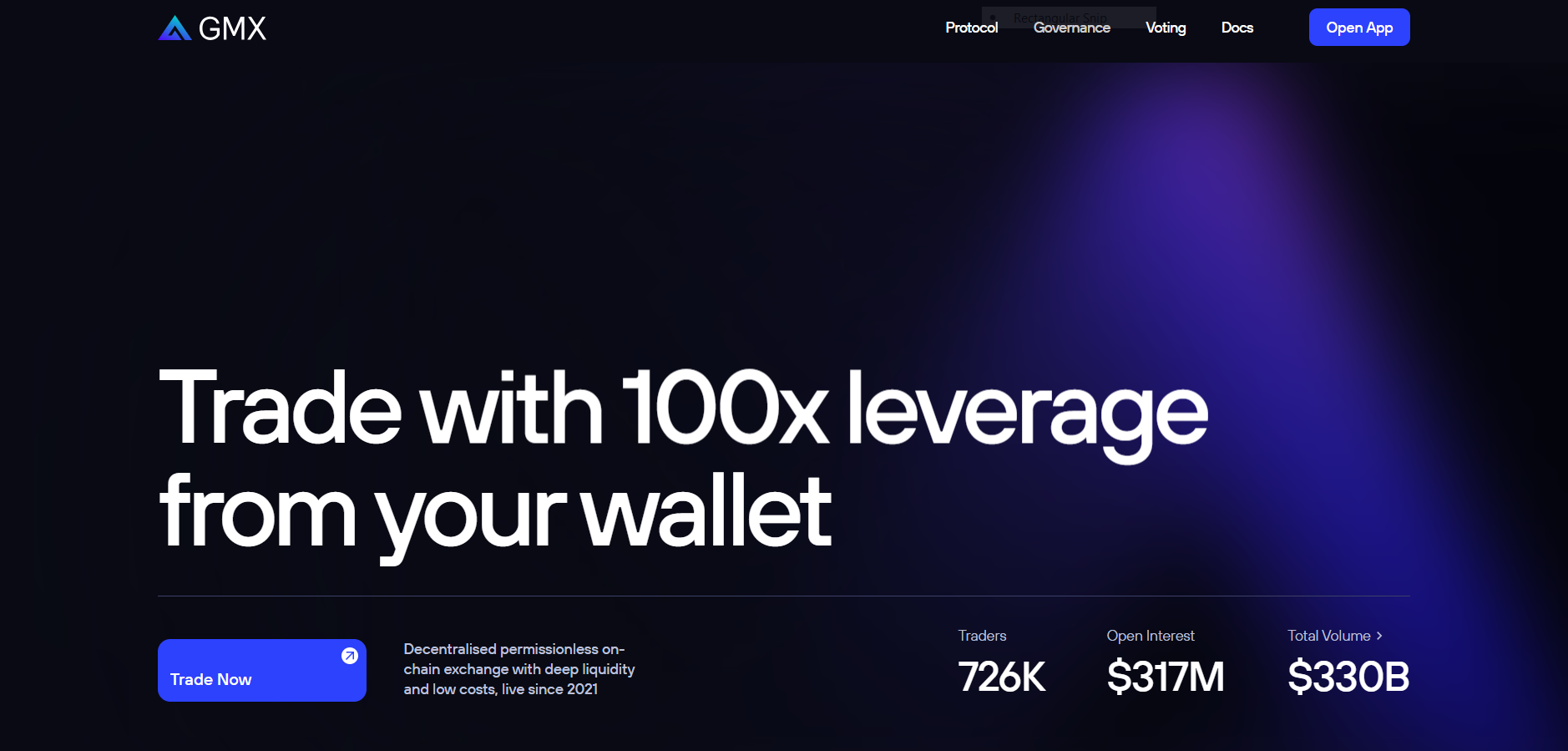

Ever heard of GMX? If you’ve been around crypto long enough, you probably have. This GMX exchange review breaks down one of the most talked-about decentralized platforms for perpetual and spot trading.

