Introduction

Cryptocurrency adoption has increased over the past few years. Yet, consumer convenience still needs to be improved due to the gap between traditional and crypto banking.

Although some crypto-integrated fintech apps have surfaced recently, their functionalities are limited: from low crypto transaction limits to the lack of crypto-earning opportunities, such as yield farming, staking, borrowing, or lending. On top of that, there’s a lack of friendly onboarding processes, intuitive app interfaces, and streamlined tax reporting.

Table of Contents

With this gap, crypto users can only partially use their assets to pursue traditional financing activities, such as using crypto payments to purchase general products and services.

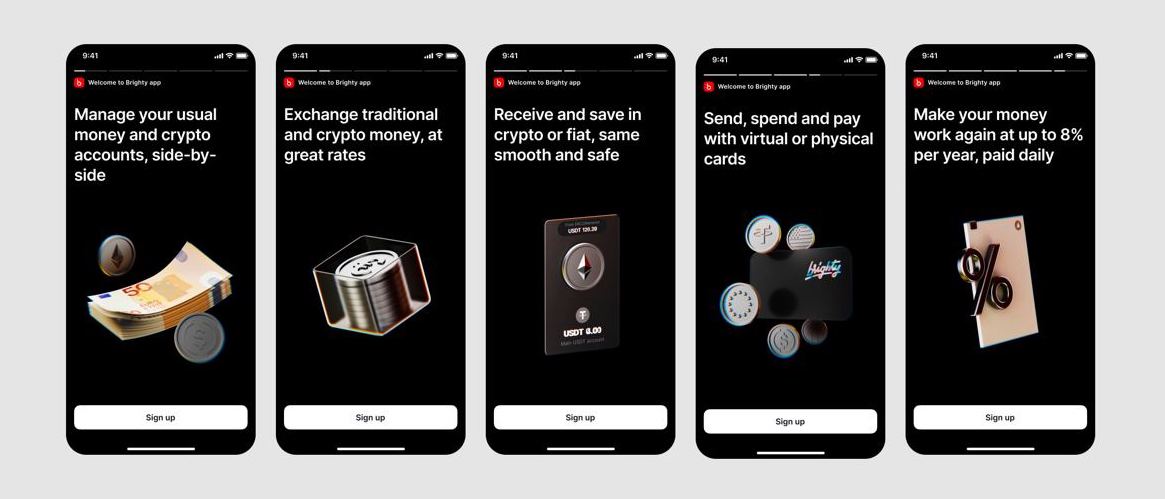

Brighty app, a new Swiss fintech, solves this problem by bringing the fiat economy and crypto with its high-yield earning opportunities together on a single user-friendly platform.

What is Brighty app?

Brighty app is a Swiss-based neodigital banking with a wide range of crypto and traditional finance facilities under one comprehensive platform. It offers easy payments, trading, and earning opportunities for fiat and cryptocurrencies, crypto trading without blockchain fees, debit card payments tied to cryptocurrency accounts, and much more.

In the nearest future, the platform will enable users to open multi-currency accounts and debit cards with low-cost f/x transactions and perform seamless fiat-crypto conversions. Brighty app’s users will be able to tie external debit cards to their fiat and crypto accounts for convenience or make payments through Brighty app using their crypto assets as collateral.

Shortly, the project plans to integrate a marketplace into the app, where anyone can purchase goods or services and make payments, from general goods to transport tickets, from hospitality services to making donations, via crypto without the need to exchange their digital assets for fiat first.

On top of that, Brightly app provides additional earning opportunities for crypto holders: a feature that is rarely offered by any digital finance solution. Within the app, users can leverage their stablecoins to access yield farming, lending, and liquidity mining opportunities and stake crypto assets on secured and audited DeFi protocols to earn up to 8% in annual interest.

Key features

- Multicurrency fiat accounts (GBP, EUR, and USD)

- Crypto accounts for trading, holding, and staking

- Debit virtual & physical cards

- SEPA, SWIFT, and Faster Payments

- Seamless crypto exchange without blockchain fees

- PDF balance and transactions statements for crypto

- Crypto deposits with any traditional EU bank account

- Wealth-management tools: advanced portfolio analytics with a detailed analysis

- Financial services for communities and creators

- Smart earning opportunities (up to 8% from stable assets)

- Referral programs

- Multiple language support (English and German)

Brighty app: meet the team

Brighty app’s story began in 2021 when founders Roger Buerli (CEO) and Nikolay Denisenko (CTO) saw the scope to develop an all-in-one, easy-to-use neodigital banking solution that would drive a range of financial opportunities for different asset types.

Roger is a respected leader in consumer products, finance, and technology. He began his career in the Swiss Consumer Products industry and later transitioned to finance, working for Credit Suisse and then managing Switzerland’s oldest private bank. Today, Roger has extensive experience in branding, data analysis, and business management.

With over a decade of experience in the financial sector, Nikolay has previously worked as the Lead Backend Engineer at Revolut. He played a crucial role in helping the company become a major fintech establishment, particularly through developing Revolut Business, and now Nikolay is going to replicate this success by leading Brighty to the state of a fintech unicorn. Nikolay is passionate about creating a user-friendly and technological neobank that provides a seamless and secure digital banking experience.

The Brighty app’s team also includes other members who are veterans in the field of data analytics, customer acquisition, and fintech.

Security and user safety

Security and user safety

Brighty app uses Swiss-level banking security, including robust and dependable identity verification by Sumbsub, a leading compliance solution. User’s data is run against official government databases to ensure AML and international sanction compliance.

Brighty app also implies PCI SAQ standards to provide top-level user security. The business also partners with some of the top embedded finance and fraud detection tools, such as Chainalysis and Fireblocks, to ensure the best security protocols and transparency across all functions.

Supported regions and fees

Currently, the app is available to residents and citizens of all EU and EEA countries. This makes Brighty app an excellent option for digital nomads who often change locations while earning and trading in different currencies.

Brighty app is free to use in all supported regions. It will also offer additional services and features based on different subscription packages, including interest rates, crypto asset insurance, risk assessment of external crypto wallets, crypto tax reports, and a one-time wallet for online payments.

Pros and Cons

Pros

- A massive move for increasing crypto adoption across the EU

- Users can access both their fiat and crypto assets in one platform

- Secure and fair earning opportunities in crypto

- User-friendly, intuitive and engaging interface

- Swiss-grade security standards

- Easy, instant conversion for multiple currencies

- Debit cards for easy crypto transactions

- Allows exchange between different cryptocurrencies without any blockchain fees.

Cons

- The community is still evolving; the project needs more time to strengthen its position in the market

- Growing competition from other fintech companies in the space

- Not yet available for users outside of Europe

Summing up

In summary, Brighty app is a robust neodigital banking solution that will bring users multi-currency accounts with low-cost foreign exchange transactions and seamless fiat-crypto exchanges.

With its wide range of features, including debit cards linked to both fiat and crypto accounts, real-time cross-border transfers, a financial marketplace for purchasing goods and services with crypto, and smart earning opportunities, Brighty app is a great choice for anyone who needs a one-stop-shop platform for fiat and crypto financial management, digital nomads, and creators.

usdt

usdt bnb

bnb