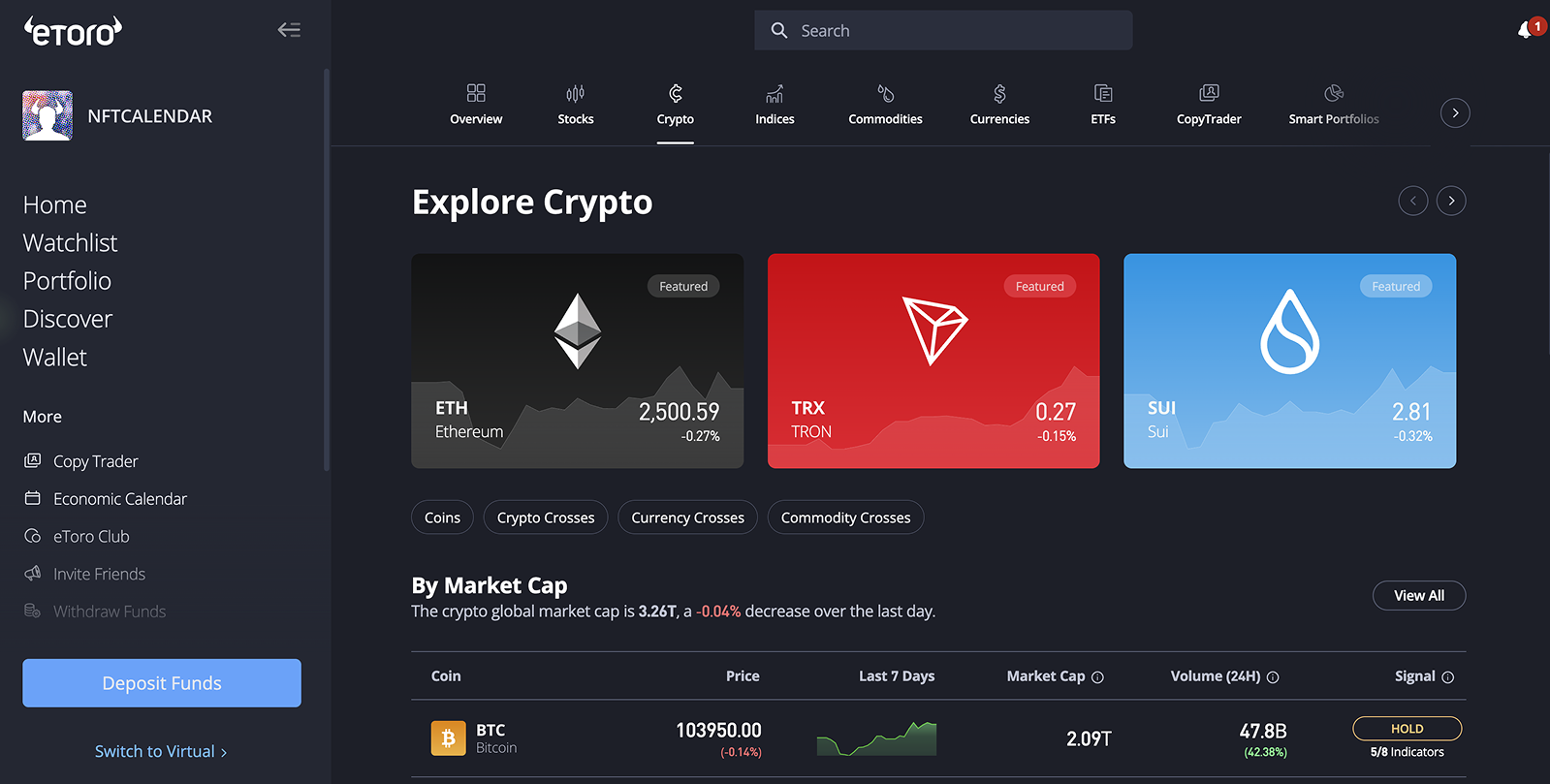

Key Takeaway: Nationwide does not offer direct cryptocurrency trading or custody, but customers can conveniently deposit funds into FCA-regulated UK exchanges like eToro.

With eToro, Nationwide customers gain secure access to a wide range of cryptocurrencies, including Bitcoin, benefit from instant GBP deposits, transparent pricing, and FCA oversight.