So, what makes GMX special? It lets you trade directly from your wallet — no sign-ups, no middlemen, no locked funds. You can open leveraged positions or simply swap assets, all while staying in control of your keys. The platform runs completely on-chain, offering the kind of openness DeFi is known for. Yet, it still feels fast and reliable, almost like using a major centralized exchange.

GMX launched in 2021 and now operates on multiple networks, including Arbitrum and Avalanche, both known for their low fees and fast transactions. These networks power fast transactions, deep liquidity, and fair pricing using oracles. Moreover, the exchange uses something called the GLP pool, a single basket of assets that supports all trading activity. Liquidity providers earn a share of the platform’s fees, kind of like owning a small piece of the house in a casino. It’s risky, but also rewarding when activity is high.

In this guide, we’ll unpack everything: what GMX is, how it works, and what changed between V1 and V2. We’ll also explore its fees, rewards, and referral system. Curious how it compares to dYdX or Hyperliquid? Stick around. Whether you trade daily or just want to earn passive income, you’ll find out if GMX fits your strategy.

What is GMX?

GMX isn’t your usual crypto exchange. It’s a decentralized platform where you can trade spot or perpetual contracts right from your own wallet. No account setup, no waiting for withdrawals, and definitely no handing over your funds to someone else.

It launched in 2021 on Arbitrum, a network known for fast and cheap transactions. Later, it added Avalanche for users who prefer that chain’s ecosystem. GMX has since expanded to Solana, Base, and Botanix, giving the platform a broader reach while maintaining its balance of speed and low cost.

Everything happens on-chain — every position, every swap, every liquidation. It’s all handled by smart contracts, not people. That means you can check what’s going on anytime, and your funds stay under your control.

One of GMX’s biggest ideas is its GLP pool. Picture a shared pot of tokens like ETH, BTC, and a few stablecoins. This pool acts as the counterparty to traders and provides liquidity for the whole system. In return, the people who supply those tokens earn part of the platform’s fees.

GMX didn’t just show up and fade away. It’s built a reputation for being reliable and efficient, not flashy, but steady. Some use it to trade. Others treat it as a quiet way to earn yield. Either way, it’s become a solid name in on-chain perpetual markets.

How Does GMX DEX Work?

At first glance, GMX might look like a regular decentralized exchange. But once you dig in, it feels different. Everything happens through smart contracts, and there’s no order book or traditional market maker involved.

When you open a position, GMX doesn’t match you with another trader. Instead, it interacts with the GLP pool, a shared pot of assets that acts as the counterparty. If you win a trade, the pool pays you. If you lose, the pool benefits. It’s a self-contained ecosystem where traders and liquidity providers keep the platform balanced.

Prices on GMX aren’t random either. They’re powered by oracles from Chainlink and other data sources, pulling accurate market prices instead of relying on volatile on-chain data. That helps avoid wild swings or price manipulation, which are common issues on smaller DEXs.

Trading itself feels smooth. You connect your wallet, pick an asset, and decide whether to go long or short. The interface shows your liquidation price, leverage, and fees before you confirm. There’s no registration or withdrawal delay; everything is instant and recorded on-chain.

It’s a simple setup, but it works. GMX manages to blend the reliability of decentralized finance with the responsiveness of a professional exchange. For a DEX, that’s rare.

Key Features of the GMX Exchange

GMX offers several features that make it one of the top decentralized perpetual exchanges. It’s built for transparency, low fees, and flexibility for every type of user.

- Perpetual and Spot Trading: You can trade tokens directly or open leveraged positions with up to 100x leverage. This allows you to trade or hedge without leaving the platform.

- GLP Liquidity Pool: The GLP pool holds assets like BTC, ETH, and stablecoins. It provides liquidity for all trades and lets depositors earn a share of protocol fees.

- Oracle-Based Pricing: GMX uses Chainlink oracles for accurate market prices. This reduces slippage and limits price manipulation during volatile markets.

