The European crypto market is expanding rapidly, driven by the introduction of the Markets in Crypto-Assets Regulation (MiCA), which establishes a uniform legal framework across the EU. With MiCA now in effect, investors benefit from clearer regulations, better security, and a more transparent trading environment.

To help you choose the best crypto platform, we’ve reviewed the top exchanges in Europe based on security, fees, EUR deposit methods, and compliance with MiCA.

Table of Contents

Top Crypto Exchanges in Europe List

Here are the top five crypto exchanges in Europe, ranked for security, ease of use, and compliance with EU regulations.

1. Kraken – Best Overall Crypto Exchange in Europe

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk

investment and you should not expect to be protected if something goes wrong. Take 2 mins to

learn more.

Regulation: Fully MiCA-compliant, Registered CASP (Crypto Asset Service Provider)

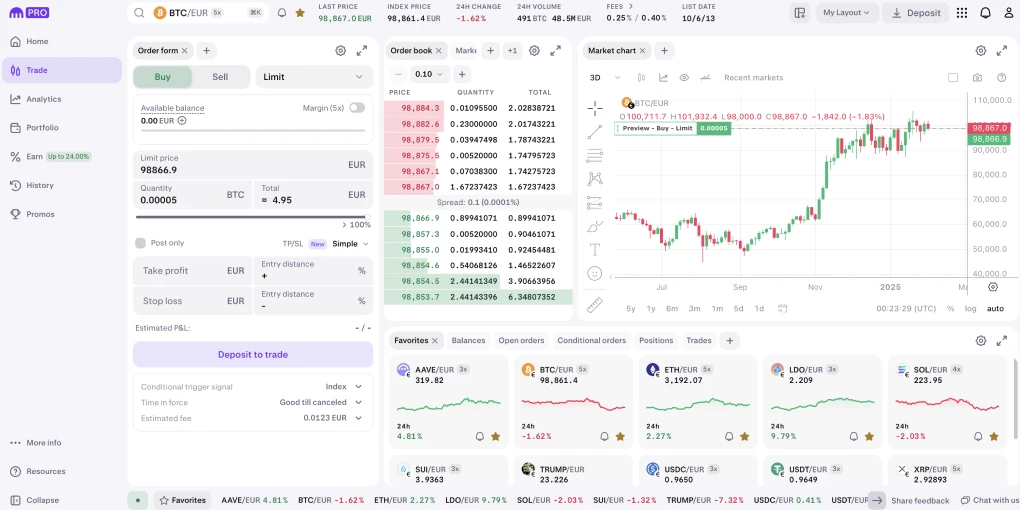

Kraken is one of Europe’s most secure and regulated exchanges, serving 30 million users with Bitcoin and 370+ other cryptocurrencies. Fully MiCA-compliant, it offers spot and futures markets, staking, and an institutional-grade OTC desk. A multilingual interface and deep liquidity make it a top choice for traders across the EU.

Security is a priority, with cold storage, 2FA, and proof-of-reserves audits safeguarding user funds. Kraken supports SEPA, PayPal, Apple Pay, Google Pay, and debit/credit cards for EUR deposits. Fees start at 0.16% for makers and 0.26% for takers, with up to 5x leverage on futures. Institutional clients gain access to high-volume OTC trading and custodial solutions.

Key Features:

