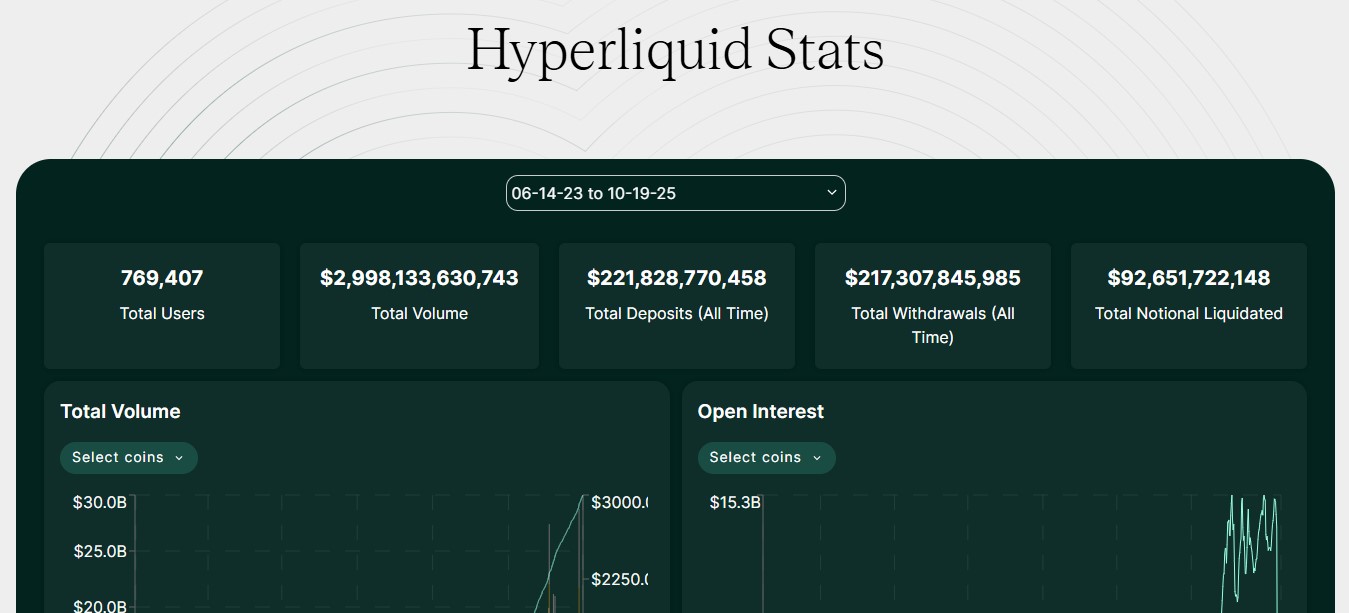

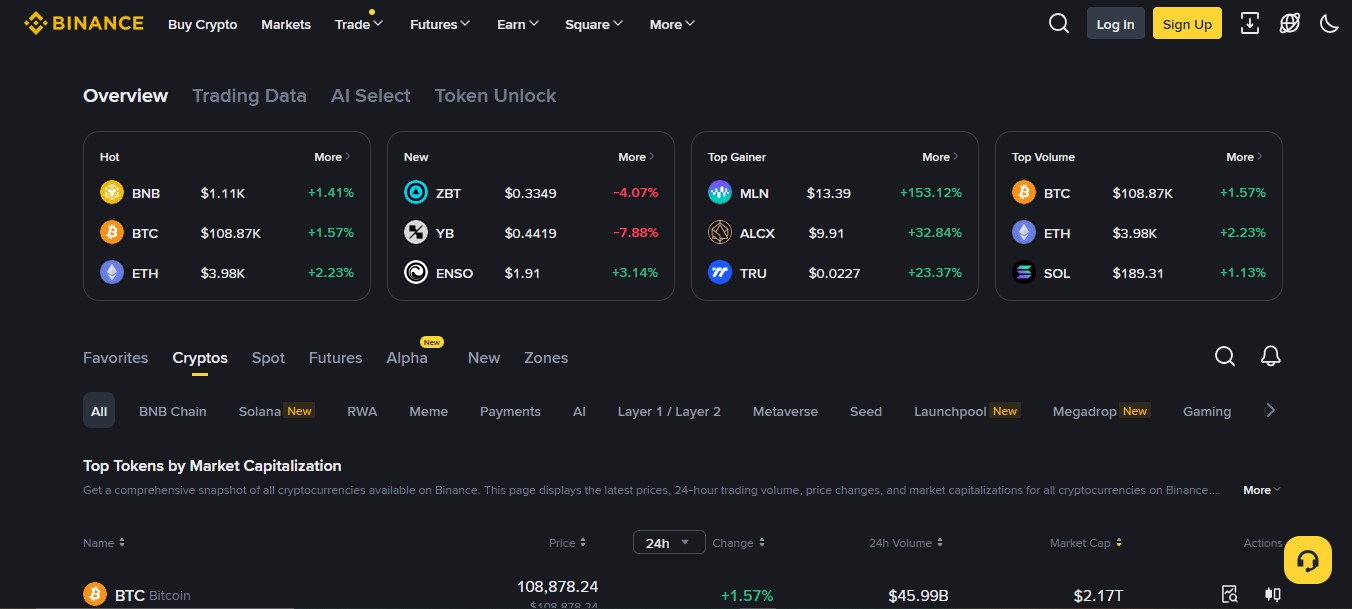

In the past few months, Hyperliquid has gone from being a name few recognised to one of the most talked-about platforms in on-chain trading. Its rise has been fast, almost too fast to ignore, leaving many traders wondering if this new player is starting to catch up with Binance, the long-time giant of the crypto exchange world. The question now making the rounds is whether Hyperliquid has truly reached a point where it can compete head-to-head with Binance in terms of speed, liquidity, and overall trading experience. Hyperliquid has processed over $1.57 trillion in total perpetual trading volume, with more than $330 billion traded in July 2025, impressive figures for a fully on-chain exchange. Meanwhile, Binance remains the powerhouse of global crypto trading, boasting over 170 million registered users and daily volumes that often top $40 billion. However, as more traders start seeking platforms that offer both deep liquidity and self-custody, the line separating centralised and decentralised trading is beginning to blur.

This article breaks down Hyperliquid vs Binance, examining how the two platforms differ across technology, usability, security, and trading opportunities.

Table of Contents

- What is Hyperliquid?

- Where is Binance Already Losing to Hyperliquid?

- Feature Comparison of Hyperliquid and Binance

- Binance vs. Hyperliquid fees explained

- How Binance and Hyperliquid Compete in Trading Experiences?

- Trust & Security: Does Binance Still Have a Security Advantage Over Hyperliquid?

- Conclusion

What is Hyperliquid?

