Key Takeaway: Lloyds Bank does not offer direct cryptocurrency trading or custodial services, but clients can fund accounts on FCA-registered digital asset exchanges in the UK, such as eToro.

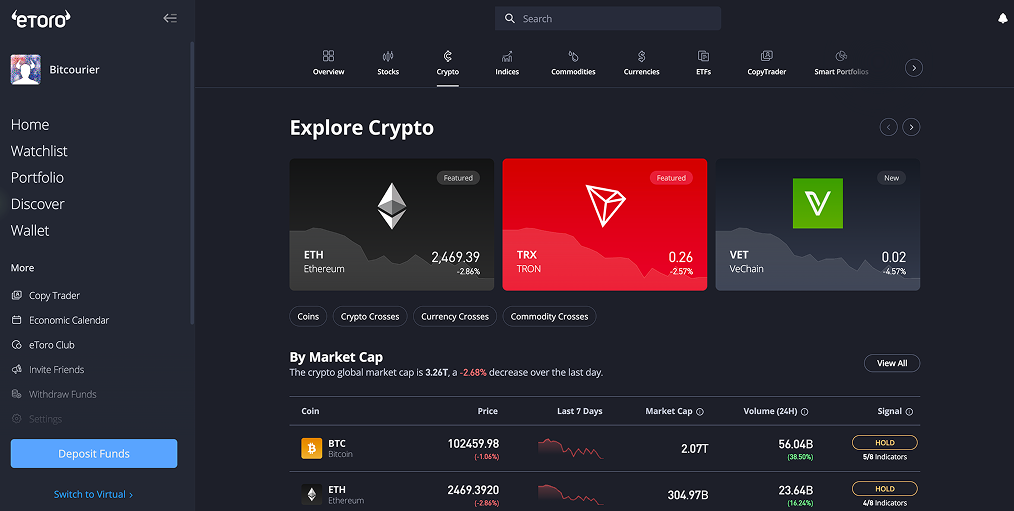

eToro provides access to more than 70 cryptocurrencies, including Bitcoin and Ethereum. The platform facilitates GBP transactions, offers minimal trading fees, and is compliant with FCA regulations.

How to Buy Bitcoin with Lloyds Bank

Lloyds Bank account holders can purchase Bitcoin and other digital currencies by sending British Pounds (GBP) to an FCA-registered crypto exchange in the United Kingdom.

A recommended option is eToro, which provides trading access to over 70 cryptocurrencies and is registered with the Financial Conduct Authority (FCA). In addition to digital assets like Ethereum, the platform supports other asset classes like shares and ETFs.

Here's how Lloyds Bank customers can buy Bitcoin through eToro:

- Sign Up: Head over to eToro's official website, register an account, and complete the required identity verification (KYC).

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY - Fund Your Account: Log in to your eToro account, click "Deposit Funds," and select GBP bank transfer. Transfer funds directly from your Lloyds Bank account.

- Choose Bitcoin: Head to the trading interface, search for "Bitcoin" or "BTC," and access its trading page.

- Execute the Purchase: Input the GBP amount you'd like to invest in Bitcoin, review the details carefully, then click to confirm your transaction.

Lloyds Bank’s Policy on Crypto Transactions

Lloyds Bank does not offer direct cryptocurrency trading or custody services. However, customers can transfer funds to digital asset exchanges registered with the Financial Conduct Authority, such as eToro and Uphold.

Customers can use debit cards and bank transfers to fund accounts on regulated platforms. However, Lloyds prohibits the use of its credit cards to purchase cryptocurrencies. This policy, implemented in 2018, aims to mitigate risks associated with volatile assets.

The bank actively monitors transactions for potential fraud and financial crime risks. Transfers to unregulated exchanges may be flagged or blocked to protect customers. Given the evolving nature of regulations and bank policies, it's advisable to regularly review Lloyds Bank's crypto policy or consult support for the latest information on crypto transactions.

Crypto Trading Fees

When Lloyds clients fund their crypto trading accounts on platforms such as eToro, understanding the associated fees helps avoid surprises. Below is a summary of the fees you might encounter when buying cryptocurrency with eToro:

- Trading Fee: eToro charges a transparent, flat 1% fee each time you buy or sell cryptocurrencies. This cost is automatically factored into the quoted price at the transaction stage.

- Market Spreads: eToro itself doesn’t charge spreads as a separate fee, but investors should be aware of the natural bid-ask spread within the crypto market. This spread varies based on liquidity and market fluctuations.

- Withdrawal Costs: For Lloyds Bank customers with GBP or EUR denominated accounts, eToro doesn’t impose withdrawal fees when moving funds back to their Lloyds accounts.

eToro has a transparent fee structure, ensuring Lloyds Bank customers can confidently budget and manage their cryptocurrency investments.

Best GBP Deposit Methods for Lloyds

Depositing funds from your Lloyds Bank account into your eToro crypto wallet is simple with several convenient GBP deposit options available:

- Faster Payments (FPS): Lloyds customers can use FPS to make instant GBP deposits. Transfers through this method are free, with no upper limit imposed by eToro.

- Debit Card (Visa and MasterCard): Deposits from Lloyds debit cards reflect instantly in your eToro account. Transaction limits are set at £30,000 per deposit.

- eToro Money: For large deposits, eToro’s payment service allows Lloyds customers to fund their accounts instantly, offering transaction limits of up to £400,000.

When withdrawing, Lloyds customers benefit from free GBP transfers via Faster Payments directly to their bank account, ensuring straightforward access to their funds.

What is Lloyds Bank?

Lloyds Bank, established in 1765 in Birmingham by John Taylor and Sampson Lloyd, is one of the UK's most enduring financial institutions. Operating under the umbrella of Lloyds Banking Group, it offers a comprehensive suite of services including personal and business banking, mortgages, loans, insurance, and wealth management.

With a significant presence across England and Wales, Lloyds Bank serves millions of customers through its extensive branch network and digital platforms, such as Halifax, Bank of Scotland, and Scottish Widows.

Conclusion

Lloyds Bank customers looking to invest in digital currencies have practical and secure options available through FCA-registered crypto platforms like eToro.

By understanding Lloyds’ clear policies, fees, and deposit methods, users can confidently enter the crypto market without unexpected hurdles. Staying informed on regulatory updates and regularly checking bank guidelines helps protect your investments.

usdt

usdt bnb

bnb