Key Takeaway: Interactive Investor doesn’t offer direct crypto trading, but you can invest indirectly via blockchain ETFs or crypto-related stocks.

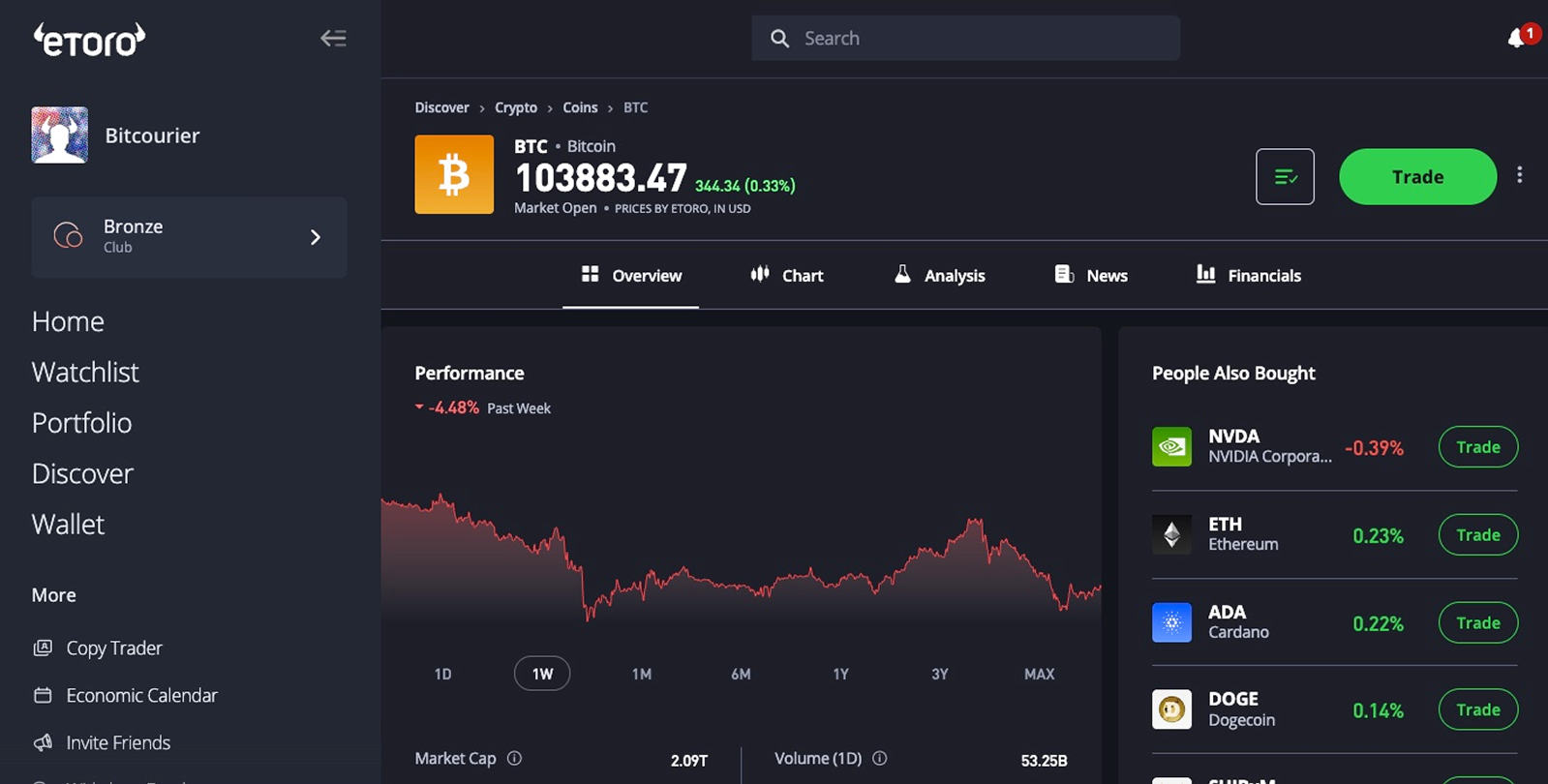

For direct ownership of cryptocurrencies like Bitcoin, transfer funds to an FCA-regulated exchange such as eToro, which supports over 70 digital assets, transparent 1% trading fees, and quick GBP deposits.