- Security: Cold storage, 2FA, and proof-of-reserves audits

- EUR Deposit Methods: SEPA, Apple Pay, Google Pay, debit/credit cards

- Fees: Maker 0.16%, Taker 0.26%

- Leverage: Up to 5x on futures

- Institutional Support: OTC trading for large orders

Pros: Deep liquidity, most competitive fees, most trusted in the EU ✅

Cons: Requires full KYC verification (Passport or Drivers License) ❌

2. OKX – Best for Web3 & DeFi Integration

Regulation: Complies with MiCA as a CASP, also regulated by OAM, AMF, BaFin

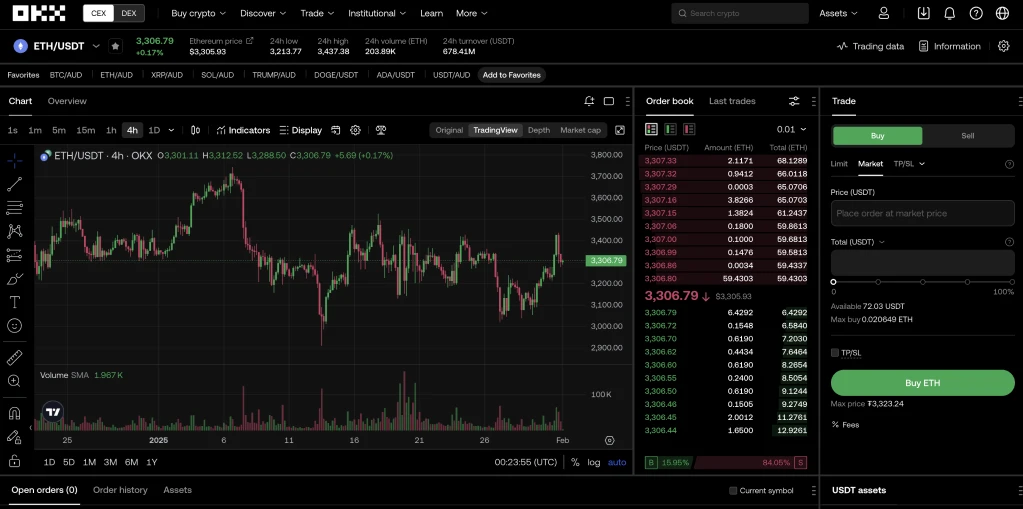

OKX is a leading exchange for crypto, Web3, and DeFi, supporting 350+ cryptocurrencies, spot, futures, options and perpetual swaps, and a multi-chain DeFi wallet for direct access to Ethereum, Solana, Base, and Arbitrum. With deep liquidity and low fees, it’s a strong choice for both retail and institutional investors in Europe.

Security and transparency are core to OKX, with an audited Proof-of-Reserves ensuring full asset backing. It supports EUR deposits via SEPA, Apple Pay, Google Pay, and bank transfers, with maker fees of 0.08% and taker fees at 0.1%. DeFi users can earn yield through staking, liquidity pools, and yield farming, making OKX one of the most versatile crypto platforms.

Key Features:

- Security: Proof-of-Reserves verification for full transparency.

- EUR Deposit Methods: SEPA transfers, Apple Pay, Google Pay, and bank transfers.

- Fees: Maker fee: 0.08%, Taker fee: 0.1%.

- DeFi Access: Earn passive income via liquidity pools and yield farming.

