Key Takeaway: The most trusted way to bridge assets to Hyperliquid is deBridge, a secure cross-chain protocol with over $7 billion in volume and a perfect security record.

It enables instant USDC transfers from Ethereum, Solana, Arbitrum, Base, and 15 other chains, providing a fast and reliable gateway to Hyperliquid’s perpetual futures DEX and HyperEVM Layer 1.

Table of Contents

How to Bridge Assets to Hyperliquid

You can transfer assets to Hyperliquid using cross-chain bridges that support its Layer 1 and HyperEVM protocol. A reliable option is deBridge, a cross-chain protocol with a strong track record, processing over $7 billion in volume with 100% uptime.

deBridge allows transfers from 15 major networks like Ethereum, Solana, Arbitrum and Base directly into Hyperliquid’s Layer 1.

Steps to Bridge Using deBridge:

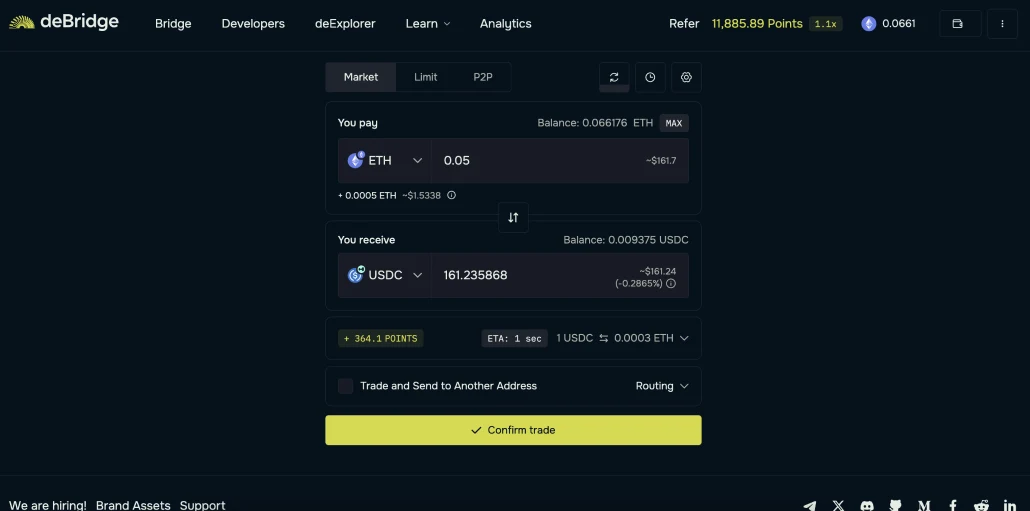

- Connect Your Wallet – Open deBridge and link a supported wallet, such as MetaMask or Coinbase Wallet.

- Select Networks & Token – Choose the source network (e.g., Ethereum), set Hyperliquid as the destination, and select the token (USDC).

- Approve the Transaction – Enter the amount, confirm the transfer in your wallet, and authorize the transaction.

- Complete the Transfer – Follow the on-screen instructions. Your funds should arrive in your Hyperliquid wallet within minutes.

Hyperliquid Bridge Fees: What to Expect

Bridging to Hyperliquid via deBridge comes with a flat transfer fee of 0.001 ETH, plus gas fees that vary by network. Transfers from Ethereum Mainnet typically cost between $2 and $8, depending on network congestion.

Using a Layer 2 network like Base is the most cost-effective option, with fees generally under $1. Other Layer 1 networks, such as Solana, also offer low-cost transfers, usually less than $1 per transaction.

💡 Cost-Saving Tip: For the lowest costs, bridging from a Layer 2 network like Base helps reduce gas fees and minimizes slippage.

What Are Crypto Bridges?

Crypto bridges allow assets, data, and smart contracts to move between different blockchains. Since most blockchains operate independently with unique rules and consensus mechanisms, they cannot directly communicate.

Bridges solve this by enabling interoperability, letting users transfer tokens and liquidity across chains.

How Do Crypto Bridges Work?

Bridges typically use one of two methods:

- Lock-and-Mint Mechanism – The bridge locks tokens on the source chain and mints an equivalent amount on the destination chain. For example, transferring ETH from Ethereum to Hyperliquid involves locking ETH on Ethereum and issuing a wrapped version (WETH) on Hyperliquid.

- Liquidity Pool Model – Instead of minting tokens, the bridge uses liquidity pools. Users deposit assets on one chain, and the bridge releases equivalent funds from a pre-funded pool on the destination chain. This method often results in faster transactions.

Bridges play a key role in expanding blockchain interoperability, making it easier for users to move assets across networks.

What is Hyperliquid?

Hyperliquid is a decentralized derivatives and spot exchange running on its own Layer 1, Hyperliquid L1. It utilizes high-speed HyperBFT consensus and RustVM to power a fully on-chain Central Limit Order Book (CLOB), delivering a Binance-like experience without KYC.

Its flagship decentralized perpetuals exchange dominates the decentralized derivatives market, offering deep liquidity, fast execution, and an on-chain vault (HLP) that serves as a counterparty.

Hyperliquid’s economic model redirects all revenue to HYPE token buybacks and HLP incentives. It also features HIP-1, a decentralized token listing system, and plans to launch HyperEVM for broader smart contract functionality, cementing its position as a major competitor to both decentralized and centralized exchanges.

FAQs

Can I Bridge from Solana to Hyperliquid?

Yes, protocols like deBridge provide a direct way to bridge between Solana and Hyperliquid, allowing users to transfer USDC and other supported tokens.

Is Bridging Safe?

Bridging on well-audited protocols like deBridge or Synapse, which also supports Hyperliquid, is the most secure option. However, bridge exploits have led to over $2.8 billion in losses, making it essential to use trusted platforms with strong security measures.

How Long Does Bridging to Hyperliquid Take?

Transfer times vary based on network congestion and the protocol used. On deBridge, most transactions settle within one minute, but delays can occur during peak activity.

Conclusion

Bridging assets to Hyperliquid is straightforward with deBridge, offering fast, low-cost transfers across multiple networks.

To minimize fees, use Layer 2 solutions like Base or high-throughput L1s like Solana. Always verify bridge security and network conditions before transferring funds.

As Hyperliquid expands its ecosystem, efficient bridging will remain essential for traders seeking deep liquidity and on-chain derivatives access.

usdt

usdt xrp

xrp