No-KYC crypto exchanges allow users to trade and withdraw cryptocurrencies without identity verification, offering an essential solution for those prioritizing anonymity or navigating restrictions in heavily regulated regions like China and parts of Russia.

These platforms, either centralized with minimal compliance or decentralized using blockchain technology, provide access to spot trading, derivatives, and fiat onramps.

Table of Contents

For 2026, we analyzed the top exchanges based on security, fees, trading features, and asset availability to help users select the best option.

Top No-KYC Crypto Exchanges for 2026

This list highlights the top five no-KYC exchanges, both centralized and decentralized, chosen for their security, features, and suitability for privacy-focused users or those in restrictive regions.

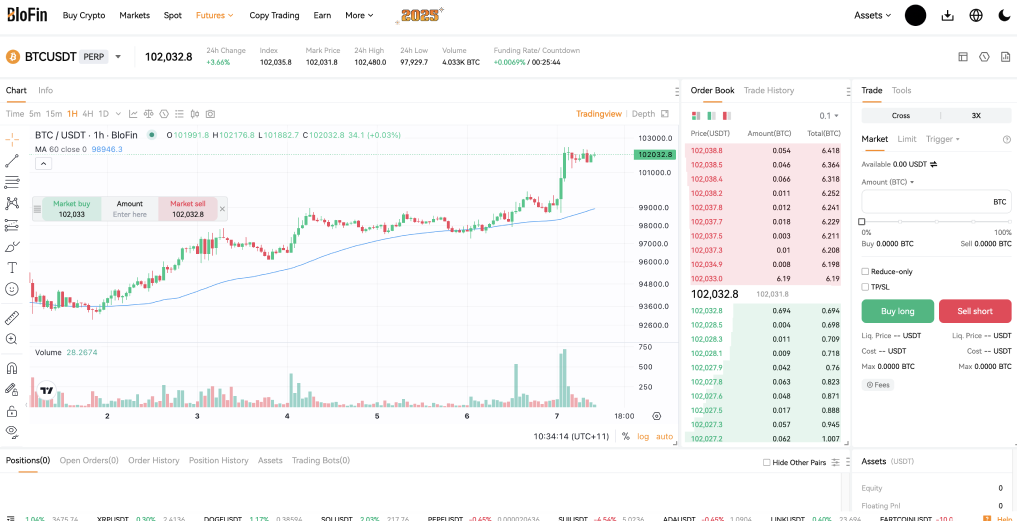

1. BloFin - Best and Most Trusted No KYC Crypto Exchange

BloFin is the largest no-KYC crypto exchange, trusted by over 5 million users globally. Operating as a centralized platform, it offers support for 650+ trading pairs and futures contracts with leverage up to 150x.

With competitive fees of 0.02% for makers and 0.06% for takers, BloFin enables users to withdraw up to $20,000 daily without identity verification. Fiat onramps are available, enhancing accessibility for traders worldwide.

BloFin had audited security through a 1:1 proof-of-reserves system, safeguarding over $59 million in assets. Its advanced tools, including demo trading, trading bots, and copy trading, make it suitable for traders of all experience levels.

Key Features:

- 650+ assets available for spot and futures trading.

- High leverage (up to 150x) for advanced trading strategies.

- Proof-of-reserves ensuring transparency and security.

- No KYC required for trading or withdrawals.

Advantages:

- Trusted by over 5 million users.

- Competitive fees and robust liquidity.

- Large daily withdrawal limits with privacy-focused operations.

Limitations:

- Less liquidity in perpetuals futures markets than CEXs like Binance and Bybit.

