Bitcoin (BTC) has moved from the margins to mainstream, representing a shift in how the world views wealth and control. Interest in digital assets continues to grow steadily, with ownership now extending beyond early adopters to a broader segment of the population in the United Kingdom.

This shift isn’t limited to personal investment. As traditional financial institutions explore blockchain integration and regulators tighten oversight, the crypto ecosystem continues to gain ground. Every day usage of crypto tools like peer-to-peer trading platforms and crypto-linked debit cards is increasing. On the flip side, developments like crypto ATMs, ICOs, and lending platforms are being phased out in response to evolving regulatory standards.

Table of Contents

With a closer look at BTC’s current standing, we’ve broken down its latest performance and adoption stats. Here’s what you need to know.

What is the Current State of Crypto Adoption in the UK?

The UK's position as a leading crypto economy is evident, with a growing number of adults gravitating towards digital assets. Between 2021 and 2024, the rate of crypto ownership in the country increased from 4% to 12%. This upward trend also extends to portfolio value, with the average holding rising from £1,595 to £1,842. Public interest in crypto continues to climb, driven by a boost in awareness from 91% to 93%.

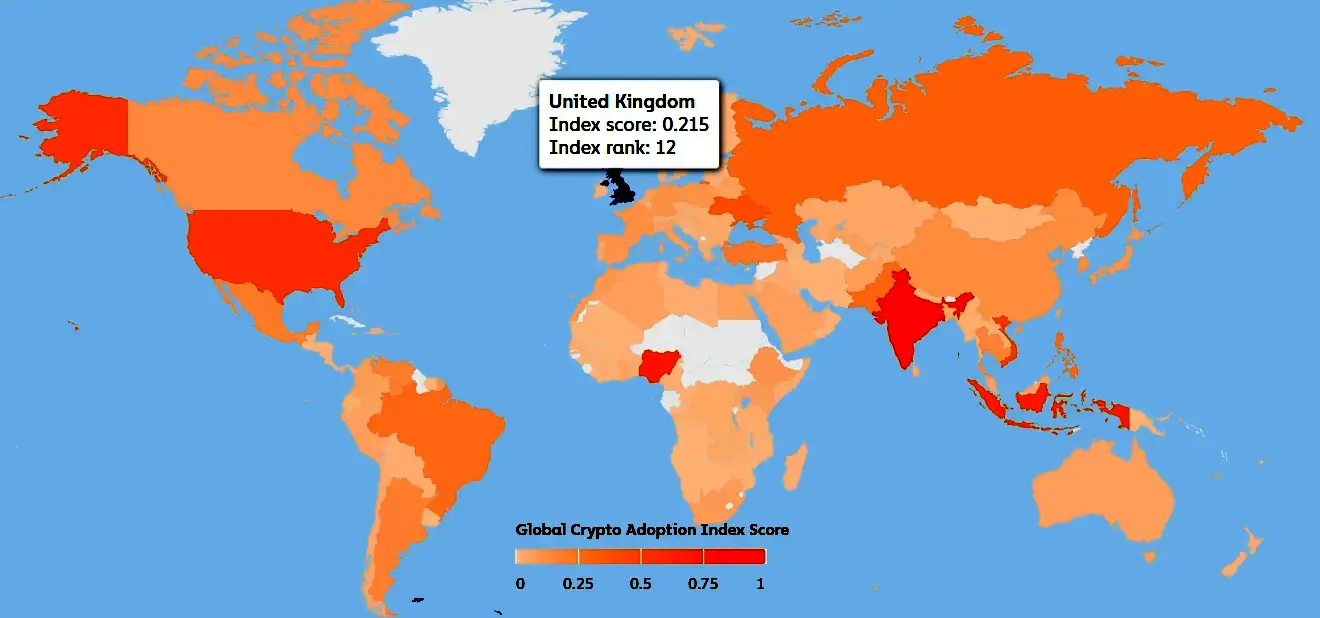

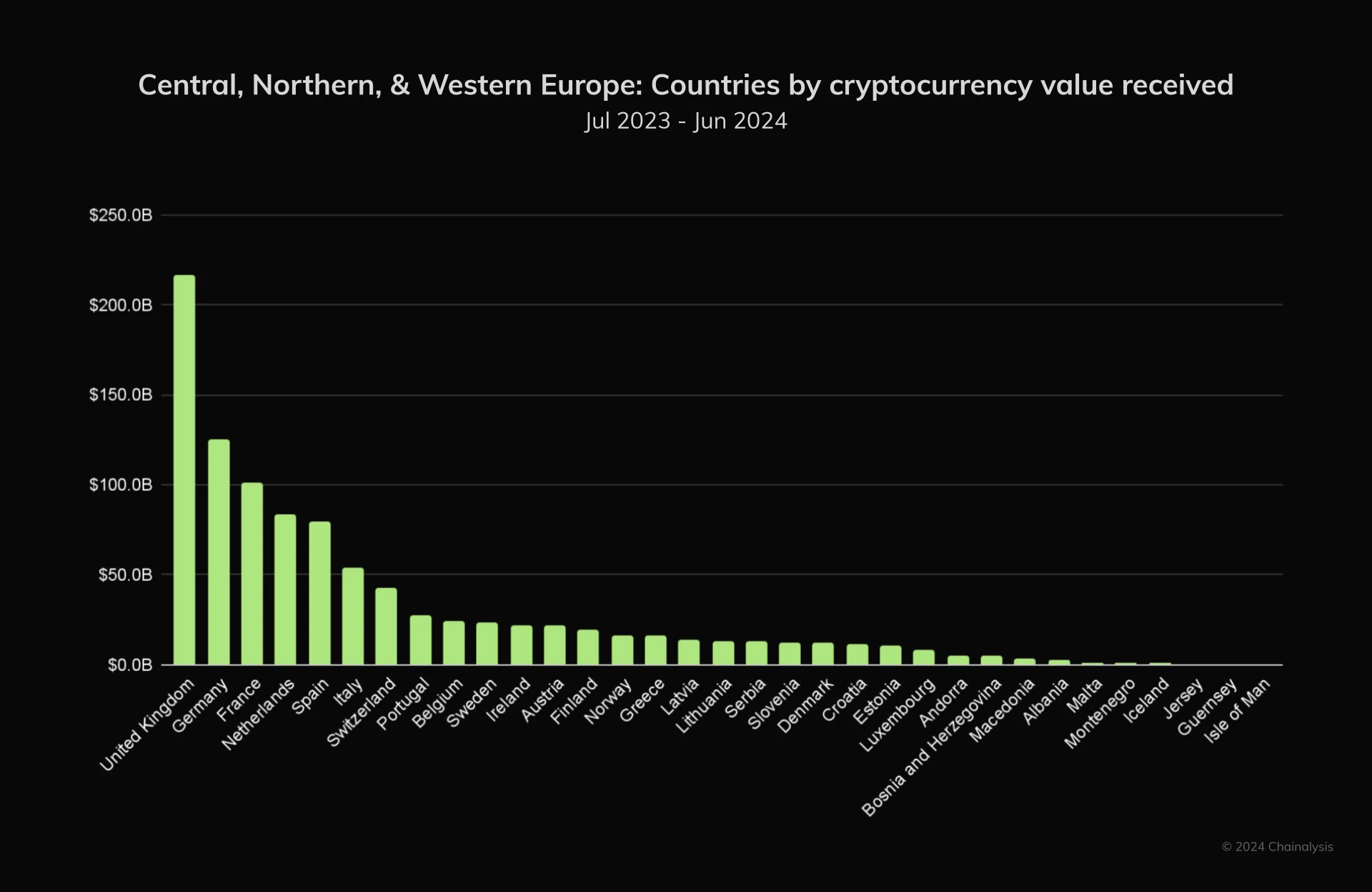

Crypto adoption in the UK is gaining traction, with the country maintaining its status as the largest digital asset economy in Central, Northern, and Western Europe (CNWE). According to Chainalysis, the UK is ranked 12th in the global crypto adoption index, advancing by two ranks since 2023. A transaction volume of $217 billion in crypto between July 2023 and June 2024 highlights the country’s growing relevance and maturity in the crypto space. Notably, the CNWE region stands as the second-biggest digital asset merchant service market worldwide, with the UK accounting for much of this growth, recording a 58.4% increase year-over-year.

