The UK is a major market for cryptocurrency trading, but regulations are tighter than in most regions. The Financial Conduct Authority (FCA) has banned the sale of crypto derivatives, including perpetual futures, to retail investors through UK-licensed platforms.

Even so, several international exchanges still accept UK traders, offering perpetual contracts with strong liquidity and competitive fees.

To help investors choose, we reviewed the top platforms accessible in the UK, evaluating security, GBP deposit options, trading fees, liquidity for perpetual contracts, and overall reliability.

Top Crypto Perpetual Platforms in the UK

Here is our curated list of the seven best exchanges where UK traders can access cryptocurrency perpetual futures.

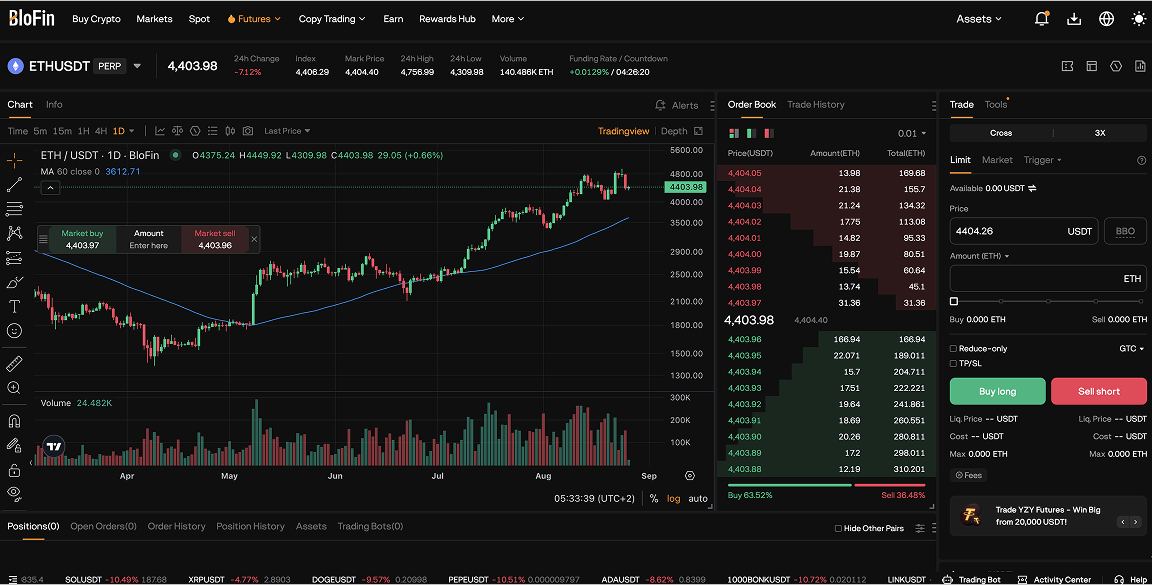

1. Blofin – Best No-KYC Futures Exchange for UK Investors

Country: Cayman Islands

Blofin, founded in 2019, has become a leading global exchange for traders seeking access to perpetual contracts without heavy compliance barriers. Its no-KYC model makes it particularly attractive for investors in regions like the UK, where the FCA restricts retail access to crypto derivatives.

The platform offers spot and futures trading with leverage up to 150x, supported by over 500 cryptocurrencies. Security is reinforced through two-factor authentication, asset segregation, and partnerships with Fireblocks and Chainalysis. Blofin also maintains a transparent 1:1 proof-of-reserves, currently holding assets above $150 million.

Key Features:

- Spot and perpetual futures with up to 150x leverage

- Transparent proof-of-reserves exceeding $117M

- Fees: 0.1% spot, 0.02% maker / 0.06% taker on futures

- No-KYC withdrawals up to $20,000 daily

- Multiple funding options: bank transfers, debit/credit cards, Apple Pay, Google Pay, Wise, PayPal, crypto deposits

- Advanced tools: automated bots, copy trading, staking, demo environment

Pros:

- No-KYC trading, ideal for UK investors under strict regulations

- Wide fiat support and multiple deposit methods

- Low fees for both spot and futures markets

- Strong trading features for beginners and advanced users

Cons:

