Decentralised exchanges (DEXs) have become the backbone of DeFi, offering a way to trade cryptocurrencies without relying on centralised intermediaries. Yet, they’re not without problems. On popular blockchains like Ethereum, network congestion and high gas fees often make even the simplest transactions expensive and slow. For active traders, yield farmers, or builders experimenting with DeFi strategies, these bottlenecks limit opportunities and create frustration.

Solana addresses these pain points head-on, achieving over 65,000 transactions per second with average fees of under $0.01. That combination of scalability and affordability makes it a strong contender for hosting DEXs that can compete directly with Ethereum’s Uniswap or Binance’s PancakeSwap. Instead of waiting minutes for a trade to clear or paying $20–$50 in fees, Solana-based exchanges offer near-instant confirmations and negligible costs, opening the door to a smoother trading experience. In this article, we examine the best Solana DEX options available today, their unique features, advantages, potential drawbacks, and how they compare to one another.

Table of Contents

What is the DEX for Solana?

A decentralised exchange (DEX) on Solana is a trading platform that allows users to buy, sell, and swap cryptocurrencies directly on the Solana blockchain without the need for a centralised authority or intermediary. Unlike traditional exchanges that hold custody of user funds, Solana DEXs operate through smart contracts, giving traders full control of their assets at all times. What makes them distinct is the way they leverage Solana’s network speed and low transaction costs to create a smoother trading experience compared to many other blockchains.

At their core, Solana DEXs rely on automated market makers (AMMs) or order book models. AMMs use liquidity pools where users deposit tokens, and trades are executed against these pools automatically, with prices determined by supply and demand. Order book DEXs, on the other hand, resemble traditional exchanges more closely by matching buy and sell orders directly. Both approaches benefit from Solana’s high throughput, which allows thousands of transactions per second to be processed with minimal delay and at an average cost of less than a cent.

Many Solana-based DEXs are not just about fast and affordable trading, as they integrate additional features such as liquidity mining, yield farming, token launchpads, and cross-chain swaps. For developers, Solana provides a favourable environment with accessible APIs and strong community support, making it easier to build trading bots, dApps, or advanced strategies on top of these exchanges. For users, it means access to newer tokens, deeper liquidity, and opportunities to earn rewards while participating in DeFi.