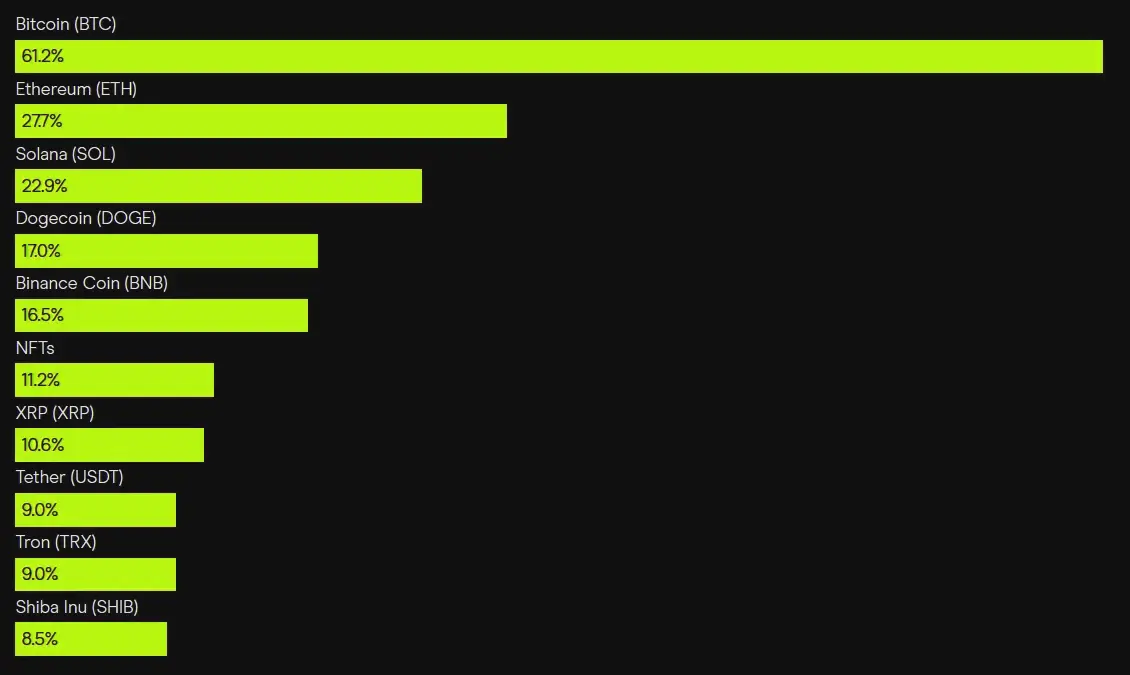

Bitcoin continues to be the most popular cryptocurrency, held by approximately 61% (4.2 million) of digital asset investors in the UK. Although the adoption rate appears steady and consistent, 38% of non-crypto users highlight unclear regulation as a major obstacle to entering crypto by late 2024. Also, despite this widespread approval, there are still lingering misconceptions among crypto owners. For instance, roughly 20% of investors expected protection against losses, and 33% believed they had the right to appeal to the FCA in case of problems. This clearly indicates the need for increased learning and awareness.

How Many People Own Crypto in the UK as of Now?

An estimated 7 million people in the UK own some form of cryptocurrency, with Bitcoin remaining the most widely held, followed by Ethereum. Ownership of digital assets is most prevalent among millennials aged 28-43, with Generation Z aged 18-27 following in their footsteps. A significant 43% of UK crypto holders are aged under 30, and they either hold a university degree, have full-time employment, or follow financial content online weekly. In contrast, interest in cryptocurrency wanes sharply among adults over 44.

Meanwhile, there’s quite a wide gender gap in the ownership and use of cryptocurrencies. While 13% of men have invested in crypto, only 6% of women own these digital currencies, with Bitcoin remaining their top choice. This shows a significant gender disparity in cryptocurrency ownership, highlighting a need for targeted education and outreach to encourage more women to engage with digital currencies. Bridging this gap could promote greater inclusivity and participation.