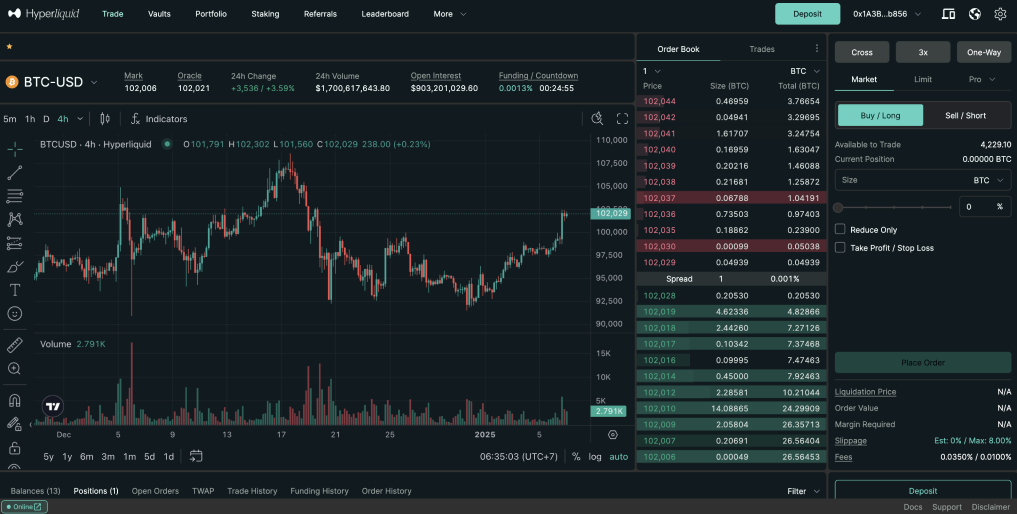

2. Hyperliquid - Top No KYC Decentralized Perpetuals Platform

Hyperliquid, with over 250,000 users and $3.6 billion in daily trading volume, is the leading decentralized no-KYC exchange. Built on the Hyperliquid L1 blockchain, it combines CEX-level speed with DeFi transparency, supporting 150+ assets, including BTC, ETH, and SOL, with up to 20x leverage on perpetual futures.

Key innovations include gas-free trading, on-chain order books, and Ethereum compatibility through the HyperEVM, enabling seamless integration with ERC-20 tokens and dApps. The HLP Vault enhances liquidity by allowing USDC deposits to earn yield from trading fees.

Hyperliquid’s community-first model is reinforced by $HYPE tokenomics, focusing on fair distribution and governance without venture capital influence.

Key Features:

- Hyperliquid L1 with sub-second order execution.

- Gas-free trading and EVM compatibility for dApp integration.

- 150+ assets with up to 20x leverage on perpetual contracts.

Advantages:

- CEX-level efficiency with full DeFi transparency.

- High liquidity and yield opportunities via HLP Vault.

Limitations:

- Requires familiarity with blockchain wallets and DeFi tools.

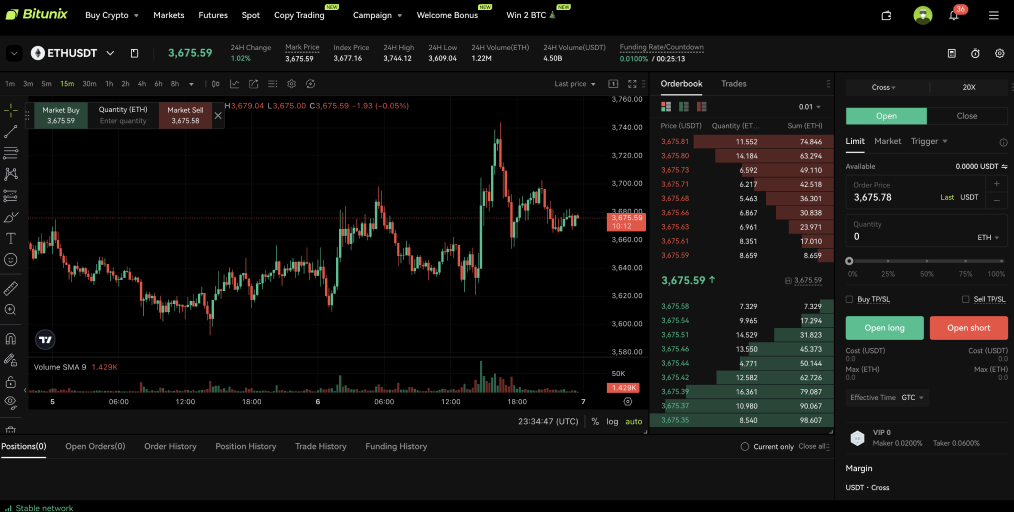

3. Bitunix - Popular Centralized No KYC Alternative to BloFin

Bitunix, based in Hong Kong, is a leading no-KYC crypto exchange known for its robust trading features, deep liquidity, and exceptional withdrawal limits. The platform supports over 500 trading pairs and futures contracts with up to 100x leverage.

Users can withdraw up to $500,000 daily without identity verification, making it an excellent choice for high-volume traders prioritizing privacy. Fiat onramps further enhance accessibility, allowing deposits via debit and credit cards.

Founded in 2021, Bitunix processes $5 billion in daily trading volume and employs a rigorous proof-of-reserves system. With collateralization ratios of 400% for Bitcoin and 230% for Ethereum, the platform ensures a high level of asset security and transparency.

Key Features:

- Over 500 trading pairs with up to 100x leverage on futures.

