Hi! Can you tell us more about yourself and the role you're playing in that blooming project?

Atakan: I'm Atakan, or you might know me as IntroToDeFi from twitter and youtube. I was one of the oldest members of ethereum reddit community, been in the space since 2015. Left the space for a while, then came back for the defi summer on ethereum. Then fell in love with DeFi, and to be honest i was a fanboy on Andre Cronje 😄 Fell in love with Fantom afterwards, and became the first educator, defi threader and influencer for Fantom back then. When i mean back then, there as nothing but fWallet at the time, and when fUSD came out, we lost our minds, that’s what’s back then.

And afterwards, i helped many protocols on their launch, i made tutorials for the community, made some interviews with guys from fantom foundation.

Helped liquiddriver ship their product, you can see my name in their discord as “liquid shipper”, alpha tested some protocols and gave feedbacks, for example, if you go to Reaper Farm Discord, you can still see my “bug hunter” tag.

I am currently the co-founder of Sonne Finance, and we hope to bring cool product for the masses who are using Optimism Mainnet.

Chris: You have an amazing project, would you please introduce it to our readers?

Atakan: So Sonne Finance is basically a lending/borrowing protocol at the backend. We forked Compound, innovate on tokenomics, and brought the first native lending/borrowing protocol on Optimism. It is a permissionless, open source and Optimistic protocol serving users. Users can deposit their assets, use them as collateral and borrow against them.

If you want to just use product, you can go to our website, and supply/borrow the same way you do on Compound or AAVE. You can earn interest on your supply, or you can borrow any other asset with collateralization.

This is all known stuff to experienced DeFi users. The action happens in the background.

