The rivalry between Aster vs Hyperliquid is quickly becoming one of the hottest topics in decentralized trading. Hyperliquid is known for perpetual contracts, offering deep liquidity and smooth access for active users. Aster, on the other hand, has entered as a strong challenger with faster execution and fresh products. It also brings a new style of user engagement.

Key takeaway: use MEXC for buying. You can still participate in Aster Airdrop and buy the currency on its native decentralised platform asterdex.com via this link.

So what makes this clash exciting? And which platform better fits your needs as a trader? In this guide, we’ll break things down side by side. From fees and leverage to innovation and trust, you’ll see exactly how both compare. The aim isn’t to choose a winner but to show you what this rivalry means. It could influence your strategies and the future of liquidity in decentralized finance (DeFi).

Why is the Aster launch a real challenge for Hyperliquid?

Hyperliquid has long dominated the decentralized perpetuals market. Its reputation for deep liquidity and smooth execution made it a favorite for many. The platform’s steady user growth has reinforced its place as a trusted venue for active trading.

Now Aster has entered the scene with a different message. It promises faster execution and simpler onboarding for new users. Unlike others, it positions itself as a community-driven exchange where governance gives users more influence.

Why does this matter? As many traders seek alternatives, older DEXs struggle with congestion, higher fees, and scaling issues. Aster markets itself as a direct answer to those pain points.

Instead of copying every existing feature, Aster focuses on leveraging products, competitive fees, and stronger transparency. This approach has sparked claims that it already outshines Hyperliquid in some areas.

The rivalry is not only about products. Aster is also shaping culture with stronger community engagement and visible momentum. This pressure forces Hyperliquid to defend its position more actively, creating a high-stakes competition.

Where is Hyperliquid already losing to Aster?

Hyperliquid has always relied on strong liquidity, but Aster is catching up in key trading pairs. Some users have already moved over, drawn by Aster’s early momentum.

Onboarding is another challenge. Aster offers a simple wallet connection and a clean interface that feels welcoming. Hyperliquid, while powerful, can seem intimidating to newcomers. Isn’t ease of access often the first thing beginners look for?

Fees also show a divide. Smaller positions often find cheaper terms on Aster, while Hyperliquid still benefits from larger orders. This difference gives Aster an advantage with everyday users, not just whales.

Community engagement further tilts the balance. Aster has grown through grassroots campaigns and strong user discussions. Hyperliquid, meanwhile, built its base gradually without the same buzz.

Innovation speed is another key factor. Hyperliquid focuses on stability, but Aster rolls out updates and features quickly. To many, it feels like Aster is moving faster.

Transparency matters too. Aster highlights audits and open communication, while Hyperliquid has faced criticism for not being as clear. Without adjustments, Hyperliquid risks losing trust to a rival that listens more closely.

Key Aster Features & Products

Aster is built for both beginners and advanced traders. Its focus is speed, ease of use, and flexible trading options.

- Spot Trading: Easily buy or sell popular cryptocurrencies using a clear dashboard. Ideal for those learning how markets work.

- Perpetual Contracts (Perp DEX): Trade assets with leverage. High liquidity ensures smooth pricing even during rapid market moves.

- Smart Order Options: Use limit, stop-limit, and conditional orders to manage trades and reduce risk exposure.

- Custom Leverage Levels: Adjust leverage for each market. This allows users to pursue bigger opportunities or protect against losses.

- Advanced Trader Mode: Unlock detailed charts and technical indicators. Faster execution helps active traders respond to trends efficiently.

- High-Leverage 1001x Mode: Offers extreme leverage for experienced traders. High reward potential comes with higher risk.

- Liquidity Programs: Provide funds to liquidity pools and earn a share of trading fees, helping improve market depth.

- Token Staking & Governance: Stake $ASTER tokens to vote on proposals and earn rewards, influencing platform decisions.

- Mobile Trading: Track markets and execute trades from anywhere. The mobile app mirrors desktop functionality for convenience.

- Community & Referral Benefits: Earn incentives by inviting friends and participating in community activities, growing the platform.

- Loyalty Rewards: Collect points, bonuses, and perks for consistent trading. Encourages long-term participation and active engagement.

Notably, Aster blends simplicity with professional tools. Beginners find it easy to navigate, while experienced traders can access all essential trading features.

