Over the past year, Hyperliquid has become one of the most talked-about names in decentralised finance. What began as a relatively unknown decentralised exchange (DEX) has quickly climbed into the spotlight, with daily trading volumes consistently crossing the billion-dollar mark and liquidity levels rivaling those of long-established competitors like dYdX and GMX. Much of this momentum stems from the growing debate around the “Aster-Hyperliquid” competition, which has not only fueled attention but also pushed more traders to explore what makes Hyperliquid different.

In this article, we provide a complete Hyperliquid review, focusing on the specifics that matter most to traders: fees, usability, features, and overall performance. Beyond the noise, the goal is to give actionable insights, information you can actually use, before deciding whether to commit capital to the platform. Let’s get started.

What is Hyperliquid?

Hyperliquid is a decentralised exchange (DEX) built on its own purpose-built Layer-1 blockchain, known as HyperEVM, and designed to handle high-performance perpetual futures trading. Unlike other platforms that depend on external chains such as Ethereum or rollups, where congestion and high gas fees can slow activity, Hyperliquid processes trades, orders, and liquidations directly on its native chain. This design gives the platform greater efficiency, control, and transparency while ensuring all market activity is verifiable on-chain.

In terms of market offerings, Hyperliquid supports both spot and perpetual futures, with the majority of its activity centered on perpetual contracts. These allow traders to open leveraged positions without expiry, while also accessing advanced trading tools. To ensure accurate pricing and risk management, Hyperliquid integrates decentralised oracles that update market data within seconds, which helps maintain fair funding rates and reliable liquidation processes.

The platform’s rapid adoption is demonstrated in its trading activity and financial scale. As of recent reports, Hyperliquid has processed more than $1.57 trillion in perpetual futures trading volume over the past year, generating approximately $310 million in revenue. In a single month, its perpetual trading volume has exceeded $200 billion, rivaling leading decentralised and even centralised competitors. Its Total Value Locked (TVL) is currently around $186 million on its native Layer-1, while protocol-wide combined contracts are valued at approximately $5.7 billion.

With this combination of speed, deep liquidity, and advanced trading features, Hyperliquid positions itself as a serious contender in the decentralised perpetual futures market.

Who are Hyperliquid’s Core Contributors?

Hyperliquid’s growth is driven by its core contributors, a compact team that combines technical expertise, trading experience, and a clear long-term vision. At the center of this group is Hyperliquid Labs, co-founded by Jeff Yan and iliensinc, both Harvard alumni with backgrounds in quantitative trading and systems engineering. Yan, in particular, brings experience from building market-making strategies, while iliensinc complements with architectural and design leadership.

The team itself is intentionally small, with around 11 contributors spanning engineering, infrastructure, operations, and community development. Many bring prior experience from leading firms such as Citadel, Hudson River Trading, Airtable, and Nuro, as well as academic training from institutions like MIT and Caltech. Several contributors remain pseudonymous, but names such as Xulian, Valinorae, Ben, and Adam are publicly recognised within the community.

A defining principle of this group is independence. Hyperliquid remains self-funded, deliberately avoiding outside venture capital. With 23.8% of the HYPE token supply allocated to contributors, their incentives are closely aligned with the protocol’s long-term success.

How does Hyperliquid Work?

To start using the Hyperliquid trading platform, users first need to connect a supported cryptocurrency wallet, such as MetaMask. Once connected, they can deposit collateral, usually USDC, into the exchange. This collateral acts as margin for opening leveraged positions. The platform offers high leverage (up to 40x in some cases), allowing traders to amplify exposure to price movements, though with higher associated risks.

Trading itself is straightforward as Hyperliquid uses a familiar order book system, similar to centralised exchanges, where buyers and sellers place limit or market orders. This design allows for fast execution and deeper liquidity, since the system aggregates orders across its active user base. Users can choose between different order types which help automate risk management and exit strategies.

Settlement on Hyperliquid happens in real time. When a trade is executed, the margin and profits or losses are instantly reflected in the trader’s account balance. Since the system is fully decentralised, every transaction is secured and verified by validators on the Hyperliquid blockchain, ensuring transparency and minimising the risk of manipulation.

What Makes Hyperliquid Stand Out in the Market?

- Native Layer-1 Blockchain

Unlike many DEXs that run on general-purpose chains, Hyperliquid is built on its own custom Layer-1, designed specifically for high-performance trading. This allows for faster transactions, lower latency, and higher throughput.

- Deep Liquidity

Hyperliquid consistently ranks among the top DEXs by trading volume, with daily volumes often exceeding $8 billion. This liquidity ensures tighter spreads, lower slippage, and better order execution compared to many competitors.

