Key Takeaway: HSBC does not directly facilitate crypto transactions or provide digital asset custody, but clients can easily invest in crypto by transferring GBP to FCA-registered exchanges like eToro.

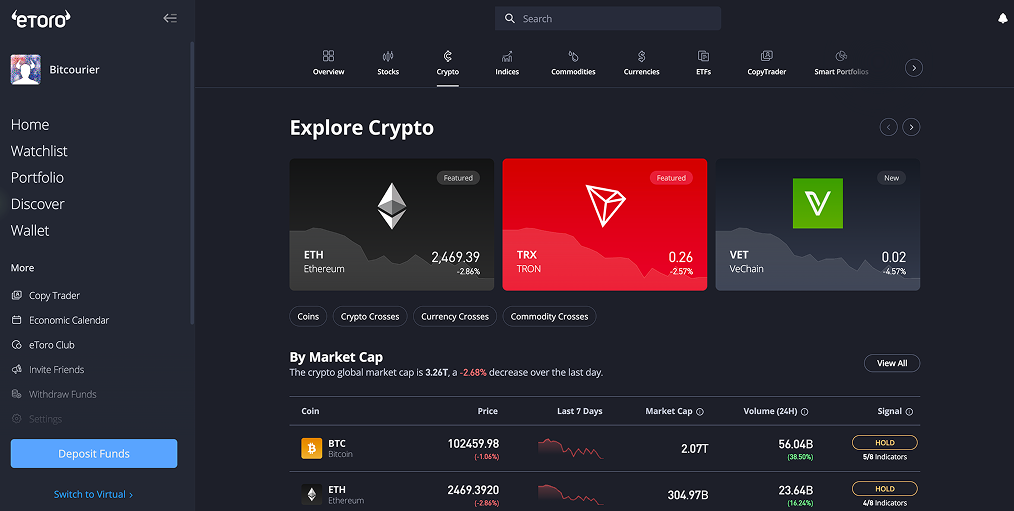

Registered with the Financial Conduct Authority (FCA), eToro offers a secure environment to trade over 70 cryptocurrencies, alongside other investment products such as shares and ETFs.

How to Buy Bitcoin with HSBC Bank

HSBC customers interested in investing in cryptocurrencies like Bitcoin and Ethereum can deposit British Pounds (GBP) into an FCA-registered digital asset exchange.

Our top pick for British investors is eToro, which is registered with the Financial Conduct Authority (FCA). eToro supports trading across over 70 cryptocurrencies and facilitates GBP deposits via bank transfers, Faster Payments (FPS), or debit cards.

Here is a step-by-step guide for buying Bitcoin using HSBC and eToro:

- Register: Visit eToro’s website, create an account, and complete the required Know Your Customer (KYC) identity verification.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY - Transfer Funds: Log into your account, click "Deposit Funds," select "Bank Transfer," and initiate a transfer directly from your HSBC account.

- Search Bitcoin: Go to the search bar, type "Bitcoin" or "BTC", and click the ‘Trade’ button.

- Execute Trade: Enter the GBP amount you wish to use for your Bitcoin investment, carefully review your transaction, and complete your order by clicking the confirmation button.

HSBC Bank’s Policy on Crypto Transactions

HSBC has implemented a crypto policy to protect customers from fraud. While the bank permits transfers to cryptocurrency platforms regulated by the Financial Conduct Authority (FCA), it enforces stringent limits and restrictions to safeguard customer funds.

Clients can deposit funds onto FCA-approved cryptocurrency exchanges through HSBC’s debit cards, online banking, mobile apps, and branches, subject to clearly defined limits. Each cryptocurrency-related transaction is capped at £2,500, with a cumulative limit of £10,000 over any rolling 30-day period.

Additionally, HSBC continues to completely prohibit using credit cards issued by the bank for cryptocurrency purchases, reinforcing their commitment to responsible investing practices. Payments from regulated crypto exchanges back into HSBC accounts remain permissible.

Crypto Trading Fees

HSBC account holders aiming to buy cryptocurrencies via exchanges like eToro should know the associated fees before proceeding. Here's a clear breakdown of eToro’s fee model:

- Trading Fees: eToro applies a transparent 1% fee on cryptocurrency transactions. This cost is automatically factored into the displayed price when buying or selling crypto, ensuring no unexpected charges occur.

- Market Spreads: eToro does not levy separate spread charges, but users should consider market spreads, which are the difference between current buy and sell prices.

- Withdrawal Fees: HSBC customers withdrawing funds from eToro to their accounts in GBP or EUR incur no withdrawal fees, enabling straightforward cash-outs without additional expenses.

This uncomplicated fee structure from eToro ensures HSBC clients have clarity and confidence, making crypto investing straightforward and free from hidden charges.

Best GBP Deposit Methods for HSBC

HSBC customers looking to fund their cryptocurrency investments on eToro have multiple GBP deposit methods to choose from:

- Faster Payments Service: HSBC account holders can quickly transfer GBP to eToro using the Faster Payments service. This option provides rapid and free transactions, typically arriving within minutes.

- Debit Card (Visa or MasterCard): HSBC-issued debit cards enable instant GBP deposits directly into your eToro trading account. Card deposits support individual payments of up to £30,000, making funds immediately available.

- eToro Money: HSBC clients planning substantial cryptocurrency investments can use eToro Money to deposit larger sums. This service allows single transfers of up to £400,000, ideal for high-volume investors.

When ready to withdraw profits or remaining balances, users can move GBP from eToro back into their HSBC accounts using Faster Payments, a straightforward process that incurs no fees.

What is HSBC?

HSBC is a global banking and financial services organisation in London. Founded in 1865 in Hong Kong to facilitate trade between Europe and Asia, HSBC has grown into one of the world's largest banks by assets, operating in over 60 countries and serving more than 40 million customers worldwide.

The bank offers comprehensive services, including retail and commercial banking, wealth management, and investment banking. In the UK, HSBC UK Bank plc operates as a subsidiary, providing personal, business, and private banking services.

Conclusion

Although HSBC doesn’t directly provide cryptocurrency services, customers can access digital asset markets by transferring GBP to secure, FCA-registered platforms like eToro.

Understanding HSBC’s protective measures, clear deposit methods, and eToro’s straightforward fee structure ensures a transparent investing experience. Before proceeding, always verify transaction limits and fees, and prioritise security by using reputable exchanges.

usdt

usdt xrp

xrp