Key Takeaway: Trading 212 no longer offers direct Bitcoin investing due to FCA restrictions on crypto derivatives.

Investors seeking actual Bitcoin ownership should use FCA-registered crypto exchanges like eToro, while Trading 212 remains suitable for indirect crypto exposure via stocks and ETFs.

Can I Buy Bitcoin with Trading 212?

Trading 212 doesn't support direct Bitcoin or crypto investments anymore. After the FCA banned crypto CFDs, Trading 212 dropped that offering entirely. If you're determined to stay on Trading 212, your only path to crypto exposure is via related stocks like Bitcoin ETFs or Coinbase.

For true Bitcoin ownership, it's smarter to use a dedicated crypto exchange in the UK. That way, you can buy Bitcoin outright and securely store it yourself.

How to Buy Crypto with a Trading 212 Alternative

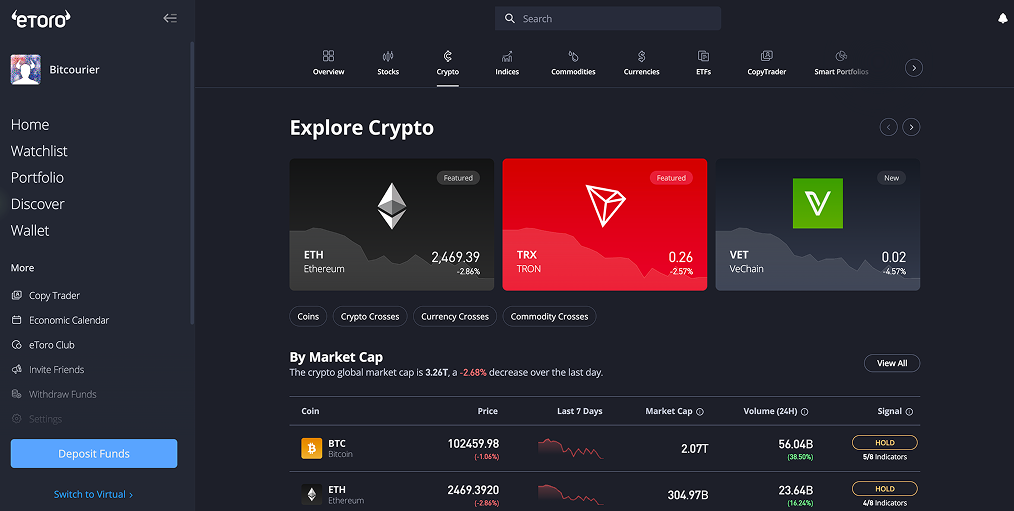

The best alternative to Trading 212 for real crypto investing is an FCA-registered exchange like eToro. Trusted by millions of investors globally, eToro provides simple and secure access to over 70 cryptocurrencies, including Bitcoin, Ethereum, and Solana. The platform also includes advanced features like copy trading, allowing beginners to mirror successful crypto strategies.

Here's how to buy crypto with eToro:

- Create an Account: Sign up on eToro's website and complete your identity verification.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY - Deposit Funds: Deposit GBP using bank transfers.

- Choose Crypto: Use eToro's intuitive dashboard to select Bitcoin or another cryptocurrency.

- Buy Crypto: Enter your investment amount, confirm the details, and complete your purchase.

Trading 212 Fees for Crypto Stocks

Trading 212 offers clear pricing for investing in crypto-linked stocks. Here's exactly what you'll pay:

- Trading Fees: Expect around a 1% spread when buying or selling crypto-related equities. This reflects typical market pricing.

- Currency Conversion: Currency conversion costs are limited to 0.15%, making international investments affordable.

- Deposit & Withdrawal Fees: Deposits and withdrawals by bank transfer are free. Card deposits over £2,000 incur a 0.7% fee.

Trading 212’s fee structure is transparent, reasonable, and straightforward for crypto-focused equity investors.

Will Trading 212 Bring Back Direct Crypto Investing?

Trading 212 stopped offering direct crypto investments in early 2021 after the FCA banned crypto derivatives, including CFDs, citing high investor risk.

Given this ongoing regulatory environment in the UK, Trading 212 is unlikely to reintroduce direct cryptocurrency purchases. Instead, the platform continues to focus on traditional assets and provides indirect crypto exposure through related equities, ETFs, and stocks.

What is Trading 212?

Trading 212 is a popular online brokerage trusted by over 4.5 million investors globally, offering commission-free trading on more than 13,000 international stocks and ETFs.

Key features include fractional shares allowing investors to buy stocks like Apple or Amazon from just A$1, automated investing through customisable "Pies," and access to multiple currency accounts (GBP, EUR, USD, AUD).

The platform is FCA-regulated, holds around A$50 billion in client assets, and appeals especially to retail investors seeking simplicity, low fees, and user-friendly trading tools.

Final Thoughts

Since Trading 212 no longer supports direct crypto purchases due to FCA regulations, UK investors seeking actual Bitcoin ownership should consider FCA-registered alternatives.

Platforms like eToro not only offer secure and direct crypto investing but also provide valuable features such as copy trading to help investors get started quickly.

If you prefer staying with Trading 212, remember your crypto exposure will be limited to indirect investments in crypto-related equities and ETFs, rather than actual cryptocurrency holdings.

usdt

usdt xrp

xrp