Pros: Good for DeFi users, supports crypto options trading ✅

Cons: Complicated user interface, less liquidity than other exchanges ❌

3. Uphold – Best for Beginners & Multi-Asset Trading

Regulation: Fully MiCA-compliant CASP, adheres to EU financial standards

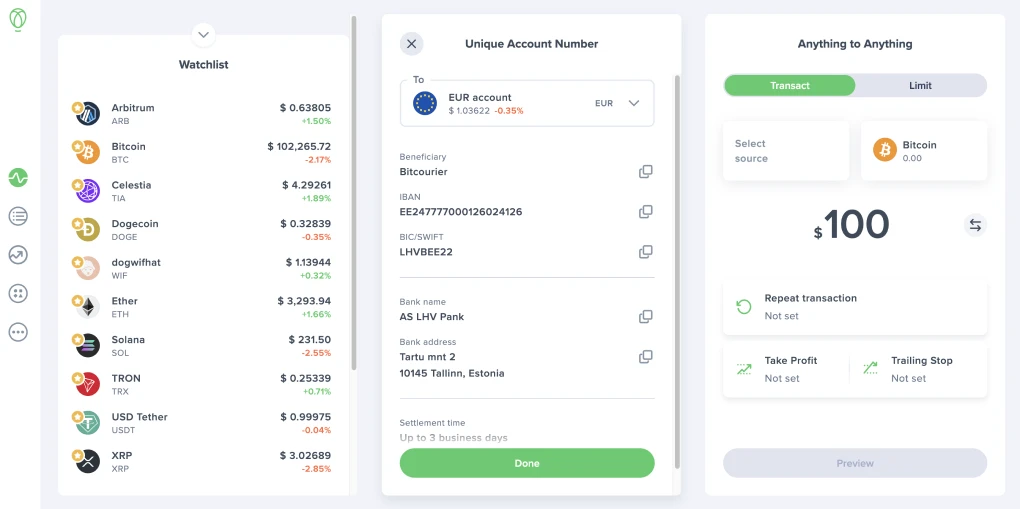

Uphold is a user-friendly exchange that supports 250+ cryptocurrencies, stocks, commodities, and fiat trading, making it ideal for beginners and diversified investors. Its transparent pricing model ensures users know their costs upfront, avoiding hidden fees. Features like recurring buys and a crypto debit card allow for seamless long-term investing and everyday spending.

Security is a key focus, with real-time proof-of-reserves guaranteeing full asset backing. Uphold accepts EUR deposits via SEPA, Apple Pay, debit/credit cards, and bank transfers, ensuring easy access for European users. Fees range from 0.5% to 1.2%, depending on the asset. Users can also stake select cryptocurrencies for passive income.

Key Features:

- Security: Real-time proof-of-reserves for full transparency

- EUR Deposit Methods: SEPA, Apple Pay, debit/credit cards, bank transfers

- Fees: Spread-based model, typically 0.5% – 1.2%

- Staking: Earn rewards on multiple cryptocurrencies

- Crypto Debit Card: Spend crypto at retailers accepting Mastercard

Pros: Simple for beginners, supports multiple asset classes ✅

Cons: Higher fees, lacks advanced trading tools ❌

4. Gate.io – Top Choice for Altcoins

Regulation: Not yet MiCA-compliant but working toward EU compliance

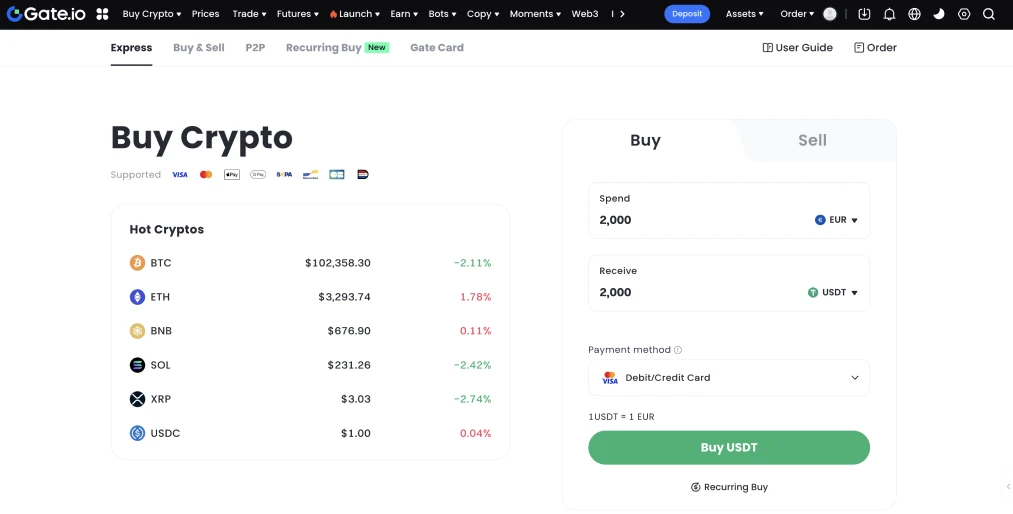

Gate.io is the best exchange for altcoin traders, offering access to 3,700+ cryptocurrencies, the widest selection in the market. With 25 million users worldwide, including strong adoption in Europe, it provides a full suite of trading options, including spot, futures, margin trading & staking. While not yet MiCA-regulated, it remains available in the EU and is actively working toward compliance.

