The decentralized finance (DeFi) sector has redefined how we interact with the perpetual futures trading market. Through decentralized exchanges (DEXs), traders can ditch centralized exchanges (CEXs) with their many rules and explore the perpetual futures ecosystem. Hyperliquid is undoubtedly one of the biggest players in the crypto perps market today. Still, you being here shows that you’re interested in exploring Hyperliquid alternatives.

This article highlights six of the best alternatives to Hyperliquid and their selling points. Whether you are an existing Hyperliquid user seeking a similar DEX with better features, a DeFi perpetual trader exploring diverse options like Hyperliquid, or a CEX trader that wants to migrate to the decentralized market, this guide satisfies your curiosity.

Why would crypto traders consider a Hyperliquid alternative?

Here are six reasons crypto traders can decide to explore similar DEXs to Hyperliquid:

Increased leverage

Hyperliquid offers a maximum leverage of 40x, a feature that determines how dramatically a trader’s portfolio moves up or down. Traders seeking a DEX with higher leverage can explore the top Hyperliquid competitors highlighted in this article.

Trading rewards

Hyperliquid offers various reward programs to enable traders to earn more yield beyond their trading profits. Still, some DEXs offer more profitable trading rewards that users will be interested in. Some decentralized exchanges also offer airdrops and other yield-generating products to bolster a trader’s portfolio.

Cheaper fees

Hyperliquid has a maker and taker fee of 0.015% and 0.045%, respectively. While these fees may seem attractive to traders, those seeking cheaper alternatives can choose from the options discussed in this article.

Trading interface and experience

Although Hyperliquid claims to have an intuitive trading interface, some users still struggle to navigate through the ecosystem. As a result, these traders may prefer to explore other DEXs with user-friendly interfaces.

Geographic restriction

Hyperliquid is not available to users in the United States and other countries due to geographic restrictions. Unlike Hyperliquid, some DEXs have their services open to users in various countries, including those restricted on Hyperliquid.

Supported blockchains and crypto

Hyperliquid supports blockchains like Bitcoin, Ethereum, Sui, and its native blockchain, dubbed Hyperliquid. Still, it does not support some other prominent blockchain networks. As a result, tokens on those blockchains are inaccessible on Hyperliquid. Since other DEXs offer blockchains unavailable on Hyperliquid, users can explore these alternatives to access more blockchains and crypto.

6 alternatives to Hyperliquid every trader should know

Here are the top decentralized alternatives to Hyperliquid you should know about:

Aster

Aster is a decentralized exchange that allows users to trade perpetual futures contracts. Although natively built on the Binance-affiliated layer-1 blockchain, BNB Chain, the DEX is accessible on Ethereum, Solana, and Arbitrum. Its roadmap shows that the project is on track to debut a dedicated blockchain, dubbed the Aster Chain. The DeFi protocol has a governance token dubbed ASTER. Apart from its futures trading service, Aster also offers spot trading and other yield-generating products, such as tokenized stocks.

Aster is the brainchild of two entities, Asthereus and APX Finance, and was launched in late 2024. YZi Labs, the venture capital arm of Binance, backs the DEX. It even got notable mentions from Binance’s co-founder, Changpeng Zhao (CZ), which contributed to its market growth.

Key Features:

- Futures trading

- Spot trading

- Governance token

- Intuitive interface

- Multi-chain compatibility

- Supports tokenized stocks

- Supports a wide range of cryptocurrencies

Fees: Aster has a maker and taker fee of 0.01% and 0.035%, respectively. It also charges fees on various trading activities, which are reduced for VIP users.

Pros:

- Aster offers diverse services across spot and futures markets.

- It also offers traditional assets, such as tokenized stocks.

- It has a solid backing from the leading crypto exchange, Binance.

- It offers competitive fees.

Cons:

- There have been questions about its level of decentralization.

- It was delisted from the analytics platform, DefiLlama, due to wash trading concerns.

