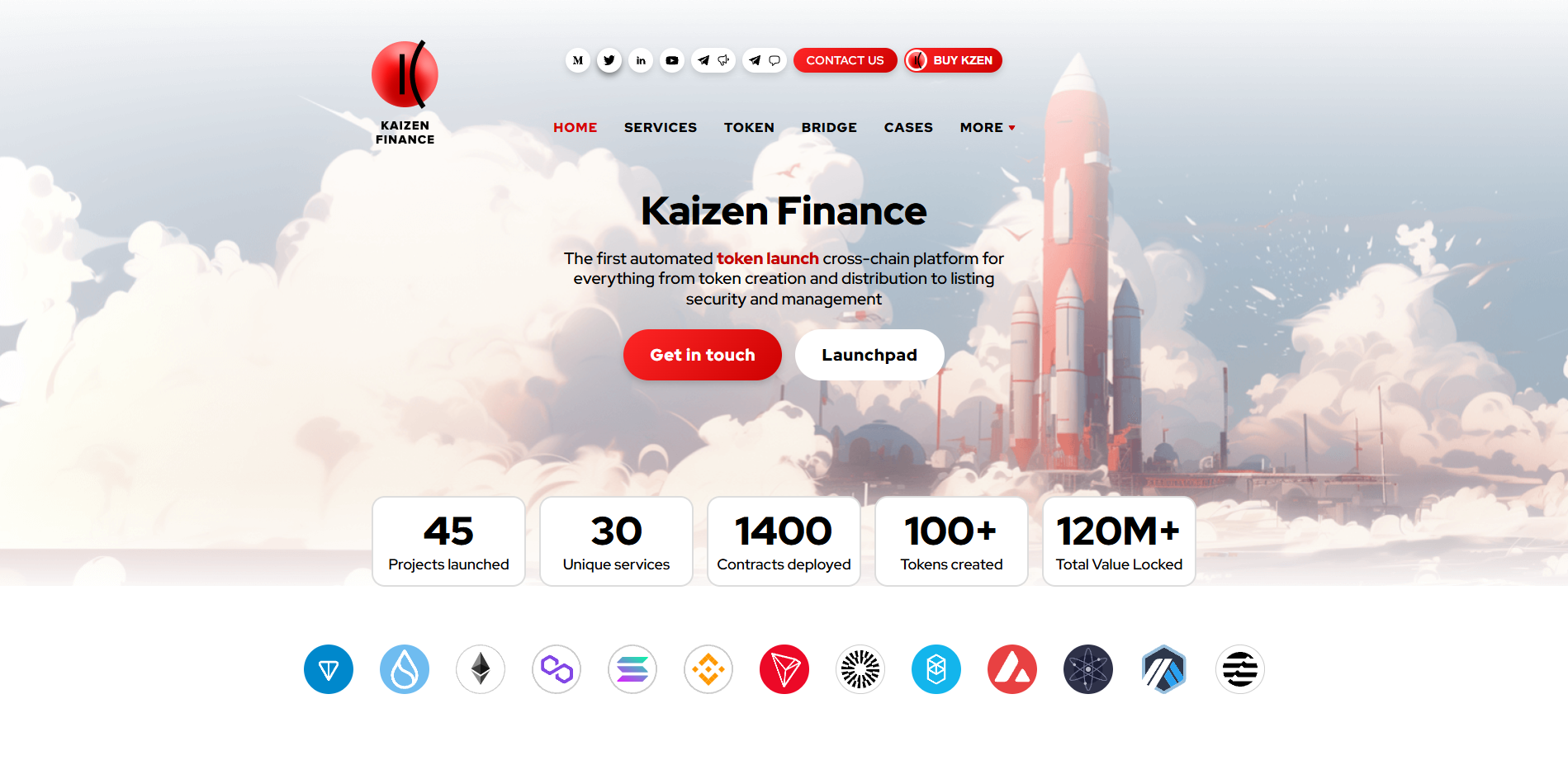

Evgen: Hi, I’m Evgen Verzun, founder and CEO of Kaizen.Finance.

My journey spans 16 years of leading engineering teams and innovating in cybersecurity and blockchain, with several patents to my name.

