As the UK government becomes more crypto-friendly with its regulatory stance, local investors have explored various ways to earn from the vast industry. Decentralized finance (DeFi) is one way many do this. However, you need a decentralized exchange (DEX) to access these DeFi protocols. This article discusses the best decentralized crypto exchanges in the UK.

We will highlight how these DEXs operate, their pros and cons, and digital wallets that allow you to use them.

Table of Contents

Top 5 Decentralized Crypto Exchanges in the UK Reviewed

A decentralized cryptocurrency exchange is a platform that enables users to buy, sell, swap, and trade crypto assets without the need for an intermediary. Using blockchain technology, users possess 100% ownership and control over their digital assets and how they are used across DeFi projects.

This is the opposite of what is seen within centralized exchanges (CEXs), where users entrust their assets’ safety to the exchanges. CEXs must also undergo a know your customer (KYC) assessment before accessing their preferred services. Because of this, most centralized exchanges are open to limited countries.

Whether you are new or experienced within the DeFi ecosystem, here is a list of the five top platforms for decentralized digital currency trading:

- Uniswap

- Curve Finance

- SushiSwap

- Balancer

- PancakeSwap

Uniswap

Uniswap is a decentralized exchange built on the Ethereum network. It is also the leading DEX on the layer-1 blockchain. The decentralized cryptocurrency exchange is compatible with over 10 blockchains such as Polygon, BNB Chain, Avalanche, Base, Zora, and Arbitrum. In February 2025, Uniswap revealed the launch of its Ethereum layer-2 network, Unichain. These compatibilities allow Uniswap to support cryptocurrencies on these blockchain networks.

Being one of the earliest DeFi projects, Uniswap has emerged as a top choice for users who want to swap and trade cryptocurrencies. According to on-chain data from DeFi aggregator DefiLlama, the DEX has a daily traded volume of £8.082 billion. This figure is significantly higher than every other DEX on the market, indicating the exchange’s market dominance.

Uniswap allows users to earn cryptocurrencies by depositing their assets into liquidity pools. The availability of these digital currencies allows the decentralized exchange to operate as an automated market maker (AMM), enabling traders to execute buy and sell trades governed by smart contracts.

The leading DEX also has a native cryptocurrency called UNI, which serves as a governance asset for partaking in voting activities. UNI holders can also stake their holdings to support the protocol’s security and boost their earnings.

Users can access Uniswap through a crypto wallet with a DeFi browser. Interestingly, the platform has a native wallet, dubbed the Uniswap Wallet.

Pros

- Available on over 11 blockchains.

- Supports governance through its native UNI token.

- Market dominance.

- Supports staking.

- Supports thousands of tokens.

- Native crypto wallet.

Cons

- High gas fees for blockchains like Ethereum.

- Pseudonymous nature makes the DEX a go-to option for hackers.

Trading Fees: Uniswap v3 has four fee tiers – 0.01%, 0.05%, 0.3%, and 1%. Its v4 has flexible fees ranging from 0% to 100%.

Payment options: Credit/debit cards, bank transfer, Robinhood, MoonPay, and Transak.

Number of crypto available: 1,270 cryptocurrencies.

