Bitcoin (BTC) has proven to be one of the top choices for anyone entering the crypto market. Apart from its market dominance, the coin’s price growth has attracted retail and institutional users. But is it possible to earn more BTC without having to get involved in complex trading activities? That is precisely YieldBasis’ area of specialty. This article provides a YieldBasis overview showing how one can make the most from their BTC portfolio.

Whether you are a crypto enthusiast, a BTC trader, or someone seeking in-depth knowledge about the YieldBasis DeFi protocol, this guide provides all the information you need to know about the project and its working principles.

What is YieldBasis?

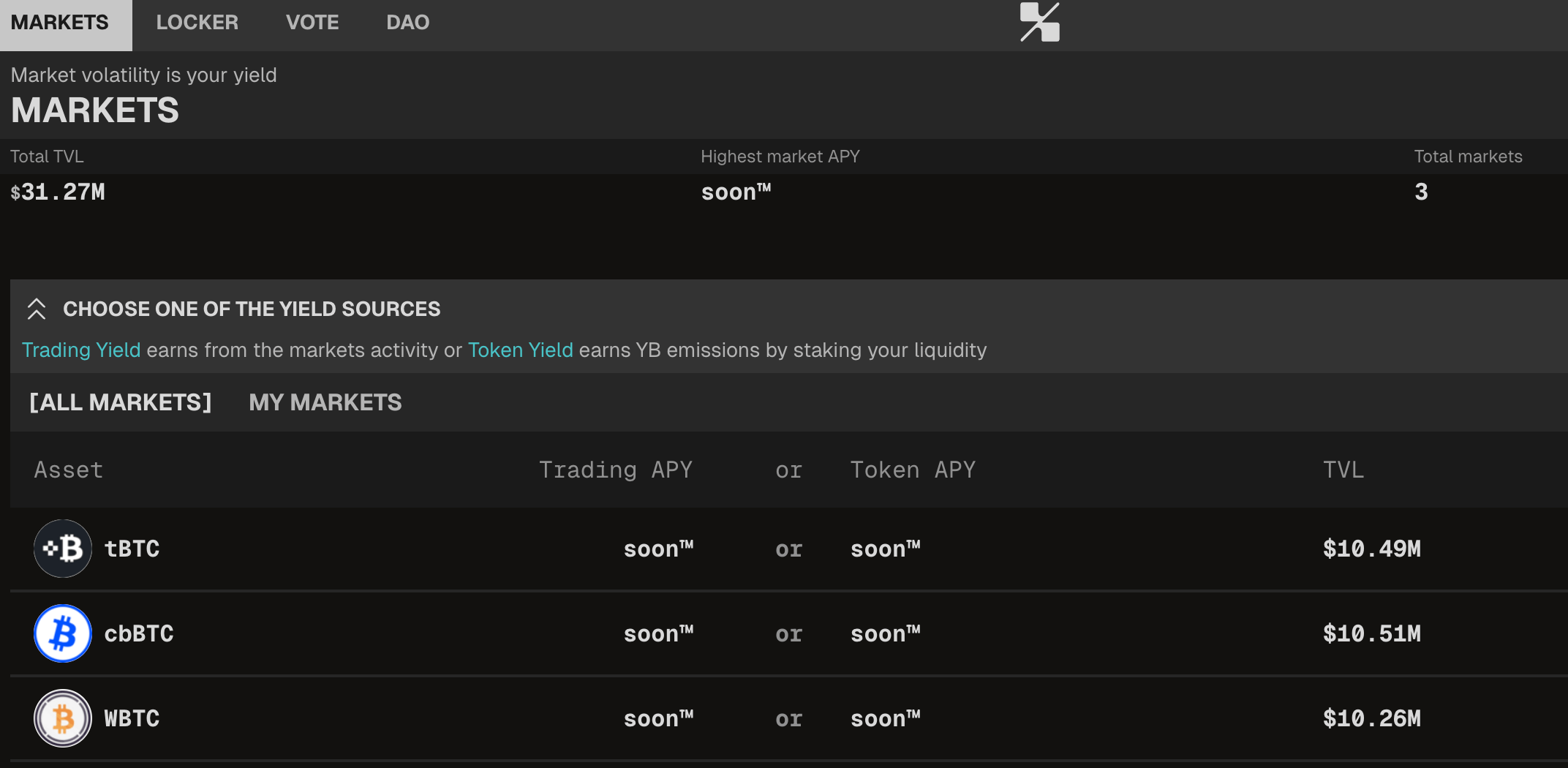

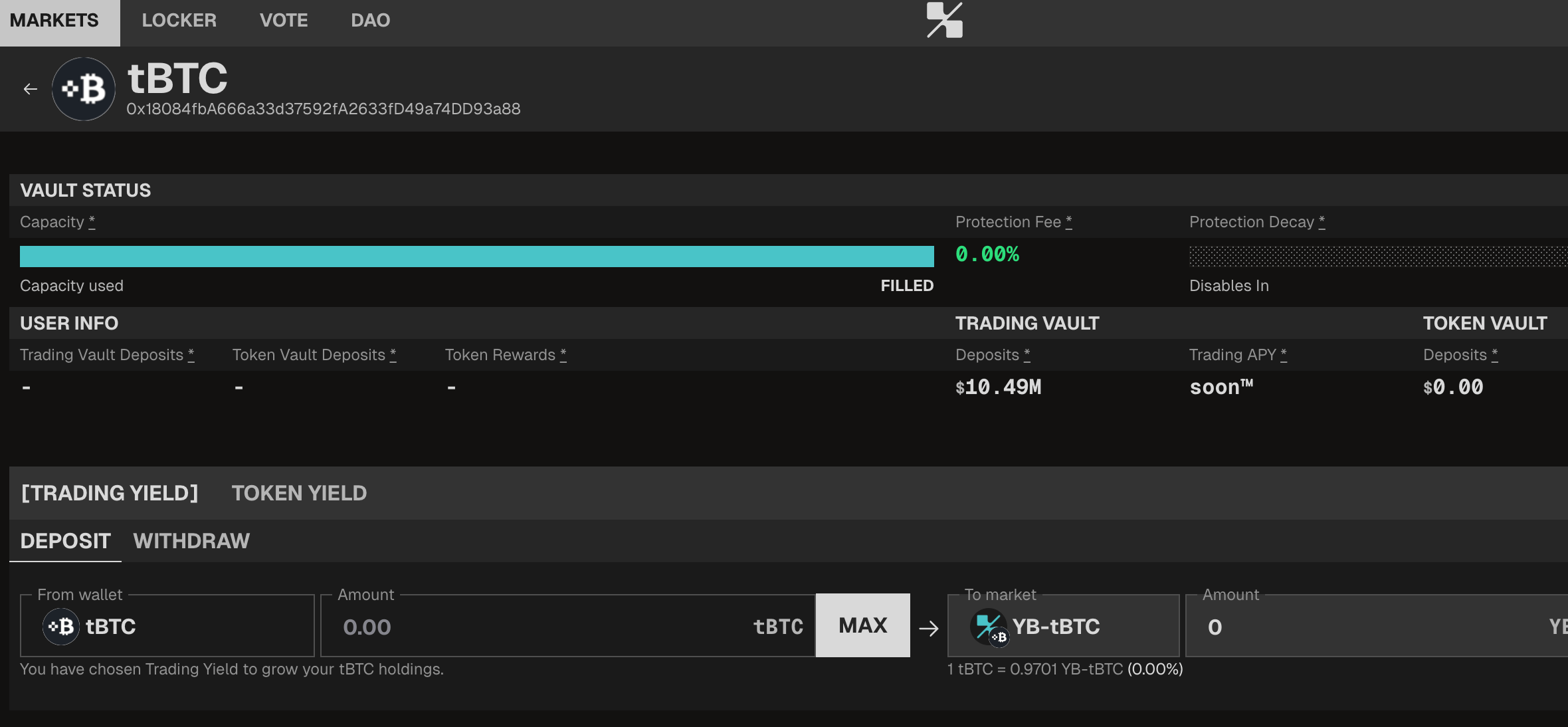

Yield Basis is a decentralized finance (DeFi) protocol designed to increase the profitability of BTC. Instead of leaving BTC idle in one’s balance, YieldBasis provides an automated market maker (AMM) pool where users deposit their bitcoin holdings to earn fees while avoiding impermanent loss (IL).

Let us break this down. The DeFi sector has offered many ways to earn in crypto. One of them is through yield farming, a concept that enables anyone to earn crypto from depositing cryptocurrencies into liquidity pools. To provide liquidity to an AMM pool, a user must deposit a pair of cryptocurrencies. For instance, $100 worth of BTC and $100 worth of USDC.

For traditional DeFi protocols, the smart contracts behind the AMM automatically sell a portion of BTC when its value increases and apportions it to USDC. This way, the crypto pair remains equal. The opposite of this process occurs when BTC falls. The issue with the model is that the user would have lost some profit due to selling early or buying late, resulting in an impermanent loss.

Most DeFi protocols compensate for this loss by offering incentives, such as crypto tokens, to liquidity providers. YieldBasis changes the narrative by introducing a mechanism that eliminates impermanent loss.