Top Solana Decentralised Exchanges: 7 Reliable Picks

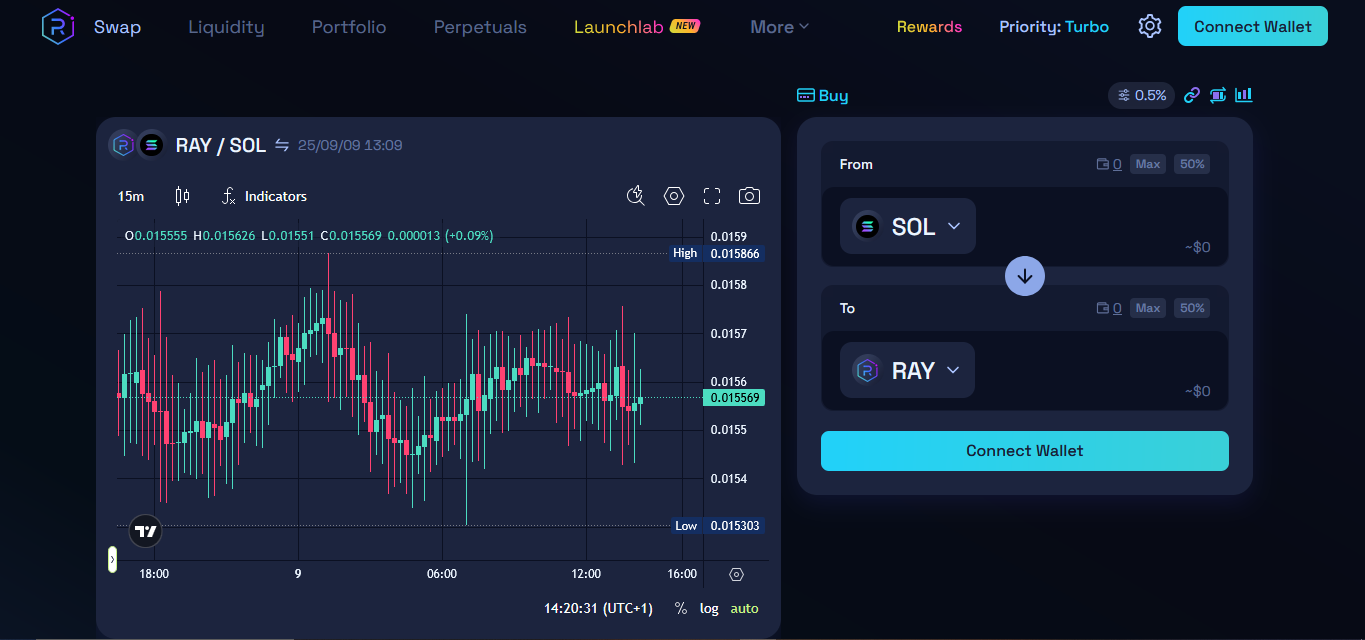

Raydium

Raydium is one of the most established decentralised exchanges built on the Solana blockchain in 2021 and designed to bridge liquidity between Solana and OpenBook, another Solana-powered order book exchange. Unlike most DEXs that operate solely with automated market makers (AMMs), Raydium integrates with OpenBook’s central limit order book.

Key Features

- Hybrid model combining AMMs with OpenBook’s order book.

- Deep liquidity across the Solana ecosystem.

- Yield farming and staking opportunities for token holders.

- Token launch platform (AcceleRaytor) for new projects.

- Integration with trading bots and developer-friendly APIs.

Fees

Raydium charges a standard 0.25% fee per trade, with 0.22% going to liquidity providers and 0.03% benefiting users staking RAY tokens.

Pros

- Low fees compared to Ethereum-based DEXs.

- User-friendly interface suitable for beginners and advanced traders.

- Wide range of yield farming and staking options.

- Strong developer support and API integrations.

Cons

- Less battle-tested compared to long-standing Ethereum DEXs.

- Limited fiat on-ramp options directly within the platform.

