Key Takeaway: Revolut offers an accessible entry point into cryptocurrency trading directly through its app, though users frequently encounter high fees and cannot transfer digital assets to external wallets.

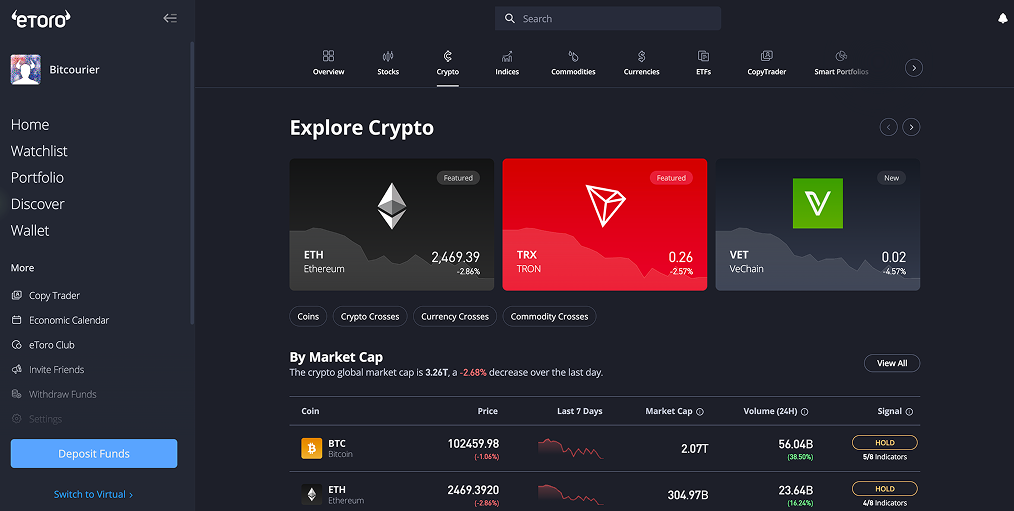

To minimise costs and access a broader selection of cryptocurrencies, investors are better served by transferring GBP from Revolut accounts to an FCA-registered exchange like eToro, which features low fees, secure crypto storage, and access to more assets.

Can I Buy Crypto with Revolut?

Yes, you can buy cryptocurrency directly through Revolut, but it’s important to understand its limitations and potential downsides before proceeding. Revolut provides an integrated cryptocurrency service allowing UK-based customers to purchase, sell, and hold digital currencies directly within the Revolut app.

However, there are drawbacks associated with Revolut’s cryptocurrency services. Firstly, Revolut charges extremely high transaction fees compared to traditional crypto exchanges. Additionally, Revolut restricts users from transferring cryptocurrency to external wallets, significantly limiting flexibility, security options, and overall control of your digital assets.

Due to these constraints, most British crypto investors prefer using Revolut solely as an intermediary to transfer GBP to fully regulated cryptocurrency platforms.

How to Buy Bitcoin with Revolut

If you're a Revolut user interested in purchasing cryptocurrencies like Bitcoin, Ethereum, or Cardano, you can directly trade these within the Revolut app. However, trading crypto via Revolut typically involves higher fees and restricts your control.

To enjoy lower fees, full asset ownership, and have access to more cryptocurrencies, a better approach is to transfer funds from your Revolut account to eToro. This FCA-registered platform supports 70+ digital currencies and thousands of shares and ETFs.

Here's how you can easily buy Bitcoin with Revolut through eToro:

- Create an Account: Visit the eToro website and sign up for an account. Complete the standard KYC (Know Your Customer) verification process.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY - Deposit Funds from Revolut: Log into your eToro account and select "Deposit Funds." Choose GBP as your deposit currency, pick your preferred payment method, and initiate a transfer from your Revolut account.

- Search for Bitcoin (BTC): Type "Bitcoin" or "BTC" into the eToro search bar. Select Bitcoin from the results and click "Trade."

- Finalise Your Purchase: Enter the amount of GBP you want to spend, carefully review all transaction details, and confirm your purchase. Your Bitcoin will quickly appear in your eToro portfolio.

