Key Takeaway: UBS Bank clients interested in cryptocurrency can transfer CHF to digital asset exchanges regulated by the Swiss Financial Market Supervisory Authority (FINMA).

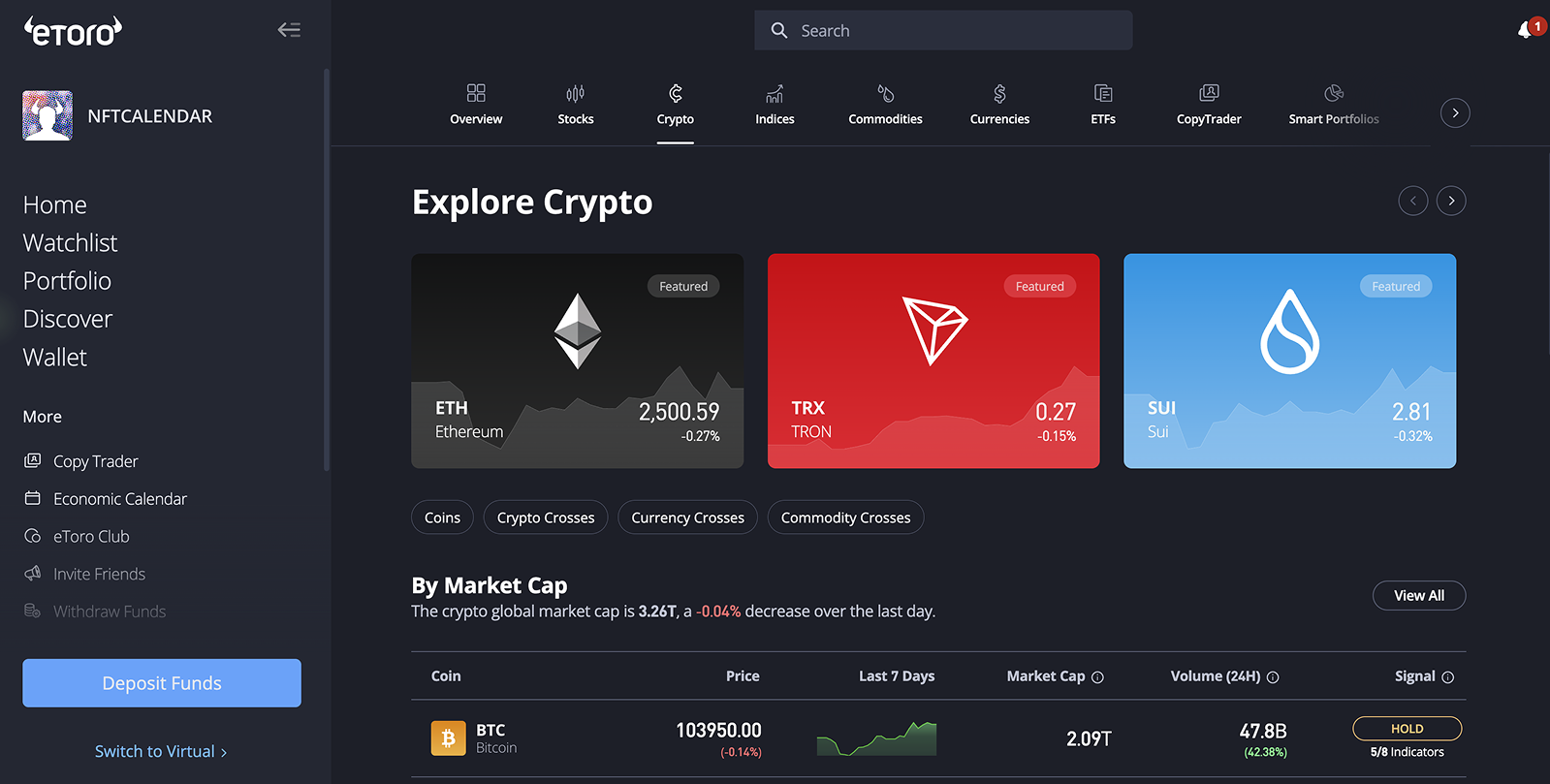

eToro is a multi-asset investment platform licensed across Europe that accepts CHF deposits. It offers over 70 cryptocurrencies, including Bitcoin and Solana, alongside assets like stocks and ETFs.