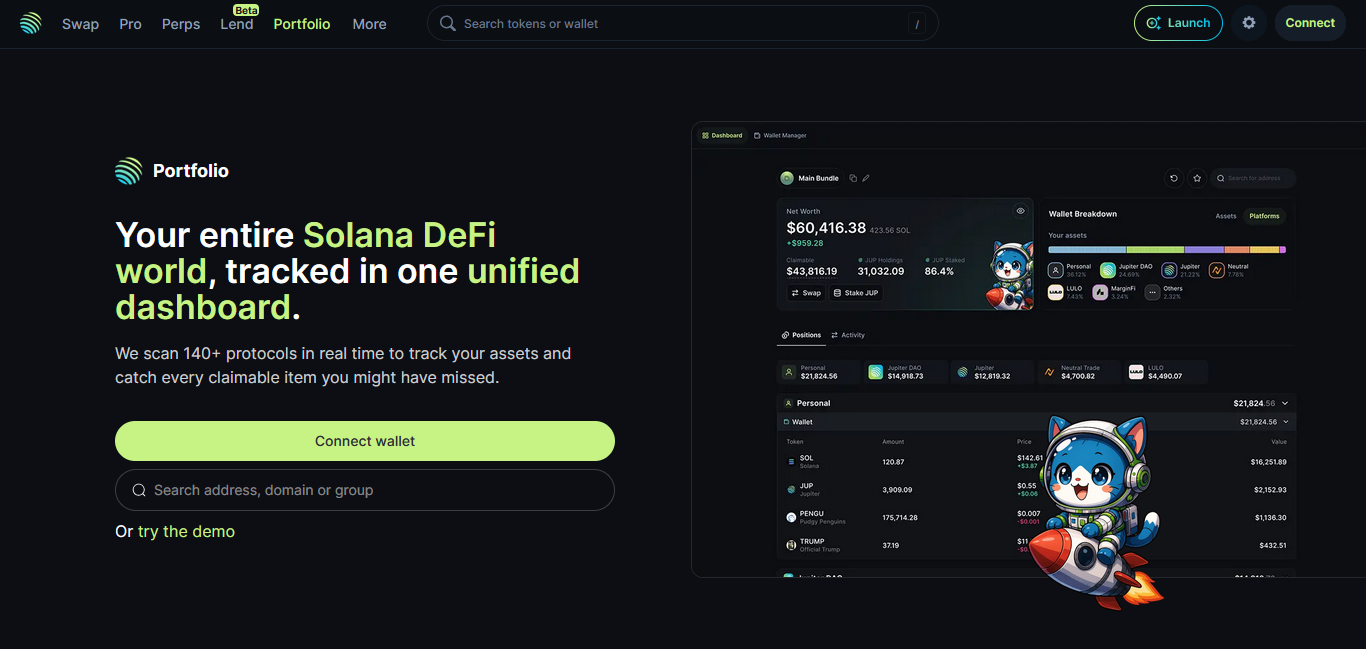

Jupiter

Jupiter is a prominent decentralised exchange built on the Solana blockchain in 2021, based within the broader Solana ecosystem, which serves as a liquidity aggregator rather than a traditional standalone DEX. This means it sources the best token prices across multiple Solana platforms, ensuring users always get optimal trade execution.

Key Features:

- Liquidity aggregation from multiple Solana DEXs.

- Advanced trade routing for the best prices.

- Easy-to-use interface with integrated trading tools.

- Cross-chain swap support.

Fees:

Jupiter does not charge additional trading fees beyond the standard Solana network fees, which are normally less than $0.01 per transaction.

Pros

- Best trade execution with minimal slippage.

- Low transaction costs (less than a cent).

- Simple, beginner-friendly interface

- Wide range of Solana-based tokens

Cons

- Heavy reliance on the performance of integrated DEXs.

- Occasional network congestion on Solana can affect performance.

