Key Takeaway: DEGIRO does not provide direct Bitcoin trading because of regulatory complexities in Europe & the UK. Investors seeking true ownership and lower fees should use regulated crypto exchanges such as eToro.

DEGIRO remains suitable only for indirect crypto exposure through ETFs and ETNs, which don't offer direct asset control or staking yields.

Can I Buy Bitcoin with DEGIRO?

No, DEGIRO doesn’t support direct Bitcoin trading, citing regulatory complexities as the main obstacle.

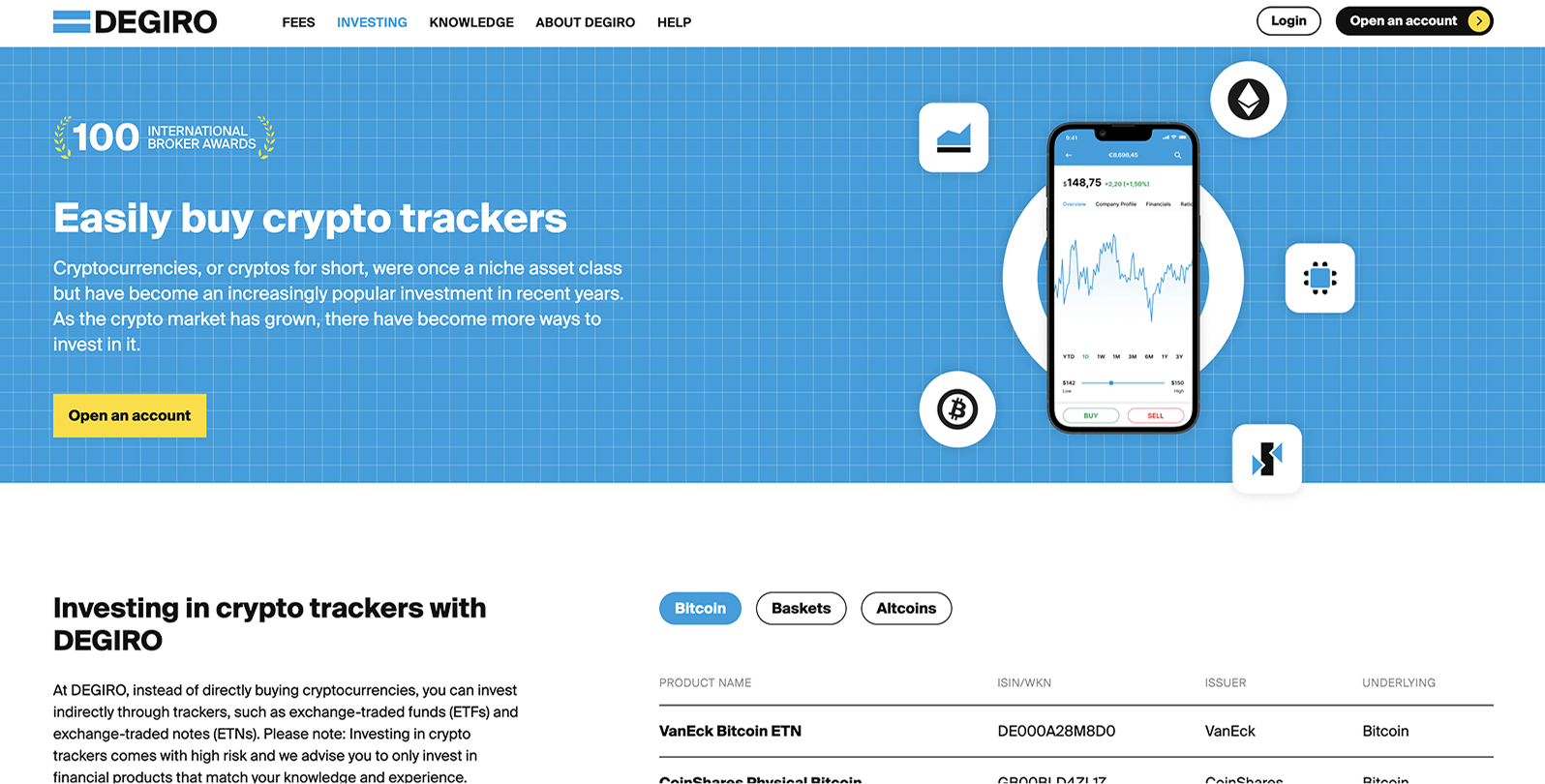

Instead, it provides indirect crypto exposure through ETFs and ETNs from providers like VanEck, CoinShares, WisdomTree, and 21Shares. These instruments track Bitcoin’s price without actual ownership.