Best for Multi-chain Decentralized Perpetual Trading

ApeX

Launched in 2022, ApeX is a DeFi protocol that offers decentralized access to perpetual futures contracts via its ApeX Pro. The platform subsequently debuted the ApeX Omni (V2), offering advanced accessibility to traders, including a modular infrastructure, up to 100x leverage, a mobile app, and multi-chain accessibility. Aside from perpetual trading, ApeX also offers spot trading, vaults, and prediction markets. Users can also access tokenized stocks on the platform.

ApeX has a native token dubbed APEX. The cryptocurrency is available on the Ethereum and Arbitrum blockchains. The token can also be staked to boost earnings. Token holders can also earn from the weekly buyback program.

Key Features:

- Mobile app

- Crypto staking

- Spot trading

- Perpetual trading

- Prediction markets

- Tokenized stocks

- Multi-chain compatibility

Fees: ApeX offers a maker’s fee of 0.02% and a taker’s fee of 0.05%. Users can enjoy zero trading fees for the ApeX VIP program.

Pros:

- ApeX supports multiple services aside from crypto perps.

- The DeFi protocol has zero record of security breaches.

- The platform boasts fully audited smart contracts.

Cons:

- Limited number of supported cryptocurrencies.

- Limited customer support.

Best for Mobile Access to Perpetual Futures Trading

GMX

GMX is one of the best alternatives to Hyperliquid for anyone seeking exposure to the perpetual futures trading ecosystem. Launched in 2021, the decentralized exchange has evolved in its trading service. In its V1 debut, users simply traded by relying on the GLP pool, a liquidity pool that keeps the trading market liquid. However, the V2 upgrade streamlined the trading experience, introducing advanced features and lower fees.

As revealed on its website, GMX supports over 80 crypto assets. It also has a native crypto asset, under the same name, which serves as a utility and governance token. The exchange’s services are available on Arbitrum, Avalanche, Solana, Botanix, and Base blockchain networks. The platform distinguishes itself from other DEXs by supporting high-leverage trading, up to 100x.

Key Features:

- Native crypto

- On-chain governance

- Staking

- Up to 100x leverage

- Perpetual trading

Fees: GMX charges between 0.04% and 0.1% fee on trades, depending on the trading pair involved.

Pros:

- The DeFi protocol supports up to 100x leverage.

- It enables staking and governance using the GMX token.

Cons:

- GMX has fewer features compared with rival exchanges.

- The GMX V1 once suffered a re-entrancy exploit.