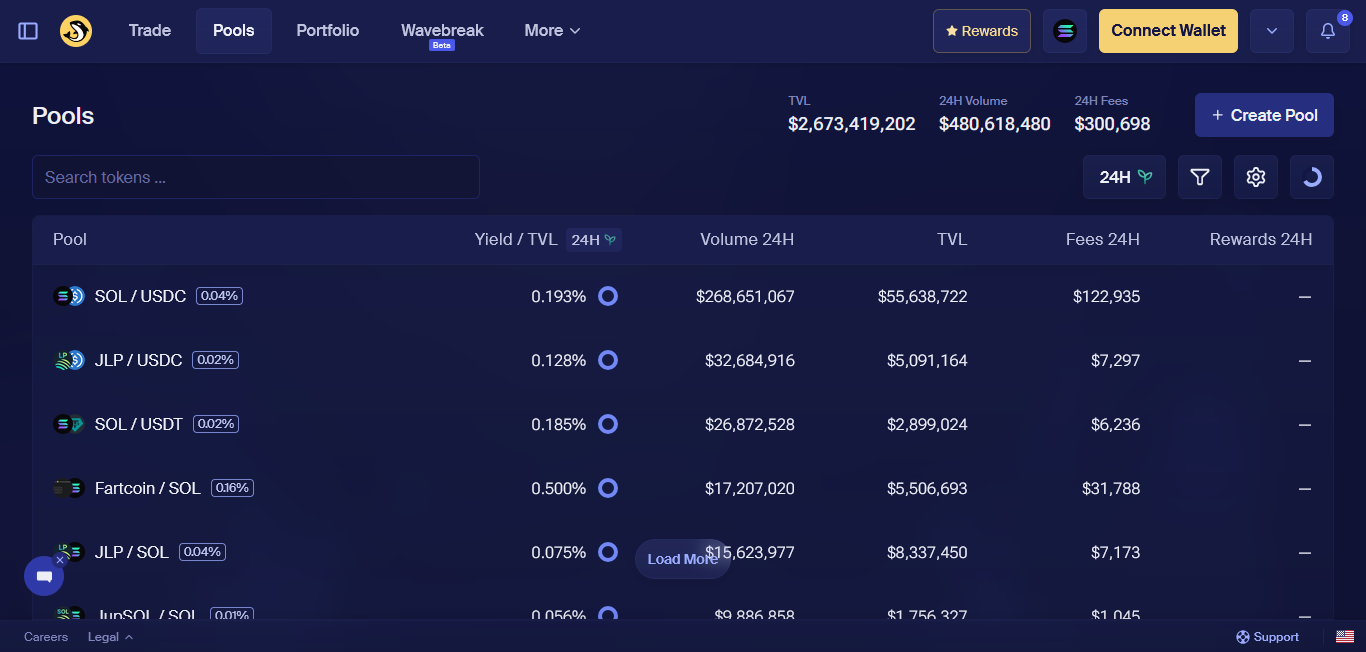

Orca

Launched in February 2021, Orca is a user-friendly decentralised exchange built on the Solana blockchain. It differentiates itself through its clean interface and a focus on simplifying DeFi for both beginners and experienced users. Unlike many other platforms, Orca emphasises fair pricing through its “Fair Price Indicator,” ensuring traders know when they’re getting the best deal.

Key Features of Orca

- Fair Price Indicator to avoid poor trade execution.

- Concentrated liquidity pools for efficient capital use.

- Sustainable yield farming incentives.

- Integration with wallets like Phantom and Solflare.

Fees

Orca charges a standard fee of 0.3% per swap.

Pros

- Transparent pricing with Fair Price Indicator

- High liquidity across major trading pairs

- Strong yield farming and liquidity pool options

- Active ecosystem integrations with wallets and DeFi tools

Cons

- Limited support for cross-chain assets compared to other DEXs.

- Fewer advanced trading features (e.g., margin or derivatives).

- Liquidity may be concentrated in major pairs, limiting smaller token support.

