Key Takeaway: Santander does not directly enable cryptocurrency purchases within its banking services. Customers who want to invest in crypto must transfer GBP from their accounts to FCA-registered digital asset exchanges, such as eToro.

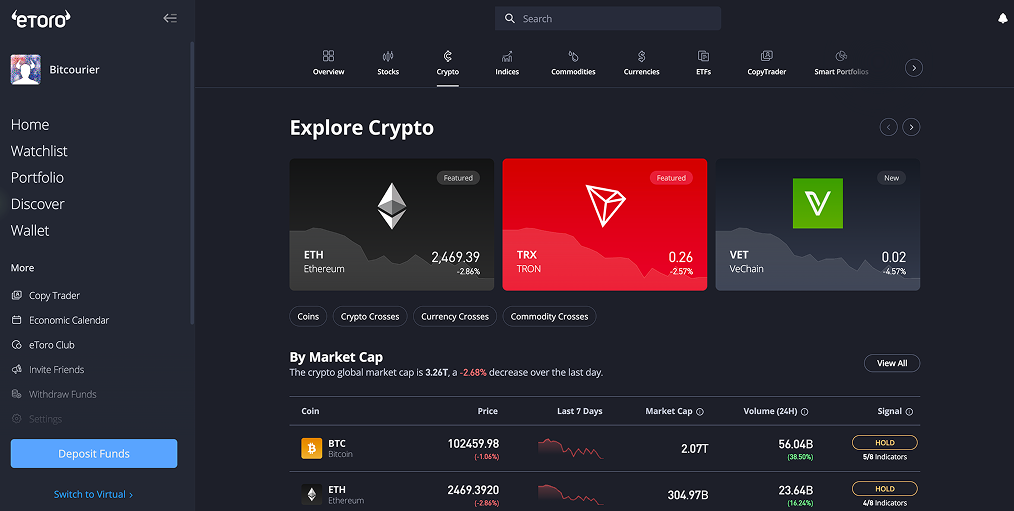

eToro is a multi-asset investment platform that is registered with the Financial Conduct Authority (FCA) and supports cryptocurrencies, shares, and ETFs for trading.

How to Buy Bitcoin with Santander Bank

Santander customers looking to buy cryptocurrencies like Bitcoin can easily transfer British Pounds (GBP) from their bank accounts to a regulated cryptocurrency exchange.

Our recommended choice is eToro, which is registered with the Financial Conduct Authority (FCA). eToro allows Santander clients to deposit GBP using bank transfers, FPS, or debit cards, and provides access to more than 70 digital currencies.

Follow these simple steps to purchase Bitcoin using Santander and eToro:

- Create Account: Head over to eToro's official website, sign up, and complete the mandatory Know Your Customer (KYC) verification.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY - Deposit Funds: Log in to your account, select "Deposit Funds," choose your preferred deposit method, and transfer funds from your Santander account.

- Find Bitcoin: In the search bar, type "Bitcoin" or "BTC," then select the "Trade" button.

- Complete Your Purchase: Specify the amount of GBP you'd like to invest, confirm the details of your trade carefully, and finalise the transaction.

Santander’s Policy on Crypto Transactions

Santander has clear cryptocurrency policies to protect its customers from crypto-related fraud, following the guidance of the Financial Conduct Authority (FCA). In line with these guidelines, Santander applies strict limitations on exchange transactions to safeguard customer accounts.

The bank restricts payments specifically to platforms flagged by regulators, such as Binance, to minimise risks linked to crypto fraud. However, customers are permitted to receive incoming payments from crypto exchanges without issue.

Customers wishing to fund FCA-regulated crypto exchanges can do so via Santander’s Mobile Banking app, Online Banking platform, telephone banking, CHAPS transfers, open banking, or at physical branch locations. Santander imposes transaction limits of £1,000 per payment and a cumulative total of £3,000 across any rolling 30-day period.

Crypto Trading Fees

Santander clients purchasing crypto through exchanges should carefully review the relevant fee structure before investing. Below is an overview of eToro’s fee schdule:

- Transaction Fees: eToro charges a straightforward 1% fee for crypto purchases and sales. This fee is embedded directly into the quoted price at the point of transaction, clearly indicating total costs upfront.

- Market Spreads: Although eToro does not impose additional spread charges separately, traders should remain aware of market spreads, the difference between the real-time bid (selling) and ask (buying) prices.

- Withdrawal Costs: Santander users can withdraw funds from eToro to their bank accounts without incurring any extra withdrawal fees when the transactions involve GBP or EUR.

eToro’s transparent fees provide Santander account holders peace of mind by clearly outlining costs and enabling informed cryptocurrency investing.

Best GBP Deposit Methods for Santander

Santander account holders seeking to fund cryptocurrency investments via eToro have several convenient GBP deposit options:

- Faster Payments: Santander customers can use the Faster Payments system to transfer GBP into their eToro account. Transactions via this method typically arrive in minutes, offering a reliable, free way to fund trades.

- Debit Cards (Visa or MasterCard): Santander debit card users can instantly deposit funds into their eToro trading accounts. Deposits using this method are immediate, enabling quick access for investing.

- eToro Money: For Santander customers making larger crypto investments, eToro Money facilitates substantial GBP deposits, accommodating single transfers up to £400,000.

Additionally, withdrawing funds from eToro back into a Santander account is free when using the Faster Payments service, simplifying the return of profits or any remaining account balances.

What is Santander Bank?

Santander is a prominent retail and commercial bank serving over 14 million customers across the United Kingdom. As a wholly owned subsidiary of Spain's Banco Santander, it operates with a strong local focus while benefiting from the resources of a global banking group.

The bank offers a comprehensive range of financial products and services, including current and savings accounts, mortgages, credit cards, personal loans, and investment solutions. With a network of 444 branches and a robust digital platform, Santander UK emphasises accessible banking experiences.

Conclusion

While Santander doesn’t offer direct cryptocurrency services, it provides a simple path for customers interested in crypto investments. By carefully transferring funds to FCA-registered platforms like eToro, Santander clients can safely access digital assets.

However, it’s important to understand Santander’s transaction limits, clearly review fees, and stay alert to potential fraud. Taking these proactive steps ensures responsible crypto investing.

usdt

usdt xrp

xrp