Key Takeaway: Metro Bank doesn't provide cryptocurrency investment services within its banking platform. However, customers can purchase crypto by using crypto exchanges registered with the Financial Conduct Authority (FCA).

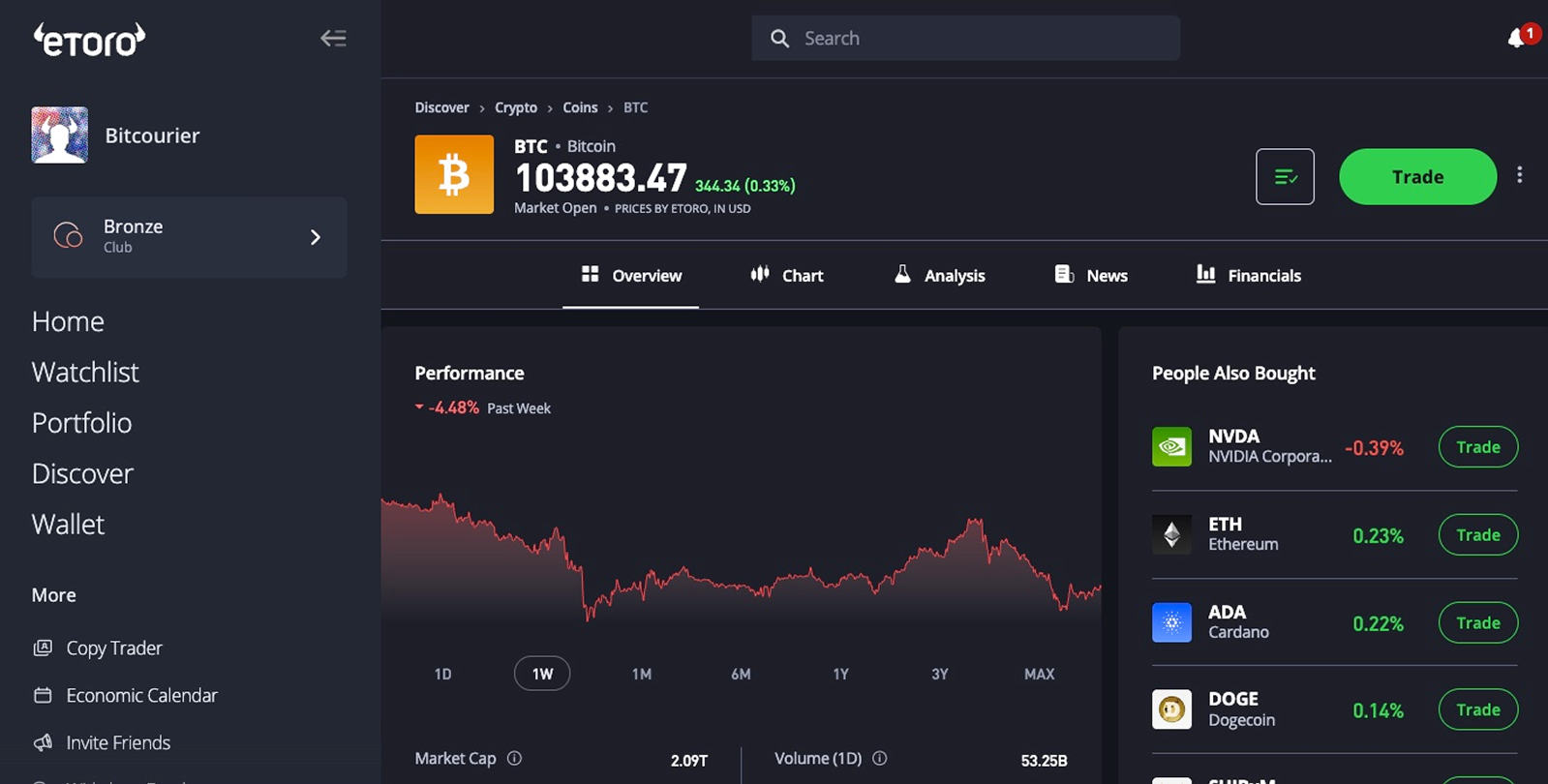

eToro is an FCA-registered platform that supports over 70 cryptocurrencies, including major assets like Bitcoin and Ethereum, plus other financial instruments like stocks and ETFs.