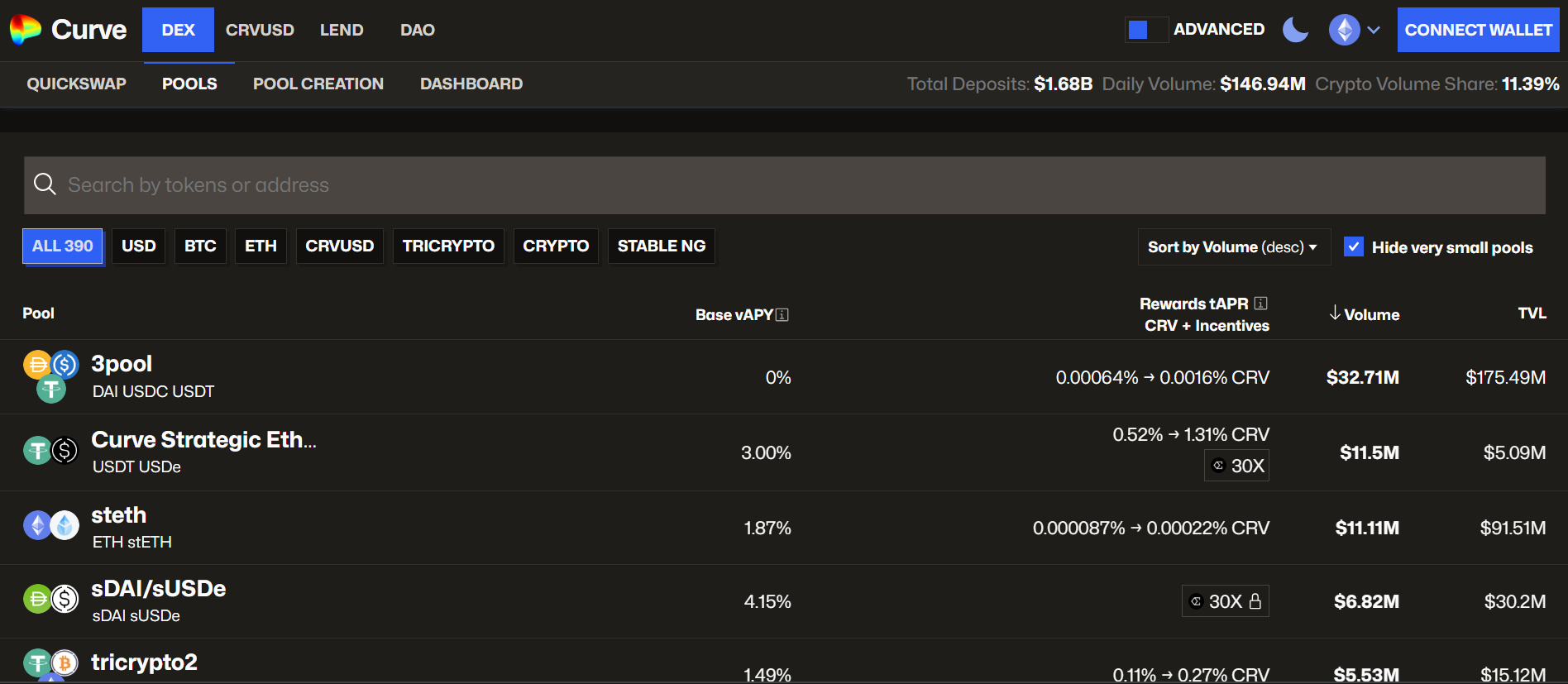

Curve Finance

Curve Finance is another decentralized exchange native to the Ethereum network. It features various cryptocurrencies, such as stablecoins, Bitcoin, and wrapped versions of existing digital assets. The DeFi protocol also supports other blockchain networks, such as those compatible with the Ethereum Virtual Machine (EVM). These include Polygon, Base, Arbitrum, and Optimism.

Despite featuring an umbrella of cryptocurrencies, Curve Finance establishes its presence as a stablecoin provider. This approach distinguishes it from other DEXs in the market. The liquidity pools in the DEX feature stablecoins and wrapped tokens. Since stablecoins’ values are relatively stable, Curve Finance features low fees and slippage. Liquidity providers benefit from fees within the Curve ecosystem. Users also earn from Curve Finance through its lending functionality.

Curve Finance has a native token, CRV, a governance token. It allows holders to participate in voting processes that define the project’s growth. The decentralized exchange also has its stablecoin, crvUSD. The stablecoin can be borrowed against various crypto collaterals within the DEX’s ecosystem.

Pros

- Supports decentralized lending.

- Supports various cryptocurrencies.

- Focuses on stablecoins.

- Supports Ethereum and EVM-compatible networks.

- Features on-chain governance.

Cons

- Complex interface for beginners.

- Lack of support for blockchains outside Ethereum and EVM-compatible networks.

Trading Fees: 0.04% of traded amount

Payment options: Cryptocurrencies.

Number of crypto available: 389 cryptocurrencies

SushiSwap

SushiSwap is a decentralized trading platform built on the Ethereum network. Forked from Uniswap, SushiSwap allows users to swap and trade cryptocurrencies without needing conventional market makers. Like other DEXs, the exchange relies on its automated market maker model, a smart contract-enabled mechanism that allows traders to buy or sell assets from a liquidity pool. SushiSwap rewards users who deposit their holdings into the liquidity pool (liquidity providers).

This decentralized digital currency trading platform supports over 40 blockchains in addition to Ethereum. Some include the Aptos, BNB Chain, Avalanche, Mantle, and Tron blockchain networks. The DeFi protocols also facilitate cross-chain swaps from supported networks like Ethereum and Arbitrum.

SushiSwap’s native cryptocurrency, SUSHI, powers the project’s governance. It allows token holders to participate in voting activities within the Sushi DAO (decentralized autonomous organization). SUSHI holders also get portions of the platform’s fees.

Pros

- Supports multiple blockchains.

- Forked from Uniswap.

- Facilitates cross-chain swaps.

- Features governance privileges.

- Rewards from trading fees to SUSHI holders.

Cons

- Supports fewer cryptocurrencies compared to rival platforms.

- History of security incidents (Sushi Saga).

Trading Fees: 0.3% fee on trades.

Payment options: The DEX does not have payment options. Instead, users swap cryptocurrencies using their existing digital assets.

Number of crypto available: 276 cryptocurrencies.