Revolut’s Policy on Crypto Transactions

Revolut allows its customers to buy and sell cryptocurrencies directly within the Revolut app, providing easy access to digital assets such as Bitcoin and Ethereum. However, the platform restricts users from sending their crypto holdings to external wallets, limiting asset control and flexibility.

While Revolut supports crypto purchases internally, it maintains strict rules about funding crypto exchanges. Notably, Revolut prohibits using its credit cards for cryptocurrency transactions on external platforms due to risks linked with market volatility and the potential accumulation of debt.

Customers are encouraged to transfer GBP from their Revolut accounts via bank transfers or debit payments to cryptocurrency platforms regulated by the UK's Financial Conduct Authority (FCA).

Crypto Trading Fees

When buying cryptocurrencies with Revolut, it's essential to understand the fees you'll encounter. Here's a straightforward breakdown of crypto-related charges with Revolut and eToro:

Revolut Costs

When buying cryptocurrencies through Revolut, it's crucial to understand their fee structure clearly, as costs differ based on your account plan and transaction volume. Here’s a quick summary:

- Subscription Fees (Monthly Account Costs): Standard accounts are free, Plus costs £3.99, Premium costs £7.99, Metal costs £14.99 & Ultra costs £45.

- Trading Fees: Standard & Plus is 0.49% - 1.49%, Premium & Metal is 0.29% - 0.99%, and Ultra is 0% - 0.49%.

- Weekend Trading Fees (Friday 5 pm - Sunday 6 pm ET): Standard is 1%, Plus is 0.5%, and Premium, Metal, and Ultra do not incur additional weekend fees.

eToro Costs

For investors seeking an affordable alternative, eToro offers a competitive fee structure:

- Trading Fees: eToro charges a fixed 1% fee for cryptocurrency trades. This fee is built into the quoted transaction price.

- Market Spread: Unlike many platforms, eToro does not add extra spread charges beyond the standard 1% trading fee. However, market conditions may still naturally create price differences between buying and selling crypto assets.

- Withdrawal Fees: Withdrawing funds from eToro back to your Revolut account in GBP is straightforward and involves no additional withdrawal charges.

Due to eToro’s clearly defined fees, lower trading costs, and flexibility to transfer crypto holdings externally, it represents a compelling alternative to Revolut for crypto investors aiming for transparency and control.

Best GBP Deposit Methods for Revolut

Revolut users looking to fund cryptocurrency exchanges have several GBP deposit methods on eToro. The following are effective ways to transfer funds from Revolut into eToro:

- Debit Cards: Revolut’s Visa or MasterCard debit cards facilitate GBP deposits onto eToro. These card payments are instant and allow for quick and secure transactions, typically supporting deposits up to £30,000 per transaction.

- Bank Transfers (Faster Payments): Users can directly transfer GBP from Revolut to eToro via the Faster Payments system.

- eToro Money: For larger investments, Revolut customers have the option to utilise eToro Money. This method comfortably handles substantial deposits, allowing transactions up to £400,000 in a single transfer.

When converting your cryptocurrencies back into GBP, Revolut users can withdraw from eToro back into their Revolut accounts without additional fees, leveraging the efficiency of Faster Payments for free transactions.

What is Revolut?

Revolut is a global financial technology company that offers a comprehensive digital banking platform through its mobile app. Founded in 2015, it has expanded to serve over 50 million customers worldwide, providing services such as multi-currency accounts, international money transfers, budgeting tools, and investment options, including crypto trading.

The app allows users to manage their finances seamlessly, offering features like instant spending notifications, budgeting insights, and the ability to hold and exchange over 30 currencies.

Conclusion

Revolut provides a user-friendly platform for cryptocurrency trading. However, users should be aware of certain limitations, such as higher transaction fees and restrictions on transferring crypto to external wallets.

For those seeking more flexibility, lower fees, and a broader range of cryptocurrencies, transferring funds from Revolut to an FCA-registered exchange like eToro may be a more suitable option.

usdt

usdt xrp

xrp