The platform ensures transparency with 1:1 proof-of-reserves, verifying full asset backing. EUR deposits are supported via bank transfers, debit/credit cards, and Google Pay. Trading fees start at 0.1%, with advanced features like copy trading, grid trading, and algorithmic strategies. A robust staking and liquidity mining platform offers additional ways to earn passive income.

Key Features:

- Security: 1:1 proof-of-reserves for full transparency

- EUR Deposit Methods: Bank transfers, debit/credit cards, Google Pay

- Fees: Spot trading fees start at 0.1%

- Trading Tools: Copy trading, grid trading, and algorithmic strategies

- Passive Income: Staking, lending, and liquidity mining

Pros: Largest altcoin selection, strong automation tools ✅

Cons: Not MiCA-compliant yet, complex interface for beginners ❌

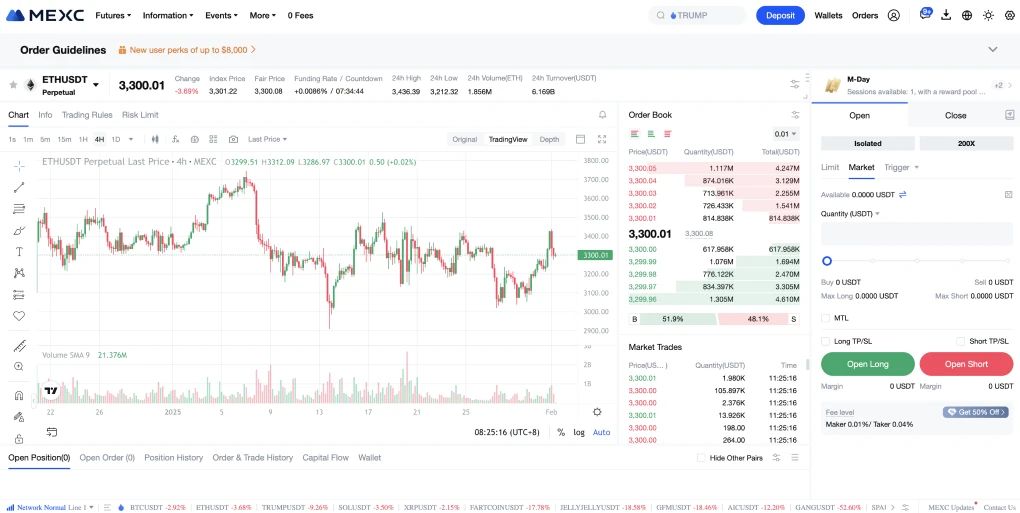

5. MEXC – Best for High-Leverage Trading

Regulation: Not MiCA-compliant but available in the EU

MEXC is a top choice for traders looking for high-leverage futures, offering up to 200x leverage on select contracts. It supports 900+ cryptocurrencies, making it one of the most diverse exchanges for spot and derivatives trading. With 15 million users, it has built a strong global presence despite not yet being MiCA-regulated.

The platform prioritizes security with two-factor authentication (2FA) and encryption protocols to safeguard funds. It also provides staking, liquidity pools, and automated trading tools, giving users multiple ways to optimize their portfolios. EUR deposits are available via bank transfers, credit cards, and debit cards, with maker fees from 0.02% to 0.06% and taker fees between 0.06% and 0.08%.