Balancer

Balancer is a decentralized exchange that distinguishes itself by its approach to its AMM model and liquidity provision. Most AMM platforms require liquidity providers to deposit equal amounts of two cryptocurrencies. However, Balancer allows users to provide liquidity for up to eight crypto assets in its liquidity pool, commonly called the Balancer Pool. This allows LP providers to increase their earnings and boost the available liquidity on the DEX.

Although native to the Ethereum network, Balancer supports EVM-compatible blockchains like Arbitrum, Base, Optimism, and Polygon. Its native token, BAL, is usable within its governance platform. This way, token holders can vote on proposals, modifications, and upgrades presented to the DAO.

Pros

- Supports variable weightings in the liquidity pool.

- Compatible with Ethereum and EVM-supported chains.

- Supports decentralized governance.

- Features more liquidity provider rewards than most DEXs.

Cons

- Platform complexity for novice traders.

- Heavy dependence on Ethereum.

- Supports fewer cryptocurrencies compared to rival DEXs.

Trading Fees: Ranges between 0.0001% and 10% of the traded amount.

Payment options: The DEX does not support a specific payment option. Instead, users depend on the Sway feature to buy or sell their desired digital asset.

Number of crypto available: 97 cryptocurrencies.

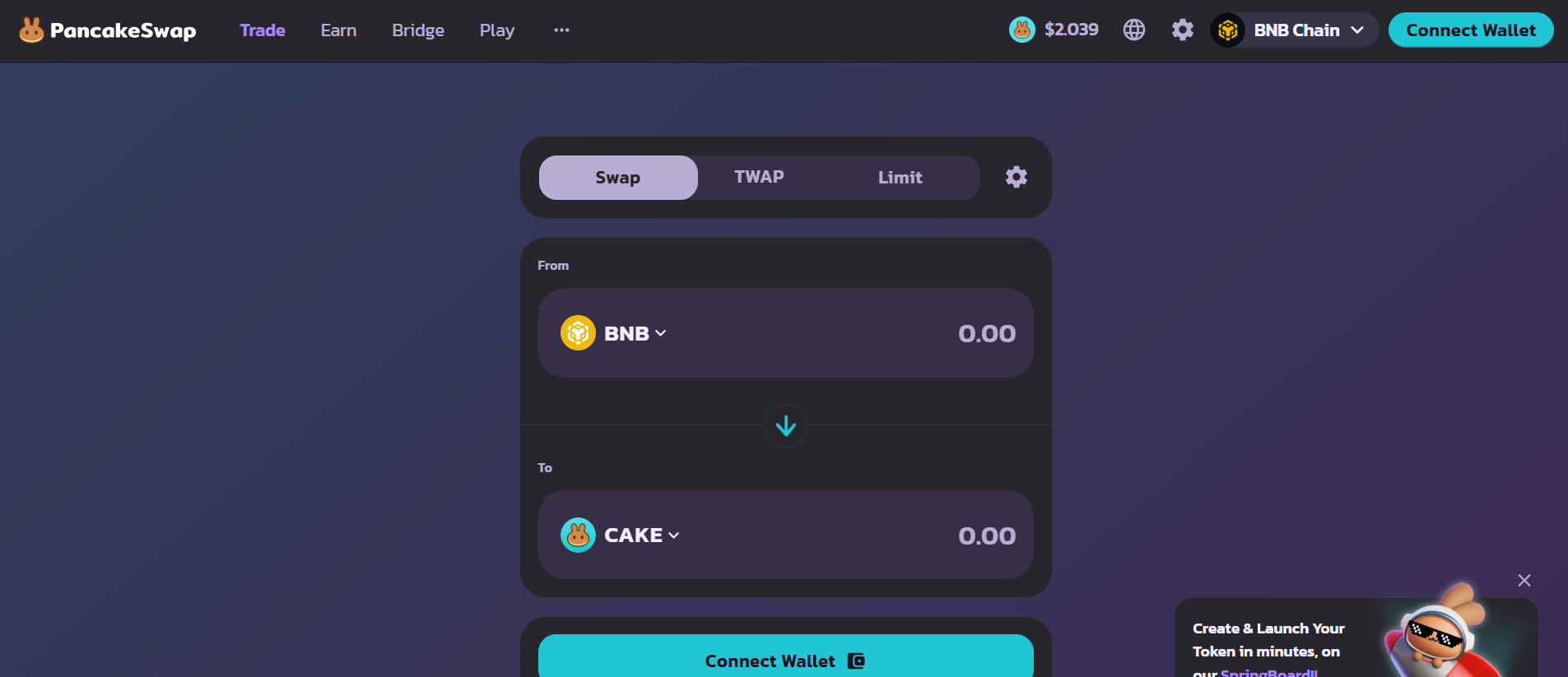

PancakeSwap

PancakeSwap is a decentralized exchange built on the BNB Chain, implying that it features BEP-20 tokens. The DEX also supports 10 other blockchain networks, such as Ethereum, Solana, Linea, Base, Arbitrum, and Polygon. This paves the way for PancakeSwap to support swaps for numerous cryptocurrencies.