- Industry-leading no-KYC withdrawal limit of $500,000 daily.

- Proof-of-reserves system with high collateral ratios for BTC and ETH.

- Fiat onramps supporting debit/credit cards for easy deposits.

Advantages:

- Exceptional withdrawal limits for privacy-focused users.

- Strong asset security through transparent reserves.

- High trading volume ensures deep liquidity.

Limitations:

- Considered less secure and trusted than alternatives like BloFin.

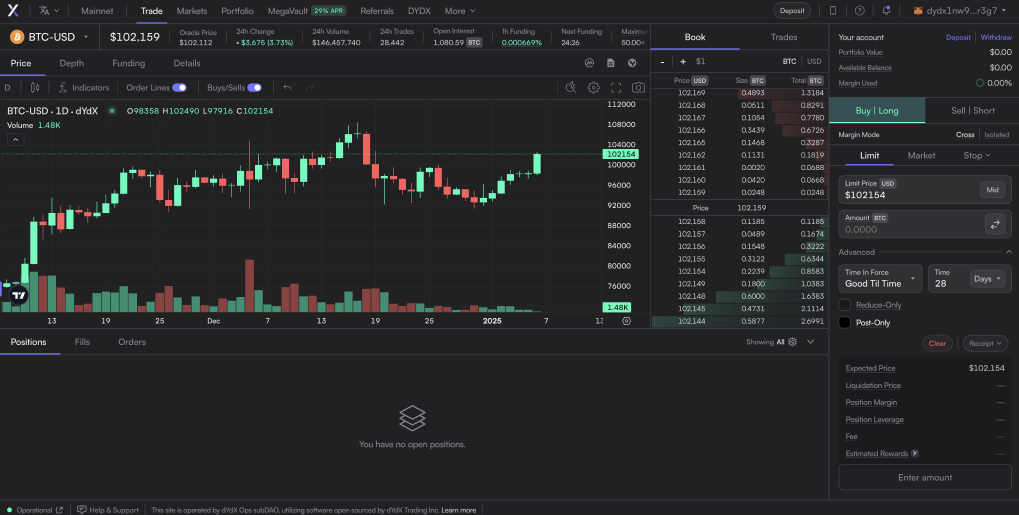

4. dYdX - Best Alternative No KYC DeFi Perpetuals Platform

dYdX is a decentralized exchange (DEX) for perpetual derivatives trading, offering 182+ markets with up to 100x leverage. Built on a Cosmos-based Layer 1 blockchain, it ensures low latency, scalability, and transparency. Averaging $300 million in daily trading volume, it caters to advanced traders seeking no-KYC solutions.

In 2024, dYdX transitioned to V4, introducing a decentralized order book, proof-of-stake (PoS) consensus, and staking mechanisms. Its $DYDX token drives governance, staking, and trading rewards, fostering a community-focused ecosystem.

With tools like MegaVault for market creation and high-yield liquidity provision, dYdX remains a strong option for decentralized perpetual trading despite rising competition from newer platforms

Key Features:

- Supports 182+ markets with up to 100x leverage on perpetual contracts.

- Built on a Cosmos-based Layer 1 blockchain for scalability and low latency.

- Decentralized governance and staking with $DYDX tokens.

- Innovative MegaVault liquidity system for new market creation.

Advantages:

- Advanced perpetual trading with low fees and high leverage.

- Transparent order book and decentralized settlement.

- Strong community-driven governance and reward mechanisms.

Limitations:

- Daily trading volumes are significantly lower than competitors like Hyperliquid.

- More complex setup compared to beginner-friendly platforms.