But beyond the tech, what excites me most is creating solutions that empower others to build the future of decentralized systems. Thank you for inviting me to this interview!

Chris: What was the original problem or gap in the token launch landscape that inspired the creation of Kaizen.Finance?

Evgen: Early on, launching a token was pure chaos.

Projects had to coordinate multiple vendors: one for token creation, another for vesting, others for staking, market making, compliance, and audits. You’ve got to think about security, smart contracts, fundraising, listings, all while trying to build and maintain a demanding community, so it all understandably becomes overwhelming.

That kind of environment often breeds disappointing results. And so we asked ourselves: what if there was one clear, secure way to navigate all this from the start?

The idea was to create a unified, crosschain platform that handles the entire lifecycle of a token. We wanted to eliminate the fragmentation, and build a place that would help projects understand the whole picture: what happens before, during, and after token launch.

Chris: Kaizen is described as the “first automated cross-chain token launch platform.” What were the biggest technical or regulatory challenges in pioneering this?

Evgen: Being first meant we had to solve problems nobody had tackled before.

On the technical side, the cross-chain complexity was like building an airport that could handle every type of aircraft simultaneously. Supporting multiple blockchains (Ethereum, BSC, Solana, Polygon, Arbitrum, etc.) required a highly modular architecture, as every chain has its own quirks and limitations, so we spent some time building a system that standardizes the experience.

The regulatory landscape was equally challenging. Unlike traditional finance with clear rulebooks, crypto compliance varies by jurisdiction and evolves constantly. In partnership with HyperID, we developed KYC/AML modules, geo-blocking, IP filters, and audit trails to meet global standards.

It’s one thing to make token launches possible, and another thing to make them safe for all sides involved. It wasn’t a straightforward process, but we got there eventually.

Chris: Your platform emphasizes “no-code” token creation and automation. How do you balance ease-of-use for non-technical founders with the complexity of secure and scalable smart contracts?

Evgen: We’ve built Kaizen to feel intuitive for any type of client. The core idea behind our platform is that launching a token shouldn’t require a PhD in Solidity or an on-site dev team.

Think of it like a guided setup wizard: you choose the options, see the outcomes, and only then launch with confidence. Of course, to find the right balance and provide clients with all the tools they need, we offer hands-on consulting.

While this automation streamlines the process, it is critical for us to help projects avoid common pitfalls in token launches, navigate crypto market risks, and potentially save hundreds of thousands that could otherwise be lost or spent fixing mistakes. A lot of problems can be avoided during the early planning stages, things like tokenomics design or go-to-market strategy.

And the results speak for themselves – we’ve had projects go from contract signing to live staking, vesting, and liquidity pools in just a single day!

Chris: Can you walk us through what happens from “create token” to DEX listing? What does full automation really look like?

Evgen: Absolutely!

It’s as straightforward as it sounds, but behind that simplicity, we’ve built some seriously powerful infrastructure.

When we talk about automation, founders define their token’s basics (name, supply, chain), set up vesting/staking rules, and deploy, all through a guided interface. That’s why we’ve designed it to feel like using a website builder, but for tokens. You make your choices, see what fits you, and then launch.

For more technical teams, we’ve got them covered too. Our platform supports deep customization: plug in your own rules, APIs, even integrate your own front end or admin panel if needed. It’s built to be both founder-friendly and dev-powerful, as cliche as it may sound!

In the case where clients need custom logic or last-minute adjustments, we’re also able to develop, test, and deploy to guide the project effectively.

Chris: With 1,400+ smart contracts deployed and $120M+ in TVL, how do you ensure security at scale?

Evgen: The scale we’ve reached is no accident. It comes from experience and years of working closely with teams across dozens of blockchains.

Our contracts start from pre-audited templates, but we also offer re-audits for custom setups. The contracts we deploy are secure, and we also give founders the option to include protections many don’t even realize they need, like anti-bot and anti-sniping mechanisms. These are critical!

A lot of projects, especially new ones, lose massive amounts of value on day one just because they didn’t block bad actors from gaming the launch. We integrate all safeguards to ensure launches go smoothly, and our platform offers comprehensive testing before anything goes live.