PancakeSwap’s selling point is its suite of services, a feat uncommon in the DEX market. In addition to providing an AMM model, the decentralized trading platform also features a lottery, non-fungible tokens (NFTs), staking, prediction, yield farming, and more.

The DEX’s native token, CAKE, is at the center of the exchange’s operations. In addition to governance rights, token holders can stake or farm their CAKE holdings to boost earnings. The CAKE token undergoes periodic token burns, reducing its circulating supply in the hopes of boosting its value.

Pros

- Supports decentralized governance.

- Features diverse utilities, like staking, NFTs, and a prediction market.

- Available on multiple blockchains.

- Supports many cryptocurrencies.

- Supports token burns to boost valuation.

Cons

- Services can be complex for beginners.

- Network congestion due to popularity.

- Risk of fund loss from services like the lottery and prediction.

Trading Fees: 0.25% of the amount traded.

Payment options: Credit/debit cards, cryptocurrencies, bank transfers, and third-party options like iDEAL and PayID.

Number of crypto available: 2,186 cryptocurrencies.

5 best non-custodial wallets for safe DEX trading

Ledger

Ledger is a hardware wallet that keeps cryptocurrencies safe by enabling offline storage. This makes the wallet a top choice for investors seeking protection from hackers. A drawback to this option is that users must spend a specific amount to purchase the physical wallet holding their assets. Since Ledger safekeeps users’ funds offline, they need a digital wallet like Ledger Live to manage their assets. Ledger Live also allows users to invest funds in their desired DeFi protocol.

MetaMask

MetaMask is a non-custodial wallet that allows users to buy, sell, and trade their desired cryptocurrencies. More than 21 million users use it through a browser extension or mobile app to manage their crypto. Although it natively supports the Ethereum network, it also integrates blockchains like Avalanche, Arbitrum, BNB Chain, Base, and Optimism. MetaMask is a go-to platform for accessing decentralized exchanges compatible with the supported blockchains. As a non-custodial wallet, users completely control their private keys and assets.

Trust Wallet

Trust Wallet is another widely known non-custodial wallet that crypto traders use. Being a non-custodial wallet, the platform allows users to access its services regardless of their geographical location. The digital wallet natively supports the BNB Smart Chain. Over time, it incorporated other networks like Bitcoin, Ethereum, Solana, Tron, Avalanche, Stellar, and about 100 others. The wallet supports over 10 million cryptocurrencies. It also connects multiple decentralized exchanges like those discussed in this article.

Atomic Wallet

Atomic Wallet is another non-custodial wallet that allows users to access decentralized finance (DeFi) protocols like decentralized exchanges. Users can also stake on the platform to boost their earnings. The wallet also allows users to purchase or sell over 1,000 cryptocurrencies using supported payment options. The wallet provider prioritizes security, decentralization, and anonymity. It also has a customer support center and a knowledge base where users can educate themselves regardless of their expertise level.

Phantom

Launched in 2020, Phantom emerged as a non-custodial wallet for the Solana community. It is a top choice because of its user-friendly interface and its seamless integration with DeFi protocols and memecoins. The wallet also features trending projects and websites, and a learn section. Although native to Solana, Phantom has added support for other blockchain networks like Ethereum, Base, and Polygon. Like most non-custodial wallets, Phantom incorporates biometric security for an extra layer of protection.

FAQs

Is it legal to use DEXs in the UK?

Yes, using decentralized exchanges (DEXs) is legal in the UK. Just follow financial rules, especially anti-money laundering (AML) regulations. The UK government monitors the cryptocurrency space, so staying informed about possible changes is a good idea.

Can I buy cryptocurrencies with GBP directly on a DEX in the UK?

Usually, you cannot buy cryptocurrencies directly with GBP on most DEXs. Instead, you typically swap cryptocurrencies. You must convert your GBP into a cryptocurrency like ETH or stablecoins like USDT on a centralized exchange or digital wallet. Next, you can transfer it to the DEX.

Which hybrid crypto exchanges are available in the UK?

In the UK, some hybrid exchanges include Coinbase and OKX. These platforms let users trade on centralized and decentralized networks through their wallet sections. This way, they combine the speed of centralized exchanges with the security and privacy of decentralized exchanges.

Conclusion

Decentralized exchanges are a game-changer within the DeFi sector, allowing users to explore the decentralized facet of crypto more deeply. This article explored the five best decentralized crypto exchanges. We also highlighted digital wallets that enable access to these protocols. Be sure to do adequate research before deciding which platform to invest in.

usdt

usdt xrp

xrp