Key Takeaway: N26 offers direct cryptocurrency purchasing within its banking services but the fees are extremely high, ranging between 1% - 3%. Customers are better of using dedicated digital asset exchanges as they offer lower costs and a broder crypto range.

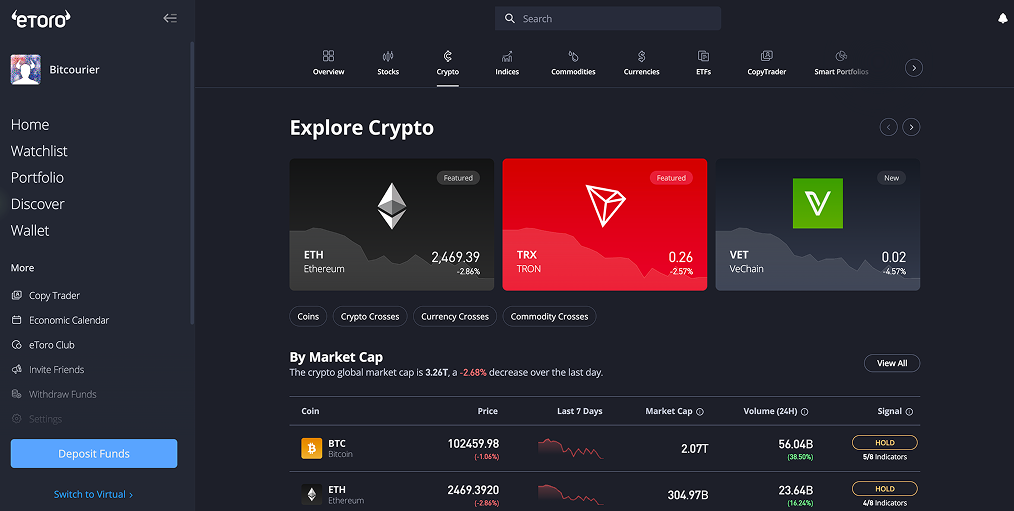

eToro is a regulated investment platform supervised by the Federal Financial Supervisory Authority (BaFin), offering trading in over 70 cryptocurrencies alongside thousands of other traditional assets like stocks and ETFs.

Can I Buy Crypto with N26 Bank?

Yes, N26 customers can conveniently buy and sell cryptocurrencies directly within the N26 app through the integrated N26 Crypto feature, powered by Bitpanda. This enables easy access to major cryptocurrencies like Bitcoin, Ethereum, and Solana without using external wallets.

However, investors should be aware that N26's crypto transaction fees, ranging from 1% to 3%, are significantly higher compared to traditional crypto exchanges. As a result, investors looking for lower fees and a broader asset section will typically benefit more by transferring funds from N26 to regulated digital currency platforms.

How to Buy Bitcoin with Santander Bank

If you're an N26 customer wanting to purchase Bitcoin or other cryptocurrencies, the simplest way is by transferring Euros (EUR) from your N26 account to a regulated crypto exchange.

We recommend using eToro, a secure investment platform authorised by BaFin. eToro supports deposits from N26 via SEPA transfers, giving you easy access to over 70 popular cryptocurrencies for trading with low fees.

Here's how you can buy Bitcoin using your N26 account on eToro:

- Sign Up: Visit eToro's official website, register for an account, and complete the required KYC verification to comply with European financial regulations.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY - Deposit EUR: Log in to eToro, click on "Deposit Funds," select a funding method, and transfer the amount you'd like to invest directly from your N26 bank account.

- Search for Bitcoin (BTC): Use eToro’s search function by typing "Bitcoin" or "BTC" and select the cryptocurrency from the results shown.

- Purchase Bitcoin: Enter your desired investment amount in Euros, review the transaction details, and complete your Bitcoin purchase.

N26 Bank’s Policy on Crypto Transactions

N26 is considered a crypto-friendly bank as it offers a built-in cryptocurrency trading feature through its mobile banking app, allowing users to buy and sell digital assets directly. This service is powered by Bitpanda Asset Management GmbH.

The bank also permits customers to fund crypto exchanges that adhere to the German Federal Financial Supervisory Authority (BaFin) regulations. Unlike some banks, N26 does not currently enforce specific daily or monthly transaction limits on crypto-related transfers.

Crypto Trading Fees

When using N26 to invest in cryptocurrencies through external platforms, customers must understand the associated fees. Here’s a clear breakdown of eToro’s fee structure:

- Transaction Costs: eToro applies a transparent 1% transaction fee on each crypto trade. Investors see the exact cost upfront, ensuring no hidden surprises.

- Market Spread: While eToro doesn't separately charge additional spreads, investors should still pay attention to the market spread, the gap between the buy and sell prices at any given moment, which affects overall trade costs.

- Withdrawal Fees: Transferring funds from eToro to your N26 account in EUR incurs no additional withdrawal fees.

With clearly defined fees and no hidden costs, N26 customers investing via eToro can manage their crypto portfolios with confidence and transparency.

Best EUR Deposit Methods for N26 Bank

If you hold an N26 bank account and want to fund cryptocurrency investments through eToro, you have multiple straightforward EUR deposit methods:

- SEPA Transfers: N26 users can deposit funds to their eToro account using SEPA transfers, which typically clear within one business day.

- Debit Cards: Customers with N26 MasterCard debit cards can deposit funds instantly into eToro accounts.

- eToro Money Wallet: Investors using N26 for larger EUR deposits will benefit from eToro’s Money wallet service, which allows single transfers up to €250,000.

Importantly, withdrawals from eToro back to N26 accounts are free via SEPA, streamlining the return of funds and making it convenient to manage your crypto investment profits.

What is N26 Bank?

N26 is a Berlin-based digital bank that has redefined personal finance with its mobile-first approach. Founded in 2013, it operates under a full German banking license, ensuring that customer deposits are protected up to €100,000 by the German Deposit Guarantee Scheme.

The bank offers a range of account options, from a free standard account to premium plans like N26 Smart, You, and Metal, each providing additional features and benefits. Users can manage their finances entirely through the N26 mobile app, which includes real-time transaction notifications, budgeting tools, and the ability to lock or unlock cards instantly.

Conclusion

Although N26 simplifies crypto investing through its integrated crypto trading feature, the relatively high fees can impact your returns over time. For more affordable trading and diverse cryptocurrency options, it's better to use dedicated platforms like eToro.

By funding these exchanges via SEPA transfers or debit cards from your N26 account, you can access more competitive rates and manage your crypto portfolio more effectively. Always ensure you review fees upfront and choose the approach that aligns best with your investment objectives.

usdt

usdt xrp

xrp