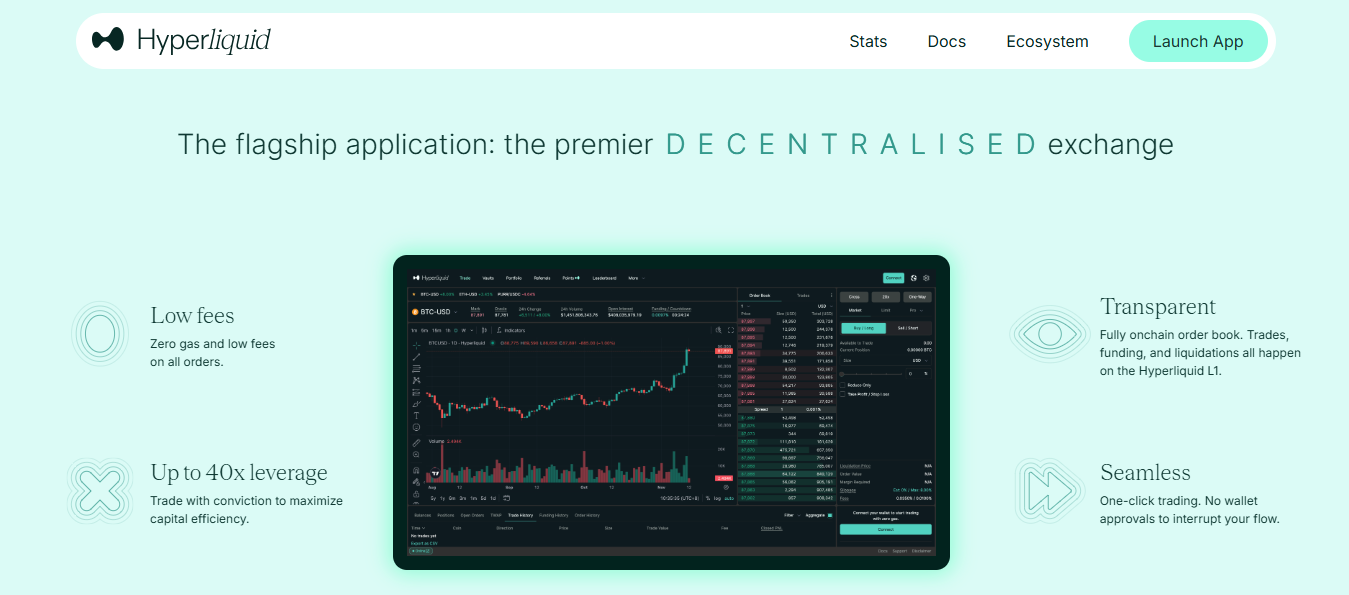

- Zero Gas Fees for Traders

Trading on Hyperliquid does not require paying gas fees, as costs are absorbed at the protocol level. This makes the experience smoother and more predictable for users compared to Ethereum-based DEXs.

- Advanced Order Types

The platform supports features usually found on centralised exchanges, such as stop-limit, take-profit, and post-only orders. These tools give traders greater flexibility in managing risk and executing strategies.

- High Leverage Options

Hyperliquid offers leverage of up to 40x (and in some cases higher), making it competitive with centralised derivatives platforms and appealing to professional perpetual futures traders.

- Onchain Order Book

Unlike AMM-based DEXs, Hyperliquid runs a fully onchain order book, which provides transparency and efficiency while still maintaining decentralized control.

What are Order Types on Hyperliquid?

- Market Order - Executes instantly at the best available price in the market.

- Limit Order - Executes only at the price specified by the trader (or better) once the market reaches that level.

- Stop Market Order - Converts into a market order once the stop price is triggered. Useful for setting stop losses.

- Stop Limit Order - Places a limit order once the stop price is reached, giving greater control over execution than a stop market order.

- Scale Order - Divides a large limit order into several smaller ones distributed across a defined price range.

- TWAP Order (Time-Weighted Average Price) - Splits a large order into smaller trades executed at regular intervals to reduce slippage and market impact.

In addition, Hyperliquid offers several order modifiers and conditional options to refine execution:

- Reduce Only - Ensures the order can only decrease or close an existing position, not open a new one.

- Good Till Cancel (GTC) - Keeps the order active until it is either executed or manually cancelled.

- Post Only (Add Liquidity Only) - Ensures the order is placed on the order book as a maker order and will not match immediately.

- Immediate or Cancel (IOC) - Executes immediately for the portion available; cancels any unfilled balance.

- Take Profit (TP) - Automatically triggers a market order once a target profit price is reached.

- Stop Loss (SL) - Automatically triggers a market order once a set loss threshold is reached, limiting downside risk.

How do Vaults Work on Hyperliquid?