There has been a sharp uptick in crypto trading across the UK, fueled by growing personal investments and frequent buying. According to Reuters, the percentage of investors using credit to fund crypto purchases surged to 14% last year, highlighting growing financial risk appetite, up from 6% in 2022. Among UK adults who hold crypto, 27% have participated in staking.

How Widely is Bitcoin Being Adopted in the United Kingdom Now?

Bitcoin is witnessing a growing acceptance in the UK and remains one of the most popular cryptocurrencies among investors. Roughly 3.9 million adults in the UK own the coin, accounting for 61% of the country's crypto investors. Both genders show strong participation, with Bitcoin held by 64% of men and 56% of women.

As the world’s first and largest crypto, several factors are driving Bitcoin’s adoption. After its launch in January 2009 by the pseudonymous Satoshi Nakamoto, BTC had gradually witnessed a subtle yet substantial increase, especially with its price rally in 2011. For the first time, it reached £1 and surged to £22 in the same year. In 2013, the cryptocurrency had its major rebound, as it traded above £800. Its key catalyst was the Cyprus banking crisis, which positioned BTC as a tool for preserving personal financial independence from government policies. Following the crypto winter in 2014 - 2016, the coin began to attract widespread media attention. With the rise of Initial Coin Offerings (ICOs) in 2017, it became the cynosure of every eye in the UK, wooing investors with hypes. Although it crashed in 2018, record-low interest rates and aggressive quantitative easing measures by the Bank of England played a role in driving Bitcoin to its 2021 peak. Since then, Bitcoin has been greatly influenced by the rise of Decentralised Finance (DeFi), renewed institutional interest, and technological developments.

With Bitcoin’s ongoing development, banks in the UK are adjusting their stance on the coin’s policies. For instance, Barclays relaxed certain compliance constraints on crypto-related services in 2022, paving the way for customers to transact with authorised exchanges. Standard Chartered followed suit by introducing a digital trading desk to serve institutional players seeking exposure to Bitcoin and other cryptocurrencies. Several fintech companies are springing up, encouraging the use of digital assets, especially Bitcoin, in everyday activities. Revolut, Monzo, etc, integrate Bitcoin features into their digital banking platforms. Driven by these developments, Bitcoin adoption is growing among those seeking financial resilience. Investors increasingly label it digital gold, offering protection where fiat currencies often fall short.

Is the UK Still Among the Top 5 Countries for Bitcoin Ownership?

Despite a 6% ownership rate, the UK has slipped from the ranks of the world’s top five Bitcoin-holding nations. Although the country has been making notable moves in recent years, it has fallen behind nations such as India, China, the United States, Brazil, and Indonesia. With 75 million users, India currently leads the world in Bitcoin adoption. China follows with 38 million users, and the U.S. ranks third with 28 million. Brazil and Indonesia are fast risers with 25 million and 23.5 million users each.

What are the Latest Market Predictions for Bitcoin Adoption?

Institutional inflows and growing regulatory scrutiny are fuelling market sentiment around Bitcoin. Since it reclaimed the $100k mark and surpassed it, after dipping by nearly 20%, its comeback has provided relief to traders’ anxieties. With high expectations, investors anticipate a combination of market forces, news, and events that could lead to a volatile change in the price of Bitcoin. On May 7, BTC was trading below $100k, and it surged, reaching $106k on May 18. This recent uptrend is all thanks to renewed institutional inflows and spot ETF momentum. On May 1, U.S. Spot Bitcoin ETFs posted a significant recovery, attracting $422.5 million in net inflows, offsetting broader ETF market outflows of $56.3 million. This indicated greater institutional interest that boosted demand and BTC’s price appreciation.

However, the sudden drop from $106k to $103k has left traders tiptoeing through the market with cautiousness. The unexpected fall resulted in $600 million worth of crypto positions being liquidated.

JP Morgan analysts have expressed their optimism and anticipation of a promising outlook for Bitcoin. Managing Director, Nikolaos Panigirtzoglou, says Bitcoin is set to outperform gold convincingly throughout 2025, gaining serious ground in the second half.