How to Buy Bitcoin with UBS Bank

UBS Bank does not provide direct crypto investment services. However, customers can transfer Swiss Francs (CHF) to a crypto exchange that is compliant with the Swiss Financial Market Supervisory Authority (FINMA) regulations.

One recommended FINMA-compliant platform for UBS customers is eToro. The exchange supports CHF deposits through bank transfers, credit or debit cards.

To purchase Bitcoin via eToro using your UBS Bank account, follow these clear steps:

- Register with eToro: Go to eToro's official website, sign up for a new account, and complete the mandatory Know Your Customer (KYC) verification.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY - Deposit CHF Funds: After verification, log into your eToro account, select the "Deposit Funds" button, and pick CHF as your deposit currency. Initiate the transfer directly from your UBS Bank account.

- Locate Bitcoin: Use the search function to enter “Bitcoin” or “BTC”, and then select the ‘Trade’ button.

- Confirm Your Purchase: Specify how many CHF you want to invest, review your transaction carefully, and complete your Bitcoin purchase by clicking “Confirm.”

UBS Bank’s Policy on Cryptocurrency Transactions

UBS Bank currently does not offer direct crypto trading or custodial services. However, the bank supports innovative digital payment solutions, including its blockchain-based platform, UBS Digital Cash, designed specifically for multi-currency settlements and cross-border transfers.

Clients seeking to buy cryptocurrencies like Bitcoin or Ethereum must transfer funds from their UBS accounts to platforms licensed by the Swiss Financial Market Supervisory Authority (FINMA), such as eToro, which accepts CHF deposits via bank transfer or debit cards.

Transactions to unregulated exchanges are closely monitored and may be blocked to ensure compliance with Swiss financial regulations and robust anti-money laundering standards.

Crypto Trading Fees

Swiss investors using UBS Bank accounts to fund crypto trades on platforms should carefully understand the fees involved. Below is a summary of eToro’s fee schedule:

- Trading Fee: eToro charges a 1% fee per cryptocurrency transaction (both buying and selling). This cost is automatically incorporated into the quoted transaction price at checkout.

- Market Spreads: While eToro does not explicitly impose additional spread charges, investors should be mindful of standard market bid-ask spreads. These naturally vary with market volatility and the liquidity of the specific crypto assets traded.

- Withdrawal Charges: UBS Bank account holders can comfortably withdraw Swiss Francs (CHF) from their eToro accounts without facing any extra withdrawal fees.

This transparent approach to trading costs helps UBS customers make well-informed financial decisions when engaging in cryptocurrency transactions via eToro.

Best CHF Deposit Methods for UBS Customers

UBS Bank clients have multiple options to fund their crypto accounts on eToro. Here are the most convenient ways to deposit Swiss Francs (CHF):

- Bank Transfer: UBS account holders can transfer CHF directly to their eToro accounts through standard bank transfers. This method typically completes within one to two business days and incurs no fees from eToro.

- Cards: Using a credit or debit card linked to their UBS account, customers can deposit CHF instantly. This provides immediate access to the crypto markets, with each card transaction allowing deposits up to CHF 35,000.

For withdrawals, UBS customers benefit from free CHF transfers directly back to their accounts, processed promptly via standard bank transfers.

What is UBS?

UBS Group AG, headquartered in Zurich and Basel, stands as Switzerland’s premier universal bank and the world’s largest private wealth manager, overseeing approximately US $6 trillion in assets under management as of 2024.

Founded through the 1998 merger of Union Bank of Switzerland and Swiss Bank Corporation, UBS now operates across more than 50 countries, employing nearly 129,000 people. The institution functions across four main segments, Global Wealth Management, Asset Management, Investment Bank, and Personal & Corporate Banking.

Conclusion

While UBS Bank doesn't directly provide cryptocurrency investment services, it offers a clear path for Swiss investors through regulated platforms like eToro.

By using transparent funding methods such as bank transfers or debit cards, UBS customers can securely access popular digital assets like Bitcoin and Ethereum. Always confirm fees, stay mindful of market conditions, and leverage UBS’s reputable banking infrastructure to confidently navigate cryptocurrency investments.

usdt

usdt xrp

xrp