Over the past few months, Hyperliquid has been making waves across the crypto space, quickly becoming one of the most talked-about names on social media. From screenshots of high-speed executions to discussions about its low fees and deep liquidity, the buzz has been impossible to ignore. In fact, Hyperliquid has already crossed billions in cumulative trading volume, reaching $330 billion monthly volume in July 2025. It is also seeing a steady uptick in active users, putting it in the spotlight as one of the fastest-rising decentralised exchanges. With the spotlight still on Aster DEX and its sensational growth, many traders are now turning their attention to Hyperliquid to compare what each platform offers and whether Hyperliquid presents a better alternative.

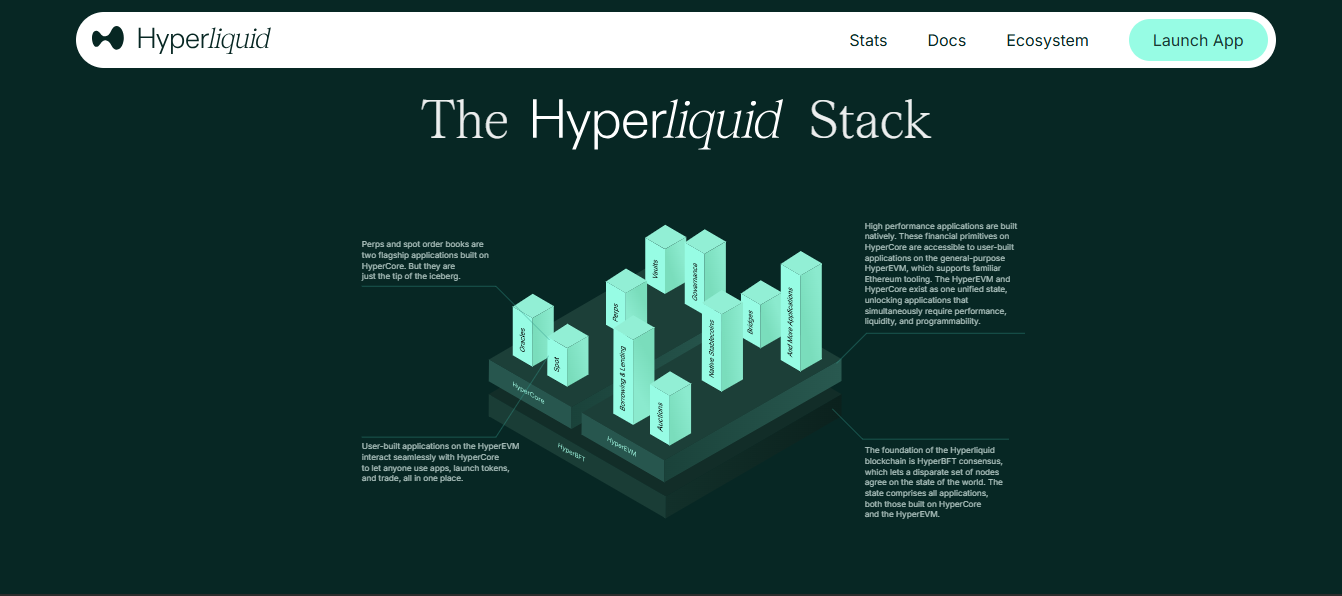

Hyperliquid is a decentralised exchange (DEX) built for speed, precision, and scalability, offering perpetual futures trading with a user experience that closely mirrors centralised exchanges. Its infrastructure is designed to give traders more control without compromising on performance, combining low fees, deep liquidity, and lightning-fast order execution. This mix of features has made it particularly attractive to those exploring perpetual trading options, those seeking new alternatives beyond Aster, and even former centralised exchange users who want a smoother transition into decentralised trading.

In this guide, we provide simple steps on how to start trading on Hyperliquid, how the platform works, actionable instructions on setting up and placing your first trades, and beginner-friendly insights that make the transition seamless.

What Makes Hyperliquid DEX Stand Out in the Market?

- High-Speed Order Execution

Hyperliquid is designed for speed, ensuring your trades are executed almost instantly. This reduces slippage, meaning you get the price you expect without delays. - Deep Liquidity Pools

The platform maintains strong liquidity across trading pairs, allowing you to enter and exit positions smoothly, even during high market volatility. This makes large trades less risky and more predictable. - Low Trading Fees

Compared to many competitors, Hyperliquid offers lower fees. Over time, this helps you keep more of your profits, especially if you trade frequently. - Perpetual Futures Focus

Hyperliquid specialises in perpetual contracts, giving you access to a variety of trading opportunities. This makes it a strong alternative if you’re seeking advanced trading tools outside of centralised exchanges. - CEX-Like User Experience

The interface feels familiar if you’re coming from centralised exchanges. You get advanced features like order books and charting tools, but with the added benefits of decentralisation and self-custody.

