Key takeaway: You can now buy crypto with PayPal in the UK. However, it’s worth noting that PayPal has temporarily paused new in-app crypto purchases for UK users while updating its service to meet local regulations. This means availability may differ, so it’s best to check your PayPal app to confirm whether the buy option is currently active. PayPal has become one of the world’s most recognised and trusted digital payment platforms, with over 430 million active accounts globally and a growing presence in the UK’s fintech world. It has gradually expanded beyond online shopping and transfers, now stepping into the world of cryptocurrency. This move opens the door for many UK users who want to explore digital assets without diving into complicated financial setups or lengthy verification processes.

This guide was created to simplify that journey as we walk you through how to purchase cryptocurrency using PayPal in the UK.

What are PayPal's Crypto Regulations in the UK?

In the UK, PayPal’s crypto services are tightly regulated and operate under clear conditions set by the Financial Conduct Authority (FCA). While PayPal UK is licensed as an electronic money institution, its crypto activities fall under separate FCA oversight. In October 2023, PayPal registered with the FCA to offer specific crypto-asset services, but this came with restrictions. To comply with new UK crypto promotion and consumer-protection rules, PayPal temporarily paused crypto purchases for UK users starting from 1 October 2023, with plans to resume once all regulatory adjustments are complete.

Right now, UK users can still hold or sell crypto within PayPal, but new purchases aren’t available. When the feature was active, users could buy Bitcoin, Ethereum, Litecoin, and Bitcoin Cash directly in the PayPal app using their PayPal balance, a linked debit card, or a connected bank account. Though they could not do these using PayPal Credit or any credit card. PayPal also set spending limits to manage risk.

It’s important to know that crypto services on PayPal are not covered by the Financial Services Compensation Scheme (FSCS) or the Financial Ombudsman Service (FOS). That means if you lose money or if PayPal runs into financial trouble, your crypto holdings aren’t protected the same way your regular PayPal balance or bank funds are. Plus, PayPal holds users’ crypto through third-party custodians in a shared account. You don’t have direct access to send or withdraw those assets to your personal crypto wallet.

Can you Buy Crypto Directly with PayPal in the UK?

As of now, you can’t buy crypto directly with PayPal in the UK. PayPal temporarily paused its crypto services for UK users due to updates required under the UK FCA regulations. This pause means that while users can still hold or sell any crypto they previously bought, they can’t make new crypto purchases through PayPal until the company resumes full operations. PayPal has stated that crypto buying options will return once all regulatory adjustments are complete, but there’s no confirmed date yet.

In simpler terms, if you’re in the UK and want to use PayPal for crypto, you’ll need to go through regulated exchanges that accept PayPal as a payment method instead of buying straight from PayPal itself. Until PayPal reactivates its direct crypto feature, this remains the main route for anyone looking to handle cryptocurrency transactions via PayPal in the UK.

What Crypto Exchanges and Platforms allow Buying Crypto with PayPal in the UK?

MoonPay

MoonPay is one of the easiest platforms in the UK that lets you buy crypto using PayPal. It’s not an exchange but a crypto-on-ramp, meaning it helps you convert regular money into digital assets like Bitcoin or Ethereum. You can start by creating a MoonPay account, verifying your ID, and choosing the crypto you want to buy. When you reach the payment section, select PayPal, link your account, and confirm the transaction. Once processed, your crypto is sent directly to the wallet address you provided.

MoonPay keeps things simple, but it does include a few fees. There’s a network fee to cover blockchain costs and a MoonPay service fee based on your payment method and transaction size. For PayPal, the fee can go up to around 4.5%, with a minimum charge of about £3.99 for small purchases. Some partner platforms using MoonPay may also include an ecosystem fee, typically between 0% and 2%.

In short, while you can’t buy crypto directly through PayPal’s UK service, you can use PayPal as a payment method on MoonPay or MoonPay-powered services. It’s a valid route to buy crypto with PayPal in the UK, fast, secure, and ideal for those who prefer using PayPal’s familiar system over bank transfers.