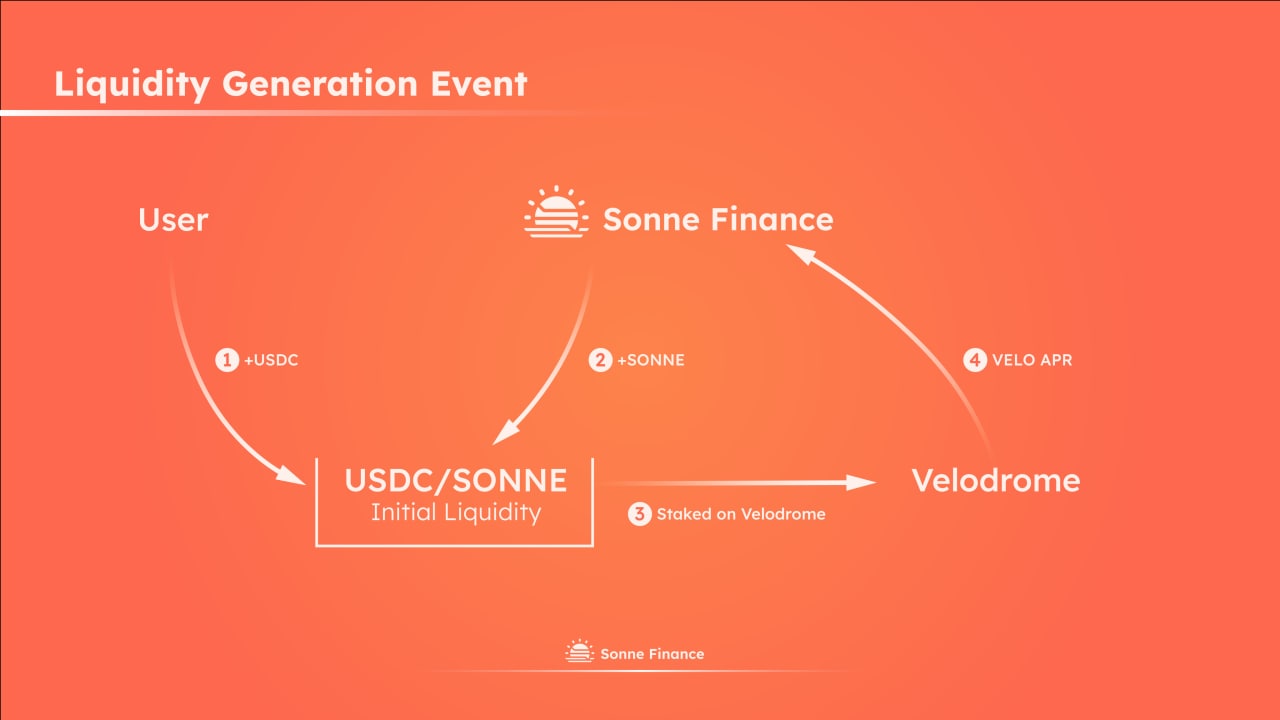

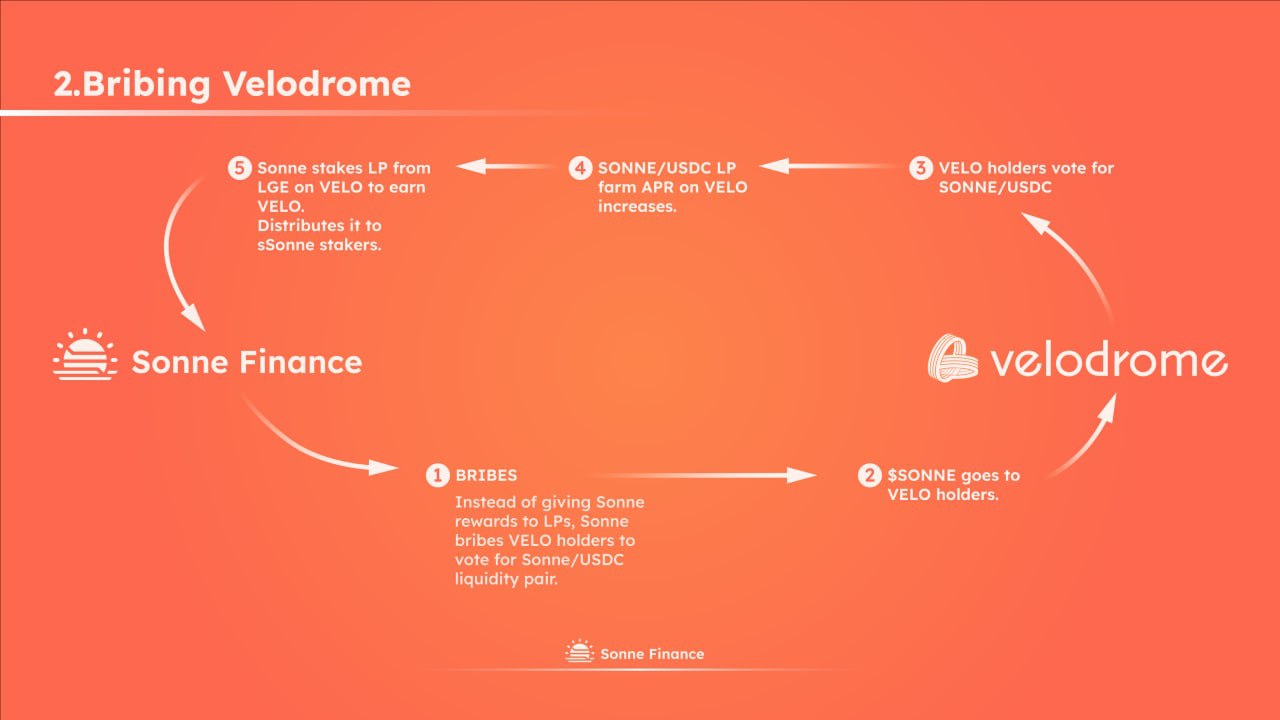

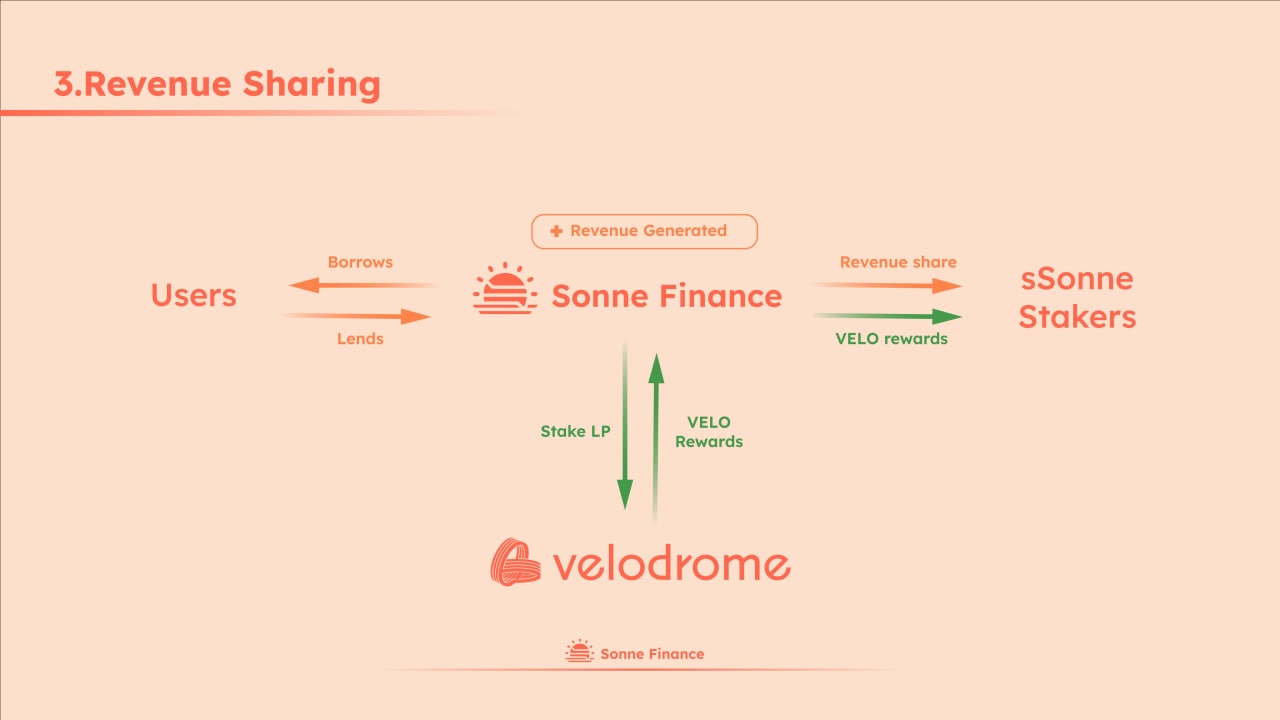

We raised $100k for our liquidity generation event. We put that liquidity in Velodrome to farm VELOs, and instead of incentivizing liquidity directly with SONNE token, we bribe Velodrome Finance holders to vote for us. VELO emissions go to our SONNE/USDC pool, we farm them with the LP coming from LGE and distribute it to stakers.

It sounds complicated, so you can check these infographics to understand it better:

Our stakers have 2 different streams of rewards. One is coming from Velodrome, and the other is protocol earnings. Both of them goes to our stakers. So stake your SONNE sirs.

Chris: How did you come together to create such a project?

Atakan: I know the lead developer for a very long time (maybe 10 years), he also is the lead dev of one of the biggest NFT marketplaces in Binance Smart Chain.

The other developer and I were working for 2 years as well. I told her to study lending protocols, and she is working on them for 10 months.

And because i am too active on crypto and DeFi in general, it was not too hard to find other missing pieces. Our UI designer is an awarded designer in Turkey.

I had the idea of this protocol back in Fantom when Solidly launched, but Velodrome is basically a better Solidly on a real Ethereum layer 2. So it was an easy choice for us to launch on Optimism.

Also, being first helps!

Chris: Would you please elaborate on the way the system works: what are a total supply and total borrow? What do these metrics so about the business?

Atakan: Total supply is, total supplied asset to the protocol. For example if you want to supply 100 USDC on SONNE, you increase the Total Supply by $100.

Total Borrow is, total borrowed asset. You can use the supplied assets as collateral, and borrow against them. For example, if you use 100 USDC as collateral, and borrow $50 worth of ETH, you increase total supply by $100 and total borrow by $50.