- Not accessible in some jurisdictions

- Operates with limited formal regulatory licensing

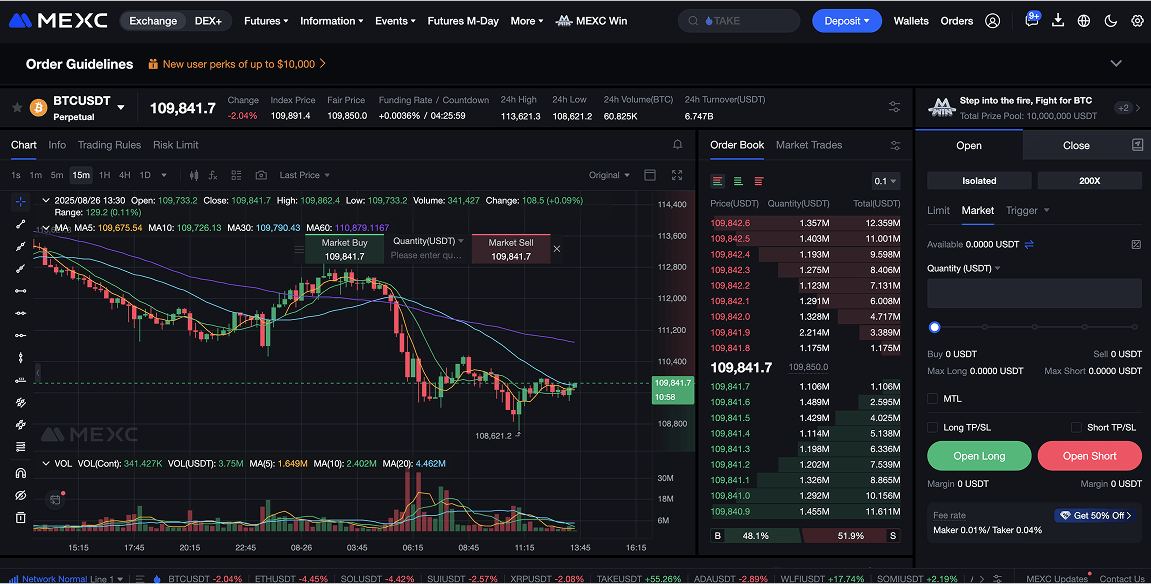

2. MEXC – Best Exchange for High-Leverage Perpetual Futures

Country: Singapore

MEXC is a global exchange known for its extreme leverage, offering up to 300x on perpetual futures. While it is not regulated in the UK, its offshore structure means UK investors can still access the platform. This availability comes with added risks, as protections under the FCA do not apply.

The exchange lists more than 780 perpetual contracts and supports over 2,500 spot assets, delivering liquidity across both major cryptocurrencies and smaller altcoins. Daily trading volumes near $25 billion highlight its scale. Traders benefit from zero maker fees, low taker fees, and advanced tools such as copy trading, trailing stops, and risk-management orders.

Key Features:

- Leverage up to 300x on select perpetual futures

- Over 780 perpetual contracts and 2,500+ spot assets

- Fees: 0% maker, 0.02% taker (discounts via MX token)

- Copy Trading and advanced order types for strategy automation

- Deposit options: bank transfers, debit/credit cards, Apple Pay, Google Pay, crypto deposits

Pros:

- Industry-leading leverage for futures markets

- Wide selection of perpetual contracts and spot assets

- Zero maker fees and low taker fees

- Strong liquidity across altcoins and majors

Cons:

- Offshore platform, with no FCA oversight for UK investors

- High leverage carries substantial risk for inexperienced traders

- Regulatory warnings issued in other jurisdictions

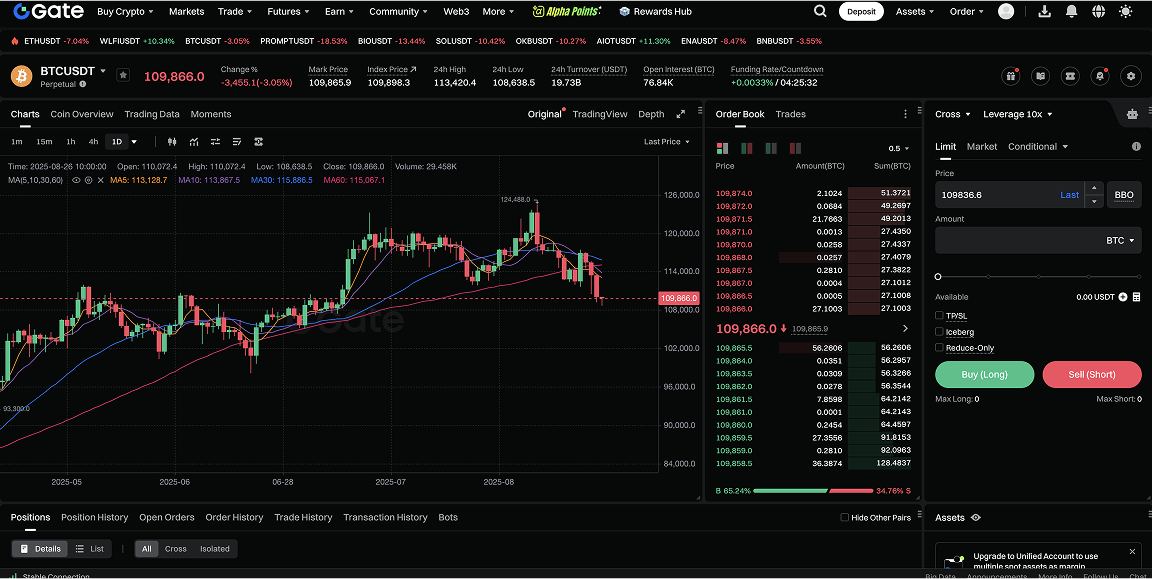

3. Gate.io – Best Futures Exchange for Altcoin Variety

Country: Hong Kong

Gate.io is one of the longest-running crypto exchanges and remains popular with traders who want access to perpetual futures on a wide range of altcoins. The platform supports leverage up to 125x and is particularly known for its depth in smaller-cap tokens.

It lists more than 800 perpetual contracts and 4,000 spot pairs, with daily volumes above $20 billion ensuring strong liquidity even in emerging markets. Gate.io also provides advanced order types, automated trading bots, and copy trading features, making it suitable for both experienced traders and those learning through strategy replication.

Key Features:

- 800+ perpetual futures contracts and 3,900 spot assets

- Leverage up to 125x on select pairs

- Daily futures volume exceeding $20B

- Fees: 0.02% maker, 0.05% taker (with volume-based discounts)

- Trading tools: advanced order types (TWAP, Iceberg, Conditional), bots, copy trading

- Payment methods: bank transfers, debit/credit cards, crypto deposits, Web3 wallets (MetaMask)

Pros:

- Largest altcoin selection for perpetual futures

- High liquidity across trending and niche tokens

- Competitive fees with discounts for active traders

- Wide set of automated and advanced trading tools

Cons:

- Offshore platform, no FCA oversight for UK users

- Complex interface can be challenging for beginners

- Regulatory uncertainty in some jurisdictions

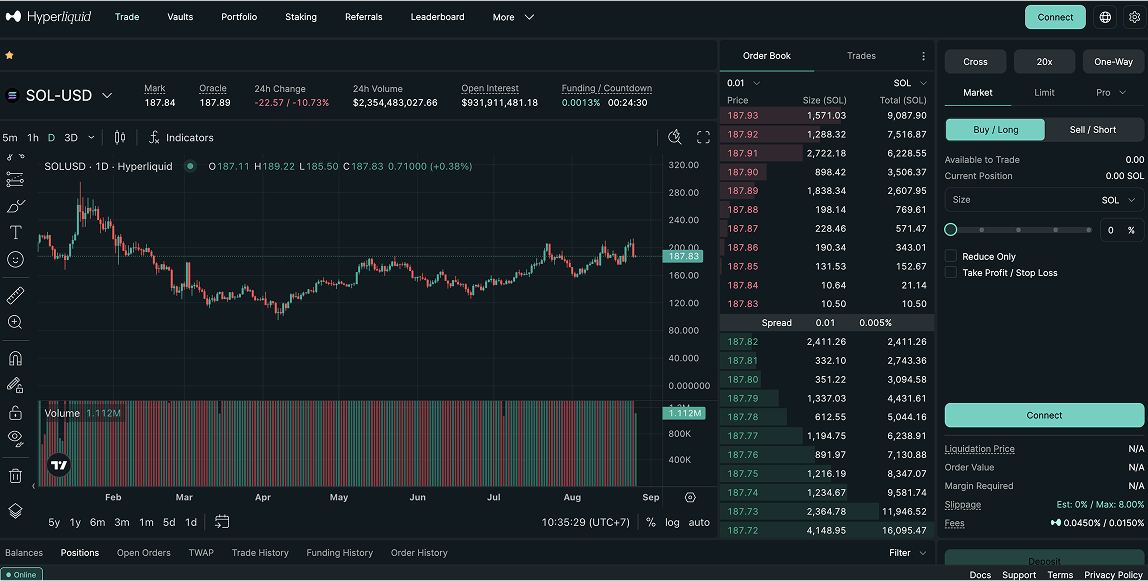

4. HyperLiquid – Best Decentralized Perpetual Exchange

Blockchain: Custom Layer-1 (Arbitrum-based origins)

HyperLiquid dominates decentralized perpetual futures with over 80% market share and more than $10 billion in daily volume. Built on its own Layer-1 blockchain, it delivers sub-second settlement, deep liquidity, and fully non-custodial trading. No KYC is required, and traders connect directly through wallets like MetaMask, keeping full custody of their assets.

The platform supports 200+ perpetual contracts with leverage up to 50x. Fees start at 0.015% maker and 0.045% taker, with rebates for high-volume traders. Its transparent design and performance-focused infrastructure put it ahead of rivals like GMX, making it the top choice for traders seeking on-chain derivatives with speed, liquidity, and privacy.

Key Features:

- 200+ perpetual markets with leverage up to 50x

- On-chain CLOB for transparent and fair execution

- Fees: from 0.015% maker and 0.045% taker, with rebates for high-volume traders

- Direct wallet integration (MetaMask, Coinbase Wallet, OKX Wallet, Keplr)

- Non-custodial design, with assets always held in user wallets

- Points program rewarding active traders with future governance tokens

Pros:

- Leading liquidity and execution in decentralized perps trading

- No KYC, accessible for UK users despite FCA restrictions

- Transparent on-chain order book with low fees and maker rebates

- Institutional-grade infrastructure with sub-second settlement

Cons:

- Newer compared to established centralized exchanges

- Requires knowledge of Web3 wallets and DeFi tools

5. Bitget – Best Platform for Copy Trading Futures

Country: Singapore

Bitget has grown rapidly since its 2018 launch and now serves more than 100 million users with daily trading volumes above $45 billion. It operates offshore and is not FCA-regulated, but UK investors can still access its perpetual contracts. This availability comes with additional risks since FCA protections do not apply.

The exchange supports over 800 cryptocurrencies, including 200+ perpetual contracts with leverage up to 125x. Bitget’s most distinctive feature is its copy trading marketplace, where users can follow the strategies of more than 200,000 professional traders. This has made it especially popular with beginners who want guidance and with experienced traders who wish to diversify strategies.

Key Features:

- 200+ perpetual contracts with leverage up to 125x

- Copy trading marketplace with 200,000+ verified traders

- Fees: 0.02% maker, 0.06% taker on futures

- Spot, margin, demo trading, and automated bots

- $536M Protection Fund, proof-of-reserves, and cold wallet security

- Payment methods: debit and credit cards, bank transfers, crypto deposits

Pros:

- Leading copy trading network for futures

- Wide range of perpetual and spot assets

- Protection Fund and proof-of-reserves add an extra security layer

- Accessible interface on both mobile and desktop

Cons:

- Offshore exchange with no FCA oversight for UK users

- Withdrawal limits can be higher than some competitors

Crypto Perpetual Futures Regulation in the UK

The UK maintains a strict stance on crypto derivatives. Since 2021, the Financial Conduct Authority (FCA) has banned retail access to products such as perpetual futures through UK-authorised exchanges. These instruments are classified as financial products under MiFID II, meaning any firm offering them domestically must hold specific permissions

Alongside this ban, HM Treasury is introducing new rules to bring crypto exchanges and custodians into the financial services perimeter, focusing on transparency, investor protection and innovation. These reforms cover spot trading and custody but do not change the prohibition on retail derivatives.