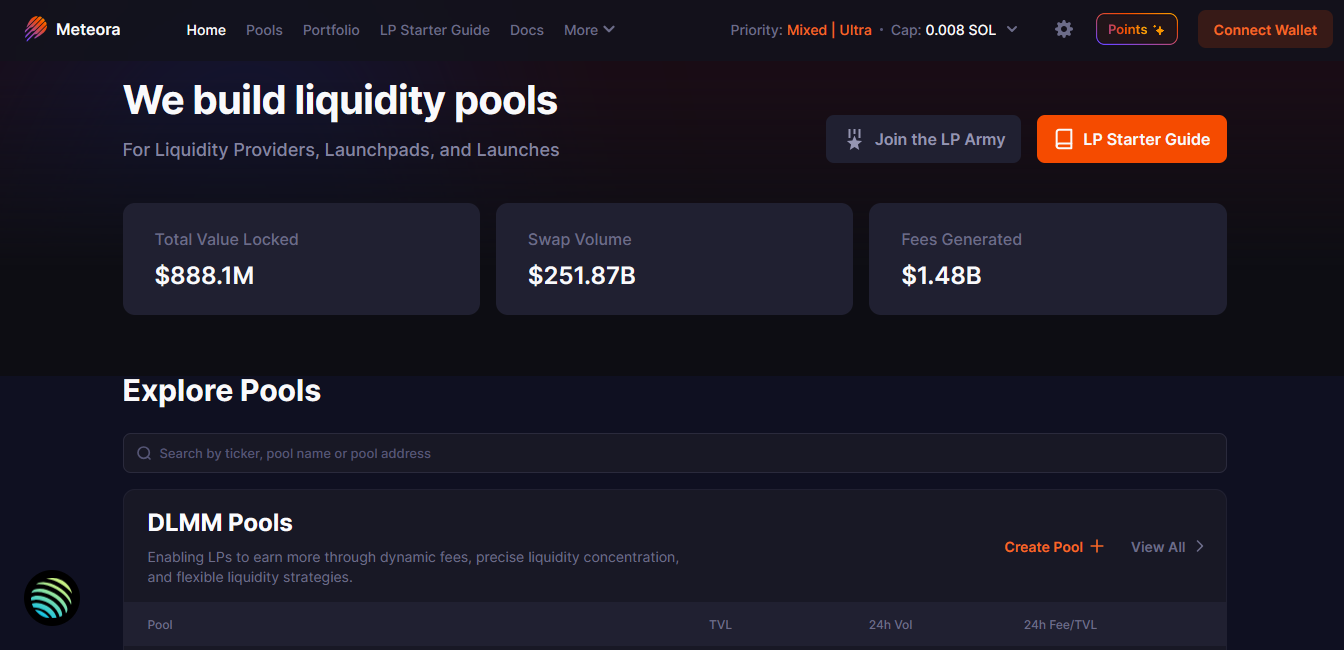

Meteora

Built by the experienced developers of Mercurial Finance, Meteora has emerged as a distinguished decentralised exchange within the Solana ecosystem. Following its rebranding in late 2022, it established itself as a comprehensive platform for liquidity management and yield optimisation. By introducing innovative mechanisms such as Dynamic Liquidity Market Maker (DLMM) pools, dynamic vaults, and the Alpha Vault, Meteora delivers sophisticated solutions that enhance flexibility, efficiency, and user experience for market participants.

Key Features

- Dynamic Liquidity Market Maker (DLMM) pools with discrete price bins and adaptive fees.

- Dynamic AMM vaults for optimised yield and capital rebalancing.

- Alpha Vault and Anti-Sniper Suite for secure token launches.

Fees:

Meteora applies variable swap fees that adjust to market conditions, starting as low as 0.04%.

Pros:

- Strong protection for token launches against bots and manipulation.

- High capital efficiency through DLMM and vault strategies.

- Audited contracts with active security monitoring.

Cons:

- Dynamic fees may increase trading costs in volatile markets.

- Feature-rich interface can be complex for beginners.

Lifinity

Lifinity is a decentralised exchange on the Solana blockchain that is primarily community-driven, with no central authority controlling its operations. Its unique selling point lies in a unique proactive market-making system that minimises impermanent loss and optimises returns for liquidity providers. Key Features

- Proactive market maker model (first of its kind on Solana)

- Optimised liquidity pools designed for stable and efficient trades.

- Automated adjustments for price stability and reduced slippage.

- Integration with Solana’s high-speed, low-cost network

Fees

Instead of charging a standard trading fee, Lifinity employs a variable model. The base fee for each pool is set manually and adjusted frequently in response to shifts in market conditions and liquidity

Pros:

- Reduced impermanent loss compared to standard AMMs.

- Low transaction costs leveraging Solana’s scalability.

- Consistent and stable pricing for traders with less slippage.

- Incentives and rewards for liquidity providers.

Cons

- Smaller number of supported tokens compared to larger DEXs.

- Relatively new platform, still growing its ecosystem and user base.