TVL is the difference between them, because borrowed assets are no longer in the system, they might be out there somewhere.

The most important metric in lending protocols is total borrowed. Lending protocols generate revenue when there is borrowing action, the more borrowing done, the more protocol earns. Total Supply is also very important because the more supply there is, the less interest rate. When interest rates are high, people tend not to borrow.

Chris: What was the process of picking assets for your platform? Do you have any limitations?

Atakan: Yes. We want to be on the very safe side for the launch. There were many partnership offerings before the launch of our protocol, but we didn't want to take any risks on behalf of our users. We want everything to be as safe as possible for a long time. For lending protocols to be safe, assets used as collateral need to be less volatile and very liquid. All of the assets we chose is eligible on this criteria on Optimism Mainnet.

Chris: What are SONNE claims?

Atakan: If you are asking about the "claim" tab on the website, they are the rewards for participating in our LGE.

If you are asking about staking claims, those are protocol earnings distribution for our stakers.

Chris: Can you share some exciting milestones you plan to reach this year and beginning of 2023?

Atakan: We plan to reach 100M total supply by the end of this month, and 200M total supply by the end of this year. We also plan to get a grant from Optimism in order to prove that we are here to stay, and we are safe.

Chris: Thanks! Anything else you would like to mention? Where can we follow your updates?

Atakan: You can follow us on Twitter and our main community hub is Discord.

You can ask any questions there, we are generally pretty fast on Discord (you can get answers in minutes if not seconds) and we would be more than happy to answer any question!

Thanks for the interview!

usdt

usdt xrp

xrp