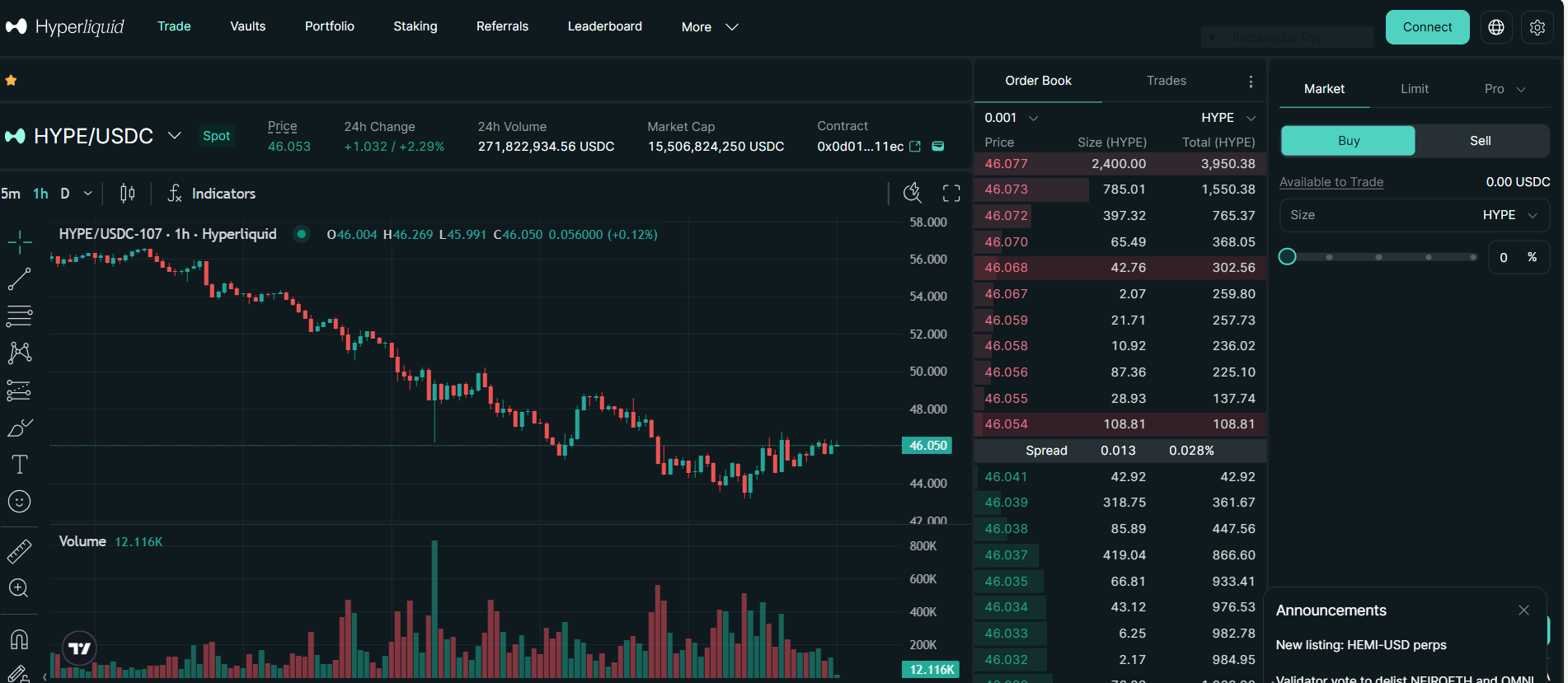

Key Hyperliquid Features & Products

Hyperliquid is designed for traders who value liquidity, stability, and professional-grade tools. It caters to active and high-volume participants.

- Deep Liquidity: The platform maintains strong order books, enabling large trades without heavy slippage. This attracts high-volume users.

- Perpetual Contracts (Perp DEX): Offers leveraged trading across multiple assets. Execution speed is optimized for fast market movements.

- Tiered Fee System: Fees decrease as trading volume increases, rewarding frequent or high-volume participants while remaining predictable for others.

- Advanced Order Tools: Supports stop, limit, and conditional orders. These help traders manage risk during volatile periods.