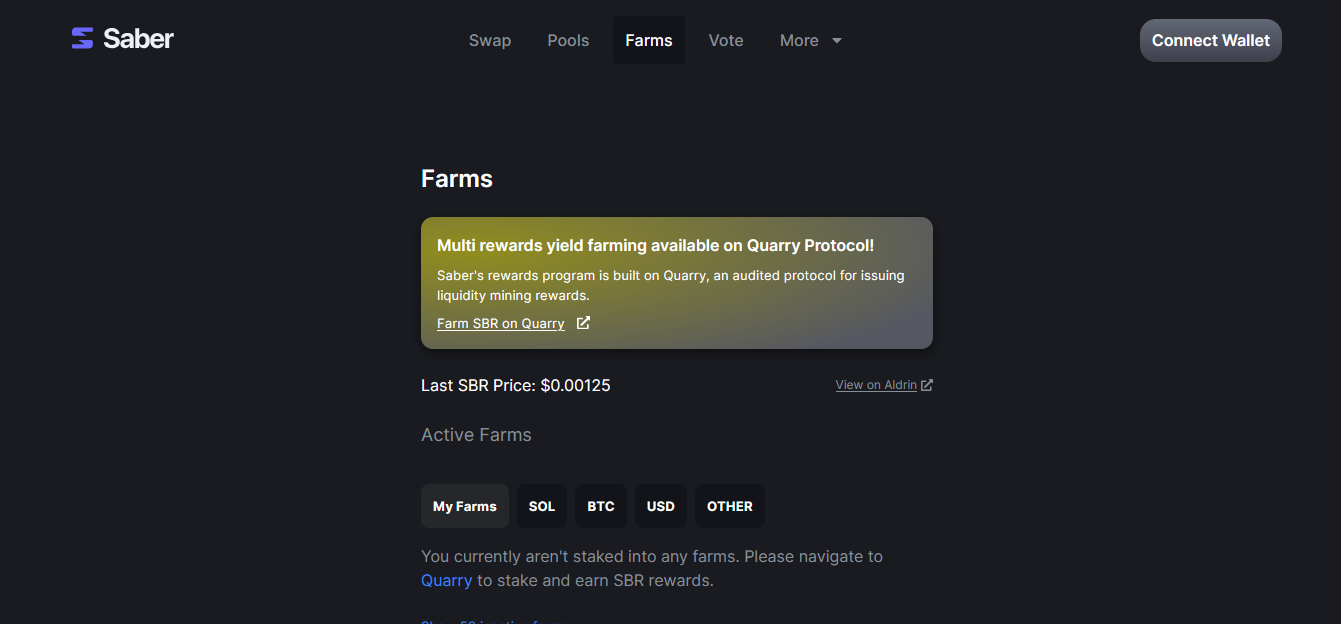

Saber

Saber is a decentralised exchange built on the Solana blockchain, which primarily focuses on stablecoin and wrapped asset trading. It was designed to make cross-chain liquidity more accessible by providing a reliable platform for swapping stable pairs such as USDC/USDT or wBTC/renBTC with minimal slippage.

Key Features

- Stablecoin and wrapped asset trading optimisation.

- Built-in liquidity pools supporting multiple pegged pairs.

- Integration with other Solana DeFi protocols for broader use cases.

Fees

Saber charges a 0.05% trading fee, and the full amount goes directly to liquidity providers.

Pros

- Concentration on stable assets, ensuring low volatility and predictable trades.

- Low slippage, even on large transactions.

- Yield farming opportunities for liquidity providers.

- User-friendly interface designed for straightforward stable swaps.

Cons

- Limited to stablecoins and pegged assets, not ideal for trading volatile tokens.

- Heavy reliance on cross-chain wrapped assets, which carry external risks.

- Smaller variety of trading pairs compared to general-purpose DEXs.

