Key Takeaway: Virgin Money does not directly support cryptocurrency trading or storage services. However, users can easily purchase digital currencies by transferring funds to regulated crypto exchanges compliant with the Financial Conduct Authority (FCA) standards.

For example, eToro is an FCA-registered platform that offers secure access to a wide selection of cryptocurrencies and accepts GBP deposits from Virgin Money accounts in the UK.

How to Buy Bitcoin with Virgin Money

Virgin Money customers wanting to purchase cryptocurrencies like Bitcoin, Ethereum, or Solana can do so by transferring funds from their Virgin Money account to an exchange regulated by the Financial Conduct Authority (FCA).

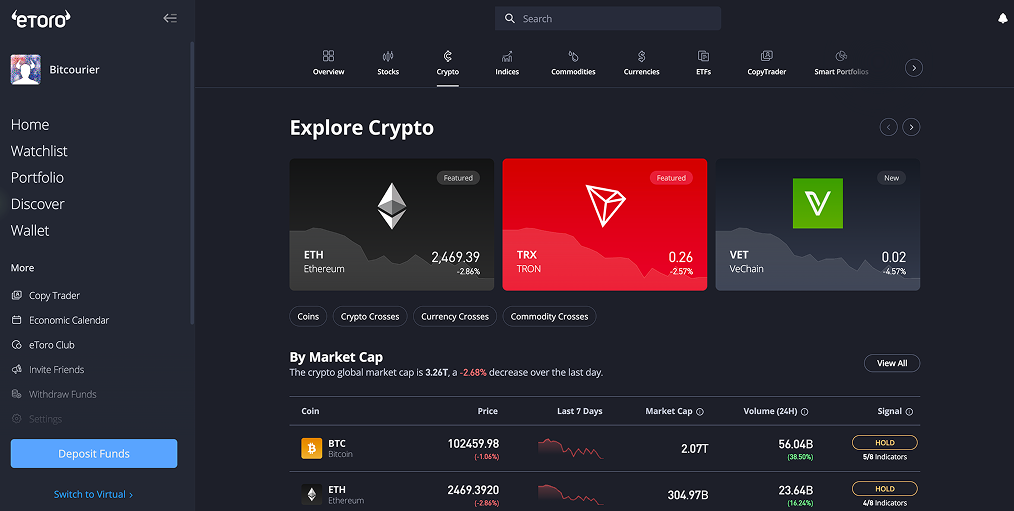

We suggest using eToro, an FCA-registered platform available to UK residents. eToro supports more than 70 cryptocurrencies and other financial instruments, including shares and ETFs.

Here is how to buy Bitcoin using Virgin Money and eToro in a few simple steps:

- Sign Up: Visit eToro's official site and register for an account. You will need to complete standard Know Your Customer (KYC) verification.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY - Deposit Funds: Log in to your eToro account and click “Deposit Funds.” Select GBP as your currency, choose your preferred payment method, and transfer funds directly from your Virgin Money account.

- Locate Bitcoin: Use the search feature to find Bitcoin by typing “Bitcoin” or “BTC,” then click “Trade.”

- Complete Your BTC Purchase: Enter the amount you wish to spend in GBP, verify all transaction details carefully, and confirm the purchase. Your Bitcoin will be credited to your eToro account promptly.

Virgin Money’s Policy on Crypto Transactions

Virgin Money does not offer direct crypto trading services, but it permits customers to transfer funds to regulated cryptocurrency exchanges. However, Virgin Money prohibits the use of its credit cards for purchasing cryptocurrencies, a policy implemented in 2018 to mitigate the risks associated with volatile digital assets and potential debt accumulation.

However, customers can still use their Virgin Money debit cards or initiate bank transfers to digital asset investment platforms registered with the Financial Conduct Authority (FCA). This allows customers to invest in a variety of cryptocurrencies while adhering to regulatory standards.

Crypto Trading Fees

If you’re a Virgin Money customer interested in buying crypto through exchanges, it's essential to fully understand the costs involved. Here's a clear breakdown of eToro's crypto trading fees:

- Trading Fees: eToro applies a 1% fee for all cryptocurrency trades. This fee is incorporated into the listed price during each transaction.

- Market Spread: eToro does not charge additional fees related to market spreads. However, customers should be aware of the gap between the buying and selling prices in the crypto markets, as these can fluctuate based on market conditions.

- Withdrawal Fees: There are no withdrawal fees when transferring your funds from eToro back into your Virgin Money account in GBP.

Thanks to eToro's transparent fee structure, Virgin Money customers can invest in cryptocurrencies clearly knowing all associated costs upfront, preventing any unwelcome financial surprises.

Best GBP Deposit Methods for Virgin Money

Virgin Money account holders can transfer GBP into crypto platforms through various options. Here are the recommended methods to deposit funds onto eToro when using Virgin Money:

- Debit Card Deposits: Virgin Money customers can deposit instantly onto eToro with their debit cards (Visa or MasterCard). These card transactions are processed immediately, enabling deposits of up to £30,000 per transaction.

- Bank Transfers (Faster Payments): Customers may transfer funds directly from their Virgin Money current accounts to eToro through standard bank transfers or Faster Payments.

- eToro Money: For larger transactions, Virgin Money users might consider eToro Money, which supports substantial deposits of up to £400,000 per transaction.

When selling crypto, Virgin Money customers can withdraw GBP from eToro to their Virgin Money accounts free of charge using the Faster Payments network.

What is Virgin Money?

Virgin Money is a prominent British retail and commercial bank, serving approximately 6.6 million customers across the United Kingdom. Established in 1995 as Virgin Direct by Sir Richard Branson, the bank has evolved through strategic acquisitions, including a merger with Clydesdale and Yorkshire Bank Group (CYBG) in 2018.

Headquartered in Glasgow, Virgin Money offers a comprehensive suite of financial products and services, such as current and savings accounts, mortgages, credit cards, insurance, and investment options.

Conclusion

While Virgin Money doesn’t offer direct crypto services, transferring funds to FCA-regulated platforms like eToro makes investing in Bitcoin and other digital assets straightforward.

Always ensure you clearly understand transaction fees, deposit options, and Virgin Money’s policies before starting. To confidently navigate crypto investments, stay informed, choose secure, regulated exchanges, and regularly review your investment strategy.

usdt

usdt xrp

xrp