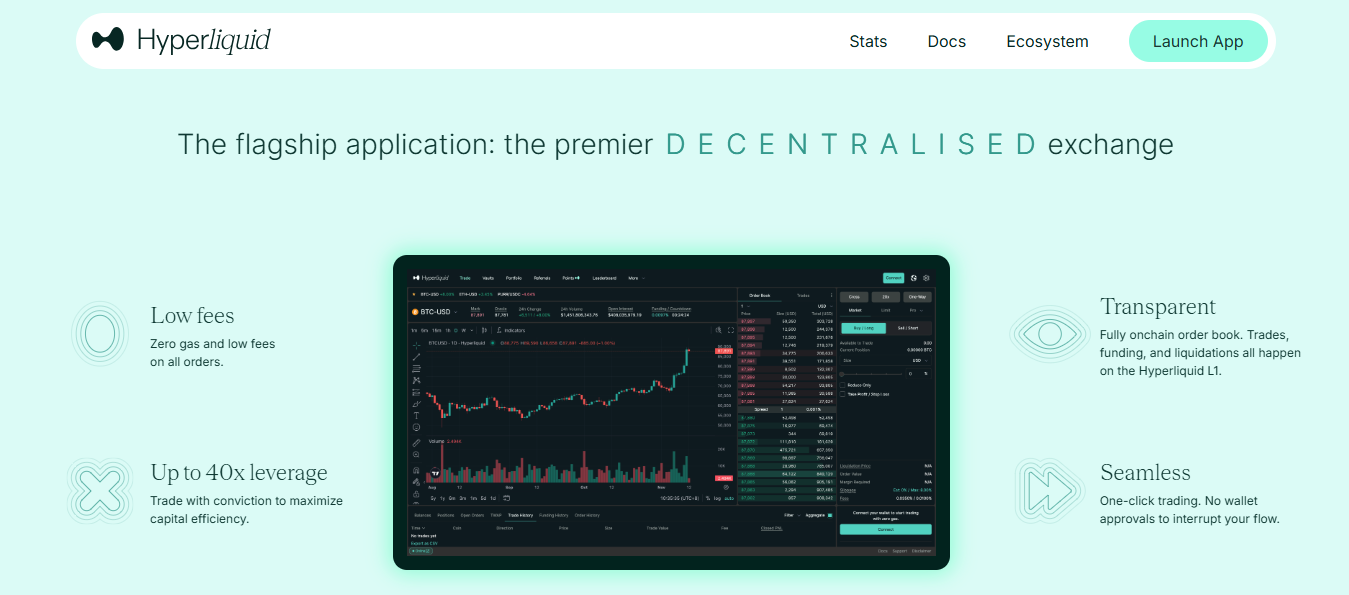

A Quick Overview of Hyperliquid Trading Dashboard

The Hyperliquid trading dashboard is designed to give you all the tools you need in one place without overwhelming you. Below are the seven main components you’ll use most often and how they support your trading experience.

- Market Selector and Price Chart

The first thing you’ll notice is the market selector, which allows you to switch between different trading pairs like BTC/USD or ETH/USD. Alongside this is the price chart, which shows live candlestick movements, customisable timeframes, and technical indicators such as moving averages. Together, these tools help you quickly identify trends, analyse price action, and decide on potential entry or exit points.

- On-chain Order Book and Market Depth

Hyperliquid uses an on-chain order book, meaning all buy and sell orders are publicly visible and verifiable on-chain. You can study the order book to understand market depth, see where major buying or selling clusters exist, and anticipate liquidity shifts.

- Order Entry and Execution Tools

This is where you actually place your trades. You can choose between market orders for instant execution or limit orders where you specify your preferred price. The panel also allows you to set order size, adjust leverage, and pick a margin mode, either cross margin, which uses your whole balance as collateral, or isolated margin, which limits risk to a specific position. Before submitting, you’ll see details like estimated fees, liquidation price, and required margin, helping you make informed decisions before executing a trade.

- Open Positions, Active Orders, and Trade History

Here, you’ll see your open positions along with details like entry price, size, unrealised profit or loss, leverage, and liquidation level. Any pending orders, such as unfilled limit or stop orders, are also displayed. Right below this, your trade history records every completed transaction, showing timestamps, fees, and execution details.

- Portfolio and Account Overview

The portfolio section displays your available balance, total margin being used, and your unrealised profit or loss across all trades. This section makes it easy to track how much capital you still have to trade with and how much risk exposure your current positions represent.

- Margin, Leverage, and Risk Indicators

Risk management tools are built directly into the dashboard to adjust leverage levels to increase or decrease your exposure depending on your strategy. The dashboard also clearly shows your liquidation price, giving you insight into how close your position is to being closed automatically. Funding rate information and fee structures are displayed here as well, helping you anticipate ongoing costs and manage risk responsibly.