- Dual-Token System (GMX & GLP): GMX is used for governance and staking. GLP represents liquidity in the pool. Both tokens work together to keep the ecosystem balanced.

- Revenue Sharing and Staking: GMX stakers and GLP holders receive a share of trading fees. This gives passive participants a steady source of on-chain income.

- Cross-Chain Deployment: GMX runs on Arbitrum and Avalanche. These networks offer low fees, fast confirmations, and a smoother trading experience.

- Community Governance: GMX token holders can vote on protocol updates and proposals. This keeps the exchange decentralized and community-driven.

What is a GMX Token?

Think of the GMX token as the backbone of the GMX exchange. It’s not just a trading token — it’s what keeps the whole system running smoothly. People who hold GMX can stake it, vote on upgrades, and even earn a cut of the platform’s revenue. Sounds nice, right? That’s because it actually gives users real skin in the game.

When you stake GMX, you earn three types of rewards. There’s escrowed GMX (esGMX), which is kind of a locked version of the token. Then you get ETH or AVAX fees, depending on your network. And if you stay staked long enough, Multiplier Points kick in to boost your yield.

It’s not just about profits, though. Staking also keeps liquidity stable and helps the platform stay secure. Basically, GMX wants long-term holders, not people chasing a quick win. Notably, the platform splits its protocol fees 30/70. Stakers get 30%, and GLP holders (the liquidity providers) take the other 70%. Fair balance between traders and liquidity suppliers.

And since GMX runs on both Arbitrum and Avalanche, the token exists on both networks. You can switch between them, stake where you like, and claim rewards whenever you want. At the end of the day, GMX isn’t just a token. It’s your access pass to being part of the protocol, earning, voting, and shaping what comes next.

GMX Arbitrum

Arbitrum was where GMX first set up shop, and it remains the busiest corner of its ecosystem. The network’s low gas fees and fast confirmations make it ideal for active traders who want quick entries and exits. Liquidity here runs deep, so even large trades execute smoothly without major slippage.

Most of GMX’s perpetual activity happens on Arbitrum, and that has built a strong on-chain community over time. Stakers on this network receive ETH and esGMX rewards, keeping the incentive loop simple and steady. Even during periods of high volatility, Arbitrum’s scalability helps GMX maintain stable performance. It’s one of the reasons users consider it a reliable base for decentralized perpetual trading.

GMX Avalanche

Avalanche came next, bringing GMX to a broader and more diverse user base. It’s a network built for speed and efficiency, offering near-instant finality and consistently low costs. For users who prefer a lightweight, environmentally friendly blockchain, Avalanche feels like a natural fit.

Here, the staking setup mirrors Arbitrum’s structure, except rewards come in AVAX instead of ETH. The network’s parallel processing helps GMX handle high-volume trades with minimal slippage, even when markets are busy. This expansion reduced GMX’s dependence on a single chain while giving users more freedom to choose where and how they operate.

Together, Arbitrum and Avalanche create a balanced ecosystem, one optimized for volume and the other for accessibility. That balance is a big part of what keeps GMX’s activity consistent across both chains.

How GMX Trading on V2 differs from GMX Trading on V1

GMX V2 is a big step forward from the original version. The first version was simple and relied on one big GLP pool to handle all trading. It worked well, but it wasn’t perfect. The new version fixes many of those early issues and gives both traders and liquidity providers more control.

In V1, every asset was tied to a single shared pool. That setup provided strong liquidity, but it also meant the whole pool felt the impact whenever one token’s price moved too sharply. V2 changes that. Each market now has its own liquidity and risk setup. This separation helps protect the system and gives users a clearer view of how their funds are used.

Another key improvement is the addition of synthetic markets. These allow users to trade more assets even when there isn’t direct liquidity for each token. It’s faster, smoother, and more flexible. The new Oracle system updates prices more frequently, too, reducing lag and lowering the risk of manipulation.

Fees have also dropped in V2, and spreads are tighter. That means traders can open positions more efficiently while liquidity providers get better returns for the risk they take.