In practice, UK investors can trade crypto, but perpetual futures are only available through offshore platforms, where users must weigh access against the absence of regulatory safeguards.

How to Trade Crypto Perpetual Futures Safely

Perpetual futures offer strong upside but carry greater risks than spot markets. For UK investors using offshore exchanges, safe trading requires discipline, reliable data, and controlled leverage.

- Use leverage carefully

Exchanges may promote leverage up to 100x or 300x, but most experienced traders stay between 2x and 5x. Lower leverage reduces liquidation risk while preserving capital efficiency. High multiples often lead to fast losses.

- Apply strict risk controls

Without exit points, losses compound quickly. Stop-loss and take-profit orders should be standard on every position. Proper sizing and defined limits are essential for long-term survival.

- Focus on liquid contracts

BTC and ETH perpetuals offer the best liquidity and tight spreads. Smaller altcoin markets can create slippage, wider spreads, and unreliable execution during volatile moves. Beginners should start with large caps before exploring niche tokens.

- Track funding rates

Funding payments keep perp prices aligned with spot but can erode returns. Rates change quickly, so monitoring them daily is crucial for anyone holding longer than a few hours.

- Use independent analytics

Never rely only on an exchange’s internal data. Tools like Coinglass and Coinperps provide open interest, liquidation maps, funding rates, and trader positioning across multiple platforms, helping avoid blind spots.

- Choose secure, reliable exchanges

Offshore platforms expose UK investors to added risk outside FCA oversight. Select venues with proof-of-reserves, cold storage, insurance funds, and a track record of stability during high volatility.

What Are Perpetual Contracts?

Perpetual contracts, often called “perps,” are a type of futures contract that has no expiry date. Unlike traditional futures, which settle on a fixed date, perpetuals remain open as long as the trader maintains sufficient margin. This makes them one of the most popular instruments in crypto trading, allowing investors to hold long or short positions indefinitely.

Prices are kept close to the spot market through a funding rate system, where longs and shorts pay each other at set intervals depending on market conditions. If the contract price trades above spot, longs typically pay shorts, and the reverse occurs when contracts trade below spot.

Perpetuals are especially attractive to traders who want to use leverage, hedge existing holdings, or profit from market swings without owning the underlying asset. However, they carry higher risks than spot trading, particularly when combined with high leverage or volatile assets.

What Are the Fees for Perpetual Contracts?

Trading perpetual futures involves several types of fees that vary by exchange but generally fall into three categories:

- Trading fees (maker and taker):

Exchanges charge a fee whenever a trade is executed. Maker fees apply when you add liquidity to the order book, while taker fees apply when you remove liquidity by matching an existing order. On most platforms, maker fees range from 0% to 0.02% and taker fees from 0.04% to 0.06%, though active traders can qualify for discounts.

- Funding rates:

Unlike traditional futures, perpetual contracts do not expire. To keep prices close to spot, exchanges use funding payments exchanged directly between long and short traders every few hours. Funding can either cost or pay you depending on market conditions and is often the most important ongoing cost for active traders.

- Withdrawal and funding costs:

While not specific to perps, traders also face fees when depositing or withdrawing crypto, as well as spreads on fiat payment methods. These vary widely by platform and payment type.

In practice, most costs come from taker fees and funding payments, especially for traders who hold positions longer than a few hours. Understanding both is critical before committing capital to perpetual futures.

Conclusion

UK traders still have access to perpetual futures through offshore and decentralized platforms, but the lack of FCA protection means risk management is essential. The best approach is to prioritize exchanges with proof-of-reserves and strong security, trade liquid contracts like BTC and ETH, and use conservative leverage with clear exit strategies.

Treated with discipline, perpetuals can be a valuable tool for experienced investors, but success depends on caution and careful exchange selection.

xrp

xrp usdt

usdt