Vaults on Hyperliquid are automated trading strategies that allow users to put their funds to work without having to trade manually. Instead of placing individual buy or sell orders, users deposit their assets into a vault, which is managed by a trader or strategy creator on the platform. Each vault follows a predefined trading approach, this could be based on market-making, directional trading, arbitrage, or other strategies. When you deposit into a vault, your funds are pooled together with other participants, and the vault executes trades on your behalf according to its strategy. Users also maintain custody through Hyperliquid’s smart contracts, meaning you can withdraw your share, along with any profits or losses, at any time. Returns are distributed proportionally based on the amount you contributed to the vault, minus any performance fees charged by the vault manager.

What are HLP Vaults?

HLP Vaults on Hyperliquid are pooled liquidity vaults that allow users to passively provide funds for trading on the exchange. Participants deposit assets into these vaults, serving as a replacement for direct trading. In return, vault depositors earn a share of the trading fees and funding payments generated on the platform.

How does Hyperliquid’s EVM Bridge Work?

The EVM Bridge on Hyperliquid is built to let users move assets seamlessly between the Hyperliquid chain and EVM-compatible networks like Ethereum. It works by locking tokens on one side of the bridge and issuing a corresponding balance on the other, ensuring that assets remain fully backed at all times. By integrating this bridge into the Hyperliquid perp DEX, the platform reduces friction for users who want quick access to perpetual futures markets while maintaining transparency and security throughout the transfer process.

Hyperliquid Fees Explained

The platform charges no gas fees for placing or executing trades, since transactions occur directly on its custom Layer-1 chain. Trading costs are divided into maker and taker fee of 0.01% and 0.045% respectively. These fees decrease based on a trader’s 14-day rolling volume, with higher-volume traders enjoying reduced rates. Hyperliquid also offers HYPE token staking discounts, granting up to 40% fee reductions depending on the user’s staking tier. In select cases, maker rebates may apply, rewarding users who contribute substantial liquidity. Deposits are free, and withdrawal fees are minimal, varying slightly depending on the asset or network used.

What is $HYPE?

$HYPE is the native governance and utility token of the Hyperliquid ecosystem. It plays a central role in powering the platform’s on-chain economy, allowing holders to participate in governance decisions, propose upgrades, and influence how the protocol evolves. Beyond governance, $HYPE also supports staking and incentive mechanisms designed to reward active participants and liquidity providers.

How do Hyperliquid Referrals Work?

Hyperliquid’s referral program allows users to earn rewards by inviting others to trade on the platform. After reaching a cumulative trading volume of $10,000, users can generate a unique referral code through the “Referrals” page. New users who register with this code receive a 4% discount on trading fees for their first $25 million in trading volume. Referral benefits exclude vault trades and sub-accounts, which operate separately.

Hyperliquid vs Aster: Which perp DEX is Best?

When comparing Hyperliquid and Aster, both stand out as next-generation decentralised exchanges for perpetual futures, but Hyperliquid currently holds a clear advantage. It offers deeper liquidity, faster execution speeds, and a smoother user experience powered by its custom-built Layer 1 chain. While Aster emphasises decentralisation and community incentives, Hyperliquid’s superior trading infrastructure, lower fees, and consistent billion-dollar daily trading volumes make it more appealing for active traders. The platform’s seamless interface, advanced order types, and near-zero latency provide the kind of efficiency professional traders expect.

FAQs

Is KYC Needed for Hyperliquid?

KYC is not required on Hyperliquid. The exchange operates as a fully decentralised protocol, allowing users to trade directly through self-custodial wallets without submitting personal identification.

Who is Hyperliquid’s Main Competitor?

Hyperliquid’s main competitor is dYdX, a leading decentralised exchange known for its strong presence in perpetual futures trading. dYdX remains a formidable rival due to its mature user base, proven reliability, and extensive liquidity infrastructure, which together continue to attract high-volume professional traders.

Is Hyperliquid Safe?

Hyperliquid is considered safe as its custom Layer-1 architecture ensures full on-chain transparency, while all transactions are validated by a decentralised network of nodes. The absence of third-party custody minimises counterparty risks, and smart contracts undergo continuous auditing and monitoring to maintain security integrity across trading and vault operations.

What Crypto Assets Can I trade on Hyperliquid?

Hyperliquid offers a broad selection of digital assets including major cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Avalanche (AVAX), alongside trending altcoins like Arbitrum (ARB), Chainlink (LINK), Aptos (APT), and Sui (SUI). The exchange continually expands its listings to include high-demand tokens across emerging ecosystems, ensuring traders can access diverse and liquid markets.

Is There a Test Mode on Hyperliquid?

Hyperliquid offers a dedicated test environment known as the Testnet, which allows users to practice trading with simulated assets under real market conditions. It’s created for familiarisation, strategy testing, and understanding platform mechanics without financial risk.

Conclusion

This Hyperliquid honest review shows why the platform is quickly becoming the go-to spot for traders who care about performance, reliability, and long-term results. The platform does more than just look good on paper, it actually delivers. From lightning-fast execution to transparent on-chain operations, every part of the system feels built for serious traders who still want a smooth experience.

usdt

usdt bnb

bnb