How to Buy Bitcoin with Nationwide

Nationwide customers can easily buy Bitcoin by transferring British Pounds (GBP) from their Nationwide account to an FCA-regulated cryptocurrency exchange that supports GBP deposits.

eToro is widely trusted among Nationwide users due to its FCA approval, straightforward interface, and quick GBP deposit methods like Faster Payments, bank transfers, and debit card transactions.

To purchase Bitcoin on eToro using Nationwide, follow these clear steps:

- Sign Up for eToro: Go to eToro’s official site, create an account, and complete identity verification (KYC).

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY - Deposit GBP: Once logged in, select "Deposit Funds," choose GBP, and initiate a transfer directly from your Nationwide bank account.

- Find Bitcoin: Enter "Bitcoin" or "BTC" in eToro’s search bar and click on "Trade."

- Complete Your Purchase: Specify the GBP amount you wish to invest, verify the details carefully, and select "Confirm" to execute your Bitcoin purchase securely.

Nationwide’s Policy on Crypto Transactions

Nationwide does not directly provide cryptocurrency trading or storage. Instead, customers can use their Nationwide accounts to transfer British Pounds (GBP) to FCA-regulated cryptocurrency exchanges.

The bank permits crypto-related deposits via debit cards and Faster Payments transfers but blocks any crypto purchases using credit cards. Payments to non-FCA registered crypto platforms may also face additional checks or be blocked completely.

Transaction Limits for Crypto Purchases

The following limits apply to crypto-related payments according to Nationwide’s restrictions on digital asset investing:

Debit Card Limits:

- Daily limit: £5,000 per account holder.

- Applies individually per debit card, including joint accounts.

- Digital wallet payments (e.g., Apple Pay, Google Wallet) included.

Faster Payments Limits:

- Daily limit: £5,000 per Nationwide current account.

- Applies across Nationwide's Banking App, Internet Bank, branches, and Open Banking transfers.

Payments to Binance:

- All payments to Binance are declined.

- Customers can still withdraw existing Binance funds to Nationwide.

Crypto Trading Fees

Nationwide customers investing in cryptocurrencies through eToro should understand the relevant costs clearly. Here’s a concise breakdown for Nationwide customers funding their eToro accounts:

- Trading Fees: eToro charges a straightforward fee of 1% per crypto transaction (buy or sell), automatically built into the transaction price.

- Market Spreads: Although eToro does not explicitly charge extra spread fees, customers should account for market spreads (the difference between buying and selling prices) which vary based on asset liquidity and market conditions.

- Withdrawal Fees: Nationwide customers benefit from fee-free withdrawals when transferring funds from eToro back to their Nationwide GBP accounts.

Awareness of these fees ensures Nationwide customers can effectively manage their crypto investments on eToro without unexpected costs.

Best GBP Deposit Methods for Nationwide

Nationwide customers have convenient, secure options to deposit British Pounds (GBP) into their eToro crypto accounts. Here’s a tailored overview specifically for Nationwide account holders:

Faster Payments Service (FPS)

Instantly transfer GBP from your Nationwide account to eToro via Faster Payments. Deposits are immediate, completely free, and eToro places no maximum limit.

Debit Card (Visa/MasterCard)

Nationwide debit card deposits to eToro offer instant account funding, ideal for timely market opportunities. Individual transaction limits are set at £30,000.

When withdrawing funds from eToro back to your Nationwide account, customers enjoy fee-free GBP transfers via Faster Payments, allowing swift and convenient access to their money.

What is Nationwide Bank?

Nationwide Building Society is the UK’s largest mutual financial institution, wholly owned by its members rather than shareholders. It serves approximately 17 million customers, providing mortgages, current accounts, savings, personal loans, credit cards, and insurance.

With over 600 branches, Nationwide maintains a direct local presence, setting it apart from typical high-street banks through its mutual structure and member-focused service.

Final Thoughts

Buying Bitcoin with Nationwide is straightforward when using FCA-regulated platforms like eToro.

To maximise safety and deposit speed, use Faster Payments or your Nationwide debit card, but always stay mindful of daily transaction limits and associated fees.

Regularly review Nationwide’s crypto policies to prevent blocked transactions and choose trusted exchanges to protect your investments.

usdt

usdt xrp

xrp