Introduction

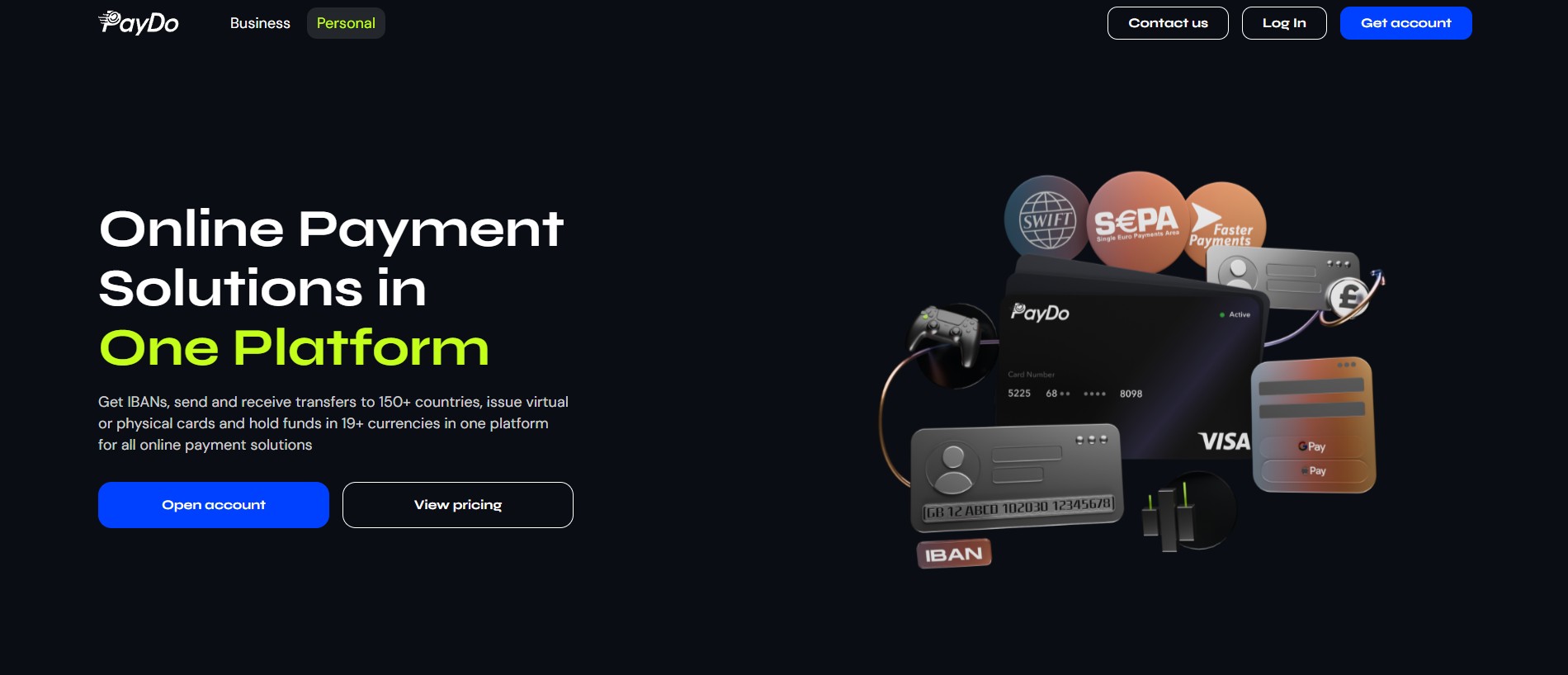

Ever tried sending money abroad and got confused by all the steps? Yeah, it happens to many people. That’s where PayDo steps in. It’s like your all-in-one tool for moving money across borders without the usual hassle.

Table of Contents

With PayDo, you can open multi-currency accounts and handle payments in different countries. No need to juggle several apps or banks. You just log in and manage everything from one place.

Wondering if it’s only for big companies? Not at all. PayDo offers both personal and business accounts. So whether you’re paying a freelancer overseas or running an international store, it’s got you covered.

And yes, it’s secure. They take safety seriously, which is a relief in today’s digital world. Think of it as a modern twist on banking, simpler, faster, and way less stressful.

Company Overview and Background

PayDo is an electronic money company licensed in the UK and Europe. It operates under strict financial regulations to keep payments secure and transparent. The goal is clear: make global payments faster and simpler for everyone.

It supports individuals, freelancers, and businesses who work across borders or use different currencies. You know how confusing international payments can get? PayDo tries to make that process feel effortless.