Can I Buy Bitcoin with Interactive Investor?

No, Interactive Investor doesn't support direct cryptocurrency trading or custody. It focuses on traditional investments such as shares, ETFs, and investment trusts. However, you can indirectly invest in crypto through blockchain ETFs or crypto-related stocks like MicroStrategy and Coinbase.

For direct crypto ownership, you'll need to transfer funds from Interactive Investor to an FCA-registered crypto exchange.

How to Buy Crypto with an Interactive Investor Alternative

To buy crypto directly, transfer funds from Interactive Investor to an FCA-regulated crypto exchange such as eToro. Trusted by over 30 million investors in the UK, Europe and worldwide, eToro offers access to 70+ cryptocurrencies including Bitcoin, Ethereum and other popular digital assets, alongside 6,000 traditional financial instruments.

Follow these simple steps to buy crypto on eToro:

- Create your eToro account: Sign up and complete identity verification (KYC).

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY - Deposit GBP: Log in, click Deposit Funds, select GBP and transfer via bank or debit card.

- Find your cryptocurrency: Enter the asset name (e.g., "Bitcoin" or "BTC") into eToro’s search bar and select it.

- Complete your purchase: Input your desired investment amount, confirm transaction details and finalise the trade. Your crypto holdings will appear in your eToro portfolio.

Crypto Trading Fees

As Interactive Investor doesn’t offer direct cryptocurrency trading, you’ll need to consider fees on crypto exchanges like eToro. Here's a clear overview of eToro’s crypto fees:

- Trading Fees: eToro charges a transparent 1% transaction fee on all cryptocurrency trades, built directly into the quoted buy or sell price.

- Market Spread: No additional spread-based fees beyond the standard 1% apply, although small market fluctuations may slightly affect final prices.

- Withdrawal Fees: Withdrawing GBP to your UK bank account (including those linked to Interactive Investor) is straightforward and free from hidden charges.

For indirect crypto exposure via equities (e.g., Coinbase or MicroStrategy) on Interactive Investor, standard share-dealing charges apply, typically £5.99 to £11.99 per trade depending on your subscription plan.

Best GBP Deposit Methods for Interactive Investor

Interactive Investor customers who wish to invest directly in cryptocurrencies should transfer GBP to an FCA-regulated platform like eToro. Here are the top GBP deposit methods supported by eToro:

- Debit Card Deposits: Deposit GBP instantly using your UK-issued debit card. This method securely handles transactions up to approximately £30,000 per transfer.

- Bank Transfer (Faster Payments): Transfer GBP directly from your UK bank account at no extra cost. Funds typically arrive within minutes.

- eToro Money for Large Deposits: Suitable for larger transactions, eToro Money comfortably supports GBP deposits up to around £400,000 per transaction.

When converting crypto back to GBP, withdrawals from eToro to your linked UK bank account, including those previously connected to Interactive Investor, are straightforward and typically free of additional charges.

What is Interactive Investor?

Interactive Investor (II) is a leading UK subscription-based investment platform with over 450,000 customers and £70 billion in managed assets.

Established in 1995, II provides investors with flat-fee access to shares, ETFs, investment trusts, bonds, and funds via accounts such as ISAs, Junior ISAs, SIPPs, and General Investment Accounts.

Key features include ready-made portfolios, curated investment lists like Super 60 and ACE 40, comprehensive market insights, and user-friendly online trading tools.

Final Thoughts

Interactive Investor is ideal for traditional investing but doesn't offer direct cryptocurrency purchases. To own crypto directly, transferring funds to a regulated exchange like eToro is a practical solution.

With clear fees, fast GBP deposits, and access to numerous digital assets, platforms such as eToro simplify crypto investing for UK customers

Consider your goals and choose an FCA-registered platform that aligns best with your investment strategy.

usdt

usdt xrp

xrp