Key Takeaway: Barclays doesn’t directly support cryptocurrency investments within its banking services. However, Barclays customers can deposit funds to FCA-registered crypto exchanges in the UK like eToro.

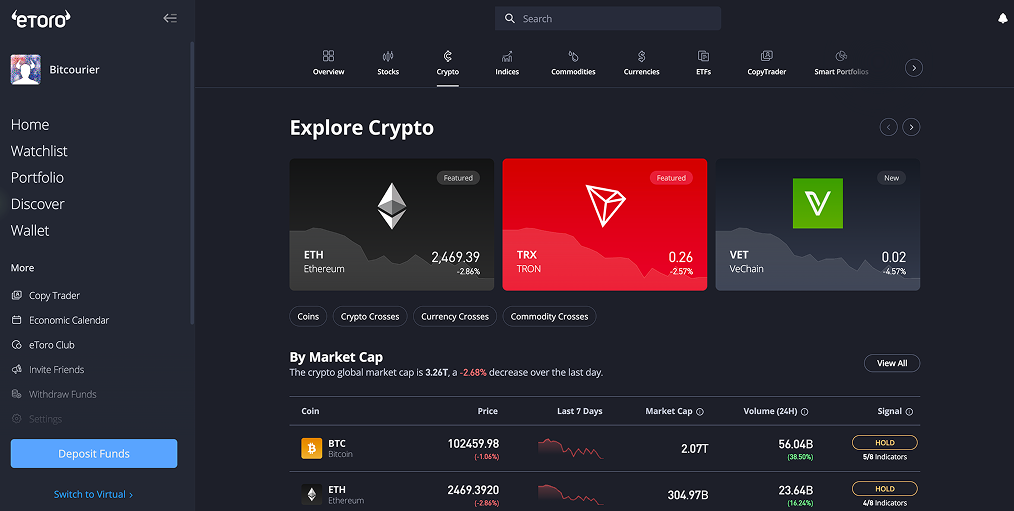

eToro supports over 70 cryptocurrencies, alongside handy features such as copy trading and a demo account. With fast GBP deposits and low fees, it is a secure and affordable choice for investing in Bitcoin, Ethereum and other digital assets.

How to Buy Bitcoin with Barclays Bank

Barclays customers can buy cryptocurrencies like Bitcoin by transferring GBP to an FCA-registered digital asset exchange in the UK.

A trusted choice is eToro, a regulated investment platform offering access to over 70 cryptocurrencies. Authorised by the Financial Conduct Authority (FCA) and based in London, eToro is popular for its diverse investment options spanning multiple asset classes.

Follow these steps to buy Bitcoin using Barclays with eToro:

- Register: Visit eToro’s website, create an account, and complete the required KYC (Know Your Customer) verification.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY - Deposit GBP: In your eToro account, click “Deposit Funds,” select your preferred deposit method, and send GBP to your trading account.

- Select BTC: Search for Bitcoin (BTC) on the trading dashboard and open the investment page.

- Complete Trade: Enter your desired Bitcoin amount, double-check all details, then confirm to finalise your purchase.

Barclays Bank's Policy on Crypto Transactions

Barclays Bank does not offer direct cryptocurrency trading or custody services. However, it has published a cryptocurrency policy, which states that clients can transfer funds to and from crypto exchanges registered with the Financial Conduct Authority (FCA), such as eToro and Uphold.

Following the FCA’s warning regarding Binance's regulatory status, Barclays ceased processing payments to Binance in 2021. Clients attempting to transact with non-compliant platforms may encounter declined payments.

The bank actively monitors transactions for potential fraud and financial crime risks. Barclays may flag or block suspicious transactions involving unregulated entities. Customers should consult the bank's official communications or contact support for the most current information on Barclays' cryptocurrency transaction policies.

Crypto Trading Fees

Investing in cryptocurrency through eToro involves a clear fee structure. Here's a detailed breakdown of the costs associated with crypto trading on the platform:

- Trading Fees: eToro applies a fixed 1% fee when you buy or sell any cryptocurrency. This fee is included in the price displayed at the time of the transaction.

- Market Spread: The market spread, which is the difference between the bid and ask prices, is determined by market conditions and is not an additional fee charged by eToro. This spread reflects the liquidity and volatility of the cryptocurrency market.

- Withdrawal Fees: Withdrawing funds from your eToro account to an external bank account may incur a fee. For GBP and EUR accounts, there is no withdrawal fee.

eToro's fee structure is designed to be transparent, allowing investors to understand the costs associated with cryptocurrency trading.

Best GBP Deposit Methods for Barclays

Funding your eToro account from Barclays Bank is quick and straightforward, and several convenient methods are available. Here’s an overview of eToro’s deposit options:

- Faster Payments (FPS): Instant GBP transfers are free, with no restrictions on deposit amounts.

- Debit Cards (Visa, MasterCard, Maestro): Immediate deposits capped at £30,000 per transaction.

- eToro Money: Instant GBP deposits up to £400,000 per transaction, plus instant withdrawals.

For withdrawals, eToro supports free and rapid GBP transfers back to your Barclays account using FPS, ensuring fast and easy access to your money.

What is Barclays Bank?

Barclays Bank, headquartered in London, is a British multinational financial institution with a history dating back to 1690. Barclays has been a pioneer in banking innovations, including introducing the UK's first credit card, Barclaycard, in 1966, and deploying the world's first cash machine in 1967.

With operations in over 40 countries and over 48 million customers worldwide, Barclays offers a comprehensive range of financial services to individuals, businesses, and institutions worldwide.

Conclusion

While Barclays doesn’t directly facilitate cryptocurrency investments, its seamless integration with FCA-registered exchanges like eToro makes crypto trading straightforward and secure.

By understanding Barclays’ crypto policies and using eToro’s transparent fees and instant deposit methods, investors can safely enter the digital asset space. Always verify the latest guidelines from both Barclays and eToro to maintain compliance and optimise your investing experience.

usdt

usdt xrp

xrp