Key Takeaway: Bank of Ireland does not offer direct crypto transactions or digital asset custody services. However, clients can transfer EUR or GBP from their Bank of Ireland accounts to regulated crypto exchanges.

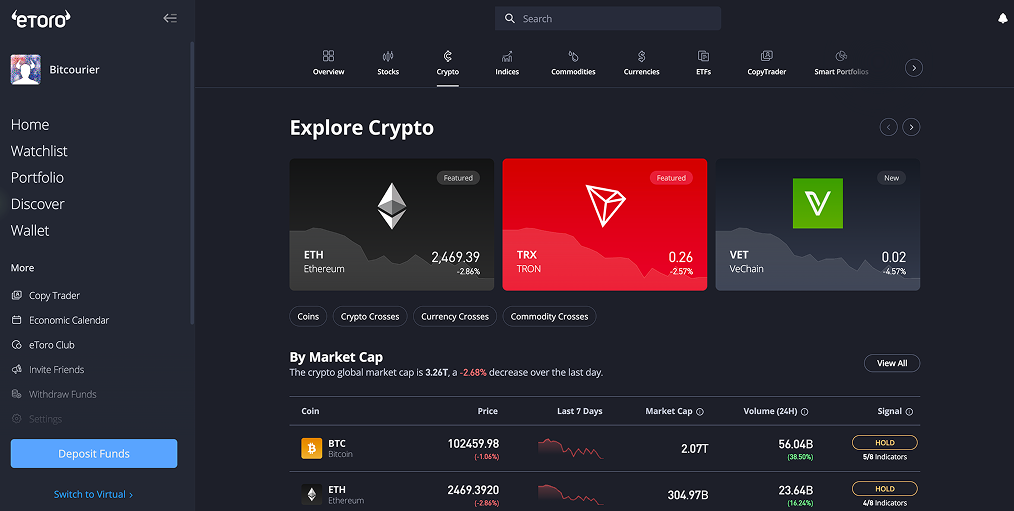

A popular choice is eToro, which is licensed across the UK and Europe. It offers over 70 cryptocurrencies for trading, as well as additional financial instruments including stocks and ETFs.

How to Buy Bitcoin with Bank of Ireland

Bank of Ireland customers looking to invest in Bitcoin and other cryptocurrencies can easily transfer funds to regulated digital asset exchanges regulated by European or UK financial authorities.

A recommended platform is eToro, which offers secure trading in over 70 cryptocurrencies. Funding your eToro account is straightforward and can be completed using bank transfers, debit cards, Faster Payments, or SEPA directly from your Bank of Ireland account.

Here’s a clear guide to buying Bitcoin using Bank of Ireland and eToro:

- Create an Account: Visit eToro’s official website, register an account, and complete the necessary identity checks (Know Your Customer or KYC) to activate trading.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY - Deposit Funds: Log into your eToro account, select "Deposit," choose your preferred deposit method, and transfer money from your Bank of Ireland account.

- Find Bitcoin: Use the search feature, enter "Bitcoin" or "BTC," and select the cryptocurrency from the results.

- Purchase Bitcoin: Input the EUR amount you wish to invest, review all details of your transaction, and confirm your purchase to complete the order.

Bank of Ireland’s Policy on Crypto Transactions

Bank of Ireland does not directly support crypto transactions or offer digital currency custody solutions due to concerns around fraud. However, the bank has stated in its cryptocurrency policy that clients can still transfer funds from their accounts to exchanges registered by the Financial Conduct Authority (FCA).

Since October 2023, any firm promoting cryptocurrency services in the UK must hold FCA registration and strictly comply with rules ensuring transparency, fairness, and explicit risk disclosures in their marketing. To further safeguard customers, Bank of Ireland explicitly prohibits the use of credit cards, which it issues for cryptocurrency purchases.

Debit cards, SEPA payments, and online banking transfers remain permissible methods to fund regulated crypto exchanges, although customers should be aware of potential internal security checks or transaction monitoring aimed at preventing fraud.

Crypto Trading Fees

Bank of Ireland customers considering crypto investments through regulated exchanges must understand the fees before starting. Here’s a breakdown of eToro’s fee structure:

- Trading Fees: eToro charges a transparent fee of 1% on each cryptocurrency trade. This fee is already included in the price you see when executing a transaction.

- Market Spreads: While eToro doesn’t charge separate spreads, investors should be mindful of market spreads, which represent the gap between the buy and sell prices quoted at any given time.

- Withdrawal Fees: Customers transferring money back into their Bank of Ireland accounts from eToro in euros (EUR) or pounds (GBP) won’t incur any withdrawal charges.

With eToro’s clear and open approach to fees, Bank of Ireland customers can confidently invest in crypto without concerns about hidden costs or complex pricing.

Best GBP Deposit Methods for Bank of Ireland

Bank of Ireland customers interested in funding their cryptocurrency investments on eToro have several deposit options available:

- SEPA Bank Transfer: Bank of Ireland account holders can transfer euros via SEPA transfers to eToro. SEPA payments are secure, typically free, and processed within one business day.

- Debit Card (Visa or MasterCard): Customers can instantly deposit funds into their eToro accounts using debit cards issued by Bank of Ireland. Card transactions are processed instantly, allowing immediate trading access.

- Rapid Transfer (Online Banking): Another option is Rapid Transfer, which links directly with Bank of Ireland’s online banking platform. It facilitates instant euro deposits securely, making this method particularly useful for investors seeking speed.

For withdrawals, customers can move euros from eToro back into their Bank of Ireland accounts via SEPA transfers, a straightforward process that incurs no additional charges.

What is Bank of Ireland?

Bank of Ireland was founded in 1783 by Royal Charter and is one of Ireland's oldest and most established financial institutions. Headquartered in Dublin, the bank has evolved from its origins as a national lender to a diversified financial services group.

It offers various services, including personal and business banking, mortgages, loans, insurance, and wealth management solutions. The bank operates under the regulation of the Central Bank of Ireland and, in the UK, is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority.

Conclusion

Bank of Ireland does not directly offer cryptocurrency trading services, but customers can still access digital asset markets by transferring funds to regulated platforms like eToro.

Before investing, ensure you clearly understand eToro’s fee structure and choose the deposit method best suited to your needs, such as SEPA transfers or debit cards. Always adhere to Bank of Ireland’s crypto guidelines and stay vigilant to potential security risks and market volatility.

usdt

usdt xrp

xrp