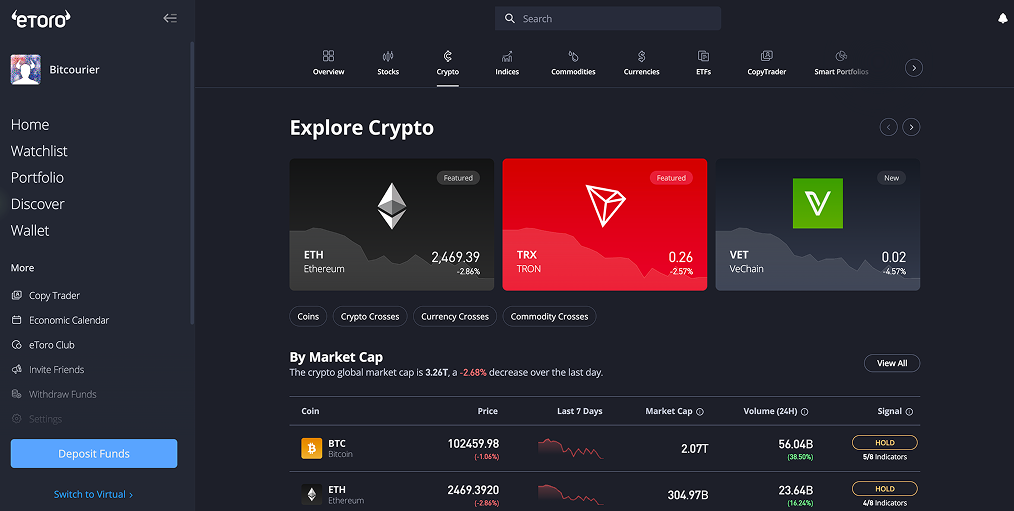

Key Takeaway: NatWest doesn't provide direct cryptocurrency investment or custodial wallet services. British investors can buy digital assets by depositing GBP to FCA-registered exchanges such as eToro.

eToro offers a secure platform registered with the Financial Conduct Authority (FCA) and provides access to over 70 cryptocurrencies, plus other financial instruments like shares and ETFs.

How to Buy Bitcoin with NatWest Bank

NatWest customers looking to purchase Bitcoin and other digital currencies can transfer funds directly to cryptocurrency exchanges registered with the Financial Conduct Authority (FCA).

A recommended exchange is eToro, which is registered with the FCA and supports thousands of cryptocurrencies, shares, and ETFs for trading. It also accepts GBP deposits via bank transfers, FPS, and debit cards.

Follow these steps to buy Bitcoin using NatWest and eToro:

- Sign Up: Go to eToro’s official site, create your free account, and complete the mandatory identity checks (KYC) to comply with UK financial laws.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY - Deposit GBP: Log into eToro, choose "Deposit Funds," and select "Bank Transfer." Initiate a GBP transfer directly from your NatWest account and confirm the transaction.

- Find Bitcoin: On your dashboard, search "Bitcoin" or "BTC" and click the cryptocurrency from the results.

- Complete Purchase: Specify the GBP amount you'd like to invest in Bitcoin, double-check transaction details, and finalise your purchase by clicking to confirm the order.

NatWest’s Policy on Crypto Transactions

NatWest permits customers to send GBP payments to exchanges approved by the Financial Conduct Authority (FCA), subject to strict limits and rigorous security measures designed to protect clients from fraud. The bank blocks crypto purchases using NatWest-issued credit cards to mitigate the risks associated with borrowing funds for speculative investments.

As of March 16, 2023, NatWest enforces transaction limits for crypto-related payments via Faster Payments and debit cards, £1,000 per day and £5,000 within any rolling 30-day window, per individual account. These restrictions aim to reduce customers' exposure to investment scams, particularly as cryptocurrencies often lack direct FCA regulation.

NatWest proactively monitors payments to cryptocurrency platforms, routinely flagging or blocking transactions identified as high-risk. Specifically, NatWest prevents payments to exchanges such as Binance, following explicit consumer warnings from the FCA.

Crypto Trading Fees

NatWest customers interested in purchasing cryptocurrencies through FCA-regulated exchanges like eToro should clearly understand the associated costs. Below is an overview of eToro’s fee structure:

- Crypto Trading Fees: eToro charges a flat 1% fee for each cryptocurrency transaction. This fee is embedded directly in the listed price during purchase or sale.

- Spreads: While eToro doesn't impose additional spread fees, traders must still account for market spreads, the gap between the buying and selling prices of assets. These spreads can vary due to asset popularity, liquidity, and market conditions.

- Withdrawal Charges: NatWest clients transferring funds from their eToro accounts back into GBP or EUR benefit from free withdrawals.

This straightforward pricing model from eToro provides NatWest customers with transparent costs, removing concerns about hidden fees when investing in cryptocurrencies.

Best GBP Deposit Methods for NatWest

NatWest users have several straightforward deposit options available to fund their eToro cryptocurrency accounts in GBP:

- Faster Payments (FPS): NatWest clients can deposit GBP securely via the Faster Payments network. This method is convenient, fast, and free, enabling rapid transfers without additional charges.

- Card (Visa and MasterCard): Debit cards facilitate immediate deposits into your eToro account. This reliable payment method permits individual transactions up to £30,000, providing quick access to your investment funds.

- eToro Money: For larger-scale investments, customers can use eToro Money to efficiently execute significant deposits, accommodating single transactions as large as £400,000 without delays or complications.

When it’s time to withdraw funds, NatWest account holders can receive their GBP through eToro via Faster Payments, ensuring a straightforward and free return of their money.

What is NatWest?

NatWest, officially known as National Westminster Bank, is a prominent UK-based retail and commercial bank with a heritage dating back to 1968, following the merger of National Provincial Bank and Westminster Bank.

As a key subsidiary of the NatWest Group, the bank operates a vast network of branches and ATMs across the UK, serving millions of personal and business customers. NatWest offers a comprehensive suite of financial services, including personal banking, mortgages, loans, insurance, and wealth management solutions.

Conclusion

Investing in Bitcoin and other cryptocurrencies with NatWest requires careful consideration of the bank’s transaction policies, security measures, and fee structures.

Using regulated exchanges like eToro ensures safer transactions, transparent costs, and compliance with UK financial guidelines. Always verify exchange details, stay within NatWest’s transaction limits, and maintain personal control of your crypto wallet to safeguard your investments.

usdt

usdt xrp

xrp