Best for Traders Seeking High Leverage for Futures Trading

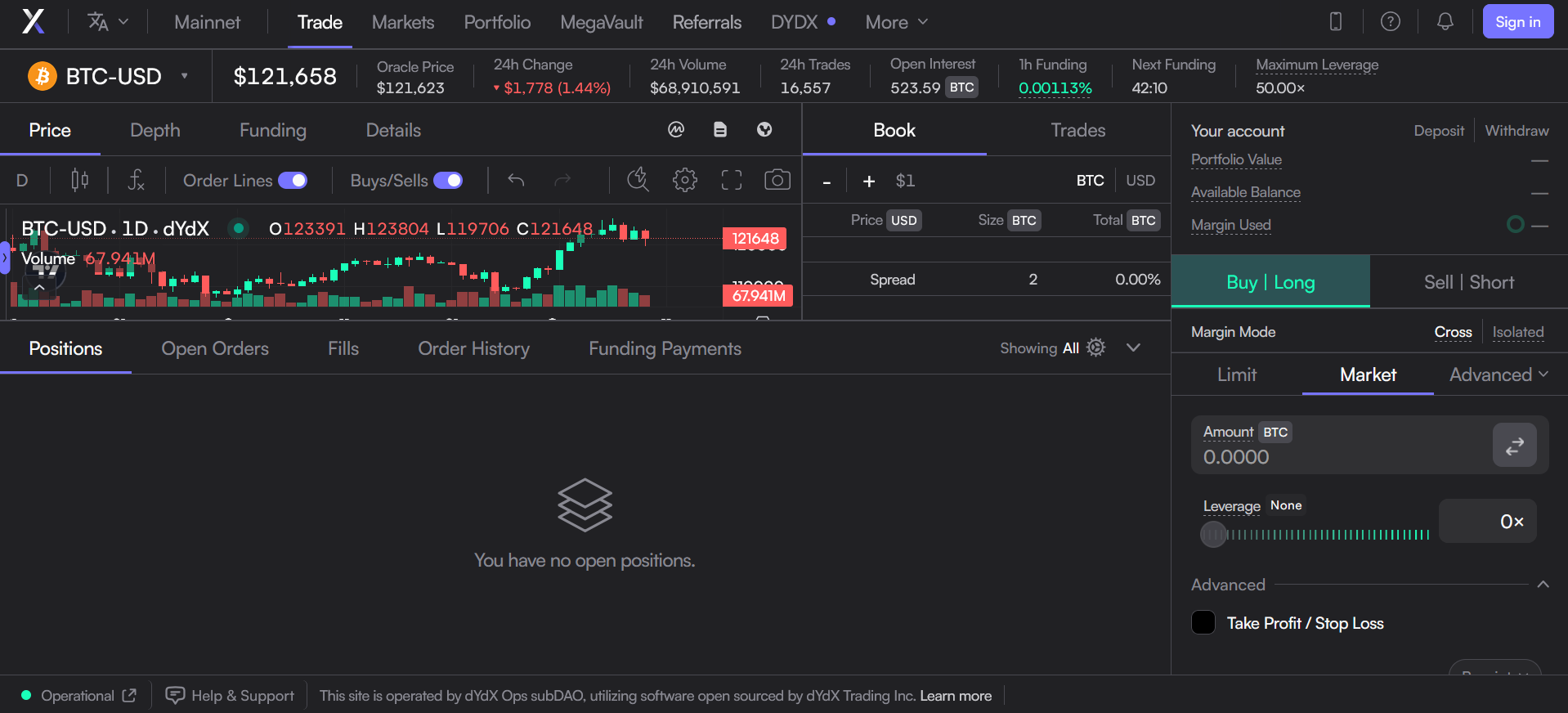

dYdX

dYdX ranks among the top decentralized alternatives to Hyperliquid due to its inherent features. Antonio Juliano founded the DeFi protocol in 2017. Since then, dYdX has introduced non-custodial, decentralized access to perpetual trading to traders. It features over 198 crypto trading pairs in its perpetual futures market, including its native DYDX crypto. It supports up to 50x leverage.

Its services are available across six blockchains: Ethereum, Base, Optimism, Avalanche, Polygon, and Arbitrum. In October 2023, the dYdX team launched the dYdX Chain, a proof-of-stake (PoS) blockchain developed using Cosmos SDK (software development kit). Aside from its perpetual trading features, dYdX also features foreign exchange (forex) trading involving currencies like USD, EUR, and TRY.

Key Features:

- Perpetual futures trading

- Forex trading

- Multi-chain support

- Dedicated dYdX Chain

- Academy section

Fees: dYdX has futures trading fees of 0.02% and 0.05% for makers and takers, respectively. VIP users are entitled to lower trading fees and rebates based on their levels.

Pros:

- It supports cross-chain usage.

- The protocol explores beyond the crypto market, such as forex.

- dYdX has nearly a decade of experience in the crypto market.

Cons:

- Leverage is not as high as some competitor DEXs.

- The platform once suffered a DNS attack.

Best for Traders Seeking DEX Services With Long-term Market Presence

edgeX

edgeX is another DEX that ranks among the top decentralized alternatives to Hyperliquid. It offers spot and perpetual trading to users within its Ethereum layer-2 blockchain, edgeX Chain. It also presents vault strategies to bolster users’ earning potentials. The DEX was incubated by Amber Group and currently boasts backing from notable experts from Goldman Sachs, Bloomberg, Bybit, Binance, and others.