In addition, Haiyang Ru, co-CEO of the HashKey Business Group, states that investors are reallocating their funds to Bitcoin due to rising concerns about a forthcoming U.S. spending bill that may increase national debt by trillions and lead to higher Treasury premiums. This signals a possible increase in BTC’s prices.

These recent events are reverberating through global financial markets, including the UK. The shift in sentiment, fuelled by macroeconomic pressures like the looming U.S. debt crisis and rising Treasury yields, is reinforcing Bitcoin’s narrative as a hedge against traditional financial instability. In a country where crypto adoption has already reached around 6% of the adult population, these global market dynamics could act as a catalyst for further growth. However, regulatory uncertainties and market volatility continue to pose risks to investors and could influence adoption rates.

What Factors Could Influence the Adoption of BTC in the UK?

With its current momentum, several factors will shape the state of Bitcoin adoption in the UK. A knowledge gap persists in the population, which can limit the barriers to entry. Public understanding of Bitcoin's utility and risks plays an important role in influencing perception.

Economic factors like inflation and currency volatility shape investor behavior, with Bitcoin gaining appeal as an inflation hedge. Although the attractiveness of BTC can wane if the economy remains stable with strong confidence in the pound.

In addition, blockchain breakthroughs and crypto’s fusion with traditional finance have a significant impact on driving cryptocurrency adoption. BlackRock, the world’s largest asset manager, warned investors about the looming threat of quantum computing to Bitcoin’s security and, by extension, its ETF. As quantum tech improves, it may threaten the encryption behind Bitcoin and much of today’s digital infrastructure. This could either potentially slow institutional adoption until stronger cryptographic safeguards are in place or accelerate demand for innovation within the Bitcoin ecosystem.

Other key indicators, such as crypto regulations and institutional involvement, also contribute to the acceptance of Bitcoin in the UK.

How Could UK-US Collaboration on Crypto Regulation Impact Bitcoin Adoption?

As leading financial giants, the UK and the US exert significant influence on global crypto markets, and their regulatory collaboration in 2025 could trigger the next major wave of Bitcoin adoption. Together, these economies account for more than 20% of the world’s GDP ($115.49 trillion), while crypto markets have a valuation of $3.36 trillion. Unified regulations would minimise market fragmentation, facilitate international transactions, and improve institutional confidence on both sides of the Atlantic.

Currently, their differing policies create confusion: the UK’s FCA supports innovation but stays cautious, while US regulators mix strict enforcement with new crypto laws. This mismatch makes it hard for businesses to operate smoothly, slowing innovation and keeping big financial players hesitant to fully join the crypto space. A coordinated UK-US regulatory approach could simplify compliance requirements for exchanges, lenders, and custodians, paving the way for faster Bitcoin adoption in mainstream investment portfolios.

Discussions in Washington between the Chancellor and US Treasury Secretary Scott Bessent confirmed that the UK and US will use the upcoming UK–US Financial Regulatory Working Group to promote responsible growth and use of digital assets. The UK and US collaborating could transform regulatory uncertainty into a key driver for Bitcoin adoption, shifting it from a speculative asset to a core financial technology.

Bitcoin’s value depends heavily on adoption and market trust. Clear and consistent regulations would boost liquidity and improve infrastructure. This would attract not only early tech adopters but also cautious investors and traditional banks. Stronger UK-US collaboration could create a global model for Bitcoin regulation. This would encourage other countries to follow. As a result, Bitcoin’s network effect would grow worldwide.

Conclusion

While the UK remains at the forefront of the global crypto economy, advancing further will require striking the right balance between encouraging innovation and providing regulatory certainty. Well-defined and reliable regulatory frameworks will pave the way for greater participation from both institutional and retail investors, boosting confidence in the market. As Bitcoin continues to gain traction amid global economic uncertainties, the UK’s ability to encourage a supportive yet secure environment will determine its leadership in the crypto space. Ultimately, sustained growth in Bitcoin adoption will hinge on the UK’s success in marrying forward-thinking policy with investor protection.

usdt

usdt bnb

bnb