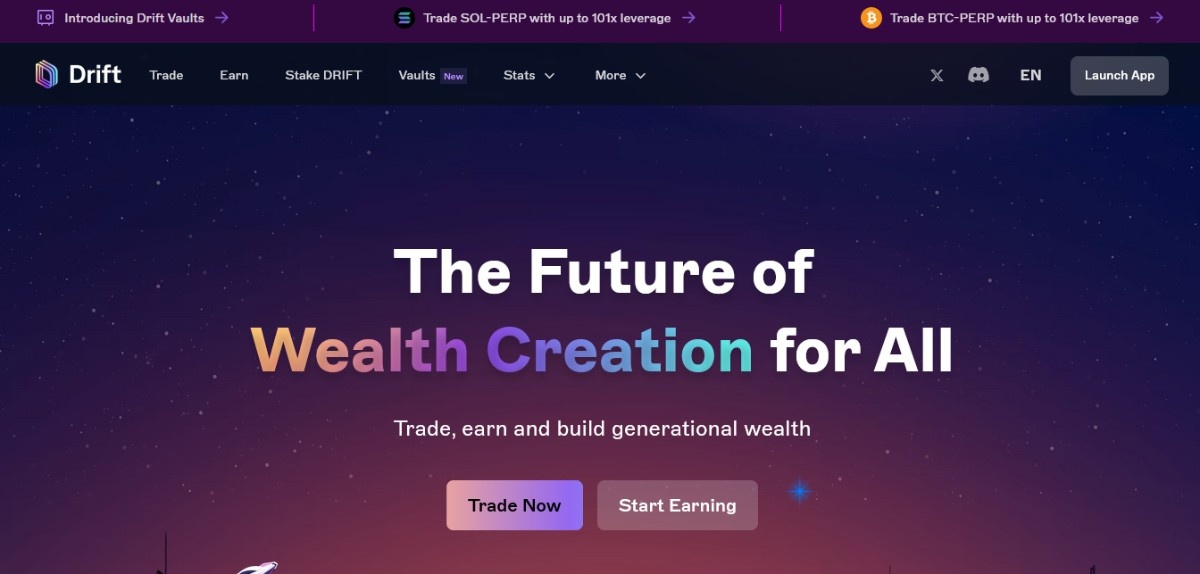

Drift

Drift is a decentralised exchange (DEX) built on the Solana blockchain, with a focus on perpetual futures trading, giving users the ability to go long or short on assets like SOL, BTC, and ETH with leverage of up to 50x. It stands out by offering a trading experience that mirrors centralised exchanges in speed and sophistication, while preserving the transparency and security of DeFi.

Key Features:

- Perpetual futures trading with leverage of up to 20×

- Hybrid liquidity system (vAMM + order book + JIT liquidity auctions)

- Advanced order types including limit, stop-loss, reduce-only, and post-only

- Governance token (DRIFT) offering fee discounts, staking rewards, and voting rights

Fees:

Trading on Drift has a near-zero gas fees. Protocol fees are structured to remain highly competitive

Pros

- Fully decentralised and non-custodial, ensuring users retain control of their assets

- Sub-second execution and low trading fees

- Unified margin system for efficient capital management

- Governance and incentive structures through the DRIFT token

Cons

- Exposure to Solana network downtimes, which may affect performance

- Higher risk profile due to leveraged trading

How to Choose the Best Solana DEX?

- Trading fees and hidden costs.

- Liquidity depth and market activity

- User interface and ease of navigation

- Security measures and track record

- Available features and supported assets on the Solana DEX platform

FAQs

What is the Best DEX on Solana for Buying Meme Coins?

For purchasing meme coins, Jupiter stands out as the best choice among Solana DeFi exchanges. Its role as a liquidity aggregator ensures access to the broadest token selection and the most competitive pricing by sourcing liquidity from multiple platforms simultaneously.

Which Solana DEX is the Best for Beginners?

For beginners entering the Solana ecosystem, Orca establishes itself as the most suitable choice. Its clear design, transparent pricing through the Fair Price Indicator, and straightforward trading process make it accessible to new users as the most beginner-friendly DEX on SOL.

Is Raydium Better than Orca?

Between Raydium and Orca, Raydium holds an edge due to its hybrid structure that merges automated market makers with OpenBook’s order book, offering stronger liquidity depth and broader utility. While Orca excels in simplicity and transparent pricing, Raydium provides more advanced opportunities such as staking, farming, and project launches through AcceleRaytor.

Conclusion

A well-informed approach to trading on Solana requires more than simply knowing which exchange to use. Beyond comparing features, users should cultivate consistency in how they engage with the market, through responsible risk management, staying updated on ecosystem developments, and diversifying their strategies. For anyone serious about DeFi, understanding and using the best Solana DEX can serve as a gateway to long-term growth and more rewarding outcomes.

usdt

usdt xrp

xrp