Although not having a native crypto like most DEXs, edgeX captured attention in the perp DEX market due to its liquidity depth and competitive fee structure. The DEX also offers up to 100x leverage for trades. The exchange attracts users with its network speed, capable of executing over 200,000 orders per second, thereby reducing latency. Since edgeX distributes points to its active users, it could possibly debut a native token in the future.

Key Features:

- Mobile app

- Spot trading

- Perpetual trading

- Vault strategies

- Up to 100x leverage

- Dedicated layer-2 network

Fees: edgeX charges a maker’s fee of 0.015% and a taker’s fee of 0.038%.

Pros:

- The DEX boasts a trading fee lower than that of Hyperliquid.

- It fosters a user-friendly usage through its mobile app.

Cons:

- It does not have a native token like most DEXs.

Best for Traders Seeking a Low-Latency Futures Trading Platform

Lighter

Lighter is a decentralized exchange that taps zero-knowledge (zk) proof technology to offer perpetual trading to users. Built on a custom Ethereum layer-2 scaling solution, dubbed zkLighter, the platform generates zk proofs to streamline trading experience, including order matching and liquidations. The exchange allows users to trade with up to 50x leverage.

The project was in private beta testing from late January 2025 to early October 2025, when its mainnet debuted. Although Lighter currently supports only perpetual trading, it claims that its infrastructure can handle various products. These include spot trading, lending services, and options trading. The exchange has yet to launch a native token at the time of writing. However, the development team has hinted at the possibility of a native token rolling out in the near future.

Key Features:

- ZK rollup

- 50x leverage

- Perpetual trading

- Zero-fee structure

Fees: Lighter charges no transaction fee for retail traders.

Pros:

- Trading activities can be carried out without cost.

- It harnesses the security and decentralization of the Ethereum network.

Cons:

- The perp DEX once experienced an outage in an occurrence of a congestion.

- It does not support as many blockchains and cryptocurrencies as rival platforms.

Best for Cost-Effective On-chain Trading Activities

What makes Hyperliquid better than its alternatives?

While Hyperliquid lacks some features that its rivals have, it possesses various capabilities that have kept it at the top of the food chain as of late 2025. So, it is safe to say that Hyperliquid has no rivals in some metrics.

Among the exchange’s selling points are its speed, security, utility, and innovations. One of the DEX’s innovations is USDH, a dedicated stablecoin that bolsters liquidity and streamlines the trading experience.

According to on-chain data from DefiLlama, Hyperliquid has a 24-hour traded volume ranging between $10 billion and $12 billion. Notably, the Hyperliquid alternatives discussed in this article do not reach this volume.

Unlike CEXs and even DEXs, Hyperliquid has withstood major crypto market congestion, operating without experiencing downtime. Despite the massive user base, the exchange has recorded zero security breaches on its trading-centric infrastructure.

FAQs

Who is Hyperliquid’s main competitor in the crypto market?

Aster is Hyperliquid’s main competitor in the crypto market. This is because Aster has a trading volume that nears Hyperliquid’s. It also offers its services across various blockchains like BNB Chain, Ethereum, and Solana. Aster also boasts major backing from Binance’s YZi Labs and CZ.

Which alternative DEX to Hyperliquid is the safest?

ApeX is regarded as the safest alternative to Hyperliquid because it has recorded zero security breaches. It also boasts a secure interface guarded by zero-knowledge proofs. The protocol’s smart contracts have also been fully audited. While at it, users can access a wide range of services on ApeX.

Which Hyperliquid alternative has the lowest trading fees?

Lighter is the Hyperliquid alternative with the lowest trading fees. It offers zero charge for retail traders, a feat not common among DEXs.

Conclusion

Hyperliquid has been the most talked-about decentralized exchange offering perpetual trading services this year. However, it lacks some features and assets that traders are looking for. Others are searching for similar DEXs to Hyperliquid. This article highlighted six options for anyone to choose from. While these DEXs have their selling points, they also have drawbacks that Hyperliquid addresses. Hence, traders need to perform due diligence when selecting from the best alternatives to Hyperliquid.

usdt

usdt xrp

xrp