Chris: What are the most common mistakes you see in tokenomics design - and how does Kaizen help founders avoid them?

Evgen: Oh, we see a few patterns pop up all the time, especially with early-stage teams trying to move too fast.

I would say that no clear vesting plan is the biggest one. It can lead to mass confusion or panic when tokens start unlocking, and nobody’s sure who can sell or when. And then there’s the issue of unlocking too much supply too early, so projects get hit with sell pressure they weren’t ready for. On top of that, many forget to introduce actual token utility or staking from day one, so naturally, holders just... sell.

We help founders avoid these traps, as with Kaizen you can literally run “what if” scenarios on the fly, like comparing the impact of unlocking 10% versus 30% of tokens, or how changing staking APY might influence holder behavior.

We also flag things that are easy to miss. For example, if your cap table doesn’t match the vesting logic, or if your unlock timelines contradict the documentation. We've seen what works and what doesn't across hundreds of launches, and we bring that experience to every project. With Bullieverse, a few smart adjustments to their staking and unlocking mechanics cut their selling pressure by 80%.

It’s all about helping founders make smart decisions that hold up under pressure!

Chris: HOFA’s ARTEM and Scotty Beam both used Kaizen. Why were they great fits, and what did Kaizen provide?

Evgen: They’re perfect examples of our flexibility.

ARTEM needed an elegant NFT-gated system for art collectors – with custom staking rules, multilingual support, and KYC that matched their high-end brand.

Scotty Beam was quite different. It is a cross-chain utility project requiring dynamic NFT staking and a complex dual-round sale structure.

What did they have in common? Standard solutions wouldn't work. And that’s really why people choose Kaizen, as we specialize in custom logic, non-standard mechanics, and adapting to the real utility needs of each project.

In both these cases, it made all the difference.

Chris: What kind of insights do founders get with Kaizen’s on-chain monitoring and analytics?

Evgen: When founders use Kaizen, they get a live window into how everything’s performing in real time.

From the moment the sale goes live, you can see exactly how many buyers are coming in, how much has been raised, which chains are driving traffic, and even how well your conversion funnel is working. But it goes much deeper than just sales.

You get real insights into what kind of wallets are buying, where they’re coming from, how long they’re holding, how engaged they are. With staking, we show you which pools are attracting TVL, what kind of APYs are working, and whether users are sticking around or withdrawing early.

We also track vesting events. You’ll know what cliffs are coming up, when major unlocks are scheduled, and even get alerts if a whale is about to have tokens freed up. We give founders full transparency around key metrics: visualizations of every expense, live data on circulating and wrapped token supply, liquidity pool performance, and trading behavior.

All of this is designed with one idea in mind: fast, confident decision-making. It’s about giving founders the kind of clarity that allows them to implement proactive strategy.

Chris: What’s the Kaizen token and Priority Pass utility? Will there be governance?

Evgen: Think of $KZEN as the fuel that powers everything at Kaizen.

When you stake $KZEN, you unlock something we call the Priority Pass. And it really is what it sounds like – early access, better terms, and front-of-the-line privileges for token sales, private offerings, and other high-demand opportunities.

The more $KZEN you stake, the higher your tier, and the better your perks. We’ve built a tier system that actually gives value to committed users. Priority Pass holders often get the best terms available, long before the general public has a chance. And beyond IDOs, Pass holders get advantages across the Kaizen ecosystem, like platform discounts, exclusive tools, and faster access to new features.

Kaizen continues to evolve toward more decentralized control, so $KZEN will also carry governance weight. Holders will be able to vote on major platform decisions.

We really like the idea of giving power back to the community that’s helping us grow.

Chris: Where does Kaizen go in five years - Stripe for Web3 tokens?

Evgen: It is hard to predict how the landscape will be looking in 5 years, but we will evolve over time to match our ambitions.

Right now, we’re focused on changing the narrative that launching a token is akin to assembling a rocket ship from scratch. We believe in a future where launching a token should be easier for the clients, where founders don’t have to wrestle with smart contracts or hire an entire blockchain dev team just to test a business model or tokenize a real world asset.

Speaking of, we’re especially excited about RWA, that’s where this all gets even more interesting! That’s the future we’re building.

usdt

usdt xrp

xrp