Crypto.com

Crypto.com supports PayPal top-ups for its prepaid Visa card in some regions, like the U.S., but that option isn’t available for buying crypto in the UK yet. Instead, the most reliable way to fund your Crypto.com account is through a GBP bank transfer using the Faster Payments Service (FPS). All you have to do is open a Crypto.com account, complete identity verification, and deposit GBP from your UK bank into your Crypto.com fiat wallet. Once the funds show up, you can use them to buy your preferred cryptocurrency inside the app. It’s simple, secure, and fully supported.

In terms of fees, the platform doesn’t charge for GBP deposits through FPS. When withdrawing back to your UK bank, there’s a flat £1.90 withdrawal fee. If you choose to top up the Crypto.com Visa card, that comes with a 1% - 2% top-up fee. So, while PayPal integration for crypto purchases isn’t active in the UK, Crypto.com still offers a straightforward and affordable way to buy, sell, and manage crypto using your local bank account.

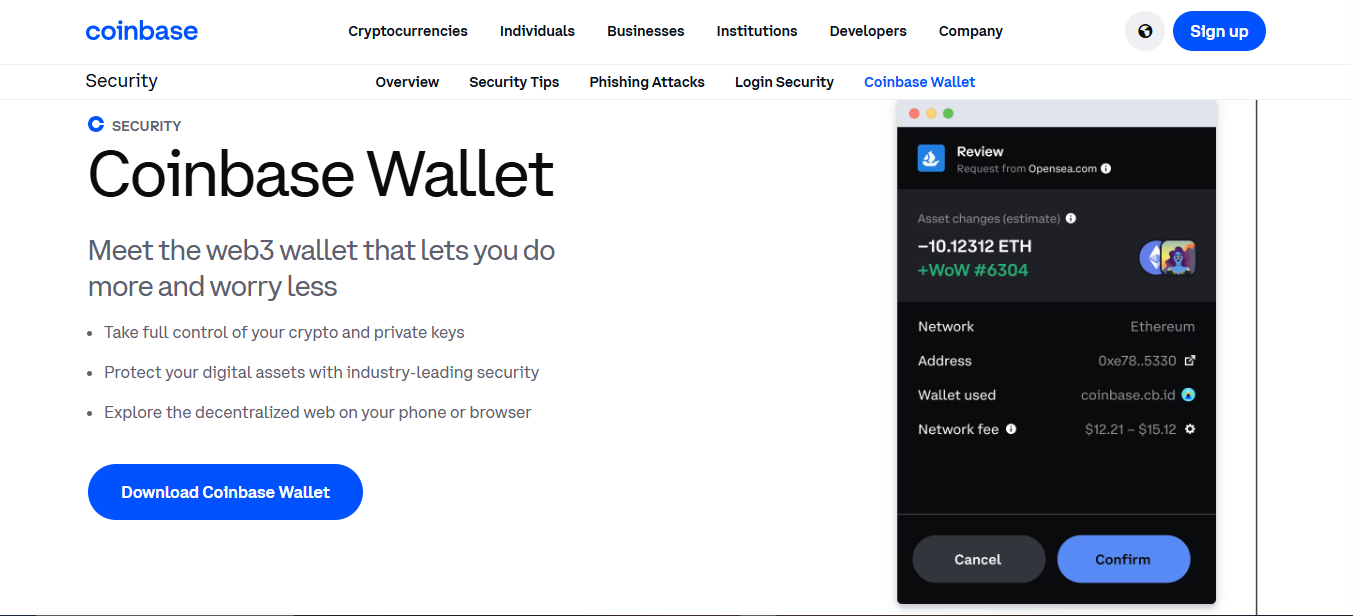

Coinbase

Coinbase is one of the most popular and trusted crypto exchanges in the world, known for its easy interface and strong security. It lets users buy, sell, and store different cryptocurrencies. While PayPal is listed as a payment option on Coinbase in some countries, it’s not currently supported for direct crypto purchases in the UK. In regions where PayPal is supported, users can link their PayPal account in the “Payment Methods” section on Coinbase and use it to fund crypto purchases. However, UK users will need to use other available payment options like debit cards, bank transfers, or Apple Pay.

