Key Takeaway: Revolut allows investing in S&P 500 ETFs like SPDR SPY and Vanguard VOO, but its fees (up to 3% per trade) can quickly add up.

Frequent investors can reduce costs by using eToro, which offers zero commissions, tighter spreads, and instant deposits directly from Revolut accounts.

Can I Buy the S&P 500 with Revolut?

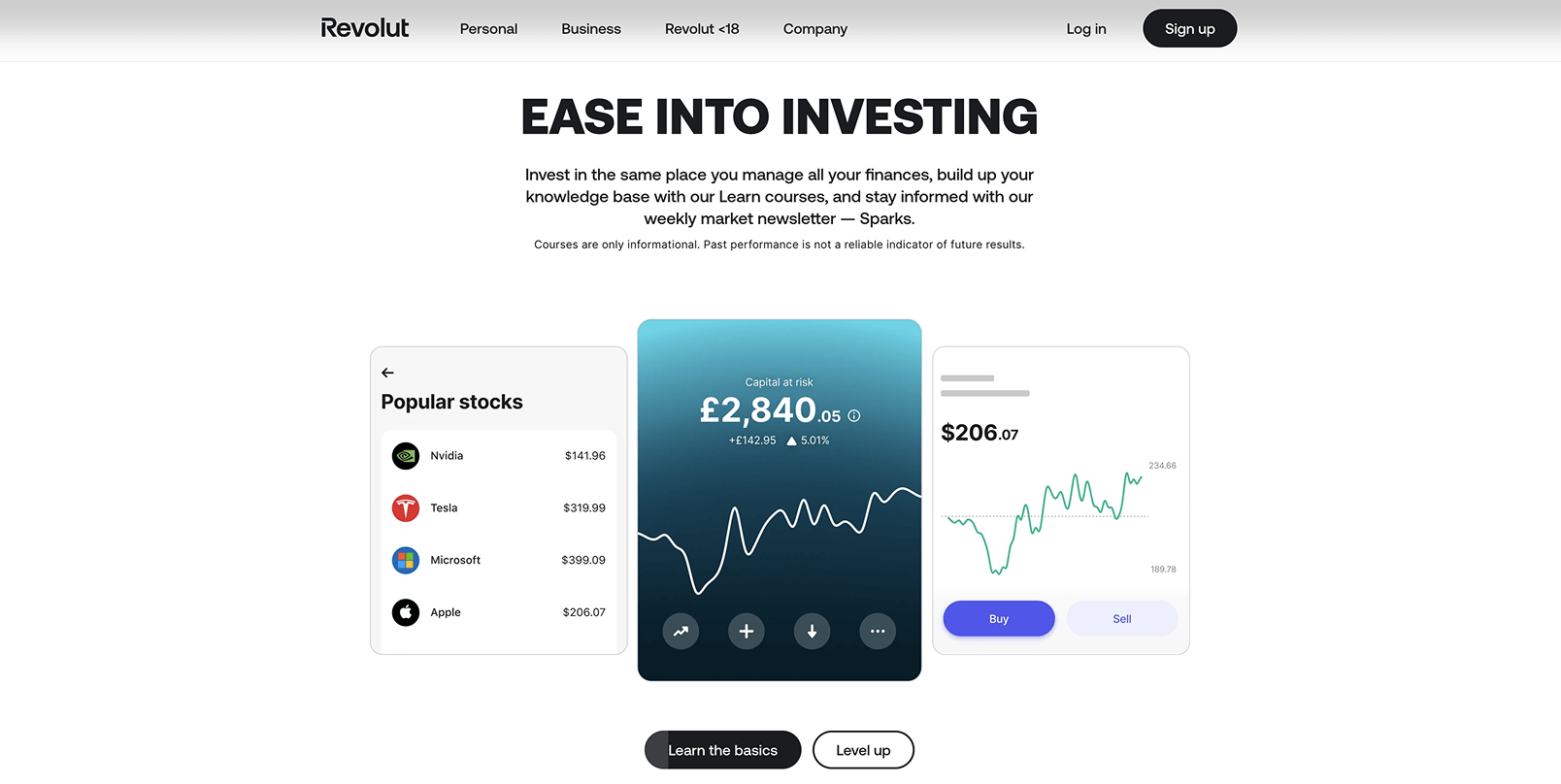

You can invest in the S&P 500 through Revolut by buying exchange-traded funds (ETFs) such as SPDR SPY or Vanguard VOO. These ETFs mirror the performance of America's largest companies, offering straightforward exposure to the index.

However, Revolut isn’t the cheapest option available. With commissions of 0.25% per trade plus spreads often surpassing 1.5%, it typically costs more compared to specialized investment platforms like eToro or DEGIRO, especially for frequent traders or investors.

How to Buy the S&P 500 with Revolut

Given Revolut’s relatively high fees, transferring money to a lower-cost ETF platform like eToro can be smarter & more cost-effective. eToro is FCA-registered in the UK, regulated throughout Europe, and trusted by over 35 million investors, making it a secure and popular choice.

Follow these four simple steps:

- Create an eToro Account: Register on the eToro website and complete quick ID verification.

Your capital is at risk. Please read the disclaimer. - Deposit Funds Using Revolut: Select Revolut as your payment method for instant GBP or EUR deposits.