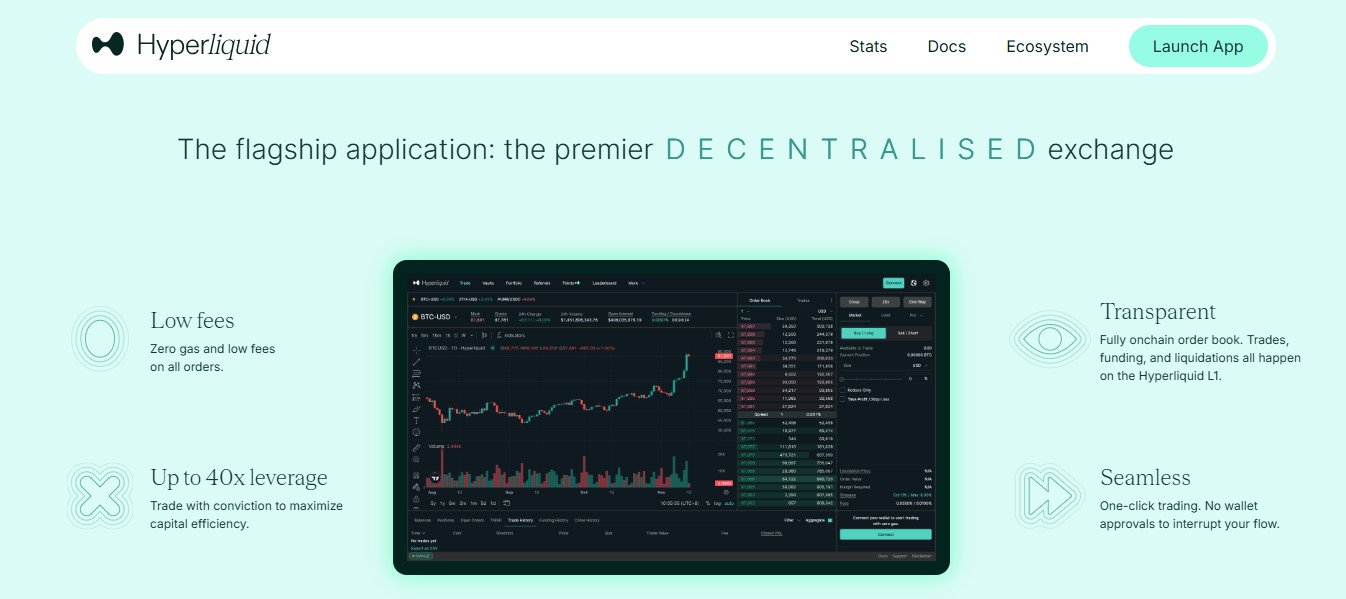

Hyperliquid is a decentralised derivatives exchange (DEX) that offers the performance of centralised platforms while maintaining full on-chain transparency and self-custody. Through the platform, users can trade perpetual futures directly from their wallets without relying on intermediaries. It was founded in 2023 by Jeff Yan and a pseudonymous co-founder known as “iliensinc”. Yan, the public face of the project, previously worked at the high-frequency trading firm Hudson River Trading and later founded Chameleon Trading, a crypto trading desk. Following the collapse of FTX, he pivoted toward building a more transparent, self-custodial trading platform. His co-founder, “iliensinc,” a former Harvard classmate, serves as a core contributor to the project. According to Hyperliquid’s documentation, the broader team includes contributors from top institutions such as Caltech and MIT, as well as seasoned professionals from firms like Citadel, bringing together deep expertise in both traditional finance and blockchain engineering.