When available, Coinbase usually charges around 3.99% for PayPal-funded crypto purchases and between 0.05% to 0.60% in trading fees on its advanced exchange. These fees can vary depending on transaction type and region. For now, if you’re in the UK, PayPal can’t be used for buying crypto directly on Coinbase. You’ll have to deposit funds through another payment option before trading.

How to Buy Crypto with PayPal in the UK: 6 simple steps

- Choose a crypto exchange that accepts PayPal

Start by picking a trusted crypto platform that supports PayPal payments for UK users. Make sure the platform is regulated and supports the coins you want to buy. - Create and verify your account

Sign up on the chosen exchange using your email address and complete identity verification. This step usually involves uploading a valid ID to meet UK’s Know Your Customer (KYC) requirements. - Link your PayPal account

Go to the exchange’s payment settings and connect your PayPal account. You might need to confirm ownership by logging into PayPal through the exchange’s secure page. - Deposit funds or select PayPal at checkout

Some exchanges let you deposit GBP through PayPal before buying, while others allow you to pick PayPal as a direct payment method when purchasing crypto. - Choose the cryptocurrency you want to buy

Once your PayPal is linked or your funds are loaded, select the coin you want, like Bitcoin, Ethereum, or Solana, and enter the amount you wish to purchase. - Confirm and complete your purchase

Review the transaction details, including exchange rates and fees, then confirm your order. Your new crypto will appear in your exchange wallet afterward.

What are the Fees for Purchasing Crypto with PayPal in the United Kingdom?

Since PayPal’s direct crypto service is still paused in the UK, the only way to buy crypto using PayPal is through trusted exchanges that accept it as a payment option. These platforms charge different fees depending on how you fund your account and the type of transaction you make.

For instance, on Coinbase, using PayPal or a debit card to fund your account often attracts around 3.99% in deposit fees. Once your funds are in, there’s also a trading fee or spread added to the crypto price, which is how the platform earns a margin on each trade. Besides trading costs, remember that you may also pay small withdrawal or network fees if you move your crypto to another wallet or platform.

In simple terms, when using exchanges that support PayPal-funded deposits, you can expect to pay around 1% to 4% in deposit fees, plus another 0.5% to 4% in trading fees, depending on where and how you buy. Checking the exchange’s official fee page before you start helps you know exactly what to expect.

FAQS

Is it Safe to Buy Crypto with PayPal in the UK?

It’s safe to buy crypto with PayPal in the UK when done through licensed and reputable platforms. PayPal uses strong security systems and fraud protection tools, but users should still research trusted exchanges and understand that PayPal crypto purchases aren’t covered by UK financial compensation schemes.

What’s the Easiest Way to Buy Bitcoin with PayPal in the UK?

The easiest way to buy Bitcoin with PayPal in the UK right now is through MoonPay. It allows you to pay directly with your PayPal account, complete quick verification, and have your Bitcoin sent straight to your personal wallet without needing a traditional exchange account.

Is PayPal Planning to Bring Crypto Back to the UK?

PayPal has confirmed plans to restore its crypto services in the UK once it fully aligns with the Financial Conduct Authority’s updated regulations. The company hasn’t announced a specific date yet, but its public statements make it clear that users will soon be able to buy crypto on PayPal UK again once all compliance updates are completed.

Conclusion

Now you know how buying crypto with PayPal works for UK users and the different routes available while PayPal’s own service is paused. Using trusted platforms like MoonPay or regulated exchanges gives you the flexibility to move between pounds and digital currencies without relying on your bank. Still, always check the fees, confirm the platform’s security measures, and keep your crypto in a personal wallet for better control.

usdt

usdt xrp

xrp