- Professional Dashboard: Features real-time charts, performance metrics, and detailed analytics for experienced users.

- Flexible Leverage: Multiple leverage levels allow tailored trading strategies, from moderate exposure to aggressive positions.

- Strong Security: Implements tested smart contracts and platform safeguards to protect funds and prevent unauthorized access.

- High-Volume Optimization: Infrastructure is stable under pressure, maintaining performance even during sudden market spikes.

- Mobile Access: Full-function app lets traders monitor positions, execute orders, and track performance on the go.

- Community Support: Active forums, updates, and announcements help users stay informed and engaged with platform changes.

Hyperliquid emphasizes stability and efficiency. Its deep liquidity, professional tools, and tiered fees appeal to active traders who prioritize reliability and high-volume performance.

Aster and Hyperliquid Fees Compared

Aster focuses on clear and fair fees for all users. Maker fees are kept low, helping smaller and mid-size participants. Clear pricing and no hidden charges build trust and make the platform approachable for new traders.

Hyperliquid’s fee model suits high-volume participants. Discounts are offered for larger positions, giving professional users advantages on heavy turnover. The structure is tiered, which works well for experienced traders managing big trades.

Overall, fee design is a key factor when choosing a platform. Aster appeals to everyday traders looking for cost-efficient access. Hyperliquid attracts those handling large positions who value savings at scale. Understanding costs upfront helps users plan trades better and decide which exchange fits their trading style.

How do Aster and Hyperliquid compete in leverage offerings?

Hyperliquid is known for offering very high leverage. This attracts users looking for bigger opportunities and more exposure. The platform also has a strong reputation for reliable execution, which helps users handle the risks of large positions.

Aster takes a different approach to leverage. Instead of just offering high numbers, it focuses on safety tools. Adjustable position caps and protective measures give users more control, which appeals to cautious participants.

So, who should choose which platform? Hyperliquid suits advanced users who want maximum exposure. Aster works better for those who want leverage but prefer safety.

This difference creates two distinct user bases. Hyperliquid and Aster are not just competing in numbers but in style and user experience. Market trends suggest Aster is gaining ground in risk-adjusted leverage. Yet Hyperliquid keeps its edge in raw leverage capacity, keeping both platforms useful for different strategies.

Did Aster bring more innovations to the market than Hyperliquid?

Yes, Aster has quickly built a reputation as a fast-moving and experimental platform. It frequently launches new products. These include tools that make leverage safer, transparency dashboards, and simpler onboarding features. Aster also supports community-driven governance, letting token holders vote on platform decisions. These updates make many users feel Aster is faster at innovating than Hyperliquid.

What about Hyperliquid? Hyperliquid takes a more cautious approach. It focuses on stability, deep liquidity, and reliable infrastructure. This reduces the risk of failed experiments but can feel slower in releasing new features. Many users see it as consistent but less dynamic than newer competitors.

Overall, the two platforms have very different strategies. Aster pushes boundaries and experiments aggressively. Hyperliquid relies on proven reliability, appealing to users who value stability over speed.

Trust & Security: Does Aster have an edge over Hyperliquid?

Aster takes security seriously by introducing new ways to protect user funds. It relies on multi-signature wallets, strong encryption, and regular audits. There’s also a bug bounty program that rewards people who find vulnerabilities. These measures help build trust, but being a newer platform, Aster hasn’t yet faced long-term market stress.

How does Hyperliquid compare? Hyperliquid has proven itself over years of operation. Its system handles large trading volumes reliably, and deep liquidity protects against market manipulation. Security has remained solid with no major breaches. Still, it uses more centralized oversight, making it less decentralized than Aster.

In short, Aster experiments with modern security tools, while Hyperliquid sticks to a proven, stable approach. Users must decide if they value innovation or reliability more.

Conclusion

Aster’s arrival has shaken up decentralized derivatives trading. Its fast innovation and new features quickly drew attention. Hyperliquid still holds strong with deep liquidity and a loyal user base that values stability over new ideas.

Both platforms shine in different ways. Aster attracts users who want fresh tools and flexibility, while Hyperliquid suits those who prefer steady performance. Choosing between them depends on what matters most to you: trying new possibilities or relying on proven reliability.

usdt

usdt bnb

bnb