The company’s system is built on compliance and trust. Its licenses allow it to process payments safely under regulatory supervision. By combining modern technology with solid legal standards, PayDo stands out as a dependable option for managing international payments smoothly.

Core Features and Functionality

PayDo comes packed with tools to help you manage money across countries without stress. You can open multi-currency accounts with unique IBANs in euros (EUR), pounds (GBP), US dollar (USD), and more. Why is that useful? Because it lets you send and receive money globally without switching between different banks.

Freelancers love this, especially when clients pay in different currencies. The same goes for businesses that deal with international partners — it just saves time.

PayDo also connects with major global payment systems like SEPA, SWIFT, and TARGET2. Heard of them? They’re the networks that make fast and secure international transfers possible. Inside PayDo, you can even send money instantly between accounts. No waiting hours to see your balance update; it happens right away.

Need a card? PayDo has both virtual and physical options for shopping online or in-store. Businesses can also plug in PayDo’s API to handle e-commerce, mass payments, or merchant services.

Security is also a top priority. The firm uses strong encryption, PCI DSS certification, and strict KYC and AML checks. In short, it’s built to keep your money and data protected every step of the way.

User Experience and Interface

PayDo keeps things simple with an interface that’s easy to understand and quick to use. The dashboard shows your balances, transactions, and key tools in a clean, organized layout. You can switch between currencies, check exchange rates, and send payments without getting lost in menus.

When it comes to accessibility, it works well on both web and mobile devices, so you can manage your money anywhere. The design is straightforward, and every main feature is just a few taps away. You can even track transfers in real time and download reports whenever you need them.

As for customer support, PayDo offers help through email and chat, which makes getting assistance pretty convenient. Response times can vary, but they’re generally fair. Overall, PayDo’s interface feels smooth, reliable, and well-suited for handling both personal and business payments.

Account Options and Onboarding Process

So, what kind of account can you open with PayDo? There are two: Personal and Business. The personal one fits freelancers or anyone moving money across borders. The business account makes more sense if you’re running a company that deals with clients or partners abroad. Either way, you get your own IBAN and access to different payment options.

Signing up is simple enough. You start with your email, fill in some details, and upload a few documents. They’ll ask for an ID, proof of address, and if it’s a business, company papers too. The review doesn’t usually take long; a short wait and you’re in. Once approved, your dashboard opens, and you can start sending or receiving money right away.

What’s nice is how easy the platform feels. Everything’s clearly laid out, and you won’t spend minutes hunting for buttons. Even if you’re new to online finance tools, you’ll find your way around without trouble.

Pricing and Fees

PayDo keeps pricing simple and transparent. How much you pay depends on your account type and the size of your transactions. Personal accounts usually have lower fees, while business accounts handle bigger transfers with specific rates. You can always check all charges in your dashboard before making a payment, so there are no surprises.

The platform may apply fees for things like currency conversion, transfers, or getting a card. Sending money internationally might include some extra bank costs too. PayDo updates its pricing from time to time based on network fees or service changes.

When funding your account with a card or bank transfer, small charges may apply depending on your provider. The good part is that the platform lets you estimate total costs before you hit send. This way, you can plan transactions better and keep control of your expenses.

Pros and Cons

Pros:

- PayDo lets you handle multiple currencies, making global transactions much easier.

- The platform is simple and responsive, so navigating your account feels straightforward.

- Setting up an account is fast, and you get flexible ways to fund it.

- Security is strong, with encryption and compliance with financial rules, you can trust.

- It works well for freelancers, e-commerce owners, and businesses managing international payments.

Cons:

- Some users may face delays during the verification process.

- Fees for certain services aren’t always fully clear upfront.

- Customer support can be slow at times, depending on the request.

Final Thoughts

So, what makes PayDo worth considering? For starters, it’s a practical solution for anyone sending or receiving money across borders. Whether you’re an individual, a freelancer, or a business, the platform keeps things simple and flexible. You don’t need to be a finance expert to get started.

Why do people like it? Multi-currency support is a big plus, and setting up an account is quick. That’s especially handy if you work with clients or partners around the world. Plus, PayDo keeps security and compliance front and center, so you don’t have to worry about your money or data.

It’s not just safe — it’s easy to use too. Freelancers, merchants, and companies handling online payments can all navigate it without getting stuck. Overall, PayDo strikes a good balance between speed, usability, and trust. If you want a single platform to manage international payments smoothly, it’s a solid choice.

usdt

usdt xrp

xrp