Key Features:

- Security: 2FA and encryption for asset protection

- EUR Deposit Methods: Bank transfers, credit/debit cards

- Fees: Maker 0.02% – 0.06%, Taker 0.06% – 0.08%

- Leverage: Up to 200x on futures contracts

- Passive Income: Staking and liquidity pools

Pros: High leverage, large crypto selection ✅

Cons: Not MiCA-compliant, higher risk for beginners ❌

Crypto Exchange Licensing Under MiCA in the EU

The Markets in Crypto-Assets Regulation (MiCA) sets a standardized licensing framework for crypto exchanges operating in the EU and European Economic Area (EEA).

To legally serve European users, exchanges must register as Crypto Asset Service Providers (CASPs) and meet strict requirements for capital reserves, security, transparency, and anti-money laundering (AML) compliance. These regulations aim to reduce fraud, enhance consumer protection, and establish clear operational guidelines for crypto platforms.

Exchanges that fail to comply risk being banned from the EU market. MiCA ensures exchanges provide proof-of-reserves, fair trading practices, and robust risk management, creating a more secure environment for investors.

The Growth of Crypto Adoption in Europe

Crypto adoption in Europe continues to expand as MiCA regulations provide legal certainty, attracting both institutional and retail investors. Germany, France, and Switzerland are leading the shift, with banks integrating crypto services and businesses accepting digital payments.

Check out our Best UK crypto exchange guide.

A significant step in institutional adoption is Deutsche Bank’s development of an Ethereum Layer-2 (L2) solution using ZKsync technology. The project aims to address compliance challenges, making public blockchains more viable for regulated financial institutions.

As of 2025, crypto users in Europe exceed 218 million, driven by MiCA-licensed Crypto Asset Service Providers (CASPs) improving access. With strong regulation and increasing institutional involvement, Europe remains a major hub for digital assets.

What are Crypto Exchanges?

Crypto exchanges are platforms where users buy, sell, and trade digital assets like Bitcoin, Ethereum, and Solana. They fall into two categories: Centralized Exchanges (CEXs), which act as intermediaries, provide liquidity, and facilitate transactions, and Decentralized Exchanges (DEXs), which use smart contracts to enable direct, peer-to-peer trading without intermediaries.

In Europe, MiCA regulations require CEXs to register as Crypto Asset Service Providers (CASPs) and adhere to strict security, transparency, and anti-money laundering (AML) standards. While DEXs operate outside traditional oversight, their growing use raises questions about future regulation.

In Italy in particular, crypto exchanges are regulated by by both the Commissione Nazionale per le Società e la Borsa (CONSOB), which focuses on investor protection and market integrity, and the Bank of Italy (Banca d'Italia), which focuses on financial system stability

FAQs

What’s the Cheapest Way to Buy Bitcoin in Europe?

For the lowest fees, OKX (0.08% maker, 0.1% taker) and MEXC (0.02% maker, 0.06% taker) offer some of the best rates. SEPA bank transfers are typically the cheapest deposit method, avoiding high card fees. Always compare spreads and withdrawal costs before trading.

How Does MiCA Impact Bitcoin Trading in Europe?

MiCA regulations require licensed exchanges to maintain proof-of-reserves, prevent market manipulation, and enforce stronger AML/KYC checks. This means safer trading environments but also stricter compliance for users, including mandatory identity verification.

Which European Exchanges Allow Crypto-to-Crypto Trading Without KYC?

Most MiCA-compliant exchanges require full KYC, but some platforms like Gate.io and MEXC allow limited crypto-to-crypto trading without verification. However, unverified accounts may face withdrawal limits and restrictions under new EU regulations.

Conclusion

With MiCA in effect, choosing a crypto exchange in Europe is now about regulatory compliance, security, and trading features. Investors should focus on platforms that offer proof-of-reserves, clear fee structures, and reliable EUR deposit methods.

As regulation strengthens, exchanges that align with MiCA will provide a safer and more transparent trading environment. Before selecting an exchange, verify its compliance status and ensure it meets your trading needs.

usdt

usdt bnb

bnb