To directly own Bitcoin, you’ll need to use a regulated crypto exchange. DEGIRO’s crypto-related products suit experienced investors willing to manage higher risks and costs compared to buying cryptocurrencies outright.

How to Buy Crypto with a DEGIRO Alternative

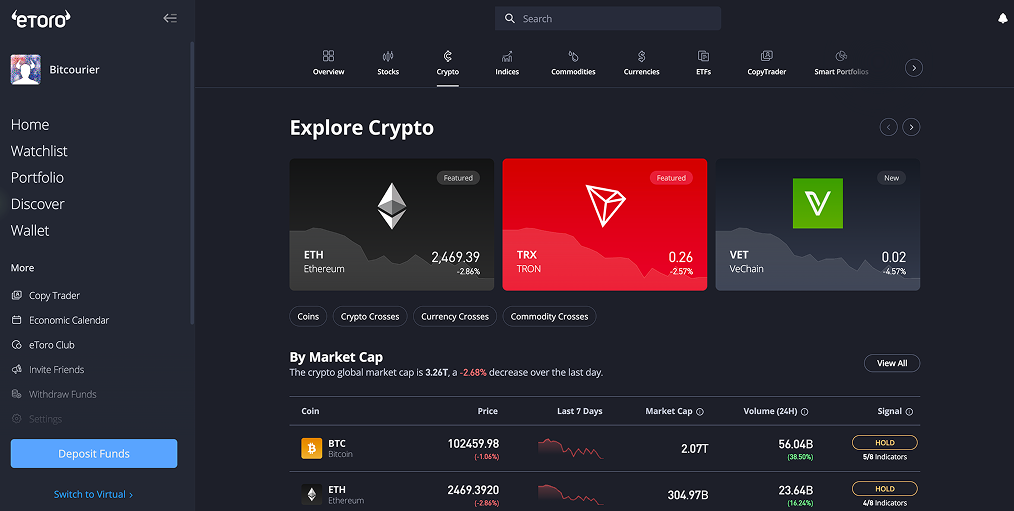

DEGIRO doesn't offer direct cryptocurrency purchases due to regulatory constraints. Investors seeking direct crypto ownership should consider a regulated alternative like eToro, registered with the FCA in the UK and compliant with regulatory standards across Europe.

Trusted by over 30 million investors, eToro enables straightforward access to cryptocurrencies such as Bitcoin, Ethereum, and Solana.

Follow these simple steps to buy crypto on eToro:

- Create an Account: Register on eToro’s website and complete identity verification.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY - Deposit Funds: Add GBP to your account securely via bank transfer.

- Choose Your Cryptocurrency: Select Bitcoin or other cryptocurrencies from eToro’s user-friendly dashboard.

- Complete the Purchase: Enter the investment amount, confirm transaction details, and finalize your crypto purchase.

DEGIRO Fees for Crypto ETFs & ETNs

DEGIRO provides clear pricing for investing indirectly in cryptocurrencies through ETFs and ETNs. Here’s precisely what you’ll pay:

- Trading Fees: A fixed commission of €2 per trade, plus a handling fee of €1 per transaction.

- Spreads: Approximately 1%, reflecting typical market costs for crypto-related products.

- Deposit & Withdrawal Fees: DEGIRO does not charge fees for deposits or withdrawals via bank transfers.

DEGIRO’s fee structure is straightforward and competitive for investors comfortable with indirect crypto exposure. Active traders seeking lower costs might prefer exchanges with tighter spreads and lower commissions.

Should I Invest in Crypto ETFs or ETNs on DEGIRO?

No, investing in crypto ETFs or ETNs usually isn't optimal. They come with higher fees, issuer risks, and no direct asset ownership, limiting your control. Additionally, these products prevent you from earning staking rewards or passive income.

Directly owning cryptocurrencies via regulated exchanges allows lower costs, genuine ownership, and opportunities to generate yield through staking.

What is DEGIRO?

DEGIRO is a leading European brokerage platform enabling investors to trade various financial products such as stocks, ETFs, bonds, futures, and options on more than 45 international exchanges.

Owned by flatexDEGIRO AG, it currently supports over 3 million clients, delivering competitive pricing and transparent fee structures. DEGIRO’s streamlined interface caters to both retail and professional investors, prioritizing ease of use and straightforward global investing.

Conclusion

While DEGIRO is a reputable platform for traditional investing, its indirect crypto exposure through ETFs and ETNs may not be ideal for investors seeking direct ownership, lower fees, or staking yields.

To fully benefit from cryptocurrencies like Bitcoin and Ethereum, consider a regulated alternative such as eToro, which offers direct asset ownership and more cost-effective trading.

Always align your investment choice with your experience level, goals, and preference for direct asset control.

usdt

usdt xrp

xrp