The project’s team harnesses the technology of Curve Finance, a DeFi protocol that introduces AMM and lending services through stablecoins. YieldBasis also uses Curve Finance’s AMM pools for liquidity provision. Michael Egorov, the founder of Curve, is also the brains behind YieldBasis’ operations.

How Yield Basis works?

As explained earlier, Yield Basis focuses on eliminating impermanent loss. To achieve this, the DeFi protocol implements what it calls the 2x leveraged liquidity. Here’s how it works.

Instead of depositing a pair of cryptocurrencies and hoping prices stay stable, YieldBasis allows you to deposit only BTC. Whatever amount of BTC you put in, the protocol borrows an equal amount of a stablecoin called crvUSD from Curve Finance. Then it pairs that borrowed stablecoin with your BTC deposit. The interesting part? The stablecoin loan is backed by the total value of the BTC/crvUSD pair, rather than just the BTC deposit.

Together, the BTC/crvUSD pair is deposited into the AMM pool to mint ybBTC. This is the protocol’s liquid token, which serves as proof of your share in the pool.

This model, used in the YieldBasis DeFi protocol, enables traders to create a leveraged position, roughly two times their normal exposure. While at it, the user earns from fees.

When BTC’s price moves up or down, the protocol adjusts things behind the scenes. This is possible through the “Rebalancing-AMM” and “VirtualPool” process. When bitcoin’s price increases, the Rebalancing-AMM prices adjust in such a way that makes bringing in crvUSD slightly profitable for arbitrageurs to trade.

When these arbitrageurs trade on the VirtualPool, the smart contracts execute various activities behind the scenes, including borrowing, minting, and rebalancing. The result? More crvUSD tokens get minted to keep the liquidity pair at equal values. The opposite happens when the price of BTC drops.

What innovations has YieldBasis brought to DeFi?

YieldBasis isn’t just another DeFi project. It’s trying to rethink how liquidity works altogether. The big idea? No more painful impermanent loss. It uses automated leveraged positions to balance risk and reward in real-time. That’s a significant shift from how most AMMs work today. Traditional ones simply balance token pairs and offer no protection when prices fluctuate.

YieldBasis also connects directly with Curve Finance’s crvUSD system. The crvUSD stablecoin features a clever “soft liquidation” mechanism. Instead of instantly wiping out your position when prices drop, it adjusts slowly. YieldBasis builds on that idea, borrowing crvUSD to create safer, more flexible liquidity setups.

Another innovation is tokenized liquidity. When a user deposits BTC, they receive ybBTC. These aren’t just receipts. You can move them, stake them, or even use them elsewhere in DeFi. It gives you liquidity freedom instead of locking it away.

YieldBasis also changes how pools stay balanced. Most pools keep equal values of two tokens. YieldBasis says, “Why not balance leverage instead?” Instead of fixing ratios, it adjusts leverage to keep your exposure close to your crypto’s actual performance.

Let’s say BTC goes up. Traditional pools rebalance and sell some of your BTC, which hurts your upside. YieldBasis avoids that by managing leverage, not token amounts. You stay close to the asset you believe in. This could mark a new chapter for DeFi. People can now have more substantial exposure to their favorite assets while still helping the market stay liquid.

And it’s not just a small experiment. Curve DAO has already approved a $60 million credit line in crvUSD to help Yield Basis grow its BTC–stable pools. That’s a strong signal of trust and ecosystem backing. In short, YieldBasis combines smart automation, flexible lending, and deep integration with Curve to make liquidity more efficient and a lot fairer.

How is YieldBasis solving the impermanent loss challenge?

What exactly is impermanent loss? It’s when your crypto earns fees but somehow ends up worth less. Sounds strange, right?

This is what happens. You deposit two tokens into a pool, for example, BTC and a stablecoin. If the price of BTC rises, the pool automatically sells some of it to maintain the balance. So when you withdraw later, you get fewer BTC than you started with. Even though you earned fees, your total value could be lower than if you just held your coins.

That’s the headache YieldBasis wants to remove. Instead of splitting your tokens evenly, it builds something smarter, a leveraged position that moves more like the crypto itself.

Imagine you deposit BTC. YieldBasis then borrows crvUSD and uses it to buy even more BTC. Now you’re sitting in a 2× leveraged position. If BTC climbs, your position stays the same as when you simply hold it. The best part is that you even earn fees on your deposit.

All of this happens through smart contracts, quietly working in the background. You don’t need to do anything. The system adjusts your leverage instead of token ratios, so the pool behaves more like an active trader who knows when to rebalance.

In simple terms, Yield Basis replaces the old AMM model with a living, breathing one that adapts to market movements. That’s how it nearly wipes out impermanent loss while still letting users earn from liquidity.