6 Steps to Start Trading on Hyperliquid DEX

- Set up a crypto wallet by creating a decentralised wallet such as MetaMask to securely manage your funds.

- Fund your wallet by purchasing crypto like USDC on an exchange and transferring it to your wallet address.

- Visit the official Hyperliquid site and link your wallet to the platform.

- Move your assets from your wallet into Hyperliquid for trading use.

- Familiarise yourself with the charts, order book, and trading tools provided.

- Place Your First Trade by selecting a pair, setting your order type and amount, then confirming to execute the trade.

How to Start Trading on Hyperliquid on the Go

- Connect Your Wallet on Desktop

Begin by connecting your wallet extension, such as Rabby, to your desktop. This will serve as the primary wallet that authorises your mobile connection. - Open the Mobile Connection Option

On your phone, tap the “Connect” button and select “Link Desktop Wallet.” This option allows your phone to pair directly with your desktop wallet for trading access. - Generate the QR Code on Desktop

On your desktop screen, click the PC + mobile icon located at the top right corner of the navigation bar. A pop-up will appear in your wallet extension, which you need to sign. Once signed, a QR code will be displayed. - Scan the QR Code with Your Phone

Use your phone camera to scan the QR code displayed on your desktop. This securely links your mobile device with your desktop wallet connection. - Start Trading on the Go

Once connected, you can now access Hyperliquid directly from your phone. This setup allows you to monitor the market, place orders, and manage trades anytime, anywhere.

Hyperliquid Trading Fees Explained

Hyperliquid uses a clear but dynamic fee system designed to reward active traders and liquidity providers. When you place a trade that fills instantly, you pay a taker fee, while orders that rest on the book pay a lower maker fee, with higher-volume makers even earning rebates. The platform uses a 14-day rolling volume to decide your tier, and spot trades count double toward this threshold, which helps reduce fees faster. At the base level, expect taker fees around 0.045% and maker fees around 0.015%, though staking HYPE tokens can cut these costs by up to 40%. As you trade more, fees drop progressively across higher tiers, making the system favorable for frequent traders. Hyperliquid also provides referral discounts and rewards, offering extra ways to save. Importantly, the exchange eliminates gas costs for trades, while withdrawals carry only a small flat fee, ensuring transparency with no hidden charges.

FAQs

Does Hyperliquid DEX Require KYC for Trading?

Trading on Hyperliquid DEX does not require KYC. As a decentralised exchange, it allows you to connect a compatible crypto wallet and begin trading without submitting personal documents or undergoing identity checks. This process ensures you maintain full control of your assets and privacy while interacting directly with the protocol. For those looking to trade crypto on Hyperliquid, the absence of KYC makes access faster and more inclusive, particularly for traders seeking alternatives to centralised platforms.

What Assets Can I Trade on Hyperliquid?

Hyperliquid offers access to an extensive selection of perpetual contracts, allowing traders to engage with both established cryptocurrencies and emerging tokens. You can trade perpetuals on Hyperliquid for leading assets such as Bitcoin (BTC), Ethereum (ETH), Cosmos (ATOM), and Polygon (MATIC). In addition, the exchange includes pre-market listings for newer projects like LayerZero (ZRO), Blast (BLAST), Jupiter (JUP), and EigenLayer (EIGEN). Altogether, the platform supports more than 135 trading pairs across multiple categories, offering broad exposure to both major and developing digital assets.

What Crypto Wallet is the Best for Trading on Hyperliquid DEX?

The most reliable wallet for trading on Hyperliquid DEX is Rabby Wallet. It is highly compatible with the platform, offering secure on-chain interactions and smooth connectivity for both desktop and mobile access. Rabby supports advanced features such as multi-chain asset management and direct dApp integration, making it particularly suitable for executing trades without disruptions. If you are exploring how to trade on Hyperliquid, Rabby Wallet stands out as the strongest option due to its reliability, efficiency, and strong security framework.

Is USDC the Only Trading Collateral Option on Hyperliquid?

USDC is no longer the sole collateral option on Hyperliquid. The exchange recently introduced USDH, its native stablecoin issued by Native Markets after a governance-led auction. USDH is fully backed by a mix of on-chain and off-chain assets, including cash and U.S. Treasuries, with its backing continuously verified through oracles. It can now be used as margin and collateral alongside USDC, giving market participants greater flexibility. This development reduces reliance on external stablecoins and broadens options when executing your first trade on Hyperliquid or managing ongoing positions.

Conclusion

A clear takeaway from this guide to trading on Hyperliquid is the importance of preparation and discipline before engaging the market. Beyond its technology and fee advantages, what sets Hyperliquid apart is the way it positions itself against established decentralised exchanges through consistent innovation and trader-focused upgrades. For you, this translates to a platform that can adapt to market demands while offering stability and precision. By mastering its tools early, you secure an edge that may prove valuable as competition across DEXs intensifies.

usdt

usdt bnb

bnb