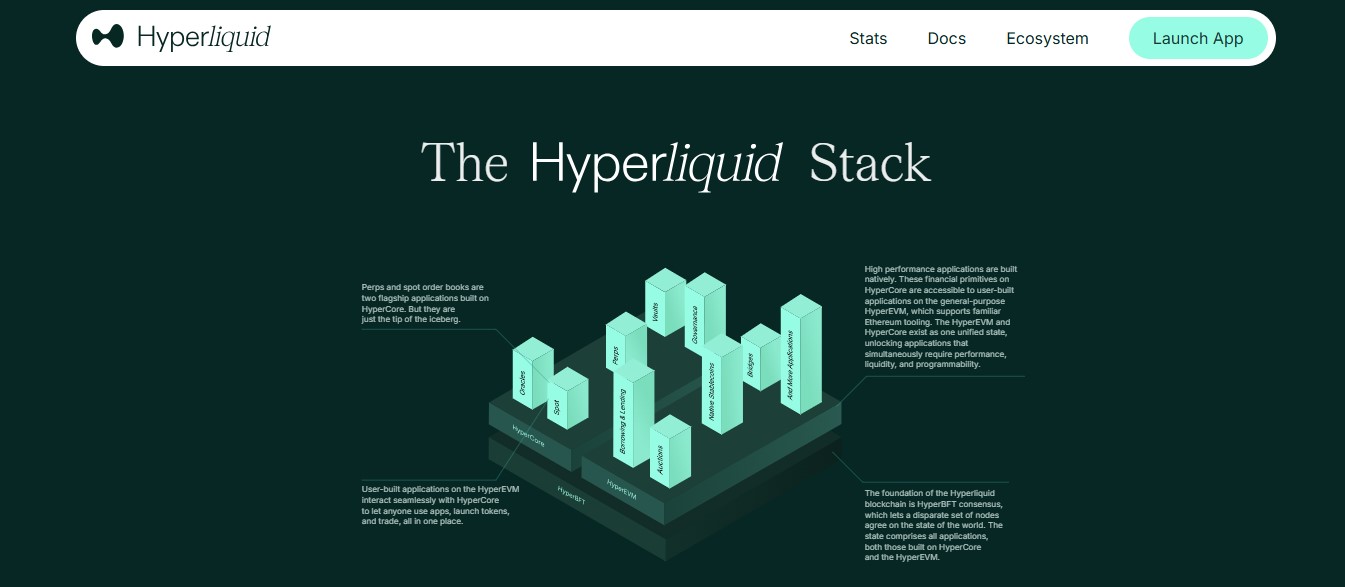

Hyperliquid was built to solve one of DeFi’s biggest challenges, which are scalability and user experience in on-chain trading. Unlike most DEXs that depend on existing blockchain infrastructures, it operates on its own Layer-1 blockchain optimised for high-speed order execution and deep liquidity. The platform’s HyperEVM, a next-generation virtual machine, provides faster transaction processing and efficient order matching while keeping all trades verifiable on-chain.

The platform started gaining momentum in late 2024, as more traders sought decentralised alternatives after growing concerns about centralised exchange risks and regulatory crackdowns. Its performance quickly caught attention within the perpetual trading community, processing billions of dollars in daily volume and attracting professional traders who valued both transparency and low latency. By mid-2025, Hyperliquid had surpassed $1.5 trillion in cumulative trading volume, establishing itself as one of the most active on-chain derivatives platforms in the world, positioning it as a serious competitor to traditional giants like Binance.

Where is Binance Already Losing to Hyperliquid?

While Binance remains the largest centralised exchange in the world, there are a few key areas where it is gradually losing ground to Hyperliquid. The most noticeable is in on-chain derivatives trading, where Hyperliquid’s fully decentralised design gives traders true self-custody, instant settlement, and transparency, advantages Binance cannot replicate due to its centralised infrastructure. Hyperliquid’s HyperEVM layer allows all transactions to be executed and verified directly on-chain without compromising performance, a major step forward for decentralised exchanges. Hyperliquid is also winning in trading performance and efficiency, achieving sub-second execution speeds and consistently low fees without gas costs, while Binance’s complex fee structure and regional restrictions can frustrate active traders. Hyperliquid’s community governance model also gives traders a real say in platform upgrades and policies, a level of inclusion that Binance’s centralised model lacks. These innovations have started to shift perception in the trading community, with many now believing that Hyperliquid is a new Binance.

Feature Comparison of Hyperliquid and Binance

- Technology and Infrastructure:

Hyperliquid runs entirely on-chain through its proprietary HyperEVM layer. Binance, on the other hand, uses a centralised matching engine capable of processing over 1.4 million transactions per second, providing industry-leading speed and stability. While Binance wins in raw performance, Hyperliquid’s decentralised infrastructure gives traders a unique edge in transparency and self-custody. - Liquidity and Volume:

Binance remains the liquidity giant, consistently handling over $40 billion in daily trading volume across spot and derivatives, ensuring minimal slippage even for large orders. However, Hyperliquid is quickly gaining ground as its volume ratio to Binance recently climbed to 13.6%, up from 8% earlier this year. This growth shows that traders are increasingly confident in Hyperliquid’s ability to deliver deep, on-chain liquidity comparable to major centralised venues. - Security and Transparency:

Hyperliquid prioritises on-chain transparency and self-custody, meaning users always retain control of their funds and can verify every transaction on-chain. Binance relies on centralised security systems, with multi-layer cold storage, insurance through its SAFU fund, and regular audits. While Binance’s record is strong, Hyperliquid offers a trustless environment that removes the need to depend on a central authority.