How to Buy Bitcoin with Metro Bank

Metro Bank clients looking to purchase Bitcoin or other cryptocurrencies can transfer British Pounds (GBP) to a cryptocurrency exchange that adheres to the Financial Conduct Authority (FCA) regulations.

A leading FCA-registered crypto platform that Metro Bank customers frequently use is eToro. eToro accepts GBP deposits through Faster Payments Service, bank transfers, or debit cards.

Follow these simple steps to buy Bitcoin through eToro using Metro Bank:

- Create an Account: Visit eToro’s official site, register for an account, and complete the necessary identity verification (KYC) procedures.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY - Transfer Funds: After logging into your eToro account, select the "Deposit Funds" option and choose GBP bank transfer. Transfer your desired amount directly from your Metro Bank account.

- Search for Bitcoin: Open up the search bar, type "Bitcoin" or "BTC", and click the ‘Trade’ button.

- Complete Purchase: Enter the GBP amount you wish to invest, carefully verify your order details, and finalise your transaction by clicking confirm.

Metro Bank’s Policy on Crypto Transactions

Metro Bank currently does not provide direct cryptocurrency trading or custody solutions. Clients interested in investing in digital assets can transfer funds from their Metro Bank accounts to FCA-authorised exchanges like eToro or Uphold.

The bank allows customers to fund regulated exchanges using bank transfers or debit cards. However, credit card transactions for cryptocurrency purchases are prohibited to reduce the financial risks linked to asset volatility.

To safeguard customers against fraud and financial crime, Metro Bank carefully monitors all crypto-related transactions. Payments directed toward exchanges lacking FCA registration might be subject to restrictions or could be blocked entirely.

Crypto Trading Fees

British investors funding crypto trading accounts on platforms like eToro should clearly understand all related fees. Here's a straightforward breakdown of the costs you can expect when trading cryptocurrencies on eToro:

- Trading Fee: eToro applies a straightforward fee of 1% on each cryptocurrency purchase or sale. This fee is integrated into the transaction price you see at checkout.

- Market Spreads: Although eToro doesn't separately charge spread fees, traders must still consider the inherent bid-ask spreads that exist naturally within crypto markets. These spreads fluctuate according to market conditions and asset liquidity.

- Withdrawal Charges: Metro Bank account holders with GBP accounts can withdraw funds from eToro without incurring any additional fees.

eToro’s transparent fee structure enables Metro Bank customers to manage costs associated with crypto trading confidently.

Best GBP Deposit Methods for Metro Bank

Metro Bank customers can deposit GBP into their eToro crypto accounts using several practical methods:

- Faster Payments (FPS): Metro Bank account holders can swiftly fund their eToro accounts using the Faster Payments system, enabling immediate deposits at no cost and with no maximum transaction cap imposed by eToro.

- Debit Card (Visa or MasterCard): Deposits via debit cards are processed instantly, allowing for quick access to cryptocurrency markets. Each debit card deposit can be up to £30,000.

- eToro Money: For larger investments, Metro Bank clients can leverage eToro’s integrated payment system, eToro Money. This method facilitates instant deposits, suitable for substantial transactions of up to £400,000 per transfer.

When it’s time to withdraw, Metro Bank users can also enjoy zero-fee GBP transfers through Faster Payments directly back into their bank accounts, ensuring convenient and timely access to their funds.

What is Metro Bank?

Metro Bank PLC, founded in 2010 by Vernon Hill and Anthony Thomson, broke into the UK market as the first new high‑street bank in more than a century, pioneering 7‑day service, pet‑friendly branches, and instant card issuance to redefine customer convenience.

It offers a comprehensive selection of products such as personal and business accounts, mortgages, credit cards, and savings solutions. Metro Bank prioritises transparency and reliable service, closely adhering to regulatory standards set by the Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA).

Conclusion

Metro Bank provides a straightforward way to invest in cryptocurrency by allowing customers to easily transfer funds to FCA-approved exchanges such as eToro.

While the bank itself doesn't directly support crypto transactions, platforms like eToro ensure a secure, transparent, and affordable trading experience.

usdt

usdt xrp

xrp