YieldBasis fees explained

Let’s talk about fees —the part nobody loves, but everyone needs to understand.

Yield Basis works a lot like other DeFi platforms, but with its own little twists. Fees aren’t just there to take your money; they help keep the system running smoothly and reward people who provide liquidity.

Here’s how it goes. When you add assets to a YieldBasis pool, you earn a share of the trading fees. Every time someone swaps tokens in that pool, a small portion is allocated to liquidity providers. Different pools can have varying rates, depending on the popularity or volatility of the pair.

Those rewards show up automatically through your ybBTC. There’s no need to claim anything manually; it all happens in the background.

Now, there’s also a borrowing fee. Remember the crvUSD the system borrows to create leverage? That’s not free money. The borrowing fee helps keep things safe and prevents people from taking on too much risk. The rate changes based on market conditions and the amount of crvUSD being borrowed.

There may be a few other small charges as well, such as fees for minting or redeeming ybBTC. Don’t worry, though; they’re kept low on purpose, just enough to cover network costs and keep everything running efficiently.

All these fees are handled through smart contracts, so everything’s transparent and traceable. You can check how the fees are split between liquidity providers, reserve funds, and maintenance.

And since YieldBasis is linked to the Curve DAO, the community can vote to change fee settings later. This means the system can adjust as it grows, ensuring fairness for both liquidity providers and borrowers. So, yes, fees exist, but at YieldBasis, they work in your favor, not against you.

What is YB?

YB is the native token for the Yield Basis ecosystem. It drives the protocol’s on-chain governance, allowing holders to participate in voting procedures that govern how the DeFi project runs.

The YieldBasis token tackles a common issue in the crypto space, which is the mass dumping of governance tokens when they are distributed to users. Most DeFi protocols employ a vesting period, which requires users to hold their tokens for a designated period of time. However, the YB token takes a different approach.

The YieldBasis token enables users to lock their YB for veYB (vote-escrowed YB). The veYB token allows holders to vote on-chain and participate in the protocol’s revenue-sharing process. This revenue comprises BTC-denominated fees, providing an additional way to earn a yield on Bitcoin.

YieldBasis rewards those who stake their YB tokens for a longer period with more veYB. The maximum lock-up period is four years. The more veYB you have, the larger your position in the governance procedures and revenue sharing. Note that the voting power decays over time unless the user activates the max lock of four years.

When users lock their YieldBasis token and receive veYB, they receive non-fungible tokens (NFTs) that represent their yield on Bitcoin. These NFTs are transferable to other users only when the holder holds a veYB position and has a maximum lock of four years.

Why did the first-ever Legion x Kraken sale start from YieldBasis?

In September 2025, the crypto exchange Kraken debuted Kraken Launch in collaboration with Legion, a crypto platform that introduces initial coin offerings (ICOs) to users. Kraken Launch aims to level the playing field, enabling all crypto users to gain early access to a cryptocurrency at a specific price within a predetermined timeframe.

On September 23, 2025, both platforms disclosed that the first sale will be the YieldBasis token, YB. The tokens were earmarked for users residing in countries that comply with Europe’s Market in Crypto-Assets Regulation (MiCA). During the sale, eligible users can claim 25 million YB tokens at a flat price of $0.2 at a fully diluted valuation (FDV) of $200 million. The public sale began on October 1, available on a first-come, first-served basis.

Why choose YieldBasis? The duo selected the YieldBasis DeFi protocol due to its overall goal of eliminating impermanent loss from the crypto market. With this initiative, millions of users within the Kraken and Legion ecosystems will get easy access to YieldBasis. They can also lock their YB tokens to earn yield.

FAQs

How is Yield Basis tied to Curve Finance?

You can think of YieldBasis as the brainchild of Curve Finance. This is because YieldBasis derives its underlying technology from Curve. For instance, it uses Curve’s AMM pools for liquidity provision.

What’s the alternative to YieldBasis?

Alternatives to Yield Basis include Curve Finance, Uniswap, PancakeSwap, and SushiSwap. However, these platforms are not immune to the issue of impermanent loss.

Who’s YieldBasis best for?

YieldBasis is best for BTC holders seeking ways to boost their earnings without losing their existing holdings. It is also suitable for those who want to explore DeFi for BTC without having to consume a large chunk of crypto information.

Conclusion

YieldBasis is on track to redefine how yield is generated in the Bitcoin market. Instead of the customary “buy and hold” strategy, this DeFi protocol offers ways to earn fees and other revenues without suffering from impermanent losses.

This overview of YieldBasis explained just that. We highlighted an introduction to YieldBasis and an in-depth understanding of its governance token, YB. Understanding this information will help users decide whether to invest in YieldBasis.

usdt

usdt bnb

bnb