- Innovation and Ecosystem:

Hyperliquid is building a new kind of DeFi infrastructure with its HyperEVM, supporting programmable derivatives and composable liquidity, a clear sign of long-term innovation in decentralised trading. Binance, meanwhile, offers an all-in-one ecosystem including its BNB Chain, Launchpad, Earn products, and NFT marketplace. Binance’s scale gives it unmatched versatility, while Hyperliquid’s focus on DeFi-native innovation positions it as a powerful alternative for traders.

Is HyperEVM a Winning Advantage of Hyperliquid Over Binance?

One of Hyperliquid’s most talked-about innovations is HyperEVM, a custom-built execution environment that runs fully on-chain order books and perpetual futures with high speed and low latency. Unlike traditional decentralised exchanges that struggle with congestion or rely on external chains for execution, HyperEVM allows Hyperliquid to process trades on its own chain without sacrificing performance. This makes trading feel almost as seamless as on centralised platforms while maintaining the transparency and self-custody that define DeFi. When we compare Binance and Hyperliquid, Binance still leads in liquidity depth, product range, and institutional adoption. However, Binance users still rely on the exchange to hold their assets and process trades off-chain, exposing them to counterparty and regulatory risks. HyperEVM, in contrast, removes that middle layer by letting users trade directly from their wallets in a verifiable, trustless environment. In that sense, HyperEVM is a genuine advantage, not necessarily because it outperforms Binance in every metric, but because its decentralised model achieves near-centralised efficiency.

Binance vs. Hyperliquid fees explained

Hyperliquid employs a unified fee structure that applies to both spot and perpetual trading, charging 0.015% maker and 0.045% taker fees. Spot trading fees recently increased to a 0.07% taker rate, with tiered discounts of up to 40% available through HYPE token staking. Notably, Hyperliquid covers all gas fees, ensuring cost-efficient on-chain execution. However, Binance applies a 0.10% maker and taker fee on spot trades, reduced by 25% when paid in BNB. Its futures trading fees start at 0.02% maker and 0.05% taker, with additional funding fees applied periodically to maintain market balance.

How Binance and Hyperliquid Compete in Trading Experiences?

When it comes to trading experience, the competition between Binance and Hyperliquid reveals two distinct design philosophies shaped by their core identities: one centralised, the other fully on-chain. Binance delivers a refined and highly structured trading environment across both web and mobile platforms, available in most regions worldwide. Its interface provides a clear distinction between simplified “Classic” views for casual traders and more advanced dashboards suited for professional use, integrating real-time data, in-depth charting tools, and efficient order execution. The Binance app maintains consistency in layout and performance, giving users a seamless transition between desktop and mobile trading, supported by reliable connectivity and multilingual functionality.

Hyperliquid takes a different route, emphasising performance and precision through its native HyperEVM architecture. Its web and mobile platforms present a clean and structured layout that prioritises speed, clarity, and verifiable data display. Traders experience near-instant order matching and can easily validate transactions through blockchain records, reflecting the platform’s focus on technical efficiency and accountability. While Binance stands out for its maturity, accessibility, and stability, Hyperliquid distinguishes itself with cutting-edge infrastructure and a commitment to on-chain execution, representing two different standards of excellence within the exchange environment.

Trust & Security: Does Binance Still Have a Security Advantage Over Hyperliquid?

While Binance still holds a slight edge in security due to its long-established infrastructure, advanced risk controls, and SAFU insurance fund, Hyperliquid is quickly closing the gap with its on-chain transparency and non-custodial design, which reduces counterparty risks. The competition between Binance and Hyperliquid now hinges on balancing transparency with top-tier security architecture.

Conclusion

The comparison between Hyperliquid vs Binance highlights two powerful exchanges built for different types of traders but united by the same goal of performance and reliability. Binance is best for users who desire extensive product options, institutional-grade stability, and established trust, while Hyperliquid remains suitable for those who value transparency, control, and on-chain efficiency. Traders should assess their risk tolerance and trading style before committing to either platform. Understanding where each excels ensures better trade execution, improved fund safety, and a stronger long-term trading strategy in an expanding digital market.

usdt

usdt xrp

xrp