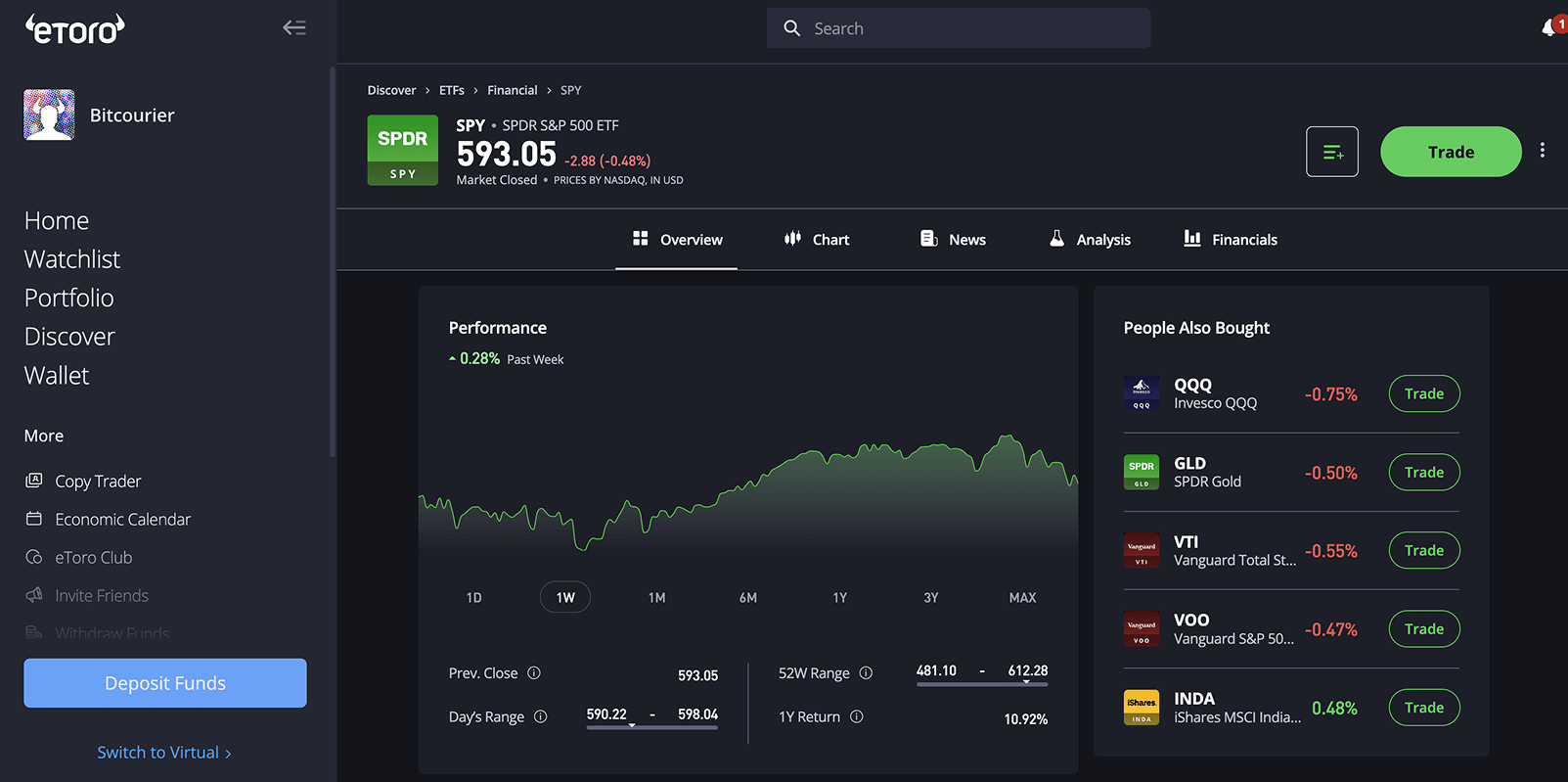

- Find the S&P 500 ETF: Search for ETFs like SPDR SPY or Vanguard VOO within the eToro platform.

- Make Your Investment: Enter your investment amount, confirm the details, and buy your chosen ETF.

Revolut Fees for S&P 500 ETF

Revolut structures its investment fees based on your account tier. Each plan includes a certain number of monthly commission-free trades for ETFs tracking the S&P 500, such as Vanguard’s VOO or SPDR’s SPY:

- Standard: 1 commission-free trade/month

- Plus: 3 commission-free trades/month

- Premium: 5 commission-free trades/month

- Metal: 10 commission-free trades/month

- Ultra: 10 commission-free trades/month at a lower commission rate

Once these free trades are used, Revolut charges a fee of 0.25% per additional trade (£1 minimum), except for Ultra users who pay 0.12%. There's also a substantial 1.5% spread on each transaction, making total costs quite high for frequent or larger investors.

A cheaper alternative for regular investing is a platform like eToro, which offers commission-free ETF purchases and narrower spreads, typically around 1%.

Is Revolut Good for Investing in ETFs?

Revolut offers straightforward access to ETFs, including popular choices like the NASDAQ (QQQ), Gold (GLD), and the S&P 500 (SPY, VOO). If you're already using Revolut's banking features and only trade occasionally, the convenience might justify the platform's higher costs.

However, these fees can be steep, hitting around 1.49% for Premium or Metal accounts and as high as 3% for Standard and Plus users. If you regularly invest or care strongly about costs, specialized platforms like eToro or DEGIRO will likely serve you better, offering commission-free trades and tighter spreads.

What is Revolut?

Revolut is a UK-based fintech firm operating as a digital banking and financial services platform. Launched in 2015, it provides services such as multi-currency accounts, currency exchange, crypto trading, and investment in stocks and ETFs through a mobile-first application.

Revolut integrates traditional banking functions with features like spending analytics, instant international transfers, and payment cards, appealing particularly to younger, digitally-savvy consumers.

Technically, Revolut operates under an e-money license in the UK, regulated by the Financial Conduct Authority (FCA), and holds banking licenses in select European countries.

Conclusion

Revolut provides an easy gateway to ETFs like the S&P 500, NASDAQ, and Gold, but its high fees make it less appealing for regular investors.

To lower costs and maximize returns, consider using specialized platforms such as eToro, which offer commission-free trades, tighter spreads, and a smoother investing experience overall.

usdt

usdt xrp

xrp