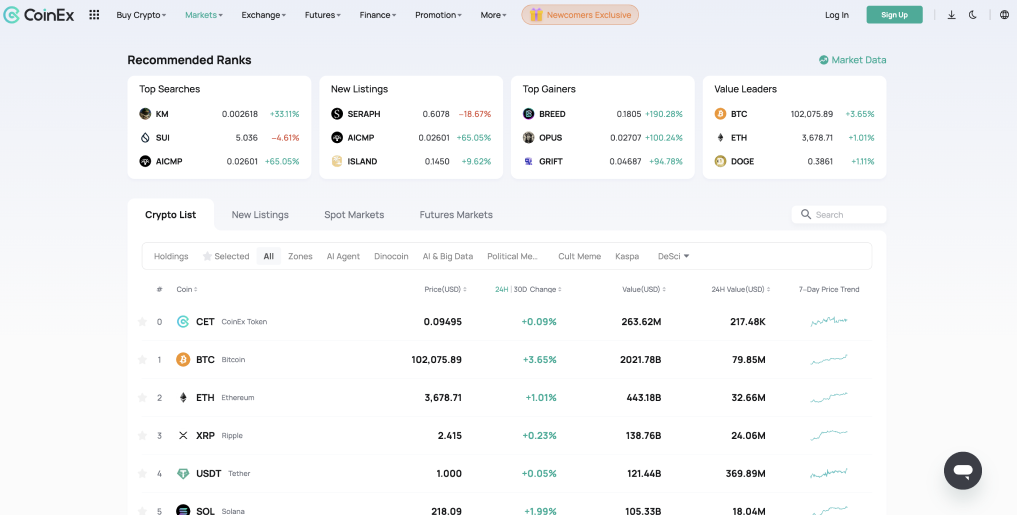

5. CoinEX - Good Choice for No KYC Crypto Staking

CoinEx is a centralized exchange specializing in spot trading and futures focusing on newer tokens. Supporting 200+ trading pairs and up to 100x leverage, it offers no-KYC trading with a $10,000 daily withdrawal limit. It supports fiat onramping via credit/debit cards and bank transfers.

Founded in 2017 and based in Hong Kong, CoinEx processes $1 billion in daily volume and secures $865 million in reserves with a transparent proof-of-reserves system. Additional features include high yield staking, token mining, and pre-listing token markets.

With competitive fees (0.03% maker, 0.05% taker) and a focus on trending cryptocurrencies, CoinEx is an excellent option for traders seeking privacy and access to new markets, though its withdrawal limits are lower than some competitors.

Key Features:

- 200+ trading pairs and up to 100x leverage.

- Fiat onramps and P2P trading.

- Staking, mining, and airdrops.

Advantages:

- Focus on trending and emerging tokens.

- Transparent reserves and strong security.

- Competitive fees and fiat support.

Limitations:

- Lower withdrawal limits compared to Bitunix.

What Are No-KYC Crypto Exchanges?

No-KYC crypto exchanges are platforms that allow users to trade and withdraw cryptocurrencies without completing identity verification. Unlike regulated exchanges, they do not require users to submit government-issued IDs, proof of address, or other personal documents, offering a higher level of anonymity.

These exchanges often operate in offshore jurisdictions like the Cayman Islands or Panama, where regulatory oversight is less strict. They appeal to users who value privacy, want quicker access to trading, or are located in regions with restrictive cryptocurrency laws.

However, some platforms impose withdrawal limits or restrict certain features to manage risks. Users must ensure these platforms align with their local regulations before use.

Are No-KYC Exchanges Legal?

The legality of no-KYC exchanges varies by jurisdiction, as many countries require identity verification for financial transactions. Users should consult local regulations to ensure compliance when trading on these platforms.

Regulators such as the Financial Crimes Enforcement Network (FinCEN) in the United States, the Financial Conduct Authority (FCA) in the United Kingdom, and the European Securities and Markets Authority (ESMA) enforce KYC and Anti-Money Laundering rules to combat financial crime.

In the European Union, the forthcoming Markets in Crypto-Assets (MiCA) regulations in 2026 are expected to impose stricter identity verification requirements, narrowing the scope for no-KYC trading globally.

FAQs

Can I access a no-KYC exchange if I live in a country with strict regulations?

Many no-KYC exchanges block users from regions like the United States or Europe due to regulatory pressure. Some traders use tools like VPNs to access these platforms, but this can violate the exchange's terms of service and may result in account suspension or loss of funds.

Check out our Best Crypto Exchange in the UK guides for regulated KYC-mandatory options

Are trades on no-KYC exchanges truly anonymous?

Not entirely. While no-KYC exchanges don’t collect personal information, blockchain transactions are public and traceable. To achieve greater privacy, users may need to use privacy-focused cryptocurrencies or mixing services to obscure transaction histories.

What risks are involved in using a no-KYC exchange?

No-KYC exchanges often lack regulatory oversight, which can make them more vulnerable to fraud, mismanagement, or abrupt shutdowns. These platforms also provide limited user protections, so funds held on the exchange are at higher risk.

Conclusion

No-KYC crypto exchanges offer private trading options and faster access for users who value anonymity or face restrictions in regulated regions. Platforms like BloFin and Hyperliquid provide specific advantages, such as high leverage or decentralized transparency.

However, these exchanges have risks, including limited protections and regulatory uncertainty. Traders should evaluate their needs and legal obligations before using these platforms.

usdt

usdt bnb

bnb