When compared to other decentralized perpetual exchanges like dYdX or Hyperliquid, GMX V2 keeps its full on-chain transparency but feels much more refined. It’s built for those who care about precision, performance, and control, whether they’re opening leveraged trades or supplying liquidity.

GMX Exchange Fees Explained

GMX keeps its fee system simple and transparent, so users always know what they’re paying for. Every trade comes with small costs, usually between 0.04% and 0.10%, depending on the market and asset pair. You’ll also find swap and borrowing fees, which change with market activity and how much liquidity is being used at the time.

Unlike centralized exchanges that stick to fixed maker or taker fees, GMX adjusts its rates on the fly. When there’s less liquidity for a certain token, fees go up slightly to attract more supply. When liquidity improves, the fees drop again. It’s a smart way to keep the system balanced without manual intervention.

The best part is that these fees don’t just disappear into a company's wallet. They’re shared with the community. Liquidity providers and GMX or GLP stakers receive a portion of the collected fees. This setup helps keep the platform sustainable while rewarding those who contribute to its liquidity. In the end, you get fair costs, steady incentives, and a fee model that keeps GMX’s ecosystem healthy.

GMX Rewards Explained

By now, you already know that GMX offers rewards through staking and liquidity provision. But how do these actually play out in real use? That’s where things get interesting.

Staking GMX isn’t just about earning a few tokens. Rewards build up over time, and the longer you stay committed, the stronger your share becomes. Escrowed GMX and Multiplier Points work quietly in the background, compounding your stake while aligning with the protocol’s stability. Many long-term users treat it as a slow, consistent way to earn rather than something to chase day by day.

The GLP pool, on the other hand, is more dynamic. Returns rise and fall with trading activity. When the market heats up, GLP holders often see higher yields because trading volume spikes. During quieter periods, the returns calm down. It’s less predictable but offers strong passive potential for users willing to take some risk.

Together, both systems strike a balance: one favors patience, the other rewards liquidity risk. That mix is what keeps GMX’s incentive model strong, fair to users, and sustainable for the protocol.

How Does the GMX Referral Program Work?

On GMX, anyone can earn by introducing new users through its referral program. It’s built directly on-chain, meaning everything runs automatically without third parties.

When you share your referral link or code, each person who joins through it becomes connected to you. Every time they open or close a position, a small part of the trading fee is shared between both of you.

Rewards come in ETH or AVAX, based on the network you’re using. They land in your wallet instantly, no need to claim or wait. There are also levels to it. As the total trading activity from your referrals grows, your rebate rate climbs higher.

Because it’s non-custodial, no one holds your funds for you. The entire process happens on-chain, keeping it open and trustless. It’s an easy way for the GMX community to help the platform grow while benefiting from real usage, not just speculation.

FAQs

What is the GLP Pool?

The GLP pool holds different assets like ETH, BTC, and stablecoins. It supplies liquidity for GMX trades and lets users earn from trading fees.

Is GMX cheaper than other perpetual platforms?

Most of the time, yes. GMX stands out for its low swap fees and zero price impact when opening positions. It also avoids the usual funding costs seen on other platforms.

Who competes with GMX?

GMX isn’t alone in the game. Projects like dYdX, Hyperliquid, and Synthetix Perps also offer on-chain perpetual trading with similar leverage options.

Is GMX safe to use?

GMX has passed multiple security audits and has a solid track record so far. Still, no DeFi platform is risk-free. Smart contract bugs or oracle issues can always happen.

Conclusion

GMX has earned a solid reputation as a dependable platform for both spot and perpetual trading. It keeps things simple, with low fees, deep liquidity, and full control of your assets. The GLP pool offers a way to earn passively, though it carries some market risk. Users can choose between staking, providing liquidity, or trading, depending on their comfort level.

Like every DeFi protocol, GMX isn’t entirely free from risk. But its steady performance and loyal community suggest long-term potential. If you prefer a decentralized, transparent, and community-focused exchange, GMX is definitely worth exploring.

usdt

usdt bnb

bnb